Get the free 2024 1099-nec/misc Worksheet

Get, Create, Make and Sign 2024 1099-necmisc worksheet

Editing 2024 1099-necmisc worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 1099-necmisc worksheet

How to fill out 2024 1099-necmisc worksheet

Who needs 2024 1099-necmisc worksheet?

2-NEC/MISC Worksheet Form: A Complete Guide

Understanding the 2-NEC/MISC forms

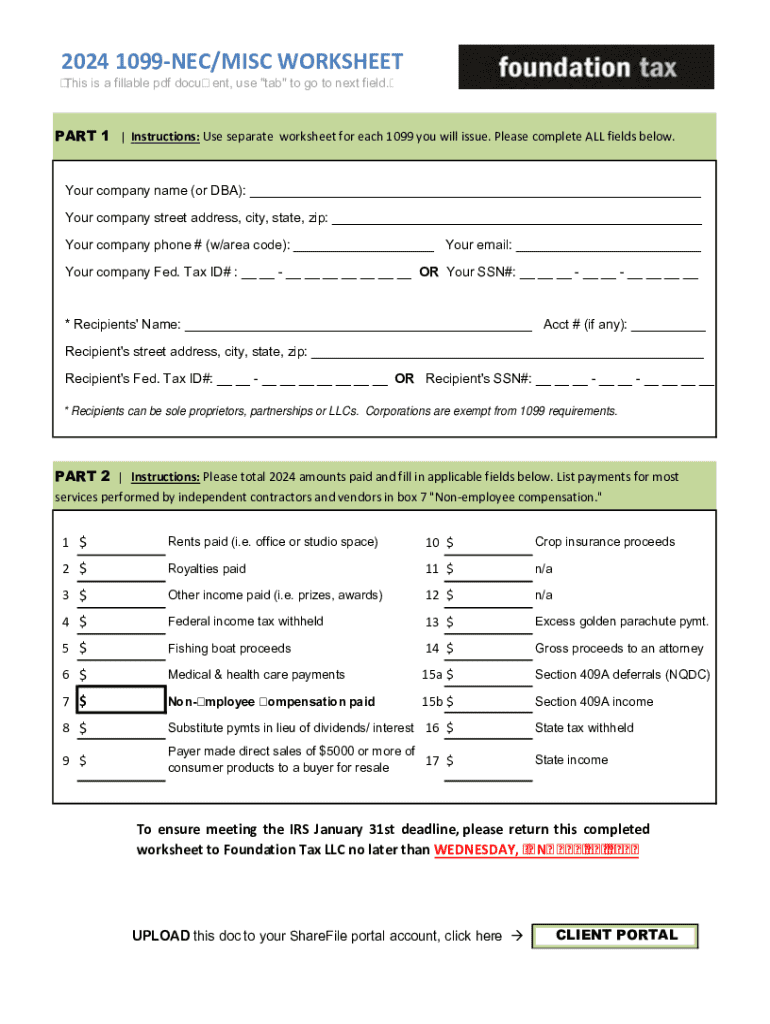

The 2-NEC/MISC Worksheet Form is essential for business owners and freelancers who need to report income paid to non-employees. Form 1099-NEC is primarily used to report payments made to independent contractors or freelancers, while Form 1099-MISC is reserved for various other types of payments, such as rent, royalties, and payments made to an attorney.

The key differences between 1099-NEC and 1099-MISC lie in their specific uses. With the resurgence of Form 1099-NEC in recent years, it has created a clearer distinction in reporting requirements. It’s crucial for filers to understand these nuances to ensure they adhere correctly to IRS regulations and avoid potential penalties.

The importance of these forms in tax reporting cannot be overstated, as they facilitate accurate income reporting and help the IRS track tax liabilities effectively. Misreporting or failing to file these forms can result in consequences for both payers and payees.

Who needs to file the 2-NEC/MISC?

Various entities are required to file the 2-NEC or 1099-MISC forms, including individuals, sole proprietors, partnerships, corporations, and other types of organizations that make reportable payments across the tax year. The requirement to file arises when payments exceed the threshold of $600 in a calendar year for services rendered by non-employees.

However, there are exceptions to filing requirements. For example, while most payments to attorneys must be reported, payments made through credit cards or third-party networks are typically reported on Form 1099-K instead. Understanding these nuances is vital for compliance.

When to use 1099-NEC vs. 1099-MISC

Knowing when to use 1099-NEC versus 1099-MISC can greatly affect your tax reporting accuracy. The 1099-NEC is mandated for payments to independent contractors for services provided, such as consulting fees and commissions. In contrast, 1099-MISC should be used for reporting other income types, including payments for rent, royalties, and certain payments to attorneys.

Consider the following examples to clarify which form to utilize: For instance, if you're compensating a freelance graphic designer for various projects surpassing $600 in a year, you would file 1099-NEC. Conversely, if you pay a landlord monthly rent that accumulates over $600, Form 1099-MISC would be necessary.

Filing deadlines for 2024

Filing deadlines for the 2-NEC and 1099-MISC forms have distinct dates, crucial for both paper and electronic submissions. The IRS mandates that forms must be postmarked or e-filed by January 31, 2024. Note that if you’re submitting the forms to the IRS, paper files must reach the agency by this date, while electronic submissions must also be completed by the same deadline to avoid penalties.

Failure to meet these deadlines can lead to penalties based on how late the forms are submitted. It's therefore essential to mark your calendars ahead of time and ensure that all necessary information is gathered early in the year to avoid last-minute stress and possible errors in reporting.

Step-by-step instructions for completing 2-NEC/MISC

Completing the 2-NEC/MISC forms requires attention to detail. Understanding each section's purpose is pivotal for accurate reporting. The first section includes payer information, consisting of your business name, address, and taxpayer identification number (TIN). Next, you’ll input payee details, such as their name, address, and TIN.

The final section covers payment information, where you’ll report the total amount paid. For 1099-NEC, this will include any payments for services rendered, while 1099-MISC will reflect different categories of payments. Common pitfalls include misreporting amounts and incorrect TIN entries, so double-check to ensure accuracy.

Electronic filing requirements and best practices

The IRS encourages electronic filing for efficiency and accuracy, especially for those filing multiple forms, as it reduces human error and speeds up processing. Businesses that file 250 or more 1099 forms in a calendar year must file electronically. eFiling allows for real-time validation of forms submitted and immediate feedback on errors or corrections needed.

Utilizing platforms like pdfFiller can simplify this process significantly. With capabilities for editing, signing, and sharing forms, pdfFiller empowers users to have a seamless document management experience. The ease of collaboration with team members further enhances accuracy and compliance, making it a preferred choice for many businesses.

Extensions for filing

If you find yourself needing additional time to complete your 2-NEC or 1099-MISC forms, you can apply for an extension. Form 8809 allows you to request an extension for up to 30 days. This can be a relief for businesses trying to ensure that all their reporting is impeccable before submissions.

However, it's essential to note that an extension only extends the filing deadline, not the tax payment deadline. Therefore, your estimated taxes must still be paid on time, or you may face penalties. You can conveniently file for an extension through pdfFiller, adding another layer of efficiency to your document management process.

Penalties for late filing or incorrect reporting

Penalties can be expensive for businesses that fail to file their 2-NEC or 1099-MISC forms on time or provide incorrect information. The IRS imposes fines ranging based on how late the filing occurs, starting from $50 for forms filed late and increasing to $270 for returns filed more than 30 days late.

Moreover, continued failure to file can result in even more stringent penalties, making it crucial for filers to keep track of their filing deadlines. A good strategy to avoid penalties includes setting reminders and ensuring a thorough review of all forms before submission.

Important calendar reminders for tax filers

Maintaining an organized calendar is crucial for business owners and self-employed individuals to ensure proper tax filing. Key tax dates include January 31, 2024, for filing deadlines and February 15, 2024, for extension requests. Keeping these reminders at the forefront can help avoid any last-minute rush which often leads to errors.

It's also beneficial to track payment schedules throughout the year, ensuring that all compensable amounts are accurately reported within the tax forms. The proactive management of these dates can safeguard against any penalties or complications that may arise.

Industry-specific filing considerations

Different industries often have unique reporting requirements concerning 1099 forms. Freelancers in the gig economy commonly file 1099-NEC for various services, while real estate professionals may be more likely to use 1099-MISC to report payments for services like property management. Healthcare providers frequently deal with multiple forms and require meticulous record-keeping.

Understanding the nuances specific to each industry can help streamline the filing process and ensure compliance with IRS regulations. Tailoring your approach based on industry standards can significantly enhance the accuracy of your filings.

Related tools and services for document management

pdfFiller enhances the filing experience for the 2-NEC/MISC Worksheet Form by offering a range of features that simplify the management of tax documents. With built-in editing capabilities, users can adjust forms before submission, ensuring that all information is accurate and complete.

Moreover, pdfFiller provides eSignature integration, which is crucial for verifying and authenticating documents. The platform’s collaborative features facilitate teamwork, allowing users to manage forms effectively and ensuring that every team member has the necessary access to information, promoting accuracy.

Comparative analysis: 1099-NEC/MISC vs. other reporting forms

Understanding the relationship between 1099-NEC/MISC and other tax reporting forms, such as 1099-K and W-2, is vital for choosing the right form based on your business needs. The 1099-K is utilized for reporting payments made through payment networks while the W-2 is strictly for employee wages.

Choosing the right form is crucial to avoid misreporting income, which can lead to penalties. For example, if payments are transacted through a third-party network, 1099-K would be appropriate, whereas direct payments for services should be reported using the 1099-NEC.

Recent changes and updates for 2024

Tax laws can evolve quickly, and it's essential to stay updated with recent changes affecting the 2-NEC and 1099-MISC forms. Legislative updates can introduce new reporting requirements or alter existing ones, impacting how businesses report payments.

For 2024, it's crucial to be aware of the IRS updates on payment thresholds and which types of payments are reportable. Such changes can have implications for businesses, especially if they inadvertently overlook new rules.

Frequently asked questions (FAQs)

It's common for filers to have questions concerning the 2-NEC/MISC forms. A frequently asked question is about the necessity of obtaining payee TINs. The answer is yes; obtaining the Taxpayer Identification Number is essential for reporting purposes, and failing to do so can lead to complications.

Another common query involves the differences between 1099-NEC and 1099-MISC, particularly in specific payment scenarios. Familiarizing yourself with these distinctions is essential to ensure that your business remains compliant with IRS regulations.

User insights and testimonials

Users leveraging pdfFiller for form management have expressed increased efficiency in completing their 1099 filings. Testimonials often highlight the ease of eSignatures and the collaborative features that streamline their workflow.

Several case studies demonstrate how using pdfFiller reduced user errors by allowing multiple team members to review and amend details before submission, thereby improving accuracy and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 2024 1099-necmisc worksheet in Gmail?

How do I fill out 2024 1099-necmisc worksheet using my mobile device?

How do I complete 2024 1099-necmisc worksheet on an Android device?

What is 1099-necmisc worksheet?

Who is required to file 1099-necmisc worksheet?

How to fill out 1099-necmisc worksheet?

What is the purpose of 1099-necmisc worksheet?

What information must be reported on 1099-necmisc worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.