Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

W-9 Form: A Comprehensive How-To Guide

Understanding the W-9 form

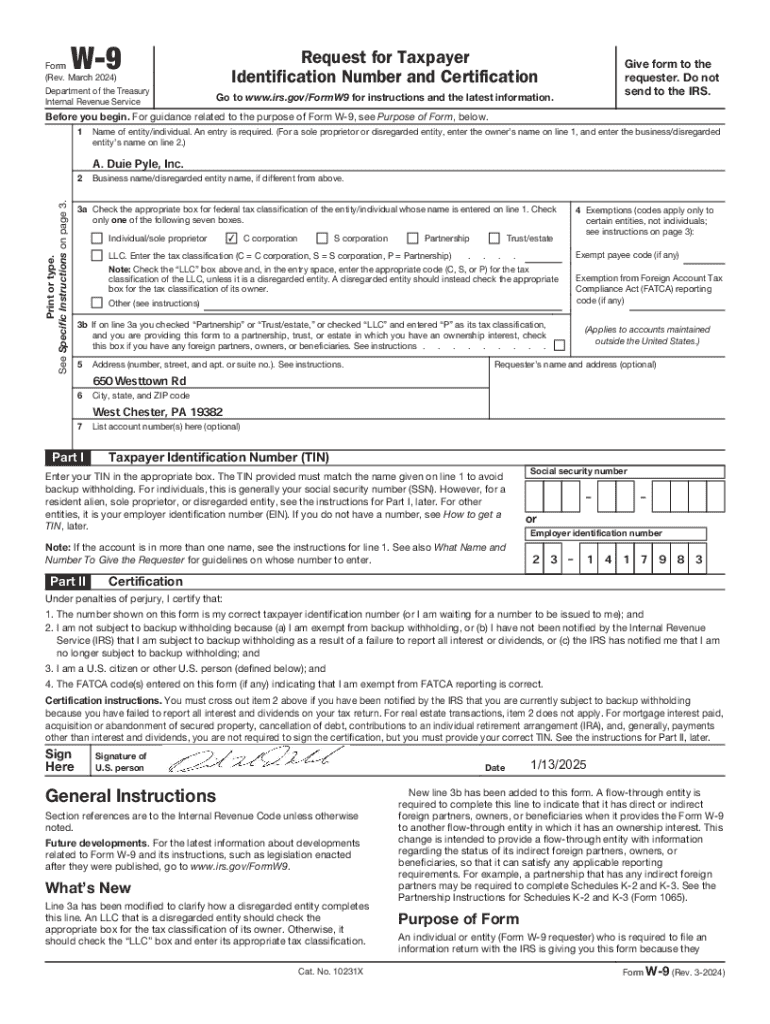

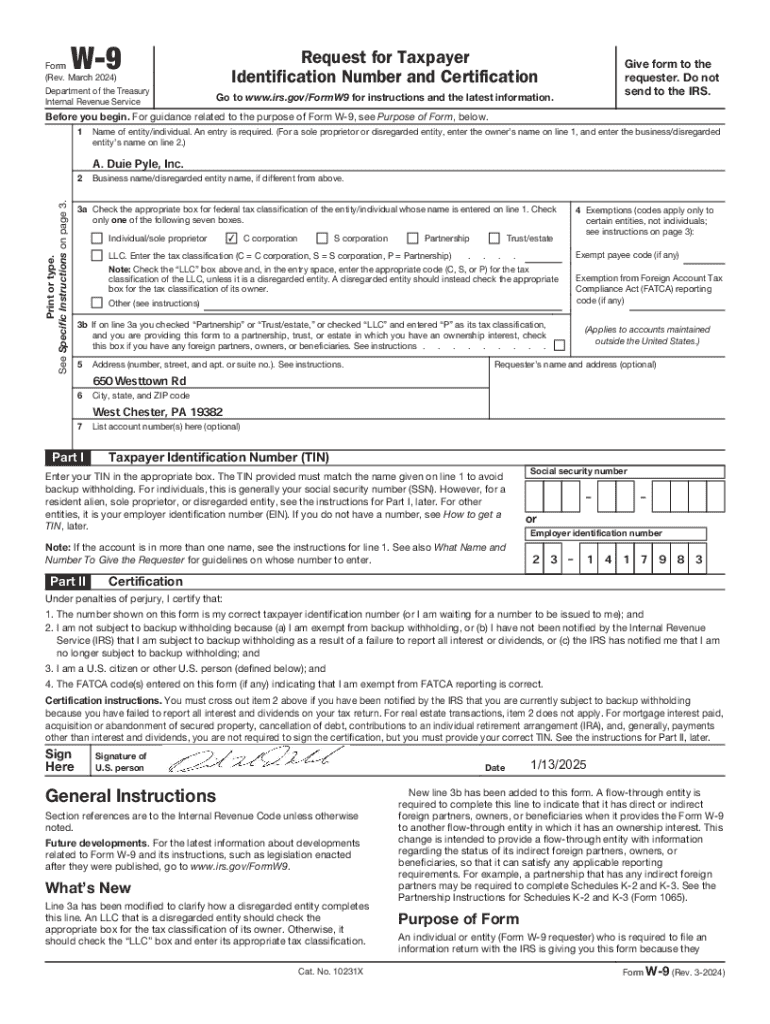

The W-9 form, officially titled ‘Request for Taxpayer Identification Number and Certification,’ is an essential document used in various financial transactions, particularly in the United States. Its primary purpose is to provide information about a taxpayer’s identity, including their name, business name (if applicable), address, and taxpayer identification number (TIN). The IRS uses this form to ensure proper reporting of income to the federal government.

Parties typically use the W-9 form when a business pays an independent contractor or freelancer, making it critical in ensuring compliance with tax laws. For example, companies must issue a 1099 form to freelancers, which requires the details collected in the W-9. Thus, knowing when and why to use the W-9 is pivotal not only for tax compliance but also for maintaining clear financial records.

Who needs to complete a W-9?

Individuals, businesses, and freelancers may all need to complete a W-9 form, depending on their role in a transaction. Freelancers usually complete a W-9 when they begin work with a new client, as clients commonly request this form to report payments made. Similarly, businesses that hire subcontractors or vendors may also need to collect W-9 forms to track expenses for tax reporting purposes.

Detailed instructions for completing the W-9 form

Completing a W-9 form is a straightforward process but requires attention to detail. Here’s a step-by-step guide for properly filling out this essential document.

It’s crucial to avoid common mistakes while completing the W-9 form. Ensure that your TIN matches your name, watch for potential discrepancies, and do not forget to sign the form. Always use the latest version of the W-9 to avoid any issues with the IRS.

Practical use cases for the W-9 form

The W-9 form is prominently used in specific scenarios involving freelance work, vendor relationships, and awards. For instance, freelancers often encounter clients requesting a W-9 before the project begins. This practice ensures that clients can report the payments made to independent contractors for tax purposes. Similarly, businesses use W-9 forms to collect information from vendors, helping streamline tax reporting at the end of the fiscal year.

Additionally, awards and prizes, such as those granted by contests or government entities, often necessitate the completion of a W-9. Organizations must properly report these payments as income, and individuals submitting a W-9 provide the necessary details that enable these organizations to comply with IRS regulations.

Filing and submission methods

Submitting your W-9 form can be done through various methods, including email, postal mail, or in-person delivery, depending on the recipient's preferences. Each method has its advantages, but it's paramount to ensure that sensitive information remains secure during transmission.

For those interested in a digital approach, eSigning tools like pdfFiller provide a seamless way to fill out and sign the W-9 electronically. With features that allow easy editing, saving, and sharing, pdfFiller enables users to handle documents with ease from anywhere, maximizing efficiency and convenience.

Important deadlines and renewal

Understanding when to submit your W-9 form is crucial for maintaining compliance. Typically, you should submit a W-9 as soon as received upon request from an employer or entity. However, it’s also vital to keep the information up to date; a new W-9 should be submitted if your name, business name, or TIN changes.

Additionally, it’s prudent to review your records annually, as clients may request updated versions to ensure compliance with IRS rules. Regular updates not only help maintain accurate records but also safeguard against potential issues during audits.

Signature requirements and digital alternatives

The signature on a W-9 form is essential for certifying that the information provided is correct. Digital signatures are valid for W-9 submissions, as long as the electronic signing process adheres to legal regulations. Utilizing digital platforms like pdfFiller allows users to eSign documents quickly and securely.

Embracing digital alternatives can save time and streamline the process, as pdfFiller offers a cloud-based solution where users can manage documents, eliminate paper waste, and collaborate effortlessly.

Implementation of W-9 reporting processes

To effectively utilize W-9 forms in business processes, it is essential to establish structured methods for collecting and managing these documents. Best practices include integrating W-9 collection into hiring processes and implementing systematic vendor registration.

Moreover, maintaining accurate records is crucial for compliance, particularly in preparation for IRS audits related to W-9 submissions. Leveraging solutions like pdfFiller not only simplifies documentation but also enhances compliance through organized and manageable records.

Troubleshooting common issues with W-9 forms

Even with careful completion, errors can occur on W-9 forms. If you discover a mistake after submission, promptly communicate with the party that requested your W-9. They will typically guide you on how to correct the issue. If necessary, you may need to submit a new W-9 with the correct information.

By being proactive and ensuring correctness in your W-9 submission, you minimize complications down the line and foster trust with those you do business with.

Quick links and contact information

To access the W-9 form or explore pdfFiller’s resources further, you can download the form in PDF format through the official IRS website or get it directly from pdfFiller. Connecting with pdfFiller’s support can enhance your document handling experience, offering personalized assistance for any questions you might have regarding your W-9 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the w-9 in Gmail?

How do I fill out the w-9 form on my smartphone?

How do I complete w-9 on an Android device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.