Get the free Payee Data Record

Get, Create, Make and Sign payee data record

Editing payee data record online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payee data record

How to fill out payee data record

Who needs payee data record?

A Comprehensive Guide to the Payee Data Record Form

Understanding the payee data record form

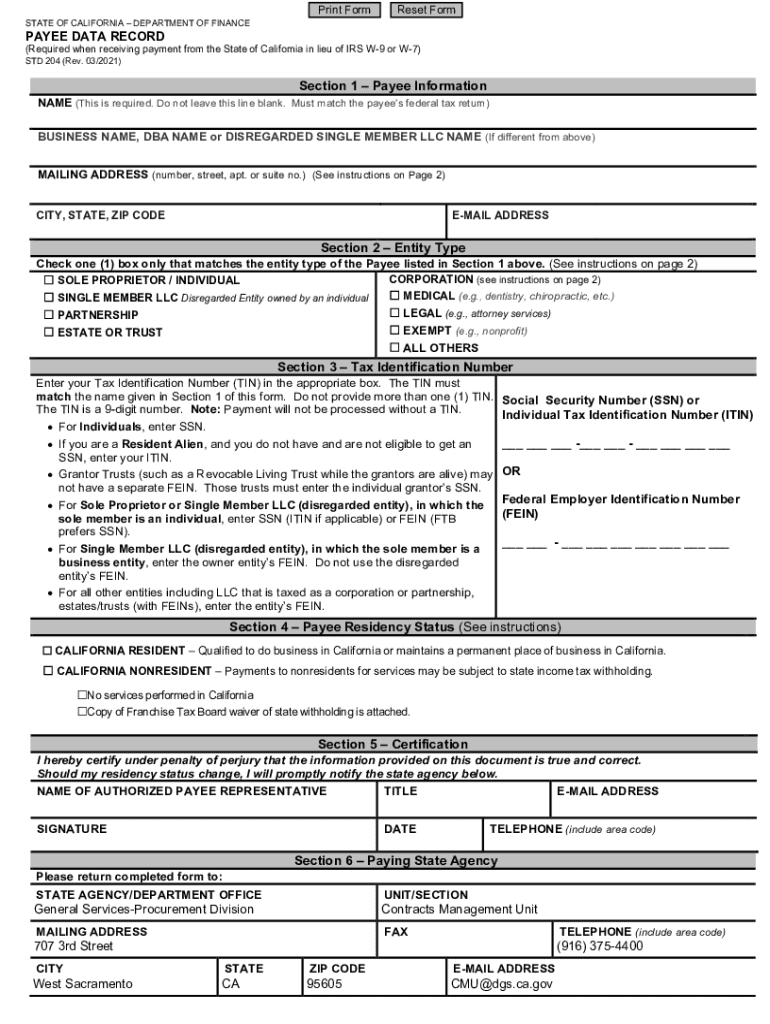

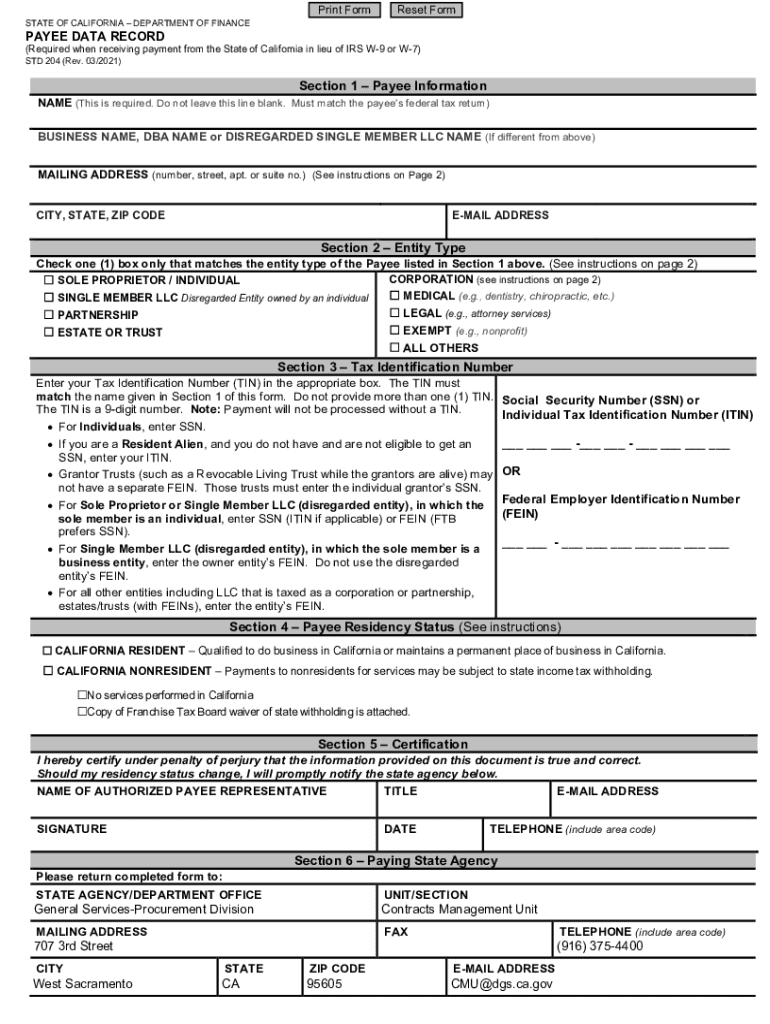

A payee data record form is a vital document utilized by organizations to gather essential information about individuals or entities to whom they make payments. This form not only ensures that transactions are processed smoothly but also aids in compliance with tax regulations. By collecting and recording accurate payee details, companies can minimize errors and avoid tax penalties.

The importance of the payee data record form extends beyond simple payment tracking; it forms the backbone of financial accountability and transparency within an organization. By having all necessary information documented, businesses can effectively manage their relationships with vendors and fulfill regulatory requirements.

Key components of the form

The payee data record form typically includes several key components. Required fields often consist of the payee's name, address, taxpayer identification number (TIN), and type of payee (individual, corporation, or partnership). Each of these elements plays a significant role in ensuring accurate record-keeping and compliance.

Purpose and applications

The primary purpose of the payee data record form is to collect and record necessary information for financial transactions, particularly in cases involving vendor payments and tax compliance. Organizations often use this form to create accurate financial records that aid in budgeting, reporting, and filing taxes. Proper data recording using this form minimizes the risk of payment errors, ensuring that vendors are paid accurately and on time.

Situations such as processing payroll, making vendor payments, or ensuring 1099 reporting compliance commonly require the use of a payee data record form. By streamlining this process, businesses can improve efficiency and reduce administrative overhead associated with managing vendor payments.

Common industries utilizing the form

Several industries frequently utilize the payee data record form to manage their payment transactions effectively. For instance, the construction and manufacturing sectors rely heavily on this to process payments for subcontractors and raw materials. Additionally, educational institutions and healthcare providers leverage this form to manage payments to staff and service providers.

How to fill out the payee data record form

Filling out the payee data record form accurately is crucial to ensure all information captured is valid and up to date. Here’s a step-by-step guide on how to complete this important document.

Step-by-step instructions

Utilizing tools such as pdfFiller can streamline the process of filling out these forms. By offering interactive features, users can edit existing forms or create new ones without the hassle of printing or manually entering data.

Editing and managing your payee data record form

Once the payee data record form is filled out, managing it effectively is crucial. pdfFiller provides a robust platform for users to edit their forms seamlessly and maintain organized records.

Using pdfFiller to edit forms easily

With pdfFiller, users can upload their completed forms to the platform, enabling easy editing and sharing with team members. The platform simplifies adjustments, ensuring that the most accurate and up-to-date information is always at hand.

Collaboration features

Another advantage of pdfFiller is its collaboration features. Users can invite colleagues to review and suggest changes on the payee data record form. This functionality allows for better communication among team members and ensures that the document meets all necessary requirements before finalizing.

Signing the payee data record form

After completing and reviewing the payee data record form, the next step is to sign it. Legal electronic signatures are recognized and valid, making the eSignature process through pdfFiller both simple and compliant with legal standards.

Electronically signing the form

Using pdfFiller's electronic signature capabilities, users can sign the form quickly and efficiently, ensuring a smooth workflow. It’s essential to understand the legal implications of eSignatures, which hold the same validity as handwritten signatures in most jurisdictions.

What to do after signing

After signing the payee data record form, users should save it in a secure location, ensuring compliance with record-keeping regulations. Options for distribution may include downloading the form, sending it directly via email through pdfFiller, or storing it in a cloud-based repository for easy access.

Frequently asked questions (FAQs)

Users often have specific questions when it comes to the payee data record form. Addressing these common queries can help ensure clarity and enhance the efficiency of using this document.

Real-world examples

Examining real-world applications of the payee data record form reveals its practicality and impact on various organizations. Case studies can depict scenarios in which accurate data management has resulted in faster transaction processing and fewer compliance issues.

For instance, a small construction business implemented the payee data record form to streamline payments to subcontractors. By ensuring that all subcontractors filled out the form correctly, they reduced payment delays and improved vendor relationships.

Testimonials from users

Users have positively responded to pdfFiller's platform for managing payee data record forms. Companies have shared feedback on how the platform’s collaborative tools and ease of use significantly improved their documentation processes, ultimately saving time and resources.

Resources for further assistance

Related terms and definitions

Understanding key terms associated with the payee data record form is crucial for accurate usage and communication. Here’s a brief glossary to help clarify relevant concepts.

Getting started with pdfFiller

To make the most out of your payee data record form, creating an account with pdfFiller is the first step. Signing up offers access to numerous features that simplify form creation and management, including templates and collaboration tools.

Keeping your data secure

Security measures are paramount when handling sensitive information on the payee data record form. pdfFiller employs various protocols to ensure that user data is safeguarded during the entire document process.

Users are encouraged to adhere to best practices for maintaining privacy, including using strong passwords, enabling two-factor authentication, and regularly reviewing access permissions for shared documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my payee data record in Gmail?

How can I modify payee data record without leaving Google Drive?

Can I create an electronic signature for signing my payee data record in Gmail?

What is payee data record?

Who is required to file payee data record?

How to fill out payee data record?

What is the purpose of payee data record?

What information must be reported on payee data record?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.