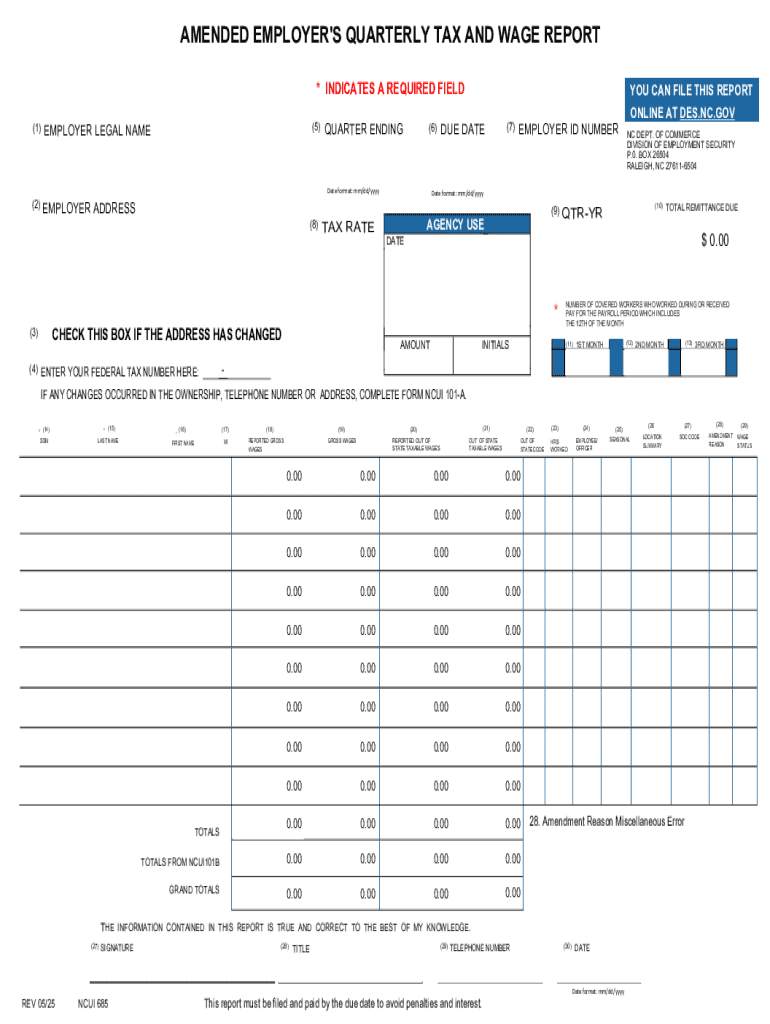

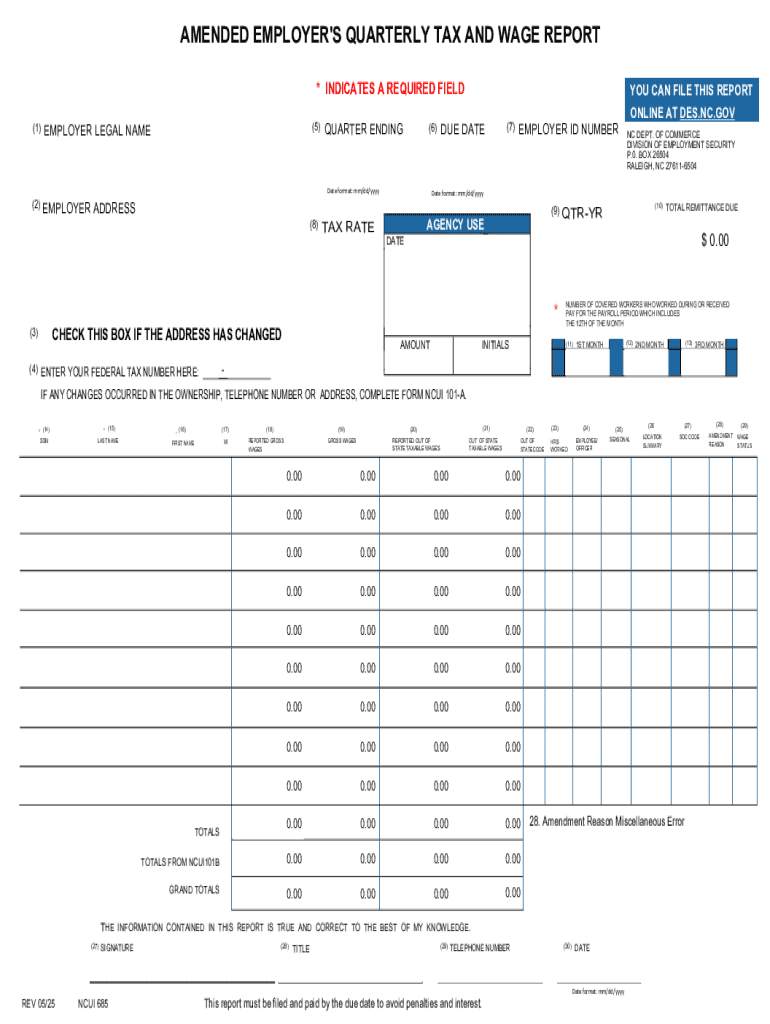

Get the free Amended Employer's Quarterly Tax and Wage Report

Get, Create, Make and Sign amended employers quarterly tax

How to edit amended employers quarterly tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out amended employers quarterly tax

How to fill out amended employers quarterly tax

Who needs amended employers quarterly tax?

Amended Employers Quarterly Tax Form: A Comprehensive How-to Guide

Understanding the amended employers quarterly tax form

The amended employers quarterly tax form is a critical document that enables employers to correct mistakes made in their original tax filings. It's vital for ensuring that tax records are accurate and up-to-date, reflecting any changes in employment status, employee wages, or other relevant information. Filing an amended form helps maintain compliance with IRS regulations and prevents potential penalties.

Understanding why it’s essential to file this form cannot be overstated. Correcting inaccuracies not only ensures accurate tax calculations but also preserves the integrity of your financial records. Moreover, distinguishing between the original and amended forms is crucial; while the original form reflects initial data, the amended version includes the adjustments, making it clear which errors were corrected.

Pre-filing considerations

Before filing an amended employers quarterly tax form, it is essential to gather the necessary information. This includes verifying employment records and reviewing previous filings. Ensuring you have all past documentation allows for thorough corrections and prevents further discrepancies.

Additionally, understanding the reason for the amendment is paramount. Common reasons for filing include reporting errors that affect taxable wages and changes in employee status, which could influence tax calculations. Determining your eligibility for amending your report is also vital, especially if it pertains to specific time frames set by the IRS.

Steps to amending your employers quarterly tax form

Amending your employers quarterly tax form involves several key steps that ensure accuracy and compliance with IRS guidelines. Start with accessing the amended form, which you can find on the IRS website or the pdfFiller platform. Downloading it using pdfFiller allows you to prepare the form digitally and streamline the editing process.

When filling out the amended form, take care to focus on common fields that often require amendment, such as employee wages and tax deductions. Utilize editing tools on pdfFiller for enhancements and accuracy adjustments, ensuring that your submission reflects true employment information.

Submission of the amended form

Once you've completed the amended employers quarterly tax form, the next step is submission. Here, you’ll choose your preferred method of filing, which can be done online through pdfFiller, by mail, email, or fax. Each method has its own best practices for ensuring secure delivery.

Following submission, it's valuable to confirm receipt of your amended form. The IRS typically provides a timeframe for processing, and keeping track of this can help you manage your expectations regarding amendments.

Understanding the implications of amending your form

After filing, understanding the implications of your amendments is equally important. Filing an amended employers quarterly tax form can affect your overall tax liabilities, possibly leading to either an increase or decrease based on corrections made. If your amendments result in overpaid taxes, you may be eligible for a refund, which involves submitting a specific request along with your amended form.

Being aware of these implications allows employers to act proactively in their financial planning and compliance strategies.

Post-submission management

After the submission of your amended form, it's essential to monitor its status. Using pdfFiller, you can easily track if and when your submission is accepted by the IRS. Should your amendment be rejected, it’s crucial to address any outlined issues promptly to rectify potential errors in your filing.

Effective record keeping will empower you to manage your tax responsibilities thoroughly and enhance your overall organizational efficiency.

Frequently asked questions

Amending employers quarterly tax forms can lead to several questions. For instance, if your situation necessitates a second amendment, it's important to know that you can indeed amend more than once for the same quarter, but each submission should clearly denote the new corrections.

You may also wonder about the possibility of amending forms filed in previous years; indeed, this is possible within certain parameters defined by the IRS. If you miss the amendment deadline, don’t panic; contact the IRS to discuss your situation, as there could be extensions available under specific circumstances.

Lastly, for those seeking further assistance, resources are abundantly available, including contacting tax professionals or checking the IRS website for more detailed guidance.

Leveraging pdfFiller for document management

One of the standout features of pdfFiller is its robust set of tools that revolutionize how users manage documents, such as the amended employers quarterly tax form. With easy editing and eSignature capabilities, users can streamline their processes significantly, ensuring all amendments are completed promptly and accurately.

Collaboration tools available in pdfFiller allow for team engagement in the amending process, fostering transparency and streamlined workflows. The cloud-based aspect of pdfFiller ensures that you can access and edit your documents from anywhere, making it a convenient solution for both individual users and teams alike.

Additional tools and resources

To further enhance your knowledge and efficiency regarding amended employers quarterly tax forms, utilizing available external resources can be beneficial. Accessing related tax forms and documents on the pdfFiller platform ensures that you always have the tools you need at your fingertips.

Community engagement offers additional support where users can join discussions on social media platforms to gather insights from fellow employers and tax professionals. Through this collaborative approach, you can stay informed on updates and best practices relevant to your tax management strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my amended employers quarterly tax in Gmail?

How can I get amended employers quarterly tax?

Can I create an electronic signature for the amended employers quarterly tax in Chrome?

What is amended employers quarterly tax?

Who is required to file amended employers quarterly tax?

How to fill out amended employers quarterly tax?

What is the purpose of amended employers quarterly tax?

What information must be reported on amended employers quarterly tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.