Get the free Real Estate Tax Commitment Book - 12.250

Get, Create, Make and Sign real estate tax commitment

How to edit real estate tax commitment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out real estate tax commitment

How to fill out real estate tax commitment

Who needs real estate tax commitment?

Real Estate Tax Commitment Form: A Comprehensive Guide

Understanding the real estate tax commitment form

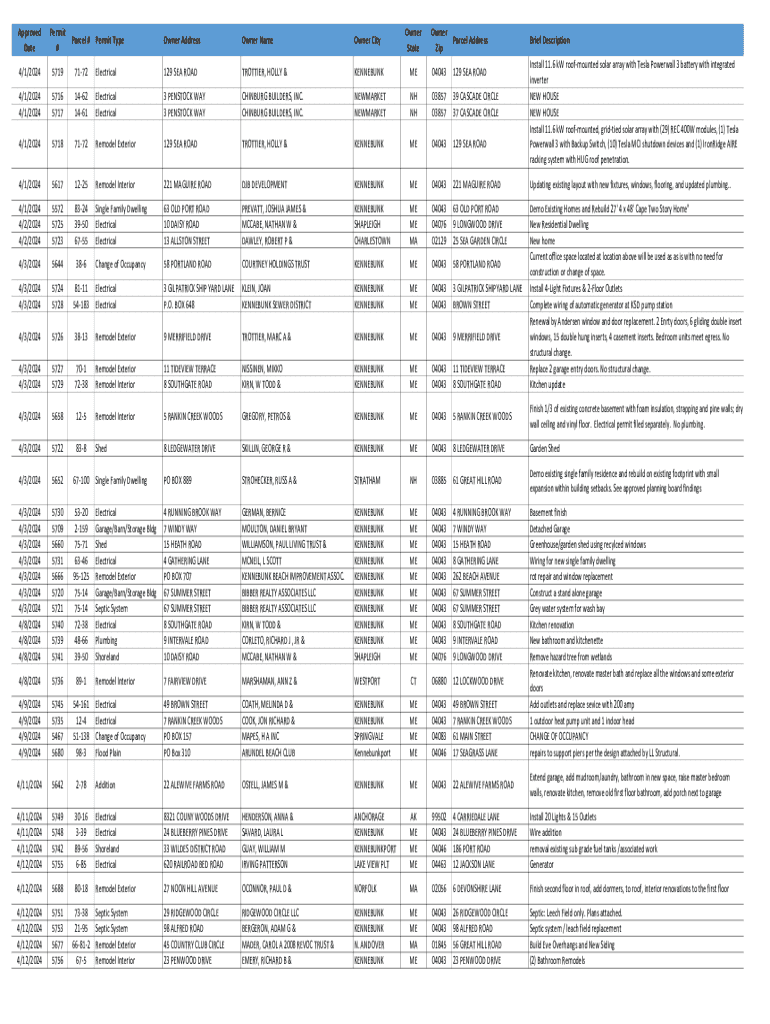

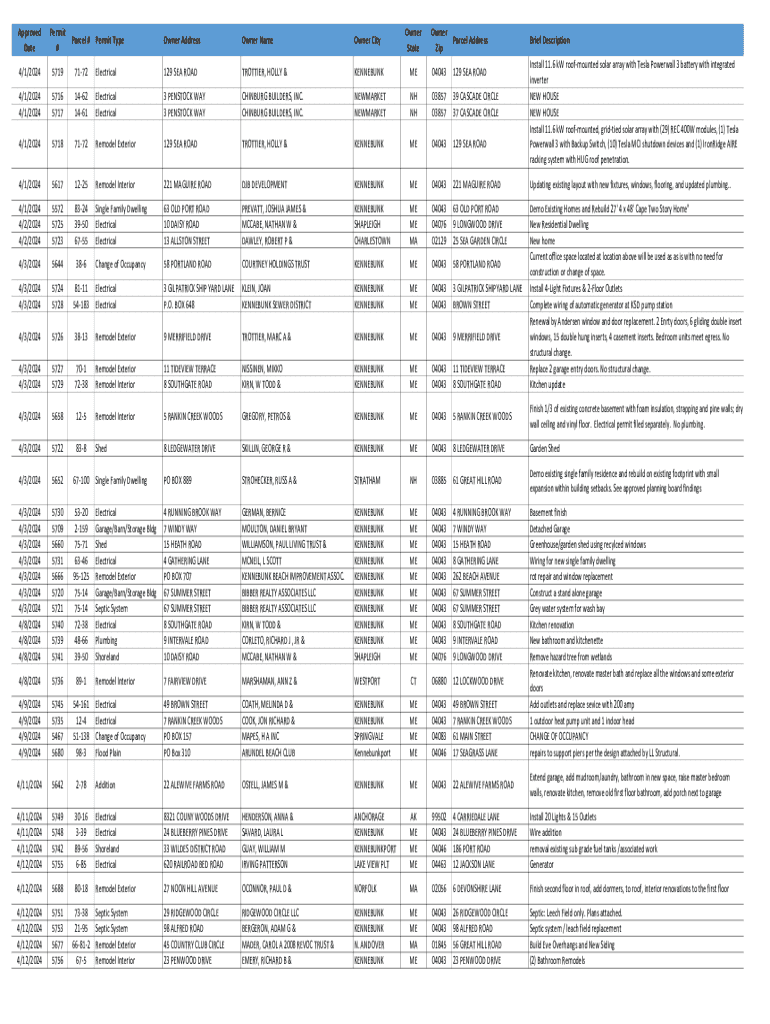

A Real Estate Tax Commitment Form is an official document issued by local government or tax authorities that outlines the tax obligations associated with a property. The primary purpose of this form is to document the assessed value of the property, the applicable tax rate, and the total tax due for that fiscal period. This form is crucial because it serves as a notification for property owners regarding their tax liabilities and provides transparency over how property taxes are calculated.

The importance of this form cannot be overstated; it impacts not just the revenue collected by municipalities, but also the financial planning of property owners. Staying updated with the tax commitment form allows property owners to avoid penalties, ensure timely payments, and ultimately plan for property upgrades or new purchases.

Who needs to use the form?

The Real Estate Tax Commitment Form is essential for multiple parties involved in property ownership and management. This includes property owners who need to stay compliant with tax regulations, real estate agents who guide clients through property acquisition, and tax assessors who calculate property values and tax rates. Situations that require the form typically arise during the buying or selling of properties, reassessments of property values, and regular tax audits conducted by local authorities.

Components of the real estate tax commitment form

Understanding the essential components of the Real Estate Tax Commitment Form is crucial for accurate completion. The form typically contains several key sections, including:

Key terminology associated with the form includes terms like 'assessed value', which refers to the value assigned to the property for taxation purposes, 'mill rate', which is the tax rate expressed in mills per dollar of assessed value, and 'exemptions', which can reduce the taxable value in certain cases.

Step-by-step instructions for completing the form

To complete the Real Estate Tax Commitment Form successfully, start by gathering all necessary documents. This includes the property deed, previous tax forms, and any assessments from local tax authorities. Essential information needed to fill out the form consists of the property owner's name, property identification numbers, and specific details regarding the assessed property value.

Pre-filling requirements

Before filling out the form, ensure you have collected the following documents and information:

Detailed filling guide

When filling out the form, follow these steps carefully:

Common mistakes often seen include missing signatures, providing incorrect identification numbers, or failing to specify pertinent exemptions. Review your completed form thoroughly, using a checklist to ensure all required sections are completed.

Editing and updating the real estate tax commitment form

Once you have submitted your Real Estate Tax Commitment Form, it may become necessary to make changes. If you discover discrepancies or if your financial situation changes, you will need to amend your submission.

How to make changes after submission

To amend a submitted form, follow these steps:

Be mindful of important deadlines that may apply to amendments and keep in touch with your local tax agency to avoid missing critical timelines.

Using pdfFiller for seamless edits

Using a cloud-based document management tool such as pdfFiller can streamline the editing process. With pdfFiller, you can easily access and edit your Real Estate Tax Commitment Form from anywhere.

Utilizing pdfFiller's intuitive editing features empowers you to make quick adjustments, add comments for collaborators, and ensure the final document meets all necessary requirements efficiently.

Signing the real estate tax commitment form

Once your form is complete, it's vital to sign it to validate the information provided. Electronic signatures have become increasingly accepted in real estate transactions, providing a convenient and secure method of signing.

Electronic signatures explained

Legally, eSignatures can hold the same weight as traditional handwritten signatures as long as they comply with certain regulations. It's important to understand the advantages of eSignatures. They provide a faster turnaround time and reduce the potential for physical errors associated with paper forms.

How to sign your form using pdfFiller

pdfFiller offers an easy-to-follow process for eSigning your Real Estate Tax Commitment Form:

Emphasizing secure signing practices such as using strong passwords and encryption can safeguard your digital documents.

Collaborating on the tax commitment form

Handling the Real Estate Tax Commitment Form often requires collaboration, especially in cases where multiple team members are involved in property management.

Working with team members

pdfFiller enhances collaboration through features that allow users to share the form with colleagues for review and feedback. Simply share the document link, enabling team members to access the form securely.

Best practices for collaborative completion

When collaborating on the form, consider these strategies:

Submitting the real estate tax commitment form

Once the Real Estate Tax Commitment Form is complete and signed, the next step is submission. Timely submission is critical to avoid late fees or penalties from the tax authority.

Submission methods explained

Typically, submission methods can include:

It's essential to track your submission to confirm that your Real Estate Tax Commitment Form was received. Keep an eye out for any communication from the tax authority regarding any queries or issues post-submission.

Frequently asked questions about the real estate tax commitment form

Many users have similar queries when dealing with the Real Estate Tax Commitment Form. Here are some common concerns and answers:

Incorporating these resources can make a significant difference in navigating the complexities of property taxes.

Real estate taxation trends and updates

Property taxes are subject to change based on various legislative updates that may affect real estate valuations and the overall taxation structure. It's crucial to stay informed about key changes that may impact your Real Estate Tax Commitment Form.

Key changes in 2025 that may affect your form

Regularly check local news or government bulletins for updates related to new laws or policies regarding property assessments and exemptions that might be introduced.

Upcoming deadlines to keep in mind

Being vigilant about important submission dates is key in avoiding penalties. Tax deadlines can vary by locality, so it's advisable to maintain a calendar with the specific dates related to your property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my real estate tax commitment directly from Gmail?

How do I edit real estate tax commitment online?

How do I complete real estate tax commitment on an Android device?

What is real estate tax commitment?

Who is required to file real estate tax commitment?

How to fill out real estate tax commitment?

What is the purpose of real estate tax commitment?

What information must be reported on real estate tax commitment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.