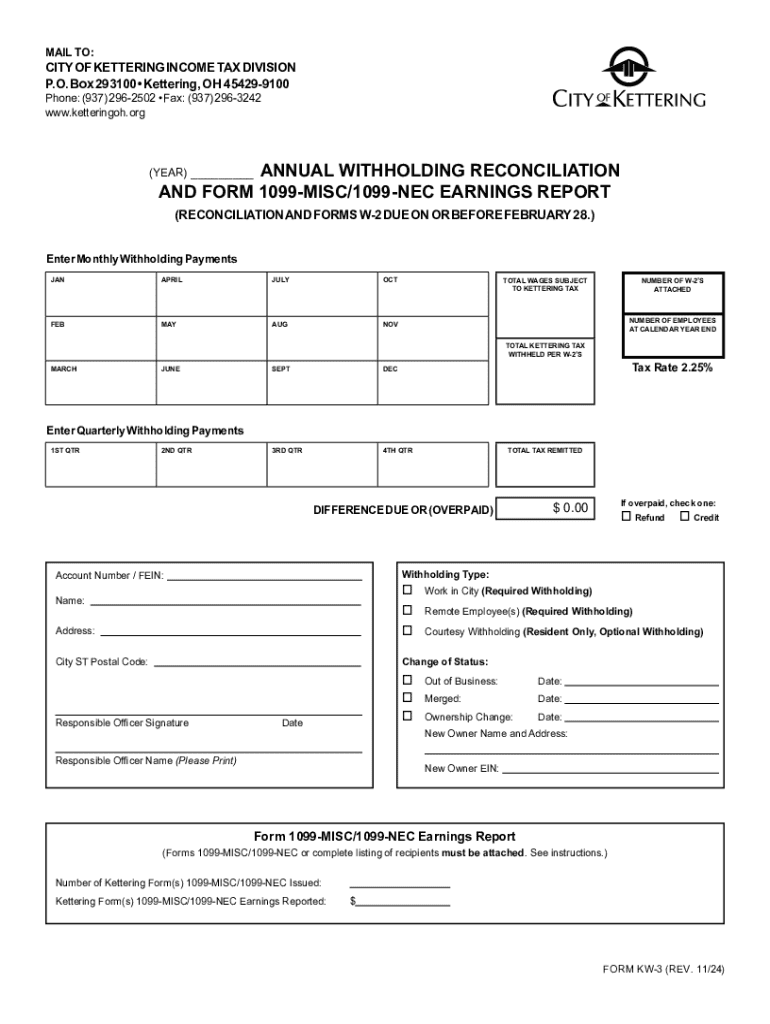

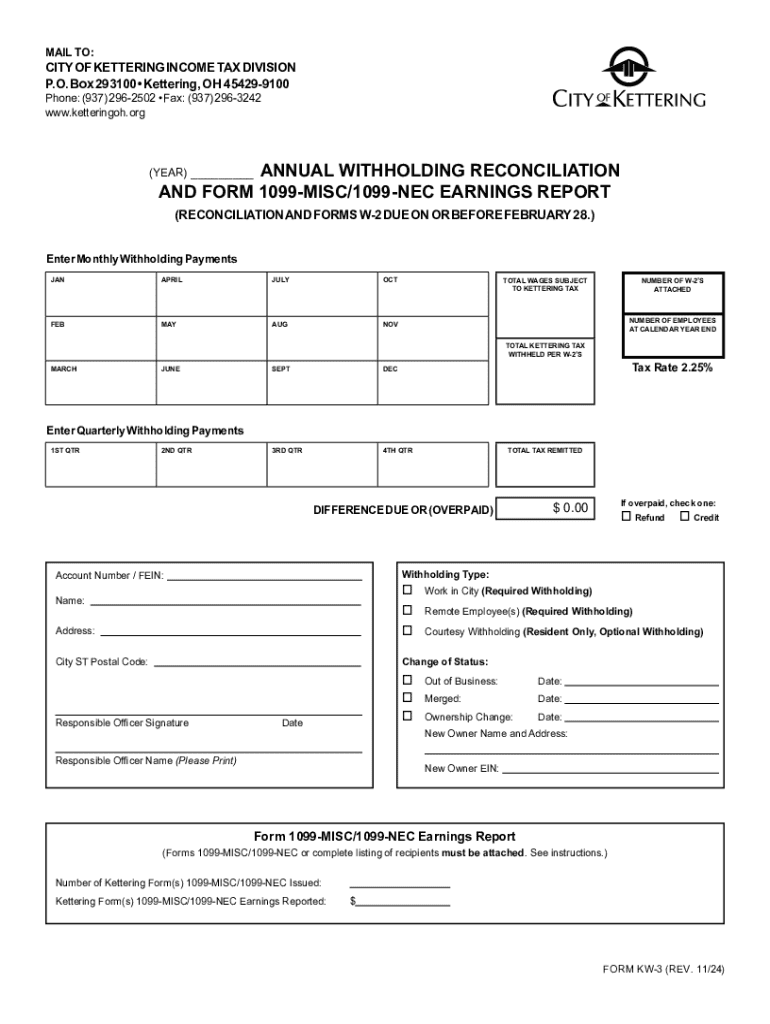

Get the free Annual Withholding Reconciliation and Form 1099-misc/1099-nec Earnings Report

Get, Create, Make and Sign annual withholding reconciliation and

Editing annual withholding reconciliation and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual withholding reconciliation and

How to fill out annual withholding reconciliation and

Who needs annual withholding reconciliation and?

Annual withholding reconciliation and form: A comprehensive guide

Understanding annual withholding reconciliation

Annual withholding reconciliation refers to the process of ensuring that the total amounts withheld from employee paychecks match the required tax liabilities for a given tax year. This process is critical for both individuals and organizations to confirm compliance with tax laws and to accurately report earnings and withholding to the IRS.

The importance of accurate reconciliation cannot be overstated. For individuals, correct withholding ensures that over- or under-payment of taxes does not occur, leading to potential refunds or tax liabilities at year-end. For teams and companies, it’s vital for maintaining proper payroll records, which can significantly affect business operations and employee satisfaction.

Common misconceptions about reconciliation include the belief that it is solely the employee's responsibility, or that errors don’t need to be corrected if the company has already filed. In reality, both parties play an essential role in ensuring accuracy to avoid complications down the line.

The annual withholding form: Key components

The annual withholding form, often referred to as Form W-2 in the United States, contains vital information regarding total compensation and withholding amounts for each employee during the tax year. This form serves as a key document for reporting taxes both to the IRS and to state tax agencies.

Key required information on the form includes:

Additional considerations may include unique circumstances such as non-resident alien status or employees who worked in multiple states, which can complicate the reporting process.

Who is required to file the annual withholding form?

Both individuals and employers have responsibilities when it comes to filing the annual withholding form. Employers are generally required to provide W-2 forms for every employee they have paid throughout the year, while independent contractors typically receive a 1099 form instead.

Exceptions do exist. For example, if an employee worked only for a short duration or earned below a specific threshold, the employer may not be required to file a W-2 for them. It is crucial to understand these nuances and ensure compliance to avoid penalties.

Importance of compliance cannot be overstated; improperly filed forms or failure to file can lead to audits, financial penalties, and negative impacts on employee trust and satisfaction.

Why is filing annual withholding essential?

Filing the annual withholding form is essential to maintain accurate records with the IRS. Neglecting or incorrectly filing this document can lead to various consequences. For individuals, it may result in experiencing a significant tax bill during tax season, while employers may face hefty fines.

Moreover, the filing process is directly related to tax refunds and deductions. Accurate withholding aligns with tax calculations, ensuring that employees owe no penalties and can maximize their potential refunds. Conversely, under-withholding can result in financial strain during tax season.

Additionally, correct filing ensures that future tax withholding amounts are on point, which can prevent similar issues in subsequent years.

Filing deadlines and important dates

Filing deadlines are crucial for both individuals and organizations to remember. Typically, the annual filing deadline for Forms W-2 is January 31 of the following year, making it imperative to stay organized throughout the year to meet this timeline.

Differences in deadlines can occur for state filings, with many requiring submission of withholding forms by the end of January as well. It's essential to consult state resources for accurate deadlines.

Key tax calendar milestones also include the submission of federal income tax returns, which are usually due on April 15, emphasizing the importance of timely withholding reconciliation and record-keeping throughout the tax year.

Step-by-step guide to filling out the annual withholding form

1. Preparing to fill out the form is crucial. Start by gathering the required documentation, including previous tax returns, employee Social Security numbers, and withholding statements.

2. Understanding the instructions for the form can help ensure accuracy during completion. Misinterpretations of the directives may lead to common errors.

3. Detailed breakdown of each section of the form should be approached methodically. For example, when completing employee information, double-check the spelling of names and accuracy of Social Security numbers.

4. Ensure all detailing of withholdings is done correctly. Pay close attention to federal, state, and any local tax withholdings.

5. Avoid common mistakes such as overlooking small omissions or incorrect values, as these can lead to significant discrepancies with tax liability.

6. Tips for effective filing include using software to streamline the process or consulting tax professionals to ensure compliance.

Submitting the annual withholding form

Submission of the annual withholding form can be done online or via paper filing. Each method has its pros and cons. Online submission is generally faster and allows for confirmation that the form has been received. However, paper submissions may be preferable for those uncomfortable with digital processes.

The process for electronic filing typically involves using IRS-approved third-party software, which can simplify reporting and calculations. Ensuring accurate submission is crucial, as errors at this stage can lead to complications during tax preparation.

Interconnectedness with 1099 and W-2 reporting

Understanding the relationship between Forms 1099 and W-2 is vital for both employers and employees. While Form W-2 reports wages and thus taxes for employees, Form 1099 primarily covers earnings for independent contractors or freelancers.

Reporting requirements for employers demand that all earnings paid to employees are accurately reflected to avoid misunderstandings. Implications for employees include ensuring that all income received is reported appropriately to maintain accurate tax filings.

Managing and tracking your annual withholding documents

Managing and tracking your annual withholding documents can significantly ease the process of filing and reconciliation. Keeping organized records is essential for both individuals and companies, as it facilitates accurate filings and timely responses to IRS inquiries.

Utilizing platforms like pdfFiller can enhance document management. With tools for editing and filling forms, users can streamline their processes significantly. The option for eSigning allows for quicker approvals, while cloud-based solutions offer enhanced access and collaboration options.

Frequently asked questions about annual withholding reconciliation

Some common questions arise during the annual withholding reconciliation process, often leading to misunderstandings. Questions regarding who must file, the correct withholding amounts, and how to rectify mistakes are prevalent.

Providing detailed answers, along with real-world examples can help clarify these concerns. For instance, if an employer has failed to deduct the correct amount of withholding due to an incorrect tax table being used, steps must be taken to adjust this moving forward.

For those seeking additional help, resources from the IRS or consulting with tax professionals can provide guidance.

The role of technology in annual reconciliation

The benefits of cloud-based platforms, such as pdfFiller, can greatly influence the efficiency of annual reconciliation. Using interactive tools for collaborative workflow helps employees and employers to work together seamlessly, reducing errors and enhancing compliance.

Technology also enhances accuracy in filing, allowing for automatic calculations and tracking adjustments. As tax regulations continue to evolve, leveraging these tools can keep individuals and organizations on the right side of compliance.

Final reminders and best practices

Key takeaways for successful reconciliation involve staying organized, understanding deadlines, and leveraging technology to streamline processes. Early preparation and documentation can minimize stress as the filing deadline approaches.

Staying informed about changes in tax regulations and forms is also critical. Keeping abreast of updates will encourage compliance and ensure that all withholdings are accurately reconciled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my annual withholding reconciliation and directly from Gmail?

How can I get annual withholding reconciliation and?

How do I fill out annual withholding reconciliation and using my mobile device?

What is annual withholding reconciliation?

Who is required to file annual withholding reconciliation?

How to fill out annual withholding reconciliation?

What is the purpose of annual withholding reconciliation?

What information must be reported on annual withholding reconciliation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.