Get the free Legislative Assembly Pension Plan Documents - mlapp novascotiapension

Get, Create, Make and Sign legislative assembly pension plan

How to edit legislative assembly pension plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out legislative assembly pension plan

How to fill out legislative assembly pension plan

Who needs legislative assembly pension plan?

Legislative Assembly Pension Plan Form: A Comprehensive Guide

Overview of the Legislative Assembly Pension Plan

The Legislative Assembly Pension Plan is a vital financial structure established to provide retirement benefits to elected members of the legislative assembly. Designed with the intent to secure financial stability for members post-retirement, this plan plays a crucial role in ensuring that individuals who have dedicated their careers to public service can enjoy a dignified retirement. Understanding its purpose allows members to appreciate the significance of careful planning and timely applications.

For beneficiaries, this pension plan fosters a sense of security, as it guarantees a consistent income stream during retirement years. The plan not only emphasizes the importance of long-term financial planning but also signifies the legislative assembly’s commitment to supporting its members.

Eligibility criteria

Eligibility for the Legislative Assembly Pension Plan spans several categories, primarily focusing on active and former members of the legislative assembly. To qualify, individuals must meet specific requirements detailed by the pension guidelines, which often include a minimum tenure in office and age restrictions. Understanding these criteria is essential for prospective applicants to ascertain their eligibility.

Key benefits of the pension plan

The Legislative Assembly Pension Plan encompasses various benefits and options, catering to the diverse needs of its members. The plan offers a spectrum of pension types, such as defined benefit plans, allowing members to receive fixed monthly payments upon retirement based on their salary and years of service. Additionally, alternative options may include lump-sum payouts or annuity-based benefits, which provide greater flexibility.

It's imperative for members to evaluate these options carefully to determine which plan aligns best with their retirement goals. For instance, some members may prefer the predictability of fixed benefits, while others might need the liquidity offered by lump-sum distributions. Comparing scenarios allows for a more informed decision-making process.

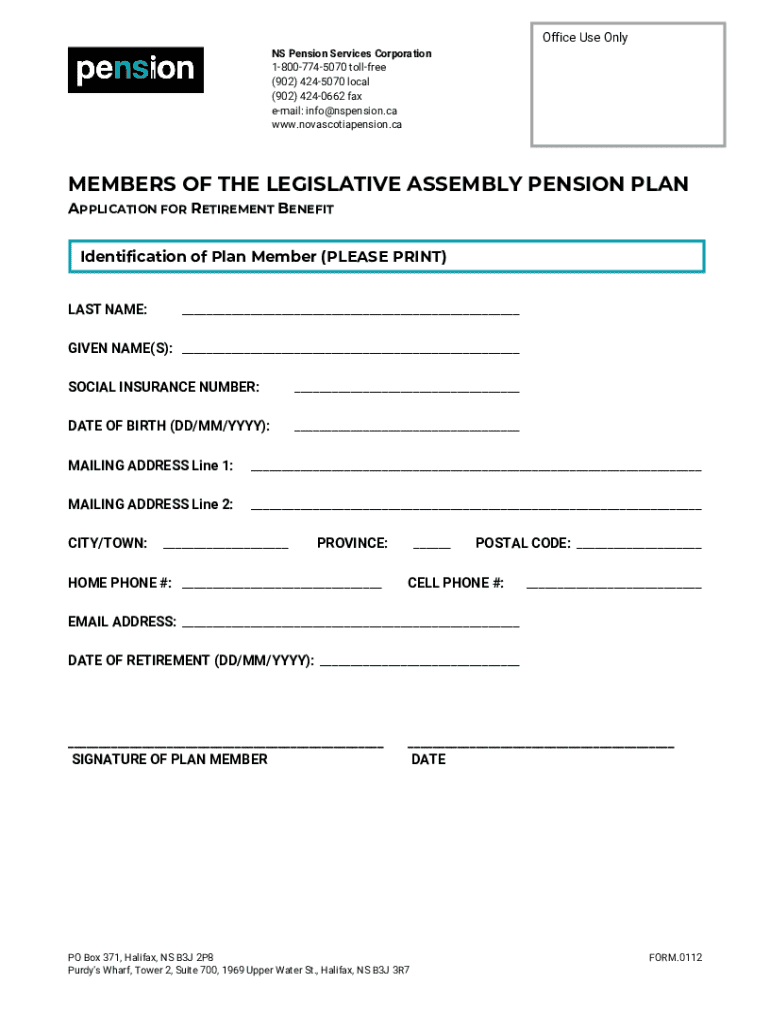

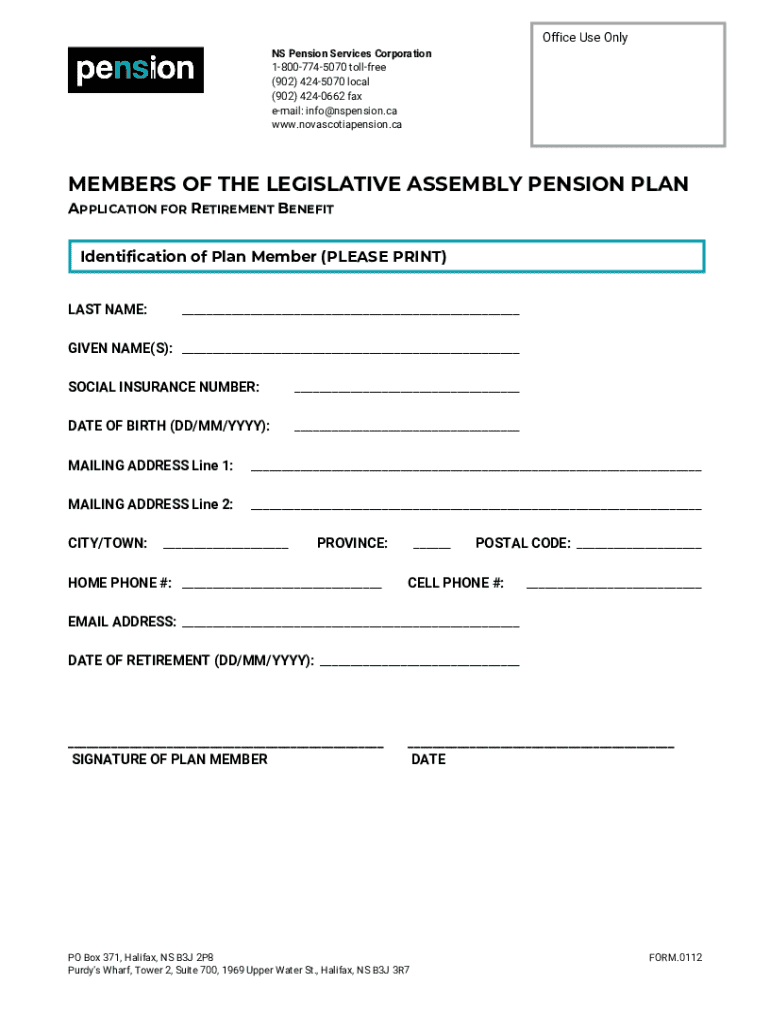

Understanding the Legislative Assembly Pension Plan form

The Legislative Assembly Pension Plan form serves as a critical tool in initiating the application process. This form is essential not only for the seamless processing of pension requests but also for collecting necessary information from applicants. Familiarizing oneself with the form increases efficiency in submitting a complete application, minimizing delays.

Each component of the form carries a specific purpose, requiring clear and accurate input from the applicant. Understanding common terminologies, such as 'vesting' and 'beneficiary designation,' is crucial as they directly impact the application outcome. Members should approach this form as a key step in securing their financial future.

Step-by-step instructions for completing the form

Filling out the Legislative Assembly Pension Plan form can appear daunting, but breaking it down into simpler steps can streamline the process. First, ensure you have all requisite information and supporting documents ready. This preparation will ensure accuracy and comprehensiveness when completing the form.

Start by carefully filling out the personal information section, ensuring all details are correct. Next, move to the employment history, highlighting your tenure and titles in the legislative assembly. Then, consider your pension options and select the suitable one based on your retirement plans. It’s also crucial to clearly provide beneficiary information to ensure proper fund distribution.

Before submitting, reviewing your form is essential. Double-check each section for accuracy to prevent delays caused by errors or missing information.

How to edit and customize your form

With pdfFiller, managing your Legislative Assembly Pension Plan form becomes more accessible. You can upload the form and utilize a variety of editing tools. This platform allows you to make real-time adjustments, ensuring that your information is accurate and up-to-date, minimizing the risk of errors.

Step-by-step, you can edit your document by adding or removing text, adjusting sections, and even inserting images if necessary. Furthermore, pdfFiller allows users to electronically sign the document, which is legally valid and speeds up the submission process.

Submitting your Legislative Assembly Pension Plan form

Once the Legislative Assembly Pension Plan form is filled out and thoroughly reviewed, it is time to consider submission methods. The form can typically be submitted both online, via a digital portal, or by sending a physical copy through postal service. Familiarizing yourself with these options is crucial to determine the most convenient and appropriate method for your situation.

Also, be cognizant of any deadlines associated with your submission. Keeping track of these timelines is vital to ensure that your application is processed in a timely manner, allowing you to access your benefits without unnecessary delays.

After submission, it's advisable to track the status of your application. Most legislative assemblies provide resources or customer service channels that enable you to inquire about your submission and any stages in the approval process.

Common questions and troubleshooting

Navigating the Legislative Assembly Pension Plan form can spark numerous questions. Whether pertaining to eligibility, benefits, or specific details within the form itself, being informed can alleviate many concerns. Frequent queries often arise regarding the required documentation and the implications of submitting incomplete applications.

Additionally, common troubleshooting issues can surface while filling out the form. Errors in personal information or misunderstanding pension options can lead to mistakes that require rectification.

Contact information for further support

When in doubt, reaching out for support is always an option. Many legislative assemblies provide designated points of contact for assistance regarding the pension plan, whether through a dedicated support team or online FAQs. Accessing this support can clarify any lingering issues and ensure that you are on the right path.

Members can utilize phone numbers, email addresses, or even in-person meetings at local offices for addressing their concerns surrounding the Legislative Assembly Pension Plan form.

Utilizing pdfFiller to manage your documents

With pdfFiller, managing your Legislative Assembly Pension Plan form becomes an efficient and organized task. This platform not only allows for seamless editing and signing of your pension forms but also serves as a centralized document management system. You can create, store, and access various important forms and templates all in one secure location.

These capabilities ensure that all your important documents are readily accessible, providing peace of mind when planning for your retirement. The ease of use offered by pdfFiller empowers users by streamlining document management and improving their overall experience.

Additional considerations

When planning for retirement, the Legislative Assembly Pension Plan is just one component of a broader financial strategy. Members should consider how this pension integrates with other savings avenues, such as personal retirement accounts, investments, or additional pension plans available. This comprehensive view will support a well-rounded approach to financial preparation.

Resources are available for those who wish to learn more about retirement planning. Comprehensive retirement workshops and financial advisory services can provide deeper insights into how to best utilize the Legislative Assembly Pension Plan alongside other financial instruments for an optimal retirement strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my legislative assembly pension plan in Gmail?

How can I send legislative assembly pension plan to be eSigned by others?

How do I edit legislative assembly pension plan on an Android device?

What is legislative assembly pension plan?

Who is required to file legislative assembly pension plan?

How to fill out legislative assembly pension plan?

What is the purpose of legislative assembly pension plan?

What information must be reported on legislative assembly pension plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.