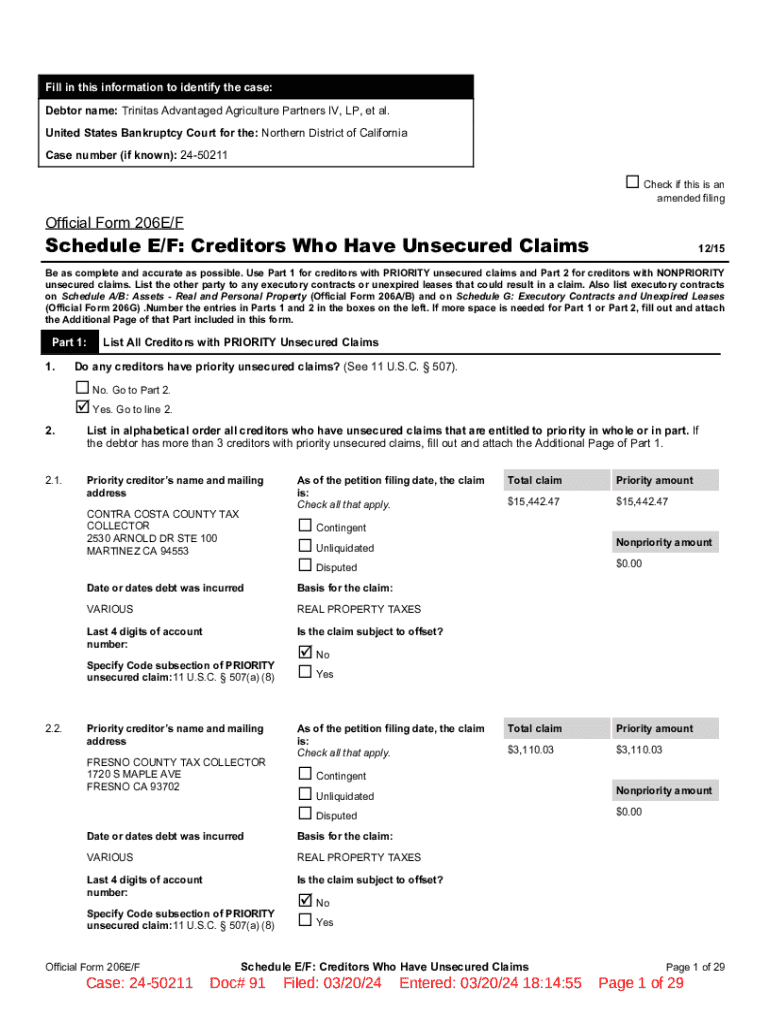

Get the free Schedule E/f: Creditors Who Have Unsecured Claims

Get, Create, Make and Sign schedule ef creditors who

How to edit schedule ef creditors who online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule ef creditors who

How to fill out schedule ef creditors who

Who needs schedule ef creditors who?

Schedule E form for creditors who form: A comprehensive guide

Understanding Schedule E: A Comprehensive Overview

Schedule E is an essential IRS form primarily used for reporting income derived from various sources including rental properties, royalties, and partnerships. The purpose of this form is to help creditors and debtors alike to accurately report supplemental income, which can have significant tax implications. For creditors, filling out Schedule E correctly is pivotal, as it allows them to claim deductible expenses related to their income-generating activities, ensuring they remain compliant with tax regulations.

For debtors, this form is equally important because it provides transparency in how income is reported, which can play a role in debt negotiations or bankruptcy filings. Accurate completion of Schedule E is crucial; misreporting can lead to compliance issues or financial penalties.

Types of income reported on Schedule E

Who should file Schedule E?

Individuals who benefit from filing Schedule E typically include landlords who earn rental income, and property owners involved in real estate investments. Additionally, investors receiving royalties from creative works, or those participating in partnerships and S corporations that generate income also fall into this category. Specific situations can arise for creditors wherein they may need to file Schedule E, especially when declaring income related to debt recovery or restructuring efforts.

For instance, if a creditor has provided loans that include a repayment structure involving interest from partnerships or equity stakes, they will need to account for that income on Schedule E. Understanding the nuances of when to file can help creditors manage their tax responsibilities more effectively.

Step-by-step guide to filling out Schedule E

Filling out Schedule E requires meticulous preparation. First, gather all necessary documentation that supports the income you will report. This includes rental agreements, partnership documents, and any financial statements that validate your income sources and related expenses.

Completing the form: Section by section breakdown

Schedule E is divided into several parts that serve different purposes.

In Part I, for those reporting rental real estate, document the total gross rents received and allowable expenses such as maintenance, repairs, and property management fees. Part II requires you to report your share of income or loss from partnerships and S corporations, often detailed in K-1 forms. Finally, Part III summarizes your rental real estate income or loss to provide a clear snapshot for tax reporting.

Common mistakes to avoid

Common errors creditors often make when filling out Schedule E include incorrect reporting of total income, failing to include allowable expenses, or not updating information from prior tax years. To increase accuracy, regularly review financial documents before filing and ensure that all figures are double-checked against your records.

Best practices for managing Schedule E reporting

An organized record-keeping system is critical for anyone filing Schedule E. Maintaining clear, categorized records of income and related expenses will streamline the filing process and minimize errors. Consider using accounting software or apps designed for financial tracking, which often include features for tracking rental income, expenses, and even tax reminders.

Timing also plays a vital role in reporting. For those who encounter high volumes of financial transactions, being proactive about deadlines can help prevent last-minute stress. Use a calendar to mark important filing dates and consider setting reminders as deadlines approach.

Interactive tools and resources for filling Schedule E

pdfFiller offers an intuitive platform that facilitates easy filling and editing of Schedule E forms. With its drag-and-drop features, users can quickly upload documents and start entering their data without hassle. You can also utilize interactive templates that guide users step-by-step through the completion process, minimizing common errors.

Utilizing collaborative features allows you to work closely with your financial team, sharing documents and securing eSignatures efficiently. This ensures that everyone involved has access to the latest information and can provide input as needed.

Real-life scenarios: When and how Schedule E comes into play

Consider a case study of a landlord who manages multiple properties. This individual must report rental income across different leases, ensuring they account for expenses from property management and maintenance. By accurately reporting on Schedule E, they can maximize deductions and minimize their tax burden.

Another scenario involves an investor receiving income from a partnership. By correctly filling out Schedule E, they ensure compliance and validate their earnings sourced from investments. Legal professionals often emphasize maintaining detailed records and being proactive when it comes to tax filing to avoid penalties.

FAQ about Schedule E for creditors

Creditors often have specific inquiries about the nuances of Schedule E reporting. One common question involves understanding which expenses can be deducted. Generally, allowed deductions include maintenance fees, repair costs, and certain legal expenses associated with managing rental properties or partnerships.

Another question frequently posed is related to income thresholds, specifically how much income needs to be reported and whether any portion of it is tax-exempt. It's advisable that creditors consult with a tax professional if uncertainties arise to ensure compliance with IRS regulations.

The role of Schedule E in overall financial management

Incorporating Schedule E into your financial management strategy can significantly enhance financial clarity. Accurate reporting of your income allows for better budgeting, planning, and investment strategies in the future. Indeed, consistency in reporting and adequately tracking earnings leads to healthier financial habits.

Additionally, by filing Schedule E correctly, creditors can present better financial profiles to lenders when seeking new lines of credit or negotiating terms for existing debts. This shows responsibility and foresight in managing finances, attributes highly valued in financial dealings.

Leveraging pdfFiller for seamless document management

pdfFiller provides creditors filing Schedule E with tools specifically designed to ease the process. Its features make it easy to create, fill, and manage the document securely from any web-enabled device. Users can directly access templates of Schedule E where they enter their information seamlessly and save it for future use.

Moreover, engaging with pdfFiller means accessing real-time data, enabling creditors to analyze financial information that may impact their tax reporting decisions. This streamlining helps eliminate confusion and ensures that users remain organized throughout the financial year.

Testimonials and user experiences with Schedule E

Many users have successfully navigated the complexities of Schedule E by leveraging pdfFiller's comprehensive document management offerings. Feedback often highlights the ease of use and time saved during the preparation of financial documents. Users have shared their appreciation for the clear instructions provided with the templates and the collaborative capabilities that allow them to involve other stakeholders in the process.

Success stories include those of landlords and small business owners who streamlined their tax filing process, reduced errors, and ultimately saved money with accurate filings, thanks to pdfFiller's dedicated solutions for Schedule E.

Engage with our community

We invite users to participate in forums and discussion platforms focused on Schedule E reporting and best practices. Engaging with fellow creditors and tax professionals provides invaluable insights and peer support that can enhance your understanding of the filing process.

Consider joining expert Q&A sessions and webinars hosted by financial professionals aimed at discussing tax filing and document management strategies. These sessions offer additional guidance that can specifically aid in complex situations, ensuring you are well-prepared for your financial obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit schedule ef creditors who online?

How do I edit schedule ef creditors who straight from my smartphone?

How do I edit schedule ef creditors who on an iOS device?

What is schedule ef creditors who?

Who is required to file schedule ef creditors who?

How to fill out schedule ef creditors who?

What is the purpose of schedule ef creditors who?

What information must be reported on schedule ef creditors who?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.