Get the free Merchant Account Application and Agreement

Get, Create, Make and Sign merchant account application and

How to edit merchant account application and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merchant account application and

How to fill out merchant account application and

Who needs merchant account application and?

Merchant account application and form: A comprehensive guide

Understanding merchant accounts

A merchant account is a specific type of bank account that allows businesses to accept payments, particularly credit and debit card transactions. This financial instrument acts as a bridge between the customer’s credit/debit card and the merchant's bank account, facilitating smooth and efficient transactions.

For businesses, having a merchant account is crucial. It not only enables them to process card payments but also enhances their credibility and opens the door to a broader customer base that prefers cashless transactions. By having a merchant account, businesses can also leverage tools that streamline the payment process.

Key benefits of having a merchant account

Having a merchant account provides several advantages that can significantly impact your business's operations and growth. Firstly, seamless credit card transactions ensure that customers can purchase without hindrances, potentially increasing sales and improving customer satisfaction.

Secondly, businesses with a merchant account project a professional image, thus enhancing customer trust and credibility. In today’s digital age, consumers often favor businesses that offer varied payment options, including card payments. Merchant accounts also provide access to advanced payment solutions like recurring billing and subscription services, which can simplify operations.

The merchant account application process

The journey to obtaining a merchant account involves a structured application process. Initially, businesses must evaluate their eligibility based on certain criteria, such as credit score, business type, and transaction history. This ensures the provider can assess the potential risk associated with the application.

To successfully apply, a business owner must prepare to submit specific documentation. Commonly required documents may include business licenses, bank statements, and valid identification of the business owners. These documents help establish legitimacy and ensure compliance with regulations.

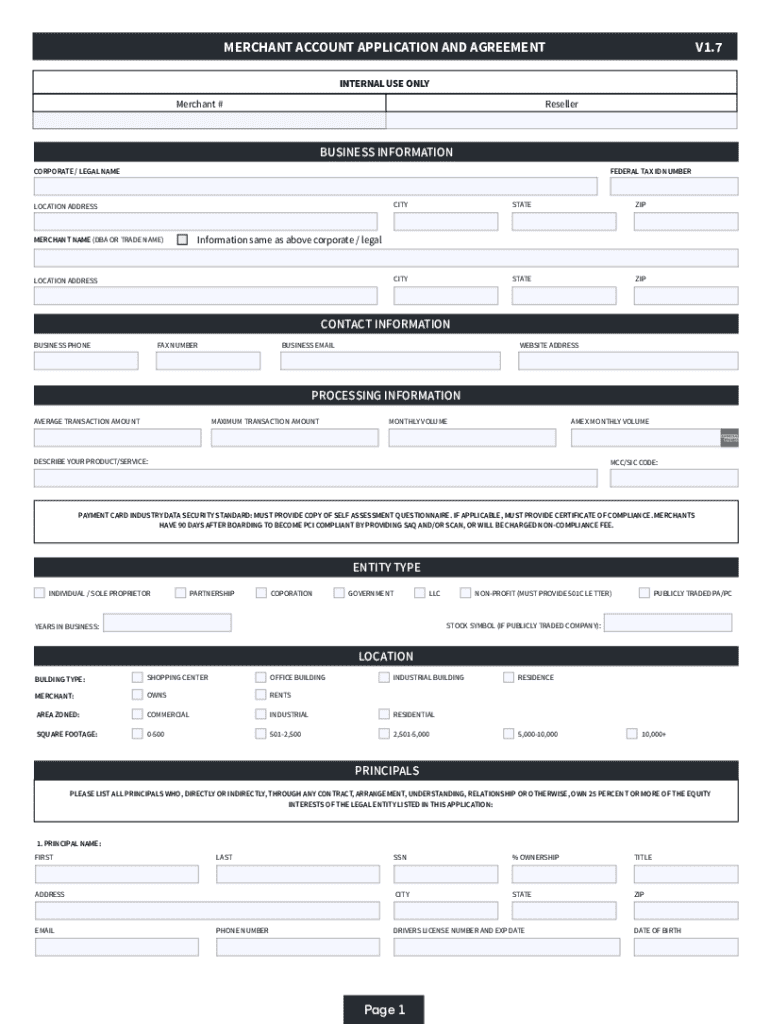

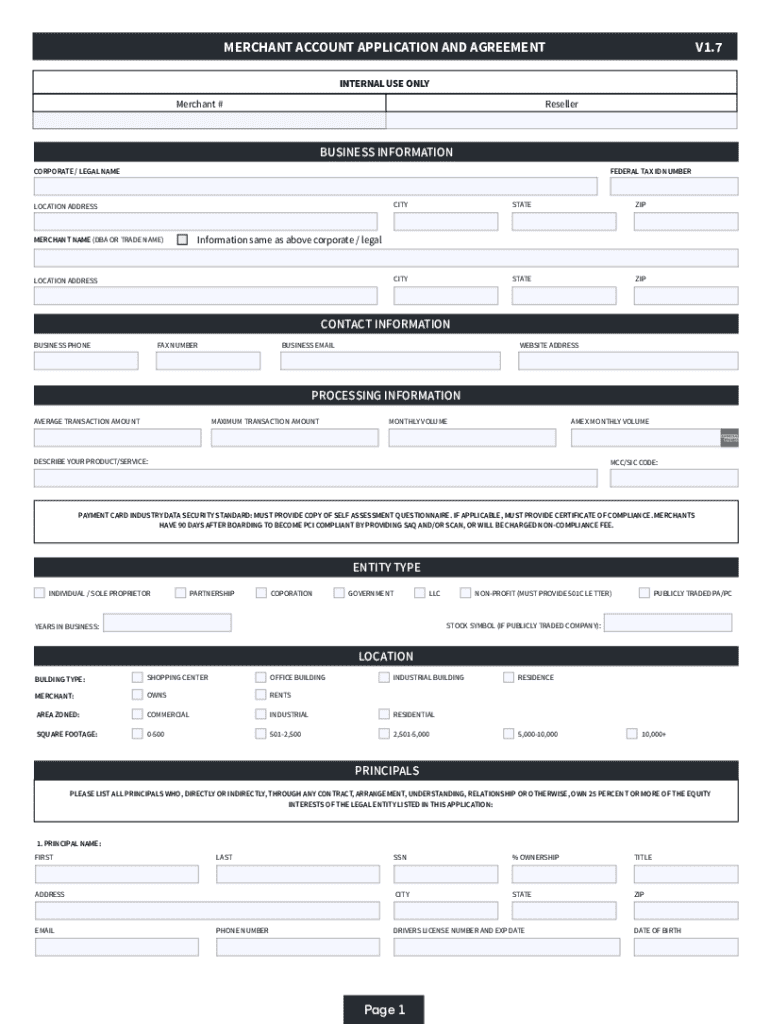

Step-by-step guide to completing the merchant account application form

Filling out the merchant account application form involves several key sections that require careful attention to detail. The first section typically includes business information, where applicants need to provide the legal name of the business, type of business entity, and the physical address. Providing accurate data here is crucial as discrepancies can lead to application delays.

Next, the owner or director information requires disclosure of personal details for the individual(s) managing the business. This typically includes names, addresses, and Social Security numbers, which are necessary for verifying identities. Finally, the financial information section asks for details about the business's financial status, including average monthly sales, the industry in which the business operates, and how long the business has been established.

When filling out each section, it’s important to double-check for accuracy and completeness. Common mistakes include providing incorrect figures, leaving sections blank, or failing to include required documents. By taking the time to review your application, the chances of approval can significantly increase.

Submitting your application: What to expect

Once completed, the application can be submitted either online or offline depending on the provider’s requirements. Many businesses prefer to submit online, as this often accelerates processing times. After submission, applicants can typically expect a review period of several business days, during which the provider evaluates the application and supporting documents.

Upon completion of this review, applicants will receive either an approval or denial notification. If denied, it’s important to review the feedback provided to understand the reasons behind the decision. In many cases, applicants can modify and resubmit their applications, addressing any concerns outlined in the denial.

Utilizing pdfFiller to manage your application

pdfFiller simplifies the document preparation process, allowing users to effectively manage their merchant account application and form. With its intuitive interface, users can easily edit, fill out, and customize their application forms without needing to print them out. This user-friendly experience streamlines the effort required to gather the necessary information.

Moreover, pdfFiller ensures document security and compliance by offering features such as password protection and secure cloud storage. This allows businesses to keep sensitive data confidential while also maintaining easy access for compliance checks and audits.

Additional features of pdfFiller

In addition to facilitating the preparation of applications, pdfFiller offers a myriad of features designed to enhance the overall document management experience. One notable feature includes electronic signatures, which can streamline the agreement processes, eliminating the need for physical signatures and enabling faster transaction processing.

Moreover, pdfFiller provides robust document storage and organization capabilities. Users can keep track of all forms and documents in one centralized location, minimizing the risk of misplaced paperwork. Built-in analytics for document performance overview allows businesses to monitor how often documents are accessed or completed, thus enhancing operational insights.

Frequently asked questions (FAQs)

Navigating the world of merchant accounts can come with its set of questions and challenges. Businesses operating with irregular income often wonder how this situation affects their application. Typically, providers look at the overall financial history rather than a single snapshot, enabling some flexibility for applicants in such situations.

Additionally, changing merchant account providers is a common concern for many businesses. It's important to review contractual obligations with the current provider and seek out a new provider that offers better rates or more suitable services. Lastly, once your merchant account is approved, practical best practices include regularly monitoring transactions, staying informed about the latest payment technologies, and managing any disputes proactively.

Next steps after getting your merchant account

Upon receiving approval for your merchant account, the immediate step is to set up the necessary payment processing infrastructure. This may involve integrating your new merchant account with existing point-of-sale systems or eCommerce platforms, ensuring that all components communicate efficiently.

Ongoing management and support are critical to ensure smooth operations. Regularly reviewing transaction statements, maintaining clear communication with your provider, and implementing fraud prevention measures are all vital aspects of operating a successful merchant account. Staying proactive about these factors can lead to sustained business growth and customer satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send merchant account application and for eSignature?

How do I execute merchant account application and online?

How do I fill out merchant account application and using my mobile device?

What is merchant account application?

Who is required to file a merchant account application?

How to fill out a merchant account application?

What is the purpose of a merchant account application?

What information must be reported on a merchant account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.