Get the free W-9

Get, Create, Make and Sign w-9

How to edit w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form How-to Guide

Understanding the W-9 Form

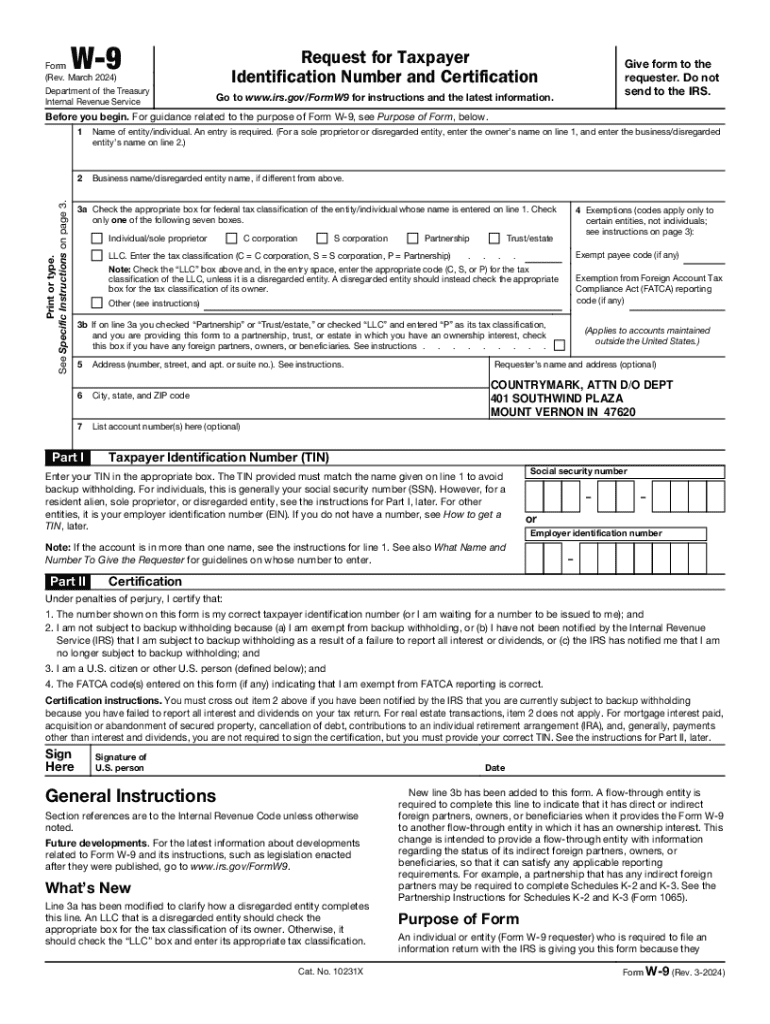

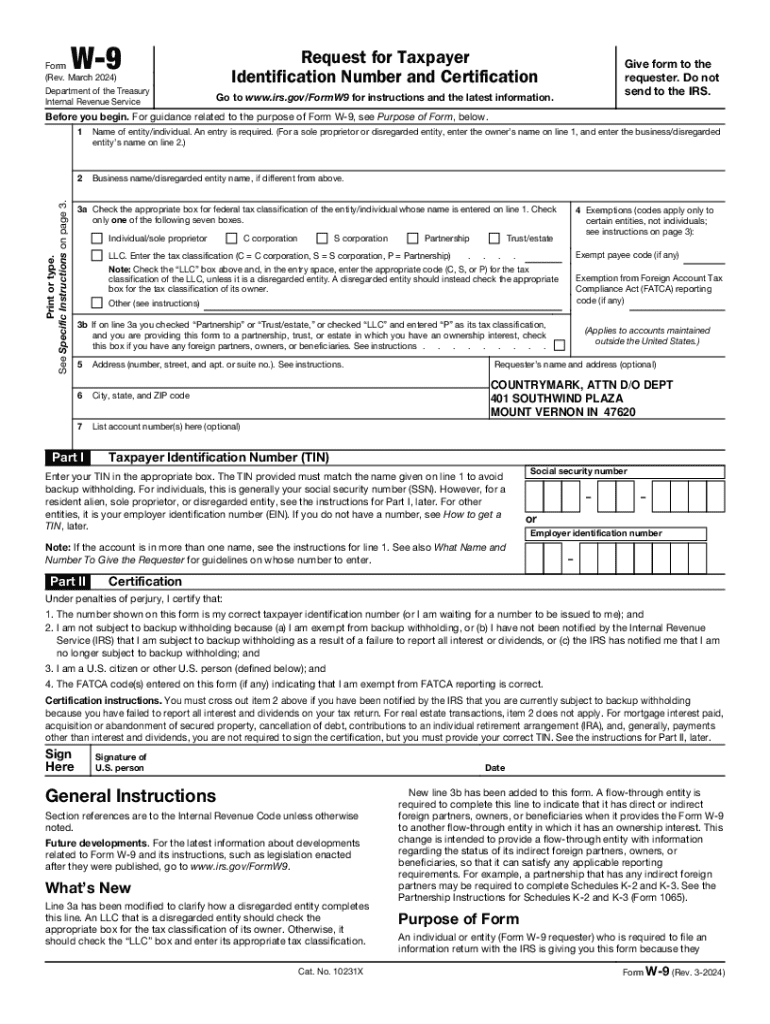

The W-9 Form, officially known as 'Request for Taxpayer Identification Number and Certification,' serves as a crucial piece of documentation for various tax-related tasks. It is primarily utilized by individuals and entities to provide their correct taxpayer identification numbers (TIN) to those who pay them income, typically in the form of dividends, interest, or contractor earnings. This form is essential as it ensures compliance with U.S. tax laws and facilitates accurate tax reporting for both payers and payees.

Filing a W-9 is particularly important because it helps the payer report to the IRS how much they have paid the individual or business throughout the tax year. Essentially, the W-9 acts as a certificate ensuring that the TIN provided is accurate, which is vital for preventing issues such as backup withholding, where taxes are withheld on payments to individuals who have not provided valid TINs.

Anyone who is required to report income on a tax return generally needs to fill out a W-9 Form. This includes freelancers, independent contractors, and entities receiving certain types of income, including but not limited to financial institutions, landlords, and law firms. Understanding who needs to fill out a W-9 is key to ensuring compliance and avoiding unnecessary penalties.

Purpose of the W-9 Form

The primary purpose of the W-9 Form is to provide payers with the necessary taxpayer identification information they need to correctly file 1099 forms with the IRS. The importance of this form extends into several contexts, including employer-employee arrangements, financial institution-customer relationships, and business-contractor interactions.

1. **Employer-Employee Arrangement:** In traditional employment scenarios, the W-9 is less frequently used since companies typically issue W-2 forms to employees. However, when independent contractors are involved, a W-9 is essential to report their earnings accurately.

2. **Financial Institution-Customer Arrangement:** Banks and financial institutions often require a W-9 Form when opening accounts or processing loans to ensure they have the correct identification for interest reporting.

3. **Business-Contractor Arrangement:** Businesses that engage freelancers or independent contractors must collect a W-9 to report payments made. This practice allows firms to meet IRS requirements while ensuring their contractors receive appropriate tax reporting.

Understanding the implications of the W-9 for both taxpayers and payees can significantly impact tax compliance and efficiency in handling financial relationships.

Step-by-step instructions for completing the W-9 Form

Completing the W-9 Form is straightforward, but preparation is essential. Gathering necessary information beforehand can make the process smoother. You will need your name, business name (if applicable), address, taxpayer identification number (Social Security Number or Employer Identification Number), and the tax classification that best describes your situation.

The form is divided into several parts, each having specific instructions and importance. Here’s a detailed breakdown of the sections:

Common mistakes to avoid when filling out the W-9 Form include using an incorrect TIN, failing to sign and date the form, and providing outdated address information. Double-check your entries before submitting the form to prevent delays in processing and potential tax reporting issues.

Managing your W-9 Form and documents

Once you have completed your W-9 Form, managing it carefully is crucial. Secure storage is essential since this document contains sensitive personal information. Ideally, store it in a password-protected digital format or a locked physical location.

When sharing your W-9 with requesters, ensure that you trust the entity requesting this information. It's advisable to send it through secure email or cloud services that offer encryption features. Keep a proactive approach to maintaining your W-9; regularly update it if your circumstances change, such as a new address, name change, or change in tax status.

A best practice is to notify the requesting party promptly when you change your W-9 details. This action can minimize confusion in future tax reporting and maintain your good standing with the IRS.

Digital and electronic signatures for W-9 Forms

With the advancement of technology, submitting a W-9 Form electronically has become increasingly popular. Understanding the requirements for digital signatures is key to ensuring compliance with IRS regulations. A digital signature must be secure, verifiable, and provide specific identification use cases.

Using platforms like pdfFiller facilitates the eSigning process for W-9 Forms. pdfFiller’s services let users complete, edit, sign, and send their forms online without printing or scanning, making it an efficient solution for individuals and businesses alike.

The benefits of using electronic signatures include enhanced security, faster transaction times, and reduced costs associated with paper and postage. Compliance with IRS eSignature regulations means that users can confidently utilize digital signatures without concerns about legality or validity.

Frequently asked questions about the W-9 Form

Common questions about the W-9 Form arise from its complexity and importance. Here are some frequent inquiries:

Troubleshooting common W-9 issues

Despite its straightforward nature, issues can arise when dealing with the W-9 Form. Discrepancies in information or changes in circumstances can lead to confusion. If you encounter discrepancies, address them immediately by providing correct information to the requester.

Classification disputes are another common issue, often stemming from misunderstandings regarding tax classifications. Those filling out a W-9 should review their business structure thoroughly to ensure the selections made are accurate.

If your W-9 is rejected, contact the requester for clarification. They may provide specific reasons for the rejection, allowing for a prompt resolution. Always ensure that your documentation supports the information provided in your W-9.

Resources and tools

Numerous resources and tools are available to assist individuals and businesses in completing and managing their W-9 Forms. Interactive tools can help guide users through the document completion process, reducing chances for errors.

Quick guides specific to various scenarios are valuable for freelancers, contractors, and small businesses to navigate the nuances of W-9 requirements effectively.

Furthermore, the official IRS guidelines on Form W-9 can provide clarity on regulations, while platforms like pdfFiller offer features for managing these documents efficiently across teams and individuals.

W-9 usage in different situations

Freelancers and contractors commonly utilize W-9 forms to report earnings from clients. This necessity underscores the importance of maintaining accurate records as self-employed individuals often face higher scrutiny from the IRS.

For small businesses, W-9 forms are essential to maintain compliance with tax laws and ensure that contractors and freelancers are properly reported. Failure to collect and file these forms can lead to penalties from the IRS.

W-9 forms also play a crucial role in rental and real estate transactions. Landlords may require tenants to complete a W-9 for the purpose of reporting rental income. This requirement assists both parties in maintaining accurate records for tax purposes.

Understanding changes in W-9 reporting processes

Significant implementation changes to the W-9 reporting process occurred on January 1, 2010, transitioning from paper forms to electronic submissions. This modernization has streamlined processes but also introduced new requirements for digital signature compliance.

Recent updates from the IRS have focused on enhancing clarity around reporting requirements and tax classifications. Staying informed about these changes is essential for individuals and businesses to ensure ongoing compliance.

Conclusion: The power of efficient document management

Effective management of W-9 Forms is vital for accurate tax recording and compliance. Utilizing platforms like pdfFiller empowers users to efficiently manage their W-9 documents through seamless editing, eSigning, and collaboration features.

Embracing a cloud-based document solution not only simplifies the management process for individuals but also enhances the collaborative experience among teams. Ultimately, maintaining accurate and up-to-date W-9 Forms through efficient document management strategies leads to smoother tax reporting and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute w-9 online?

How do I make changes in w-9?

How do I edit w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.