Get the free Indemnity Form

Get, Create, Make and Sign indemnity form

Editing indemnity form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indemnity form

How to fill out indemnity form

Who needs indemnity form?

The Comprehensive Guide to Indemnity Forms

Understanding indemnity forms

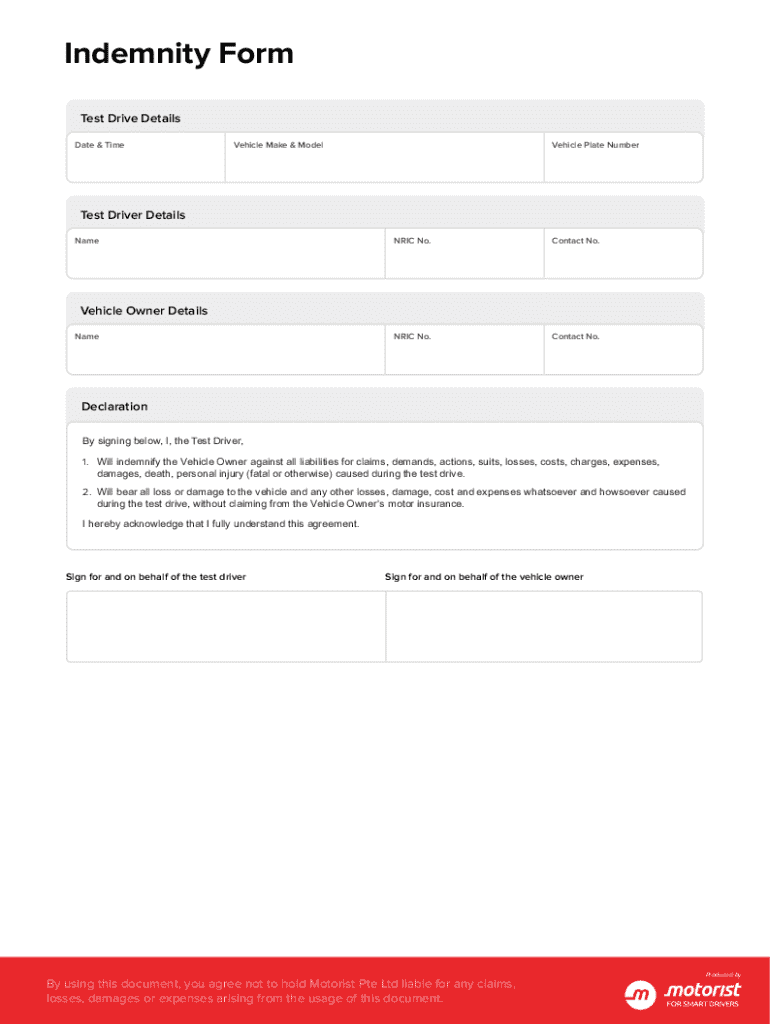

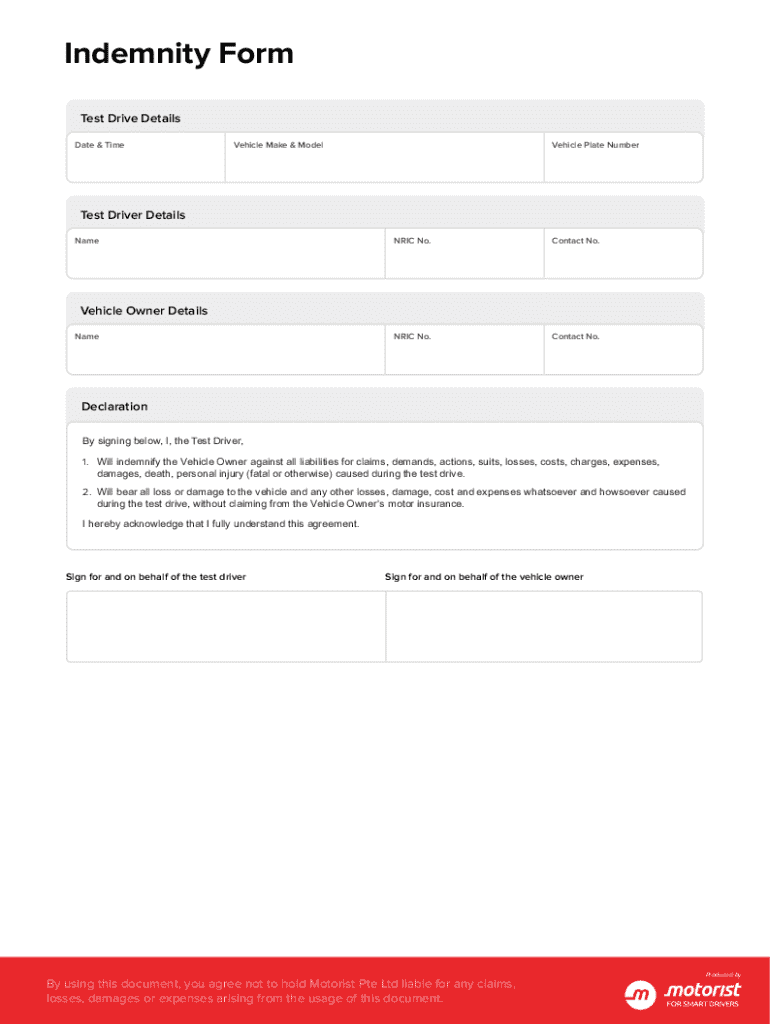

An indemnity form serves as a legal document providing protection against certain types of liabilities or losses. It’s often used to ensure that one party agrees to compensate another for specified damages or losses. This form acts as a safeguard, detailing responsibilities and the scope of coverage in various situations, thus offering a layer of security for individuals and businesses alike.

The primary purpose of an indemnity form is to clarify the terms of indemnification, outlining who is responsible for what in case of an unexpected event. Understanding key terminologies such as 'indemnitor' (the party providing the indemnification) and 'indemnitee' (the party receiving protection) becomes crucial in deciphering these agreements.

The importance of indemnity forms in legal and business contexts

Indemnity forms play a vital role in both legal and business environments, providing a structured means of managing risks. By effectively outlining liabilities, these agreements protect parties from unforeseen expenses and claims that may arise from their activities or engagements. This is particularly pertinent in dynamic sectors such as construction and healthcare, where risks are prevalent.

For instance, in the construction industry, indemnity clauses might safeguard contractors against lawsuits due to on-site accidents, while in healthcare settings, they can protect service providers from malpractice claims. These forms also serve as risk management tools during business transactions, fostering trust and facilitating smoother dealings between parties.

How indemnity forms function

Indemnity forms operate by establishing a contractual relationship between two parties: the indemnitor and the indemnitee. The indemnitor agrees to cover certain costs or losses incurred by the indemnitee under specified conditions, essentially transferring the financial burden from one party to another. This mechanism is crucial in situations where unforeseen circumstances can lead to significant financial exposure.

This framework is especially pertinent in scenarios such as hosting large events, where organizers might require vendors to sign indemnity forms to absolve themselves of liability for incidents that could occur during the event. Similarly, companies engaging outsourced staff often utilize indemnity forms to protect themselves from liabilities arising from the subcontractor’s actions.

Drafting an effective indemnity form

An effective indemnity form is meticulously crafted, incorporating key elements that protect the interests of both parties. The primary components include definitions of terms used, scope of indemnification, and exclusions or limitations that specify what is not covered under the agreement. Ensuring clarity and comprehensiveness is critical to prevent disputes down the line.

Drafting can be approached in systematic steps: begin by researching relevant laws and understanding the context of the agreement. Clearly outline the parties involved, specifying the circumstances that invoke indemnification. Incorporate necessary procedures to follow in the event of a claim and ensure a thorough review before finalizing the document.

Filling out and editing an indemnity form

Utilizing tools like pdfFiller can significantly streamline the process of filling out and editing indemnity forms. The platform offers an intuitive interface that allows users to customize their documents easily, ensuring accurate and timely completion. From template options to fillable fields, pdfFiller positions you to manage your indemnity forms with confidence.

To personalize your indemnity form, start by selecting the relevant template available on pdfFiller. Fill in your details, ensuring accurate information about the parties involved and the specific coverage terms. Once completed, you can save, print, or share the document securely. Additionally, pdfFiller ensures compliance with legal standards and clarity in language, making the process smoother.

Signing and managing indemnity forms

The signing process for indemnity forms has evolved, with electronic signatures gaining prominence. The ease and security of e-signatures streamline document management, allowing parties to sign from anywhere. Platforms like pdfFiller enable secure eSigning, ensuring that agreements are finalized quickly and efficiently without compromising on legal validity.

Using pdfFiller, teams can collaborate seamlessly by sharing indemnity forms for review and signatures. This collaborative feature ensures that all parties can participate in the document management process, facilitating transparency and accountability in the signing phase.

Common mistakes to avoid when using indemnity forms

When dealing with indemnity forms, awareness of potential pitfalls is crucial. Many individuals overlook critical clauses, which can lead to significant liability gaps. It’s essential to thoroughly understand the implications of the indemnification agreement, including the legal obligations it imposes and ensuring that it conforms with relevant laws.

Additionally, failing to revise the indemnity form as circumstances change can result in outdated terms that no longer reflect the risks involved. Regularly reviewing and updating indemnity forms in light of new information or modifications in operational practices can prevent future disputes.

Real-life examples of indemnity forms in action

Real-world applications of indemnity forms illustrate their importance in mitigating risks. For instance, a construction company that employs subcontractors may require that each subcontractor sign an indemnity form to ensure that the company is protected against third-party claims stemming from any accidents caused by the subcontractors.

Similarly, organizers of community events often ask vendors to sign indemnity agreements to cover any potential liabilities due to mishaps during the event. These examples highlight the practical utility of indemnity forms in safeguarding against unforeseen liabilities.

Frequently asked questions about indemnity forms

Indemnity forms invite numerous questions, particularly regarding their validity and adaptability. A key question includes what makes an indemnity form valid. Properly executed forms include clear language, specific terms outlining responsibilities, and mutual agreement between the parties. Disputes frequently arise over differing interpretations, and most are resolved through negotiation or legal arbitration.

Regarding modifications, many indemnity agreements allow for alterations post-signing, provided both parties agree. If a breach of the indemnity form occurs, the indemnitor typically holds liability for fulfilling the obligations laid out in the agreement.

Interactive tools for crafting indemnity forms

pdfFiller enhances the indemnity form creation process with interactive tools designed to simplify document design. Users can take advantage of built-in features such as drag-and-drop functionality, enabling them to customize their forms dynamically. This level of flexibility makes it easy to include specific clauses, alter terms, and adapt the form to meet unique needs.

With a hands-on demo available on pdfFiller, users can explore the platform’s capabilities, quickly crafting an indemnity form and experiencing firsthand how to utilize the various features. This approach not only demystifies the document creation process but also empowers users to take control of their indemnity agreements.

Additional considerations

Understanding the legal framework surrounding indemnity is essential for anyone involved in the drafting or management of indemnity forms. Potential claims must be considered along with relevant federal, state, and local laws that dictate the enforceability of such agreements. Consulting a legal professional before finalizing indemnity forms can help identify any potential risks and ensure compliance with applicable laws.

As situations evolve, so too should indemnity agreements. Adaptation in response to changing laws or operational contexts is crucial. Legal professionals can also provide guidance on how to navigate these changes effectively.

About pdfFiller

At pdfFiller, our commitment to document empowerment stands at the forefront of our mission. We aim to equip individuals and businesses with intuitive tools for creating, editing, and managing documents efficiently. Whether you’re an entrepreneur needing indemnity forms or a team collaborating on various legal agreements, pdfFiller simplifies the process, ensuring accessibility and user-friendliness.

Choosing pdfFiller means opting for a versatile cloud-based solution that not only enhances document workflows but also provides the support and flexibility necessary for effective document management. We prioritize user satisfaction and compliance, ensuring that every document meets legal standards while facilitating a smooth user experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get indemnity form?

How do I edit indemnity form straight from my smartphone?

How do I complete indemnity form on an iOS device?

What is indemnity form?

Who is required to file indemnity form?

How to fill out indemnity form?

What is the purpose of indemnity form?

What information must be reported on indemnity form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.