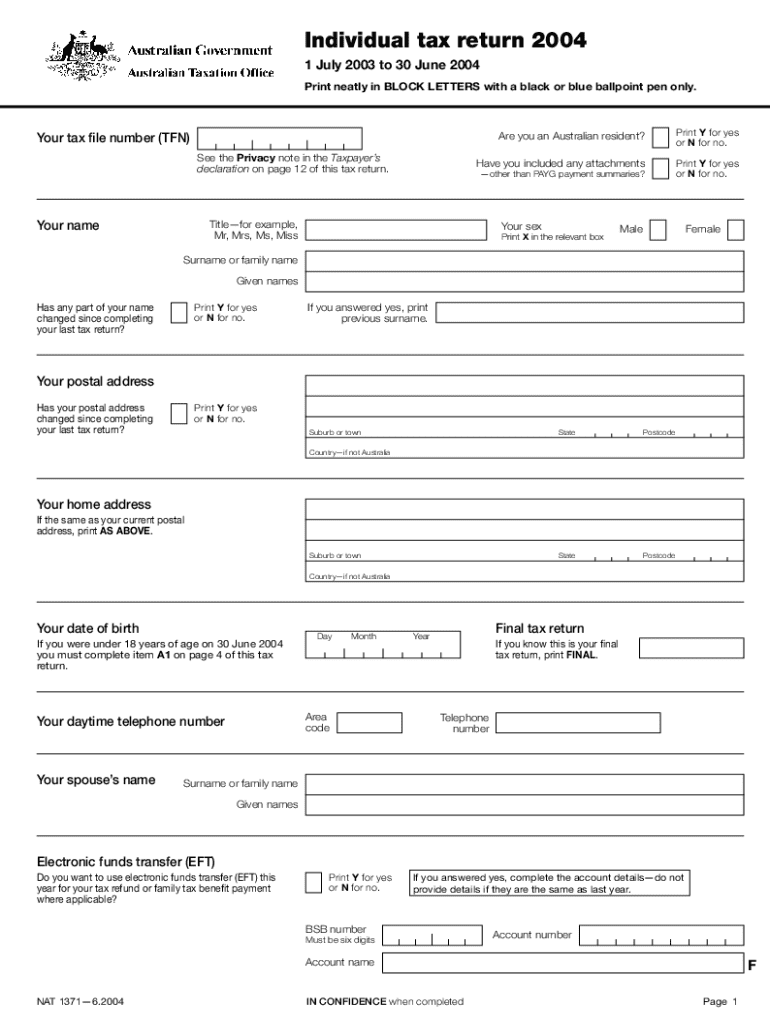

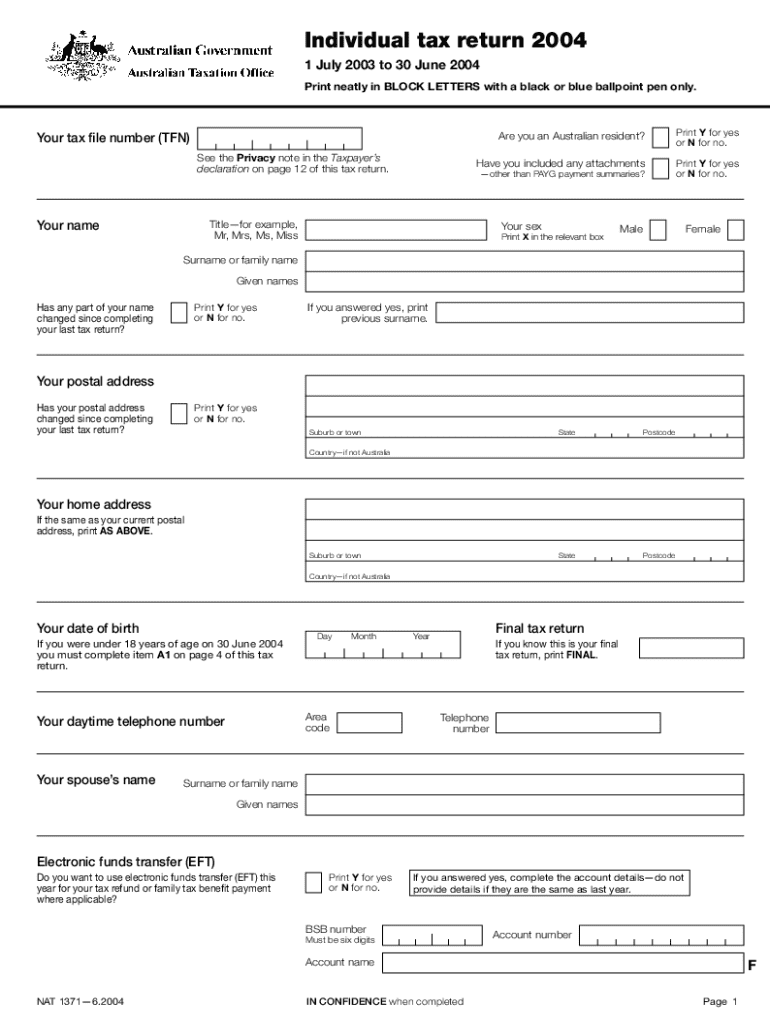

Get the free Individual Tax Return 2004

Get, Create, Make and Sign individual tax return 2004

How to edit individual tax return 2004 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual tax return 2004

How to fill out individual tax return 2004

Who needs individual tax return 2004?

Understanding the Individual Tax Return 2004 Form

Understanding the individual tax return 2004 form

The Individual Tax Return 2004 Form, commonly referred to as Form 1040, plays a crucial role in the tax landscape of that year. Designed for individual taxpayers, this form is essential for reporting income, deductions, and credits to the IRS. Its importance lies not only in tax compliance but also in determining one's tax liability, which could lead to a refund or an amount due.

The typical deadline for filing the Individual Tax Return 2004 Form was April 15, 2005, unless an extension was requested. Understanding these deadlines is vital to avoid penalties that can arise from late submissions.

Who needs to file this form?

Not everyone is required to file the Individual Tax Return 2004 Form. Generally, individuals who earned income above a certain threshold must file. This includes employees, self-employed individuals, and freelancers who had a specific minimum income that year. Notably, self-employed individuals must also pay self-employment tax, which can add complexity to their total tax liability.

Special considerations apply for certain groups, including students, dependents, and those with only unemployment income. These individuals may have different filing requirements or potential for filing exemptions.

Preparing to fill out the individual tax return 2004 form

Preparation is essential when tackling the Individual Tax Return 2004 Form. The first step is gathering all necessary documentation. This includes your W-2s for wages, 1099 forms for other sources of income, and any receipts relevant for claiming deductions. Proper documentation is vital as the IRS may require proof for any claimed amounts.

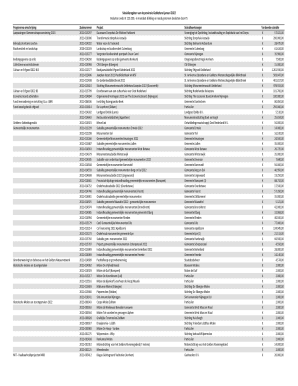

Additionally, applicants should familiarize themselves with the tax brackets and deductions applicable in 2004. The tax rates varied based on income levels, and knowing where one falls can help calculate the owed taxes accurately. Common deductions from that year include student loan interest, mortgage interest, and certain business expenses.

Tax credits available for 2004 filers

Tax credits can significantly reduce the amount owed to the IRS by providing dollar-for-dollar reductions in tax liability. For the year 2004, some of the notable credits included the Earned Income Tax Credit (EITC), Child Tax Credit, and the Hope Scholarship Credit for education expenses. Understanding how to claim these credits on the Individual Tax Return 2004 Form can result in substantial savings.

When you come to fill in the form, ensure you have details at hand for any credits you wish to claim. Be aware of eligibility requirements for each credit, as these can vary significantly.

Step-by-step instructions for completing the form

Navigating the Individual Tax Return 2004 Form requires a thoughtful approach. Each part of the form has specific requirements. Familiarize yourself with the layout: beginning with personal information, moving through income reporting, then to claiming deductions and credits, before finishing with your signature.

Start by filling out the personal information section accurately. Mistakes here can lead to processing delays. Report various types of income, ensuring you categorize them correctly — wages from W-2s, interest income from savings accounts, or self-employed income from 1099 forms.

Claim deductions by entering them into the respective areas of the form. Remember to check eligibility for each deduction and accurately calculate the total amounts. Finally, review your return thoroughly for errors; failure to double-check can lead to costly mistakes or audits.

Leveraging pdfFiller for your 2004 tax return needs

pdfFiller provides a comprehensive solution for accessing and managing the Individual Tax Return 2004 Form. Users can easily find and download Form 1040 by searching for it on the platform. With an intuitive interface, users can begin filling it out directly within the platform, saving time and ensuring that all information fits the necessary fields.

The interactive tools provided by pdfFiller allow for easy collaboration with tax professionals or advisors, ensuring all parties can review and edit as necessary. This level of interactivity can streamline the process of ensuring all information meets IRS standards.

Once completed, users can electronically sign the form using pdfFiller’s eSigning capabilities. This not only saves time but also allows for quick submission of the return, whether electronically or via mail.

Troubleshooting common issues

Mistakes can happen when filling out your Individual Tax Return 2004 Form. If you realize you've made an error after submission, it's essential to act quickly. The IRS allows for amendments through the Form 1040X. It's crucial to provide proper documentation for changes and keep a note of any communications with the IRS.

Additionally, be prepared for possible inquiries from the IRS regarding your submission. Often, these inquiries stem from discrepancies in reported income or deductions. Responding promptly and thoroughly is vital in addressing any concerns the IRS may have regarding your tax return.

Final thoughts on filing the individual tax return 2004 form

Filing the Individual Tax Return 2004 Form accurately and on time is essential for avoiding penalties and ensuring compliance with tax laws. Understanding the nuances of the tax code from that year can aid in maximizing deductions and credits available to you. Staying informed about future tax changes will benefit you in subsequent tax years.

By employing modern tools such as pdfFiller, individuals can simplify the tax preparation process, making it more efficient and intuitive. Whether you’re filing for the past year or preparing for years to come, having the right platform can make all the difference in your tax experience.

Frequently asked questions (FAQs)

When filing the Individual Tax Return 2004 Form, many taxpayers have common concerns. Questions about whether specific income sources require reporting, or how to handle deductions, are frequently raised. Understanding these FAQs can empower you as a taxpayer, ensuring you're well-prepared.

Moreover, situations such as international income require special attention — different rules apply, and being aware of them is crucial for compliance. Engaging with tax professionals or reliable resources like pdfFiller can provide clarity.

Contact options for assistance

If you need help with your Individual Tax Return 2004 Form, resources are readily available. Tax professionals can provide tailored guidance, ensuring your return is compliant and taking advantage of all available deductions and credits. Additionally, pdfFiller offers support resources that guide users through the process, guaranteeing their experience is seamless.

Direct engagement with tax experts can also clarify unique situations, especially for filers with complicated tax scenarios.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my individual tax return 2004 in Gmail?

How do I edit individual tax return 2004 straight from my smartphone?

How do I edit individual tax return 2004 on an iOS device?

What is individual tax return?

Who is required to file individual tax return?

How to fill out individual tax return?

What is the purpose of individual tax return?

What information must be reported on individual tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.