Get the free Formulir Rekening Dana Nasabah (badan)

Get, Create, Make and Sign formulir rekening dana nasabah

How to edit formulir rekening dana nasabah online

Uncompromising security for your PDF editing and eSignature needs

How to fill out formulir rekening dana nasabah

How to fill out formulir rekening dana nasabah

Who needs formulir rekening dana nasabah?

Formulir rekening dana nasabah form: Your Comprehensive Guide

Understanding the formulir rekening dana nasabah (RDN)

The formulir rekening dana nasabah (RDN) is a crucial document utilized within Indonesian banking systems. This form serves multiple purposes, primarily designed for customers to set up an account with a financial institution. The RDN is essential for both individuals and businesses looking to manage their finances efficiently. By filling out this form, clients can open a dedicated fund account, ensuring they have direct access to their deposits while facilitating various financial transactions.

The importance of the formulir RDN cannot be overstated. It provides a structured way for users to document their personal and financial information securely. Furthermore, this form plays a pivotal role in protecting the interests of both the bank and the account holders by verifying identity and compliance with regulatory requirements. Whether for personal saving, business funding, or investment purposes, using the RDN helps streamline financial operations.

Key features of the formulir RDN

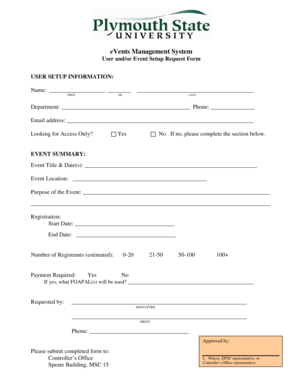

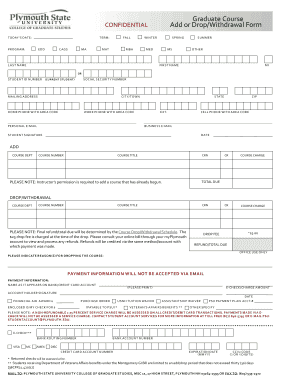

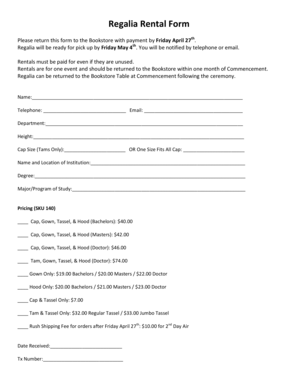

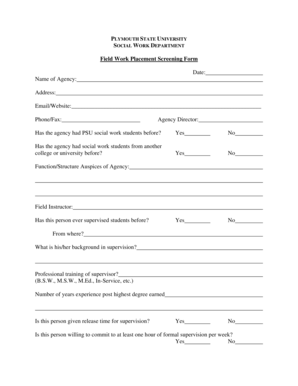

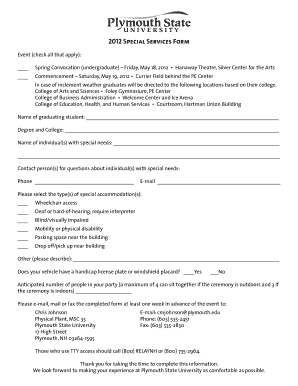

The formulir RDN is designed to collect comprehensive information to ensure proper account setup and functionality. This includes personal identification details such as full name, address, and identification numbers. It also requires financial details, including income sources and expected account usage intentions. Contact information, including email addresses and phone numbers, ensures that banks can communicate effectively with account holders.

One significant benefit of using the formulir RDN is the streamlined application process it offers. By consolidating all necessary information into one document, banks can expedite account approvals. This efficiency also enhances financial management for users by maintaining a clear record of their personal finances. Additionally, users can have peace of mind knowing that banks prioritize security and data privacy during the handling of this sensitive information.

Step-by-step process for filling out the formulir RDN

Before diving into completing the formulir RDN, it's crucial to prepare adequately. First, gather all required information to minimize errors and delays. This includes personal identification documents, financial records, and any other relevant paperwork. Being familiar with the document's requirements beforehand ensures smoother processing.

When you start filling out the form, begin with the personal information section where you will need to enter your full name, address, and identification details. Next, proceed to banking preferences, where you can specify whether you'd like a savings or investment account. Additional notes offer you a chance to communicate any special requests. It's essential to double-check each section to avoid common mistakes, such as incorrect identification numbers or typos.

After filling out the form, take time to review it thoroughly. Create a checklist to ensure you checked your contact and personal information for accuracy, clarity, and completeness. Submitting an error-free form significantly increases the likelihood of swift approval.

Editing and managing your formulir RDN

Using tools like pdfFiller can greatly enhance your experience when managing your formulir RDN. Start by uploading the completed form to the platform, which allows for easy edits and adjustments. If any information changes or needs correction, pdfFiller provides a simple interface to make interactive changes directly on the document.

One of the standout features of pdfFiller is its eSigning capabilities. Users can securely sign their documents digitally, eliminating the need for printing. Additionally, collaborative signing options are available, allowing multiple stakeholders to review and sign the form seamlessly. Managing versions of your documents is also straightforward with pdfFiller, enabling users to track changes and restore previous versions if needed.

Submitting the formulir RDN

After completing and editing your formulir RDN, it's time to submit it. Users have multiple options for submission: digital submission via email or the bank's online portal provides convenience, while in-person submission allows for immediate verification and questions. Whichever method you choose, ensure that all documentation is correctly attached to avoid delays.

Follow-up procedures are also a vital part of the submission process. Always confirm receipt of your application, as it ensures that the bank has processed your request. Keep an eye on your application status, and be proactive in contacting customer support if you haven't received updates within a reasonable timeframe.

Frequently asked questions (FAQ)

If you encounter issues when filling out the formulir RDN, don't hesitate to reach out for help. Whether it’s technical difficulties with the PDF tool or uncertainties regarding specific sections of the form, contacting customer support can resolve most issues promptly. Thoroughly review instruction materials and website FAQs for hints as well.

As for the duration for processing applications, it typically depends on the institution's workload and your submission method. Completing the form accurately and providing required documentation can speed up this process. When it comes to fees, each bank may have different policies regarding account setup and maintenance fees, so always check directly with your banking institution.

Additional tools and support from pdfFiller

pdfFiller provides a range of interactive tools to assist with the completion of your formulir RDN. These tools help automate the filling process, reducing errors associated with manual entries. Moreover, the platform includes customer support options, ensuring help is readily available for any questions or issues that users may face.

Consider using alternative document templates for related financial forms to further ease your workload. pdfFiller’s extensive library provides a variety of templates that can be tailored to individual or business financial needs, making it a holistic solution for document management.

The value of using pdfFiller for your formulir RDN

Adopting a cloud-based document management solution like pdfFiller offers several advantages for users dealing with the formulir RDN. Primarily, it allows for convenient access from any device, enabling users to work on their documents from anywhere, whether at home or on the go. This accessibility is particularly beneficial for individuals and teams that are often on the move or need to collaborate remotely.

The collaborative features available within pdfFiller enable teamwork on financial documents, ensuring that multiple contributors can provide input and finalize the form efficiently. Overall, pdfFiller presents a seamless solution for editing, signing, and managing important forms such as the formulir rekening dana nasabah form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out formulir rekening dana nasabah using my mobile device?

How can I fill out formulir rekening dana nasabah on an iOS device?

Can I edit formulir rekening dana nasabah on an Android device?

What is formulir rekening dana nasabah?

Who is required to file formulir rekening dana nasabah?

How to fill out formulir rekening dana nasabah?

What is the purpose of formulir rekening dana nasabah?

What information must be reported on formulir rekening dana nasabah?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.