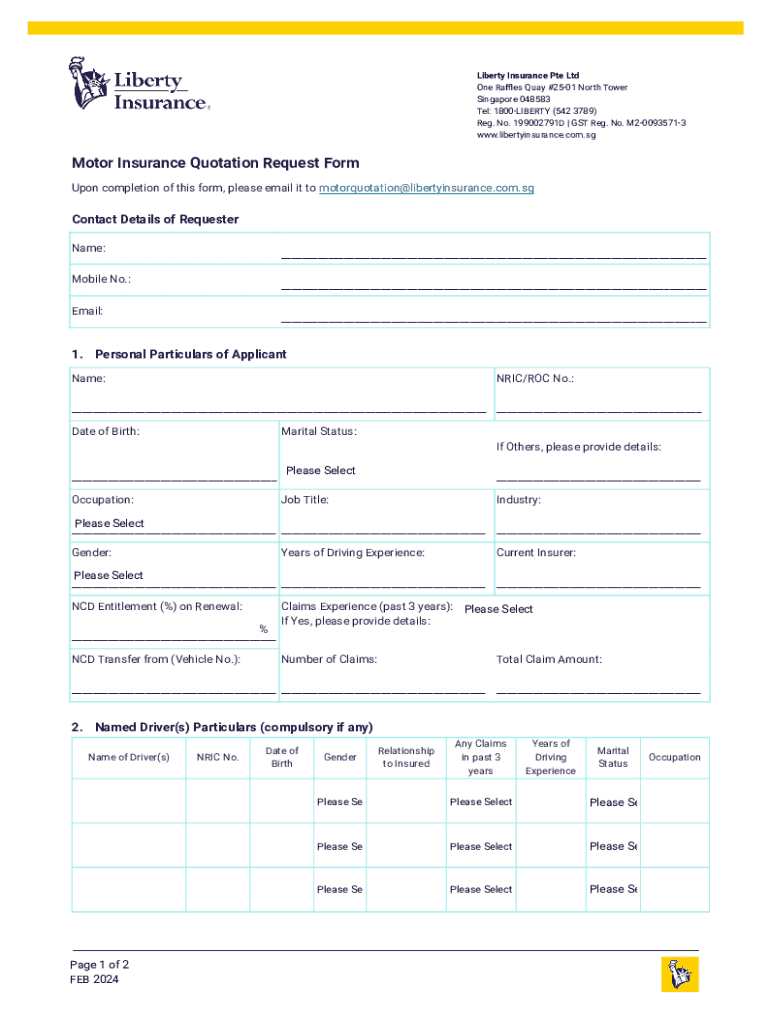

Get the free Motor Insurance Quotation Request Form

Get, Create, Make and Sign motor insurance quotation request

Editing motor insurance quotation request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor insurance quotation request

How to fill out motor insurance quotation request

Who needs motor insurance quotation request?

Motor Insurance Quotation Request Form - How-to Guide

Understanding the motor insurance quotation request form

Motor insurance is a critical financial safeguard for vehicle owners. It provides coverage for the vehicular damages that might occur due to accidents, theft, or natural disasters, and it also offers liability protection against bodily harm to others. The importance of having adequate motor insurance cannot be overstated; it not only protects your investment but also ensures compliance with legal mandates. In many regions, driving without insurance can result in hefty fines and legal consequences.

The amount of premium you pay for motor insurance is influenced by a variety of factors. These include the type and age of your vehicle, your driving history, where you live, and your claims history. Insurers analyze these details to determine your risk profile, ultimately affecting how much you pay for coverage. Understanding these components can help in making more informed decisions when seeking quotes.

The motor insurance quotation request form serves a crucial role in the process of acquiring coverage. By filling out this form, you can obtain tailored quotations from various providers, allowing you to compare prices and coverage options effectively. This not only helps you to find the best policy that fits your needs but also enhances your chances of getting reasonable pricing.

Preparing to fill out the quotation request form

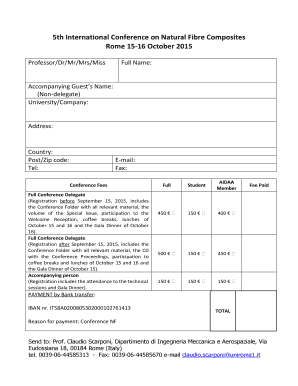

Before you begin filling out the motor insurance quotation request form, it’s essential to gather all the necessary information. This helps ensure accuracy and expedites the process of receiving quotes. Collect your personal details such as your full name, address, and contact information. Additionally, gather information about your vehicle, which includes the make, model, year, and VIN (Vehicle Identification Number).

Your driving history is another critical aspect of the quotation process. This includes information such as the type of driver’s license you hold, any past claims you may have filed, and any traffic violations. Knowing your preferred coverage needs—like liability limits and additional coverages, such as collision or comprehensive insurance—will also help ensure that the quotes you receive are aligned with what you actually need.

Step-by-step guide to completing the form

1. **Accessing the form**: To get started, go to pdfFiller and locate the motor insurance quotation request form. It’s crucial to ensure a secure browsing experience; look for HTTPS in the URL and consider using a secure network.

2. **Filling in personal information**: Accuracy is key. Double-check all personal details for any mistakes, as any discrepancies may delay quote processing. Consider the privacy implications of sharing your information and ensure that the platform provides adequate security.

3. **Providing vehicle details**: Make sure to input accurate information regarding your vehicle. This encompasses details like the vehicle's make, model, and year, as well as the VIN. The type of vehicle can significantly influence your insurance premium, so accuracy is critical.

4. **Detailing your driving history**: A clean driving record can lead to better rates. Report your driving history truthfully, including any past incidents or claims. Insurance providers tend to reward responsible drivers with lower premiums.

5. **Specifying coverage needs**: Assess your coverage requirements based on your circumstances. Consider different coverage options available, such as liability, collision, or comprehensive, and specify these in the request form.

6. **Reviewing your information**: Before submitting, double-check your entries for accuracy. pdfFiller allows easy editing, so use its features to make adjustments if necessary.

Interactive tools available on pdfFiller

pdfFiller offers a wealth of online features designed to streamline the quotation request process. Collaborate in real-time with other users, such as family members or advisors, enhancing the information-sharing experience. The platform also supports eSigning and allows for secure document saving, enabling you to manage your forms effectively.

In addition, pdfFiller provides tracking features that help you manage and monitor your quotation requests. You can easily check the status of your submitted forms, ensuring you stay updated throughout the process.

Managing your motor insurance quotations

Once you receive multiple quotes, it’s vital to compare them effectively. Pay attention to key metrics such as coverage limits, exclusions, and premiums. Look for the best value by not only focusing on costs but also on what each policy covers. Sometimes, a slightly higher premium might yield significantly better coverage.

After evaluating your options, finalize your insurance policy. Ensure you thoroughly understand the terms and conditions of your selected policy before making a commitment. Being clear on details regarding claims processes, renewal terms, and payment schedules is crucial to avoid future complications.

Frequently asked questions

What happens if I make a mistake on the form? Mistakes can happen, and most insurers provide options for corrections. If you notice an error after submission, contact the insurance provider immediately to rectify it. Tools like pdfFiller also allow you to edit the form before final submission.

How long does it take to receive quotes after submission? While times may vary based on the insurer, expect to receive quotes within a few hours to a couple of days. Be sure to confirm with the provider if you haven’t received anything within the expected timeframe.

What if I need to change my insurance after obtaining a quote? Life changes such as a move or vehicle change may necessitate modifications. Reach out to your insurance provider directly to discuss options for adjusting your policy or obtaining updated quotes.

Case studies: success stories of finding the right coverage

There are countless testimonials from users who successfully navigated the motor insurance quotation request form through pdfFiller. For instance, one user, after extensive comparison, found a policy that saved them 20% annually while offering superior coverage. They attributed their success to the comprehensive capabilities of pdfFiller in managing quotes efficiently.

Another user shared how they used the collaborative features to involve family members in the decision-making process, thus ensuring everyone’s needs were considered before finalizing the insurance policy. These case studies highlight the real-world benefits and efficiencies provided by utilizing a structured quotation request form.

Next steps in your motor insurance journey

Once you've secured your motor insurance, remember that maintaining it over time is just as essential. Regular reviews of your coverage are necessary, especially as circumstances change. This includes assessing your policy before renewal periods to ensure you’re still getting the best value.

Keep your information updated and accurately reflect any changes in your circumstances, like moving residences or changes in driving habits. Periodic evaluations can help you secure better rates or coverage options suited to your evolving needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute motor insurance quotation request online?

How do I edit motor insurance quotation request in Chrome?

How do I edit motor insurance quotation request straight from my smartphone?

What is motor insurance quotation request?

Who is required to file motor insurance quotation request?

How to fill out motor insurance quotation request?

What is the purpose of motor insurance quotation request?

What information must be reported on motor insurance quotation request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.