Get the free Non-delegated Correspondent Loan Submission Checklist

Get, Create, Make and Sign non-delegated correspondent loan submission

Editing non-delegated correspondent loan submission online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-delegated correspondent loan submission

How to fill out non-delegated correspondent loan submission

Who needs non-delegated correspondent loan submission?

Non-Delegated Correspondent Loan Submission Form: How-to Guide

Understanding non-delegated loans

Non-delegated lending refers to a loan process where the correspondent lender retains responsibility for underwriting and making decisions regarding the loan. Unlike delegated lending, where lenders are empowered to underwrite loans on behalf of the investor, non-delegated lending requires all involved parties to follow a more stringent review process. This approach focuses heavily on compliance and regulatory adherence, making it essential for correspondent lenders to navigate the system meticulously.

Key differences between delegated and non-delegated processes include the level of authority granted to lenders, the underwriting process, and compliance burdens. Essentially, delegated correspondents can approve loans with less scrutiny from investors, while non-delegated loans demand more thorough verification to ensure all guidelines are meticulously followed.

Choosing non-delegated loans can be advantageous for lenders who prioritize compliance and risk mitigation. This pathway lets lenders maintain tighter control over their operations, ensuring they manage the underwriting process effectively. As a result, investing in a solid understanding of the non-delegated correspondent loan submission form becomes crucial for seamless transactions in this model.

The importance of the non-delegated correspondent loan submission form

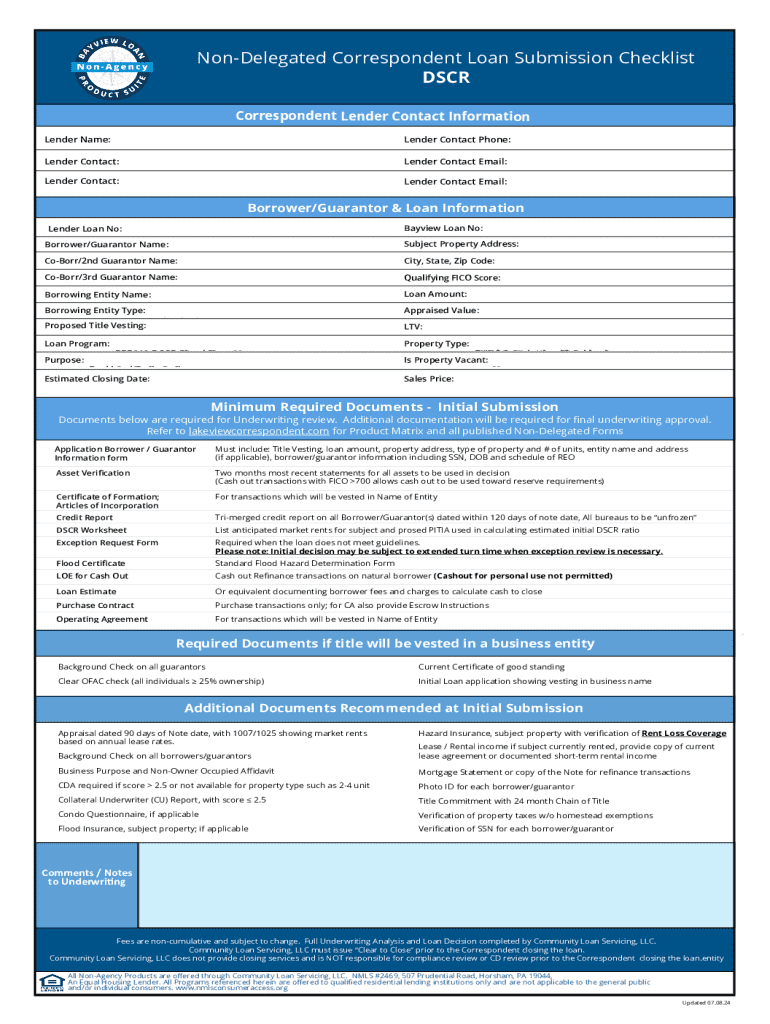

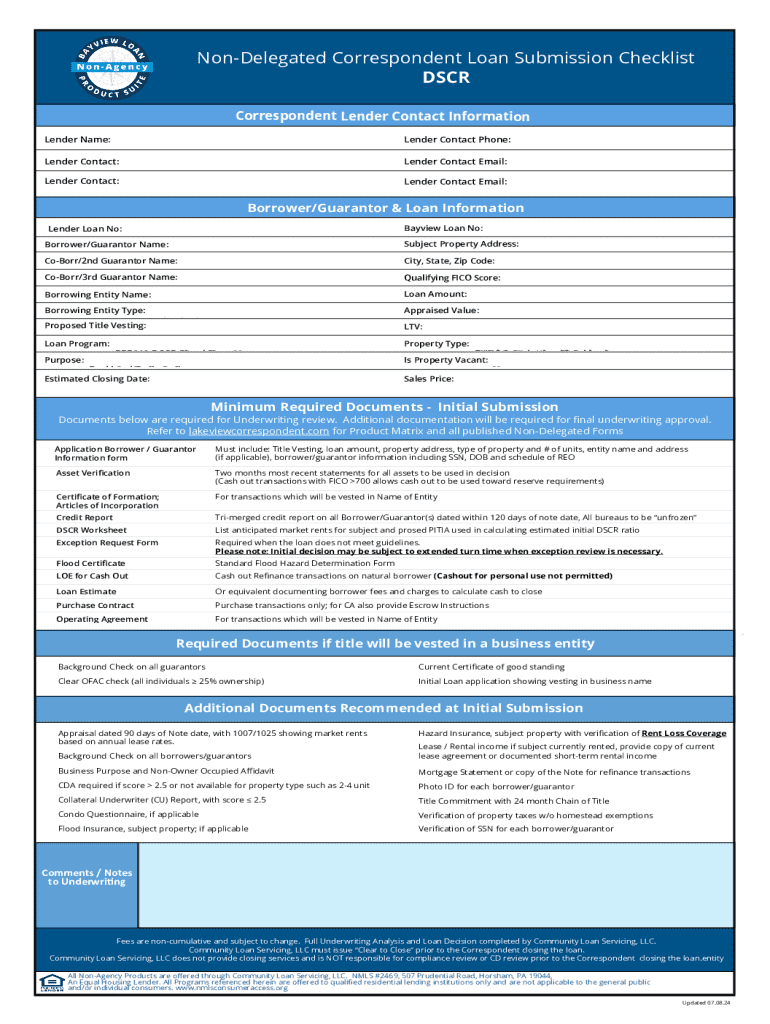

The non-delegated correspondent loan submission form plays an essential role in the loan application process, serving as the primary document that captures all relevant information about a loan request. It consolidates data required by investors and ensures that lenders adhere to necessary compliance standards. By utilizing this specialized form, lenders can better manage the expectations of both borrowers and investors.

Compliance and regulatory considerations are particularly critical in non-delegated lending. Investors need assurance that all submissions align with their policies and federal regulations. Each submission must provide exhaustive and accurate information to mitigate risks of rejection. Common pitfalls during form submission include incomplete data, incorrect documentation, and failure to follow guidelines, which can delay the approval process significantly.

Step-by-step guide to completing the non-delegated correspondent loan submission form

Preparation before filling out the form

Before commencing to fill out the non-delegated correspondent loan submission form, it’s essential to prepare adequately. Gather all required documentation to ensure that the process goes smoothly. Creating a list of essential documents is paramount.

Verifying all information before submission is critical. Mistakes at this stage can lead to setbacks. Utilizing a pre-filling checklist can help you confirm that all necessary documents are gathered and ready, which can save time and avoid unnecessary back-and-forth between parties.

Filling out the submission form

After gathering the relevant documentation, it’s time to fill out the submission form. Approach this step methodically, ensuring you accurately complete each section.

Review and verification process

Once you have filled out the submission form, double-check for accuracy. This is a critical step that should not be overlooked, as errors can lead to significant delays. Involving your team in this review process can be beneficial. Cross-checking each section ensures that no important details are missed.

Best practices for eSigning and submitting the form

Incorporating eSigning into your submission process can greatly enhance efficiency and security. Utilizing pdfFiller’s eSignature tool ensures all signatures are authenticated and legally binding. This fosters a faster transaction timeline and reduces the likelihood of document errors.

For submitting through the cloud, ensure you are familiar with supported platforms. Confirming transactions are secure is vital. This includes checking for encryption and adherence to industry-standard security protocols, ensuring that all data remain protected throughout the submission process.

Managing the non-delegated correspondent loan submission form post-submission

Tracking your submission

After submission, tracking your application is essential. Knowing how to confirm receipt can help gauge the progress of your loan application. Follow-up protocols are equally important, allowing you to stay informed on the status of your loan.

Handling potential issues

Should any delays occur, keeping open lines of communication with the correspondent lender can ease your concerns. Understand the nature of any rejections or requests for additional information, and act quickly to provide what's needed. Being proactive can significantly impact the final decision.

Additional tools and resources

Utilizing interactive templates and calculators can streamline your submission process. For instance, a bank statement submission checklist can help ensure all required documents are correctly assembled, while a Debt Service Coverage Ratio (DSCR) calculator can assist in evaluating the income versus debt responsibilities.

Helpful tips for successful loan submissions

Utilizing technology not only enhances efficiency but also saves time. Familiarity with available tools can help facilitate smoother submissions in the future. Understanding the typical timeline for loan approvals and the factors that may influence it is equally crucial for managing expectations.

Effective communication throughout the correspondent lending process fosters transparency. Promptly addressing any queries or concerns proves beneficial for both lenders and borrowers, creating a trusting relationship that can lead to a more favorable outcome.

User testimonials and case studies

Real-world applications of the non-delegated correspondent loan submission form can offer invaluable insights. Users of pdfFiller have shared success stories detailing how streamlined submission processes led to timely approvals and smoother transactions.

By leveraging the tools provided by pdfFiller, many have experienced enhanced document management capabilities. These testimonials underline the utility and impact of adopting effective systems that cater to non-delegated lending.

Conclusion of the guide

To summarize, mastering the non-delegated correspondent loan submission form is essential for lenders aiming for success. Through understanding the importance, completing the form accurately, and utilizing tools like pdfFiller, you can enhance the overall loan submission experience.

In a competitive lending landscape, taking steps to leverage the right resources will empower you to manage documents seamlessly, ensuring smoother transactions and satisfied borrowers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-delegated correspondent loan submission to be eSigned by others?

Can I sign the non-delegated correspondent loan submission electronically in Chrome?

How do I edit non-delegated correspondent loan submission on an iOS device?

What is non-delegated correspondent loan submission?

Who is required to file non-delegated correspondent loan submission?

How to fill out non-delegated correspondent loan submission?

What is the purpose of non-delegated correspondent loan submission?

What information must be reported on non-delegated correspondent loan submission?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.