Get the free Form 10-qsb

Get, Create, Make and Sign form 10-qsb

Editing form 10-qsb online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-qsb

How to fill out form 10-qsb

Who needs form 10-qsb?

Understanding and Navigating Form 10-QSB: A Comprehensive Guide

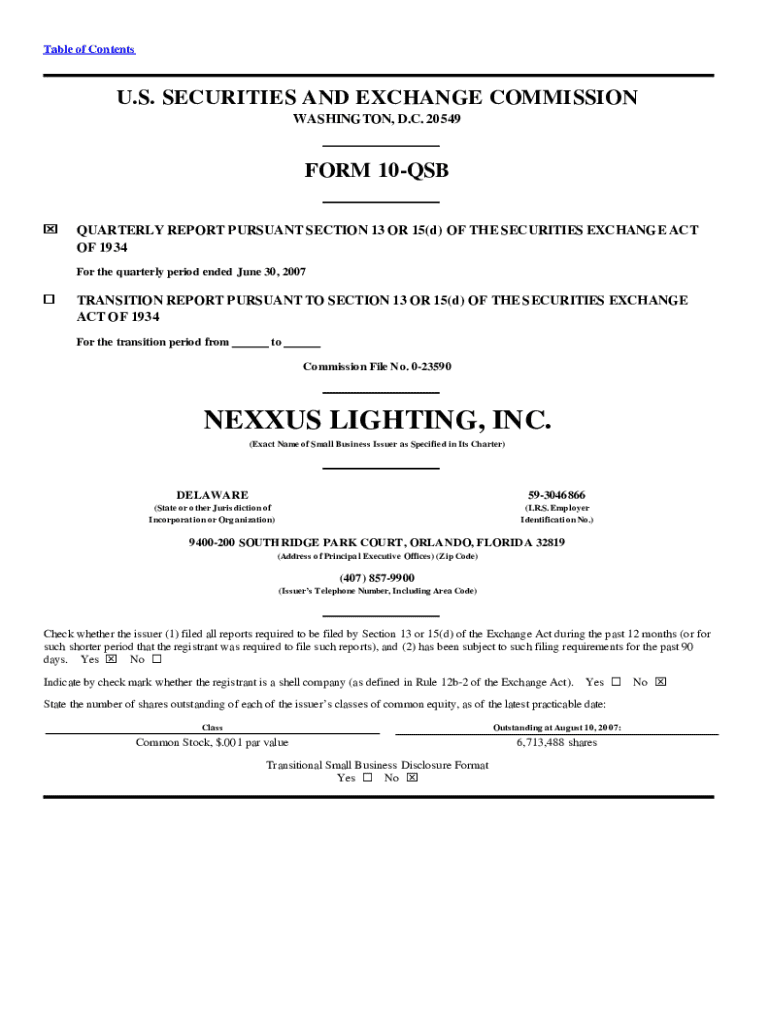

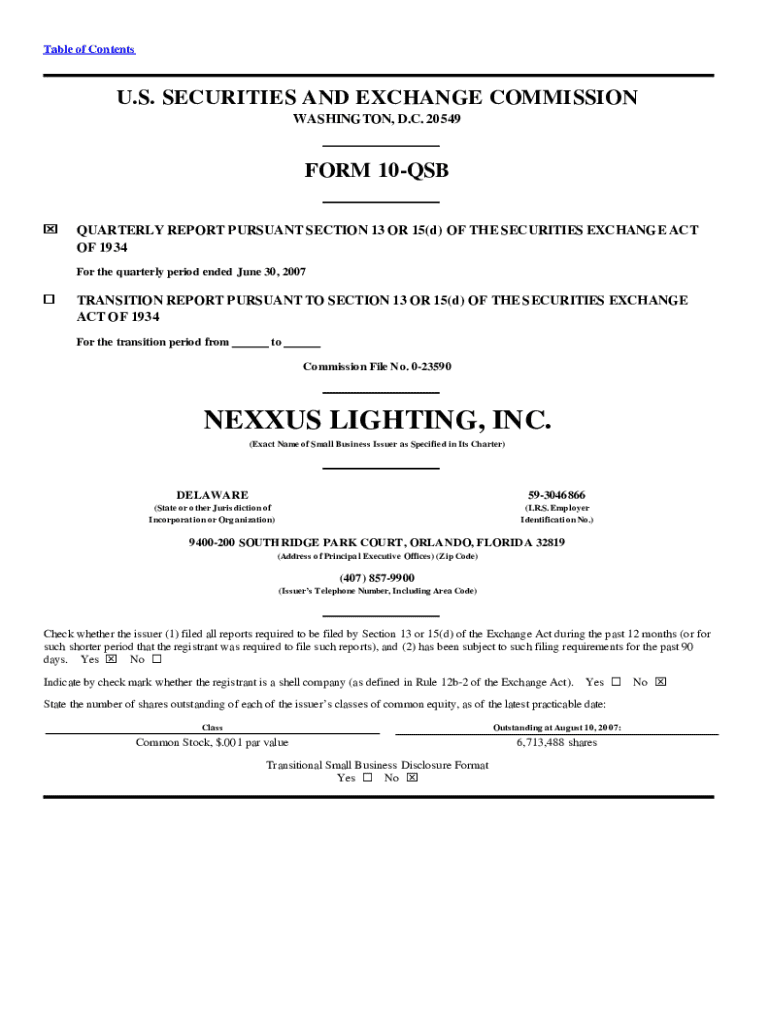

Understanding Form 10-QSB

Form 10-QSB is a crucial document for small businesses reporting to the Securities and Exchange Commission (SEC). This quarterly report provides important insights into a company's financial performance and operational status. Unlike the traditional Form 10-Q, the 'SB' designation means this form caters to smaller entities, simplifying reporting requirements while ensuring transparency with investors and regulators.

The purpose of Form 10-QSB is to give stakeholders an updated view of the business's financial health. It includes unaudited financial statements and management’s discussion about the operational results and future prospects. For small businesses, this form serves as a platform to communicate their performance metrics and strategic direction effectively.

Who needs to file?

Organizations that meet specific criteria set by the SEC are required to file Form 10-QSB. Generally, those that qualify are smaller reporting companies with a public float of less than $250 million or those that meet specific revenue thresholds. This designation allows SMEs to follow a less burdensome reporting process compared to larger corporations.

Compliance with Form 10-QSB not only fulfills regulatory obligations but also fosters credibility with investors, suppliers, and partners. By making informed financial data publicly available, small businesses can attract funding, enhance business relationships, and demonstrate sound management practices.

Preparing to fill out Form 10-QSB

Preparation is key when filling out Form 10-QSB. Start by gathering essential financial documents, including your balance sheets, income statements, and cash flow statements. This information will provide the necessary context for your financial performance, ensuring stakeholders have clarity about your business operations.

You will also need to compile other vital data such as management’s discussion and analysis (MD&A), disclosures on risk factors, and management's evaluation of internal controls. This holistic approach ensures comprehensive reporting that addresses all relevant facets analyzed during your financial periods.

Timeline and key filing dates

Understanding the timeline for filing Form 10-QSB is essential for small businesses. Typically, the SEC requires this quarterly report to be filed within 45 days after the end of each fiscal quarter. This schedule means small businesses must maintain accurate and timely financial records throughout the year to meet these deadlines.

Step-by-step instructions for completing Form 10-QSB

Completing Form 10-QSB involves a structured approach. Let's break down each section: The Cover Page includes the company name, description, and the reporting period. Following this, you will submit your Financial Statements, which should include the required balance sheets and income statements.

The Management's Discussion and Analysis (MD&A) section is critical as it provides context to the data presented. Businesses must discuss their financial condition, operational results, and future strategies. Lastly, ensure you’ve covered all Other Required Disclosures, including any legal proceedings, changes in organizational structure, or significant adjustments in the internal control methods.

When filling in these sections, avoid common pitfalls like providing incomplete or inaccurate data, which could result in penalties. Best practices include cross-referencing your reports against internal records to ensure consistency and correctness.

Editing and finalizing your Form 10-QSB

Once your Form 10-QSB is completed, editing is a crucial step to ensure accuracy. Utilizing tools like pdfFiller allows you to upload your PDF of Form 10-QSB for easy editing. With features like text boxes and comment capabilities, pdfFiller makes adjustments straightforward, allowing for user-friendly collaboration among team members.

As you finalize your report, ensure it meets all filing requirements. Create a thorough review checklist, confirming all sections are complete and compliant with SEC standards. This proactive approach avoids unnecessary complications.

Signing and submitting your Form 10-QSB

With your Form 10-QSB complete, it’s time to submit it officially. E-signing options through pdfFiller enable secure signing of your document without the need for printing. This digital method ensures convenience and maintains the integrity of your submission.

When it comes to submission methods, the SEC offers various avenues: online submission is the most common, especially through the EDGAR system, but you can also opt for email or traditional mail. Confirming your submission allows you to track its acceptance status, ensuring no steps are overlooked.

Post-filing actions and best practices

After filing your Form 10-QSB, it's essential to keep accurate records of your submission. Retain copies of the filed document as well as any confirmation emails or receipts provided by the SEC. This documentation is vital should any questions regarding compliance arise.

Understanding the review process by the SEC is equally important. Once submitted, your filing will be subject to review, and you may receive comments or requests for additional information. Engaging promptly and transparently during this phase fosters positive relationships with regulatory bodies.

Common questions and troubleshooting

Filing Form 10-QSB often raises questions among small business owners. Some frequent queries include the timeline for submissions, the types of disclosures required, and how to handle initial filing errors. Being well-informed helps prevent common pitfalls and stresses that can arise during this process.

If issues arise, such as technical difficulties with the filing system or questions about data interpretation, have a designated compliance officer or financial advisor on hand to assist. Setting up a FAQ section within your team can also facilitate smoother processes in the future.

Leveraging pdfFiller for ongoing document management

After the filing of Form 10-QSB, the capabilities of pdfFiller extend beyond just editing or signing. The platform supports ongoing document collaboration, making it easier for teams to manage subsequent filings and related documents efficiently. It offers functionalities that keep everyone on the same page.

Setting up reminders and deadlines through pdfFiller ensures that small businesses can proactively manage future filing requirements. Utilize integrated dashboards and automated notifications to stay ahead of compliance deadlines, making collaborative efforts smoother and more effective.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 10-qsb in Chrome?

How do I edit form 10-qsb straight from my smartphone?

How can I fill out form 10-qsb on an iOS device?

What is form 10-qsb?

Who is required to file form 10-qsb?

How to fill out form 10-qsb?

What is the purpose of form 10-qsb?

What information must be reported on form 10-qsb?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.