Get the free Property Tax Bill for 2016

Get, Create, Make and Sign property tax bill for

Editing property tax bill for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property tax bill for

How to fill out property tax bill for

Who needs property tax bill for?

Managing Your Property Tax Bill: A Comprehensive Guide

Understanding property tax bills

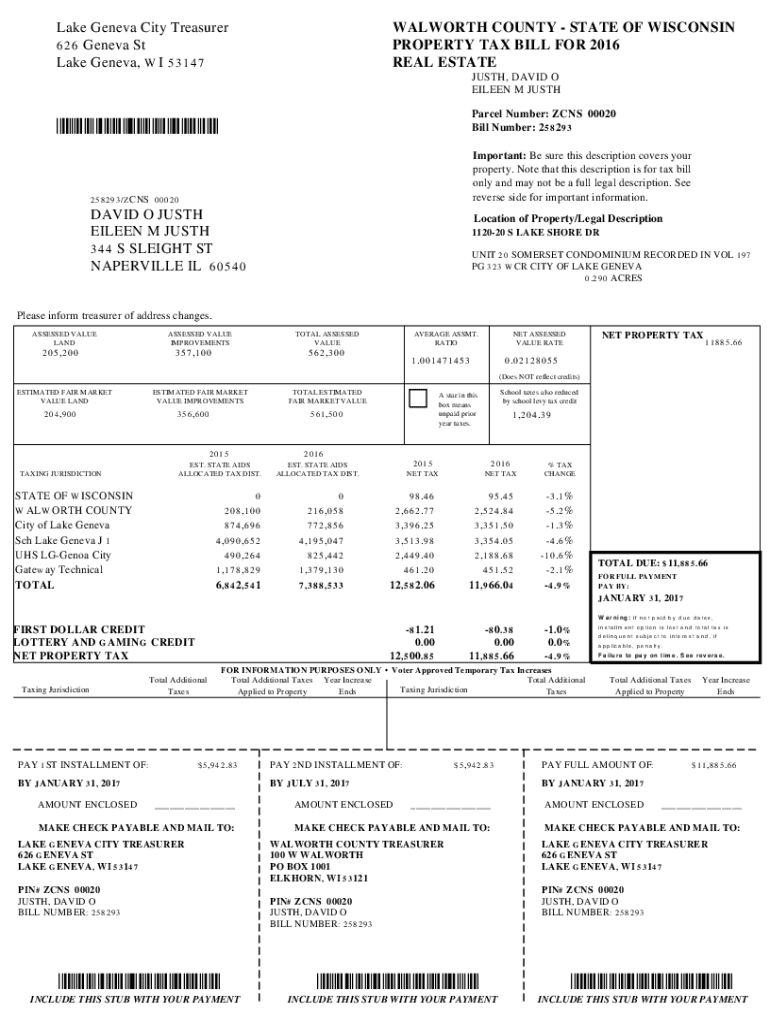

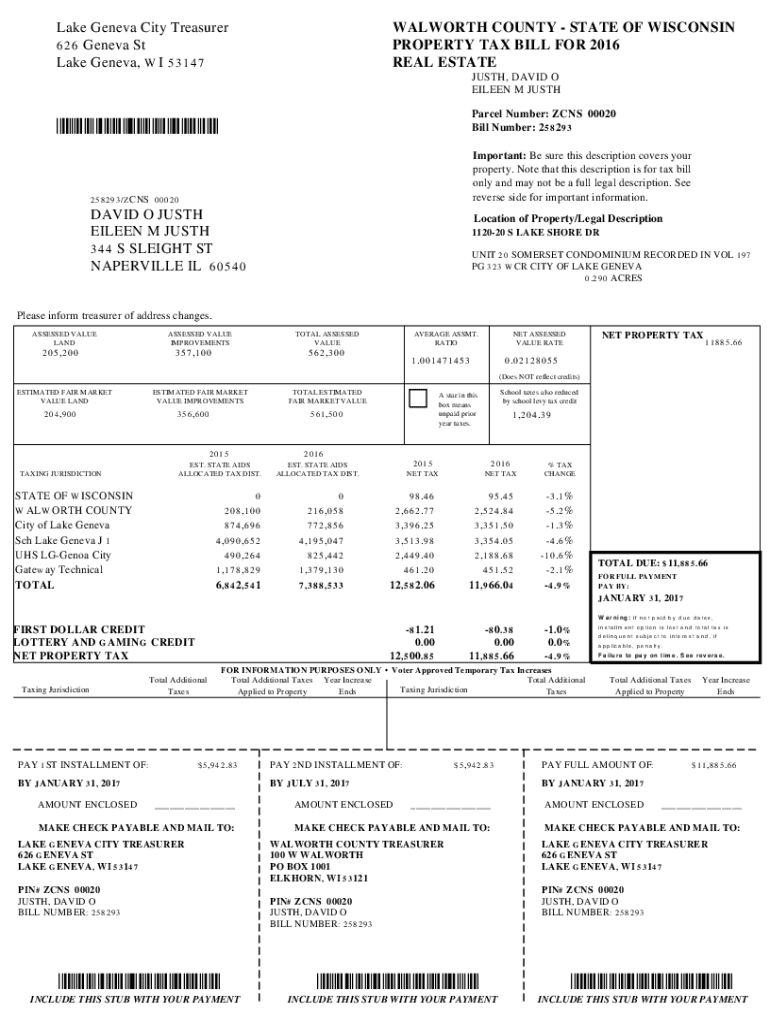

Property tax bills represent a critical financial obligation for homeowners and property owners, signifying how local governments fund essential services such as education, public safety, and infrastructure. These bills are calculated based on the assessed value of a property and the local tax rate, and their timely payment is crucial to avoiding penalties.

Each property tax bill consists of several components, providing clarity on what you owe. A typical bill will detail various charges, such as school district taxes, city or county levies, and special assessments for improvements. Understanding the details is vital because they dictate how your property is valued and taxed.

Accessing your property tax bill

Today, many local governments offer online access to property tax bills, allowing owners to view, print, or pay their tax bills conveniently. To access your property tax account online, visit your local tax authority's website. Once there, you typically need to log in using your property's ID number or related personal details.

In cases where an online bill is not accessible, you can request a physical copy from your local tax authority. It's essential to have specific information ready, including your property address and tax account number, to expedite your request.

How to read your property tax bill

Understanding how to read your property tax bill is crucial to staying informed about your financial obligations. A typical property tax bill will include several key sections. First, the account identification section will list your property’s account number, making it easy for tax agencies to process your payments accurately.

Most bills will also indicate the tax year and the billing period during which payments are due. It is imperative to note due dates, as failing to pay on time can lead to penalties or late fees. Meanwhile, understanding how your property tax is calculated involves knowing both the assessment value of your property and the local tax rate applied.

Payment options for your property tax bill

When it comes to paying your property tax bill, various options make the process more manageable. Many local tax authorities offer online payment methods. This may include credit cards, debit cards, and eChecks, allowing homeowners to complete their payments securely from home.

If you prefer offline payments, checks or money orders can often be mailed directly to the tax office. Additionally, some localities may have authorized payment locations where you can pay cash. For those who find it difficult to manage one lump-sum payment, many counties offer installment plans, allowing property owners to spread payments over the year.

Managing your property tax bill

Effective management of your property tax bill includes keeping track of your payment history and knowing how to seek refunds if applicable. Most local tax offices maintain online systems where you can log in to view previous payments, ensuring you don’t miss any records or payments.

If you believe you've overpaid your taxes or qualify for a refund due to an adjustment, knowing the steps to request a refund can save you money. Each locality will have its specific procedures, but generally, you'll need to fill out an application detailing your case and include any supporting documentation.

Disputing your property tax bill

If you find discrepancies on your property tax bill, it’s crucial to understand the appeal process available to you. Ground for disputing a tax assessment often includes errors in property assessments, or notable changes in market value that aren’t reflected in the bill. Knowledge of your rights and local tax laws will be integral in this process.

To file an appeal, you’ll often need to complete specific forms and respect deadlines imposed by your locality. Having organized documentation and compelling evidence will strengthen your case. If you're uncertain about the process, consider seeking help from real estate professionals or attorneys who specialize in property tax matters.

Resources for property tax information

Navigating property tax information is simplified through local government websites. These platforms serve as centralized resources where property owners can find their tax collector’s office and relevant forms. Often, these sites will also host FAQs, additional guides, and community resources for taxpayers.

Furthermore, education about budgeting for property taxes and understanding property tax laws is vital for homeowners. Many community colleges and organizations offer workshops or online courses aimed at demystifying these responsibilities, ensuring you’re well-prepared for any financial obligations.

Frequently asked questions (FAQs) about property tax bills

Property tax bills often raise questions among property owners. If you haven’t received a bill, check with your local tax authority to confirm your property’s assessments and addresses are correct. Errors on your tax bill should also be addressed swiftly—contacting your tax office can often rectify simple mistakes.

Additionally, exemptions and deductions are common queries; many homeowners are unaware they qualify for reductions based on certain criteria like age, disability, or income levels. Being proactive in inquiring about these aspects can save you significantly.

Utilizing pdfFiller for property tax bill management

Managing property tax forms often involves tedious paperwork. pdfFiller simplifies this by providing a cloud-based platform for filling out, editing, and eSigning your property tax bills. Whether you need to prepare a specific tax form or modify an existing one, pdfFiller provides intuitive tools that help streamline these tasks efficiently.

To fill out your property tax form on pdfFiller, simply upload your document, and utilize the editing tools to enter your information. You can easily capture electronic signatures, saving time while ensuring documents are properly executed. This is particularly useful during tax season when timely submissions and precise documentation are crucial.

Interactive tools to simplify your property tax management

Tax management becomes less daunting with the help of interactive tools. Tax calculators are invaluable for property owners who want to estimate their potential tax burden based on assessed values and local rates.

Additionally, having access to document templates ensures that you do not miss critical information or formatting requirements. Many states provide ready-to-use property tax forms, which can save you considerable time, especially when deadlines are approaching.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify property tax bill for without leaving Google Drive?

Can I edit property tax bill for on an iOS device?

How do I complete property tax bill for on an iOS device?

What is property tax bill for?

Who is required to file property tax bill for?

How to fill out property tax bill for?

What is the purpose of property tax bill for?

What information must be reported on property tax bill for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.