Tax Compliance Verification Certificate Form – A Complete Guide

Understanding tax compliance verification

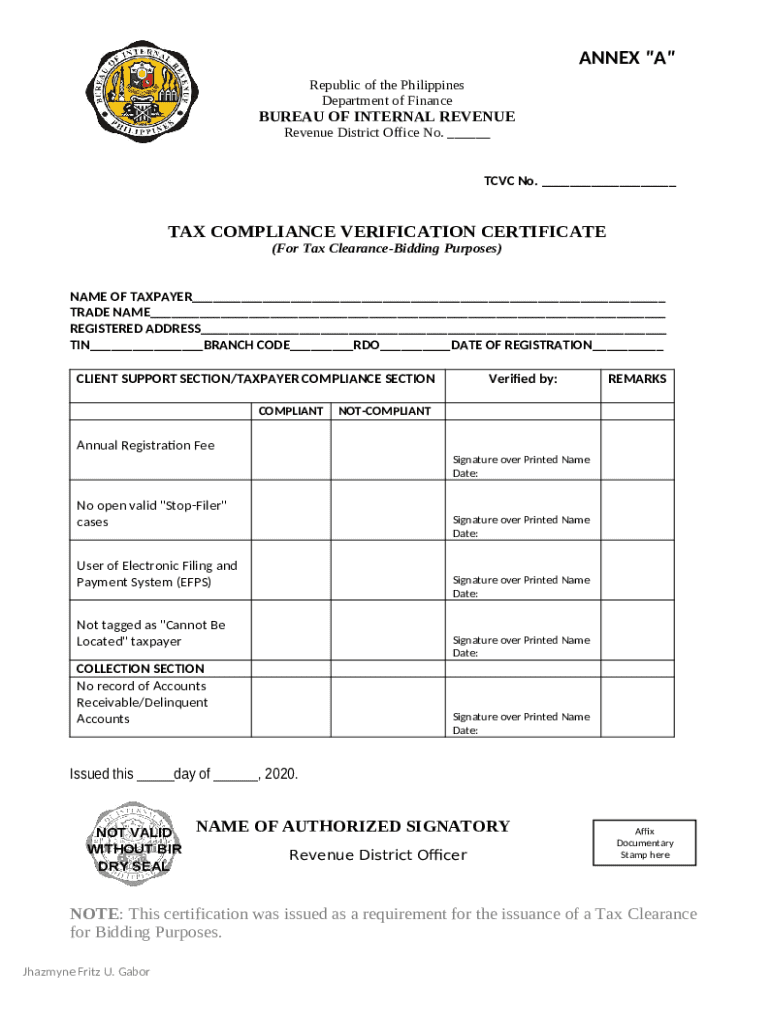

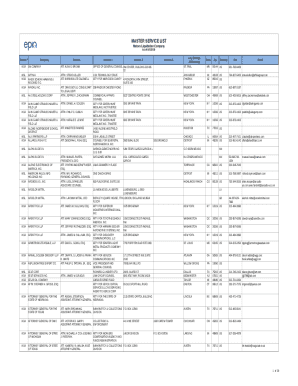

A Tax Compliance Verification Certificate (TCVC) is an official document issued by a tax authority confirming that an entity or individual complies with their tax obligations. This certificate serves as a testament to the credibility of a business, allowing it to engage in transactions that require proof of tax compliance.

For businesses, maintaining tax compliance is critical to ensuring smooth operations and gaining trust from clients and partners. It is often a prerequisite for securing contracts, especially in public sector engagements. Without a valid TCVC, businesses risk being seen as unreliable, which can affect their reputation and operational capabilities.

Businesses applying for government contracts or licenses.

Freelancers and contractors needing proof of tax standing.

Corporations seeking loans or financial support.

Government authorities typically set comprehensive tax compliance requirements that may vary by jurisdiction. These mandates include regular payment of taxes, accurate filing of returns, and timely updates on any changes in business operations.

Key components of a tax compliance verification certificate

A TCVC includes several key components essential for its validity. Firstly, it must contain clear identification details of the entity or individual, such as the Tax Identification Number (TIN) and contact information. Secondly, it specifies the scope of compliance; this may include tax periods covered and types of taxes validated.

The certification process varies by location but generally involves submission of proof of tax compliance like recent tax returns. This ensures that the issuance of a TCVC is backed by documented evidence, protecting the integrity of tax compliance verification.

Tax Identification Number (TIN)

Type(s) of taxes verified

Certification authority and date of issue

Common terms associated with the TCVC include compliance rate, tax liabilities, and tax clearance. Understanding these terms is essential for navigating the complexities of tax regulations effectively.

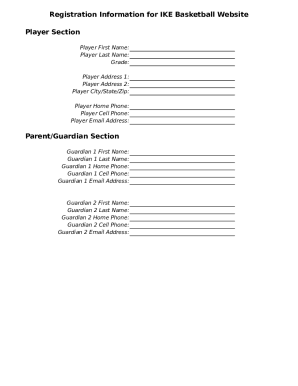

How to apply for tax compliance verification certificate

Applying for a TCVC involves a series of steps, starting with the collection of necessary documentation. First and foremost, you will need your Tax Identification Number (PIN) as a reference. Additionally, gathering recent tax returns is crucial as they serve as proof of your filing history.

You must also prepare any additional supporting documents that might be requested, which can include bank statements or financial audits to validate your business operations and tax payments.

Gather necessary documentation (PIN, recent tax returns, additional documents)

Complete the application form with all required information

Submit your application through the appropriate channel (online, in-person)

Completing the application form

Filling out the TCVC application form requires attention to detail. You should ensure that all fields are completed accurately to prevent delays. Be mindful of common mistakes such as incorrect TIN entries or missing documentation. Double-check all details before submission.

Submitting your application

The submission process can vary; many authorities now allow online submissions, which can expedite processing times. However, in-person submissions might still be required in some jurisdictions. Expect a timeframe of several days to weeks for processing, depending on the volume of applications received.

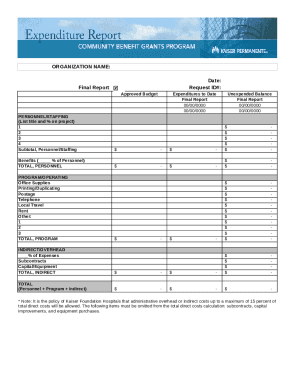

Validity and renewal of the tax compliance verification certificate

A TCVC is typically valid for a specific duration, often ranging from six months to one year, depending on the jurisdiction and the nature of the business activities. It is crucial to be aware of renewal procedures to ensure continuous compliance.

Indicators that it might be time for renewal include pending contracts or license applications that specify TCVC validity. To renew, you usually need to resubmit the application form along with updated documentation to reflect your current tax status.

Check the expiration date of your current TCVC

Gather updated tax documentation

Submit renewal application before the expiration date

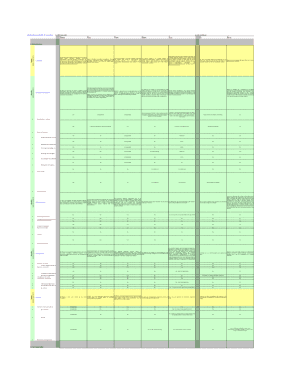

Verifying your tax compliance status

To ensure that you maintain a good standing, methods of verification are available to check your tax compliance status. One of the most efficient methods is online verification through government portals, which can provide instant or same-day results.

Alternatively, third-party services can assist in certification verification, offering an additional level of confidence when engaging in business transactions. Utilizing your KRA PIN can facilitate quick tax status checks through formal tax authority channels.

Utilize government online verification portals

Contact third-party verification services

Check tax status using KRA PIN

FAQs about tax compliance verification certificates

Here are some frequently asked questions regarding the tax compliance verification certificate process. Understanding these can help clarify your path to achieving and maintaining compliance.

How long does it take to obtain a certificate? Processing can take anywhere from a few days to several weeks, depending on the volume of applications.

What to do if your application is rejected? Review the rejection reasons, make necessary corrections, and reapply promptly.

Is there a fee associated with the application? Fees vary by jurisdiction and should be confirmed with local tax authorities.

What if you operate across multiple jurisdictions? Ensure compliance in all locations and consider obtaining TCVCs from each relevant jurisdiction.

Tips for ensuring successful tax compliance

To ensure successful tax compliance, effective document management is paramount. Keep detailed records of all tax-related documents, including receipts, invoices, and communications with tax authorities. This not only aids in compliance but also simplifies the application process for a TCVC.

Staying updated with tax regulations is another important aspect of compliance. Engage with resources available on platforms like pdfFiller, which offers tools for document management to help you streamline the process of creating and maintaining tax documentation.

Implement robust document management systems

Regularly review and update your knowledge on tax laws

Utilize pdfFiller's editing and signing features for ease of use

Related topics and additional insights

Tax compliance varies widely depending on your business structure. Freelancers and independent contractors face unique challenges that often necessitate engaging with tax professionals for advice on their compliance landscape. Small businesses must understand their tax obligations fully to avoid legal complications, while expats need tailored resources that address cross-border compliance.

Case studies illustrate common tax compliance challenges, shedding light on practical solutions that have worked for various entities. These help illuminate the real-world complexities and how understanding tax compliance can lead to successful long-term operational strategies.

Tax compliance for freelancers and contractors—specific strategies

Understanding tax obligations for small businesses

Resources for expats managing tax compliance

Common challenges and real-life examples of tax compliance strategies

Interactive tools

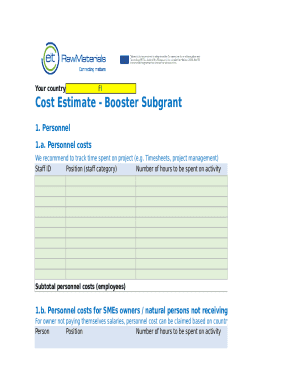

Leverage interactive tools like a tax compliance checklist and a form-filling guide to streamline your TCVC application. These tools can help you stay organized and ensure that you do not overlook any critical components required for a successful application.

Additionally, a cost calculator for tax compliance services can offer valuable insights into potential expenses associated with maintaining or renewing your tax compliance verification.

Tax compliance checklist for easy tracking

Interactive form filling guide for the TCVC application

Cost calculator for estimating compliance service expenses

Conclusion of tax compliance insights

In conclusion, understanding the tax compliance verification certificate form is vital for individuals and businesses alike. Maintaining an ongoing tax compliance strategy not only boosts credibility but also safeguards your business against potential legal complications.

Utilizing resources like pdfFiller can streamline your document management, making it easier to maintain compliance seamlessly. By staying informed and organized, you can navigate the complexities of tax compliance with confidence.