Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

Understanding the W-9 Form: A Comprehensive Guide

Understanding the W-9 form and its purpose

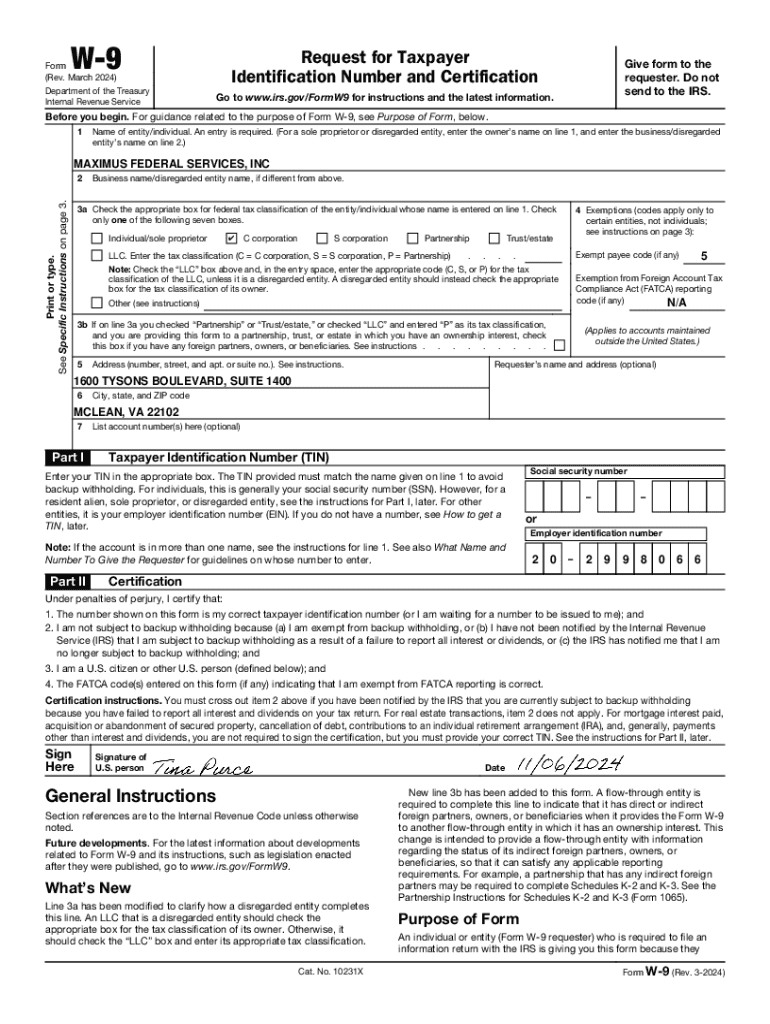

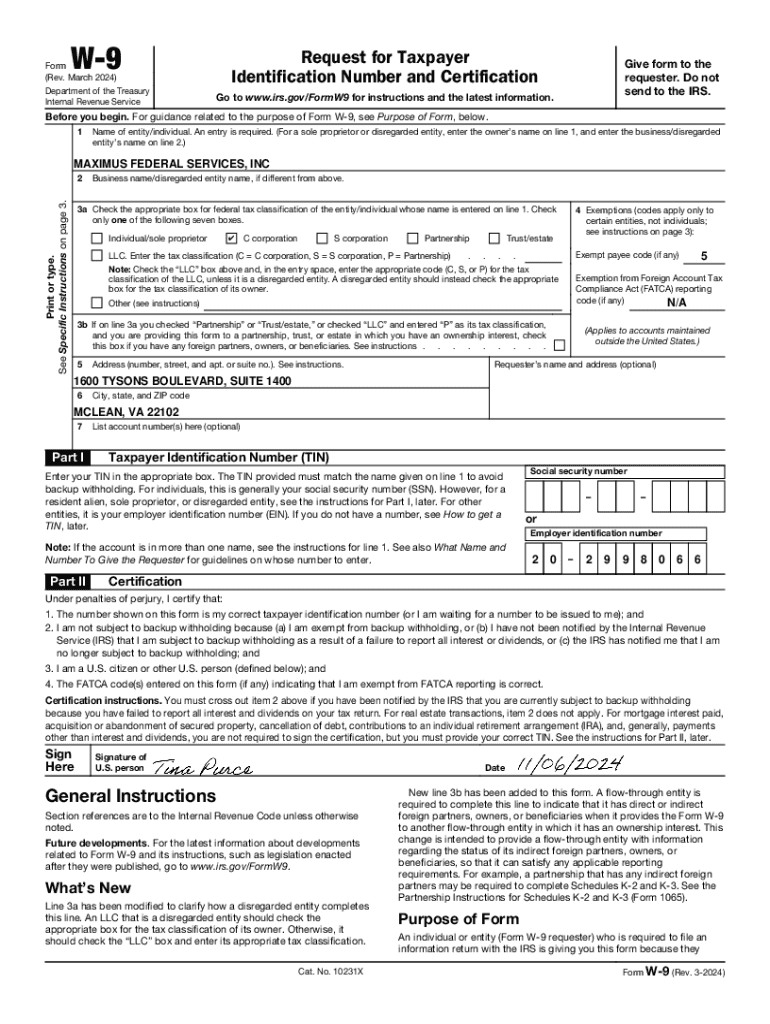

The W-9 form is a crucial document utilized by the Internal Revenue Service (IRS) in the United States. Its primary purpose is to provide a taxpayer identification number (TIN) and other necessary details about an individual or business to entities that are required to report income paid to them. The W-9 form serves as a foundational piece in tax reporting, ensuring that payments are accurately documented and necessary taxes are withheld.

Individuals, independent contractors, and various businesses often need to fill out a W-9 when they work as vendors or otherwise earn income from clients. The primary importance of the W-9 lies in its role in complying with tax laws and facilitating correct 1099 reporting, which is vital for both the payer and recipient.

Who should fill out a W-9 form?

The W-9 form is applicable to a diverse range of entities. Individuals who receive income from self-employment or freelance work typically must complete this form. This includes independent contractors and consultants who are not officially classified as employees but still receive substantial income. Additionally, businesses and corporations are also required to submit a W-9 if they intend to receive payments that will later be reported on a 1099.

Specific situations may necessitate different requirements: Freelancers providing services, businesses supplying goods, and even certain non-profit organizations may find themselves needing to furnish a completed W-9 to comply with financial and tax regulations.

Step-by-step instructions for completing the W-9 form

Completing the W-9 form accurately is essential for ensuring proper tax reporting. The form is relatively straightforward, but attention to detail is critical. The W-9 consists of several sections, each requiring specific information.

Filing methods for the W-9 form

Once you have completed the W-9 form, it’s essential to understand how to submit it. There are two primary methods for filing the W-9 form: electronic submission and paper submission.

Understanding the W-9 form’s role in tax reporting

The W-9 form is pivotal in tax reporting because it allows clients and businesses to gather the necessary information about their payees for 1099 reporting. The IRS mandates that businesses must issue a 1099 form when they pay an independent contractor or freelancer $600 or more in a tax year, necessitating the prior completion of the W-9.

Failure to submit a W-9 can have ramifications for both the taxpayer and the business. The business may be required to withhold backup taxes or might face penalties, while the individual or contractor may not receive payments promptly or could incur additional tax issues.

Frequency of updating your W-9

It’s important to recognize that the W-9 form is not permanently valid and should be updated periodically. Situations that necessitate a new W-9 submission include changes in your name, business structure, or taxpayer identification number. If a contractor or vendor experiences significant alterations in their information, a new W-9 should be submitted promptly.

For businesses, it's recommended to request fresh W-9 forms from contractors or vendors annually or before any significant business transaction. This practice ensures that your records remain accurate and compliant with tax regulations.

W-9 form management tools

Managing W-9 forms effectively is essential for ensuring compliance and efficient record-keeping. Utilizing tools like pdfFiller can simplify the process significantly. pdfFiller offers intuitive features that enhance the W-9 completion and management experience.

Common mistakes to avoid when filling out a W-9

Avoiding common pitfalls when filling out the W-9 form can save time and prevent complications. Ensuring that you provide accurate information is crucial.

Alternatives to the W-9 form

While the W-9 form is essential for certain situations, there are alternatives available for specific circumstances. For foreign entities that earn U.S. income or engage with companies, the W-8 form is generally required.

Comparing the W-9 to other tax forms highlights significant distinctions. For instance, while the W-9 is used for domestic individuals and entities, forms like the W-8 focus on non-resident foreign entities. Understanding these differences is vital for proper tax reporting.

Signature requirements for the W-9 form

A valid signature is a critical component of the W-9 form. It serves as a confirmation that the information provided is accurate to the best of the individual's knowledge. Without a proper signature and date, the form may be deemed invalid by the receiving entity.

For those utilizing digital tools like pdfFiller, there are various options for signing the W-9, including digital or electronic signatures. These options not only expedite the process but also ensure compliance with modern signing standards.

W-9 form usage in different scenarios

The W-9 form is versatile and finds its application across various scenarios, depending on the relationship between the payee and the entity requesting the form.

Helpful guides for completing the W-9

For those who are new to filling out W-9 forms, various resources can provide guidance. First-time filers may benefit from tutorials or step-by-step guides that elucidate the process.

Additionally, having access to a sample completed form can serve as a useful reference point, demystifying the sections you’ll encounter on the actual document. FAQ sections related to completing the W-9 form can clarify common misconceptions and ease concerns about the process.

Quick links and tools

To effectively navigate the W-9 process, having direct access to necessary resources is advantageous. Many websites offer direct W-9 form PDFs, allowing you to easily print, fill, and submit them.

Additionally, linking to IRS resources and guidelines regarding W-9s not only provides credibility but also equips the reader with accurate, up-to-date information. How-to videos, especially regarding the use of pdfFiller for W-9 forms, can bring practicality into the learning process.

Contact us for further assistance

For individuals or businesses requiring additional help in filling out their W-9 forms, support options are available through pdfFiller. Whether you need clarification on a specific section or face technical challenges, assistance is just a click away.

Engaging with support teams can ensure that you navigate your W-9 requirements smoothly and that all your submissions are prepared and delivered accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get w-9?

Can I create an electronic signature for the w-9 in Chrome?

How do I fill out w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.