Get the free Certificate of Compensation Payment/tax Withheld

Get, Create, Make and Sign certificate of compensation paymenttax

Editing certificate of compensation paymenttax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of compensation paymenttax

How to fill out certificate of compensation paymenttax

Who needs certificate of compensation paymenttax?

Understanding the Certificate of Compensation Payment Tax Form

Understanding the certificate of compensation payment tax form

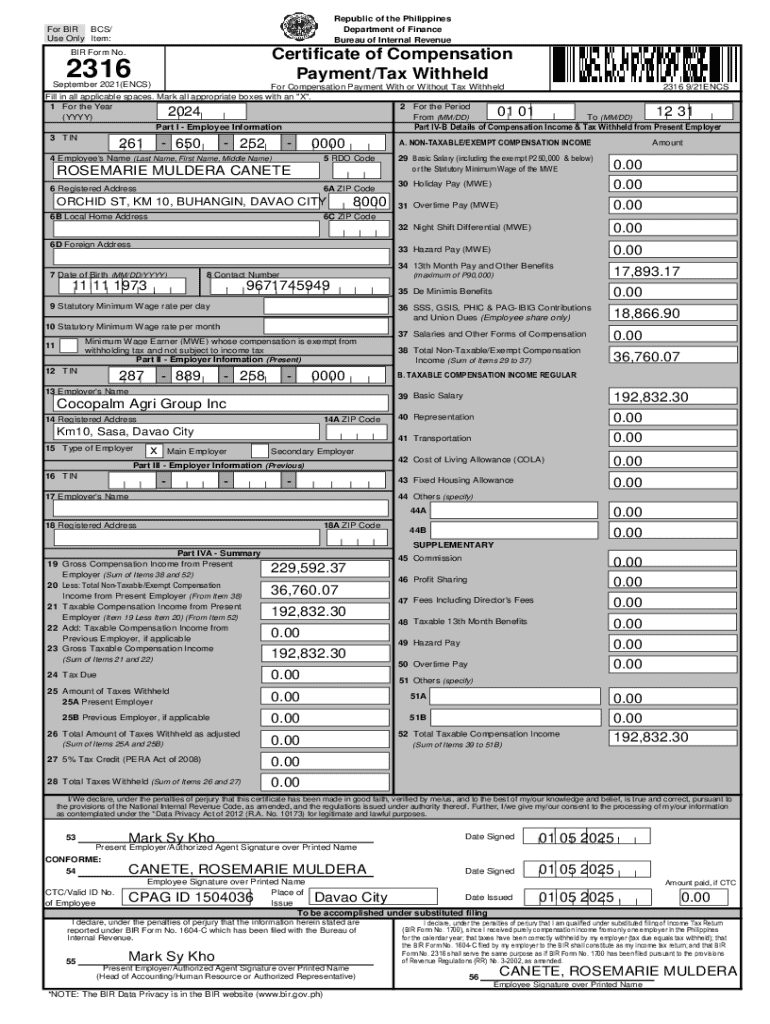

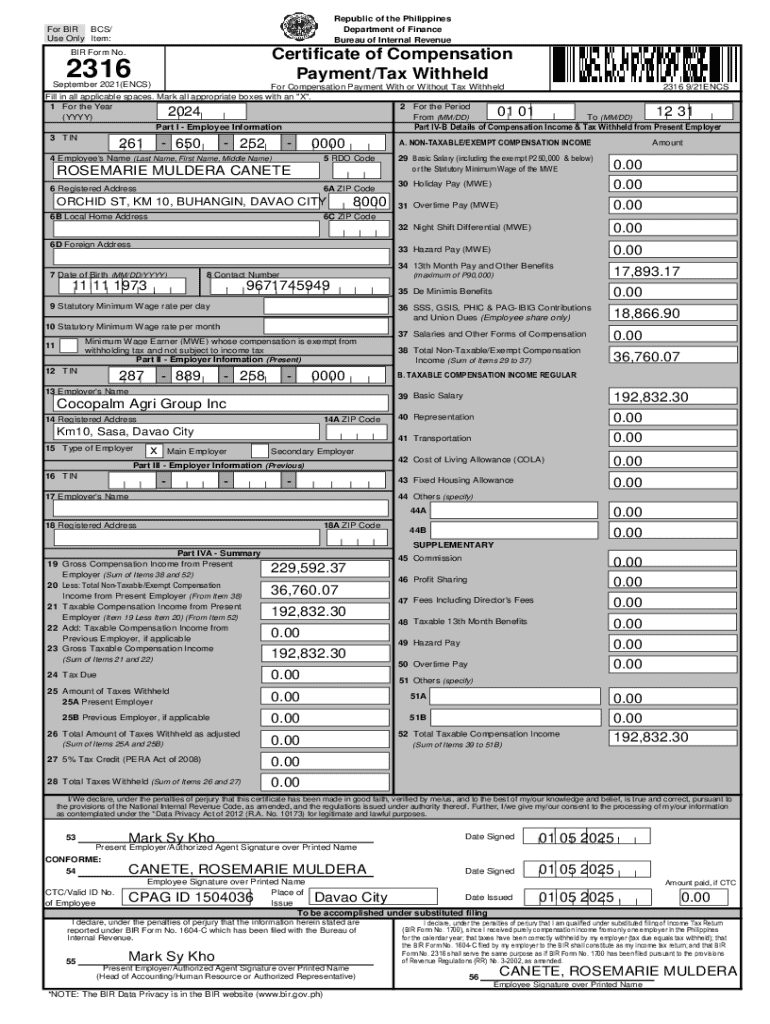

The certificate of compensation payment tax form is a crucial document for both employees and employers. It serves as proof of compensation received by an employee during a specific tax year, detailing necessary information regarding income and tax withheld. This form not only facilitates accurate tax filing for individuals but also ensures compliance for employers, affirming that employee income has been reported correctly to the tax authorities.

Employers use this form to report the total compensation paid to employees and the taxes withheld from their salaries, making it an essential tool for reconciling payroll taxes throughout the year. Understanding the key features of the certificate of compensation payment tax form allows employees to ensure their tax returns are accurately prepared, thus avoiding potential penalties or audits.

Who needs to file the certificate of compensation payment tax form?

Individuals who earn income from employment need to file the certificate of compensation payment tax form. Any employee receiving regular compensation from an employer must have this form to accurately declare their income and taxes withheld when filing their tax returns. This includes full-time, part-time, and contract employees. Understanding the eligibility criteria is key to ensuring that the right forms are completed during tax season.

Employers, on their part, have the responsibility to issue this form to all qualifying employees. It is imperative for employers to understand their obligations in completing and distributing this form to ensure compliance with tax regulations. Failure to provide the certificate can lead to penalties, resulting from employees being unable to substantiate their income.

When to file the certificate of compensation payment tax form?

Filing deadlines are integral to ensuring timely submission of the certificate of compensation payment tax form. Generally, employers are required to submit this form to the tax authority by the end of January for the preceding tax year. It's crucial for employers to be aware of state-specific deadlines, as they can differ significantly. Employees should receive their forms in a timely manner to allow for sufficient time to prepare their tax declarations.

Different employment types may have specific considerations regarding filing the certificate. For instance, contract workers may receive different forms from those employed full-time, and understanding when to file based on employment status is essential for accurate compliance.

How to fill out the certificate of compensation payment tax form

Filling out the certificate of compensation payment tax form requires careful attention to detail. The form is typically divided into several sections, each focusing on different aspects of compensation and tax information. Let's break it down step by step.

Part : Employee information

This section captures personal identifiers like the employee's name, address, Social Security number, and other relevant details. Accurate information is crucial; any errors can result in delays or miscommunications with the tax office.

Part : Employer information

Here, the employer must provide their name, address, and employer identification number (EIN). Ensuring that all information is current prevents any complications in the tax reporting process.

Part : Summary of compensation income

This part details the total compensation, including wages, bonuses, and any other financial remuneration. Clear reporting of this information ensures that both employer and employee reports are aligned.

Part : Tax withheld

Employers report the total tax amounts withheld from the employee's income. This is critical, as it directly impacts the employee’s total tax liability.

Filling out the certificate accurately is essential. Here are some tips to ensure effective completion:

Common mistakes to avoid when filling out the form

Misreporting income is one of the most frequent mistakes encountered when filling out the certificate of compensation payment tax form. Incorrectly reporting income can lead to discrepancies with the IRS, potentially resulting in penalties or audits. It is crucial to cross-verify all figures against payroll records.

Another common pitfall involves failing to include correct employer details, which can confuse the tax authority and delay processing. Ensure that the employer's name, EIN, and address are accurate and current.

Lastly, watch out for overall errors and omissions that may arise during the completion of the form. Lack of attention to detail can result in significant issues later. A checklist can help.

Managing your certificate of compensation payment tax form

Once the certificate of compensation payment tax form is completed, proper management of the document becomes vital. Keeping records organized is essential for tax purposes. Any documentation that supports entries on the tax form should be retained. This includes pay stubs, bank statements, and other financial records.

Additionally, storing your certificate securely is crucial to protect against identity theft or other unauthorized access. Use secure digital storage solutions, such as encrypted files or reputable online platforms, to maintain your documents safely.

eSigning the certificate of compensation payment tax form

In today's digital age, eSigning documents is not only convenient but also legally binding in many jurisdictions. The certificate of compensation payment tax form can be electronically signed, streamlining the filing process. Electronic signatures carry the same validity as traditional handwritten signatures, making eSigning a reliable option.

Using platforms like pdfFiller to eSign your form is straightforward. Simply upload your certificate, sign it electronically using their advanced tools, and save the signed document for your records. This method enhances efficiency, especially for those managing multiple documents.

Substituted filing: what you need to know

Substituted filing allows employers to submit a simplified version of the certificate of compensation payment tax form or an alternative document that meets IRS requirements. This is particularly useful if an employer has made a significant number of errors on their forms.

The requirements for substituted filing generally stipulate that all relevant information must still be presented, but in a format that may reduce redundancy. Adopting this method can also enhance processing speed. Thus, it is particularly advantageous for businesses with multiple employees.

Frequently asked questions about the certificate of compensation payment tax form

Answers to common queries can provide valuable insights into the certificate of compensation payment tax form. One question often raised is whether the form can be filed via mail. Yes, it can, but eFiling is generally more efficient, allowing for immediate confirmation of submission.

Another question revolves around errors after submission. Should a mistake be identified post-filing, it is advisable to correct it with the appropriate tax authority promptly. Lastly, those seeking prior year certificates from previous employers can usually request a duplicate from the HR or payroll department, ensuring all tax documents are comprehensive.

Related posts and resources

Exploring further topics related to the certificate of compensation payment tax form can empower you with the knowledge needed for effective tax management. Resources available include guides on other tax forms that are frequently required, such as the W-2 and 1099 forms, as well as additional information on employment taxes, which can further clarify obligations and rights as an employee or employer.

Editable certificate of compensation payment tax form PDF download

To facilitate a streamlined process when filling out your certificate of compensation payment tax form, pdfFiller provides an editable PDF version available for download. This resource allows users to fill out the form digitally with ease, ensuring that the document can be accurately completed and eSigned without the hassle of printing.

Automated form preparation tools available at pdfFiller

Utilizing automated tools from pdfFiller enhances the process of managing your certificates and tax forms. These tools can auto-complete fields based on provided data, ensuring greater consistency and less potential for errors.

Success stories of users managing taxes with pdfFiller

Many users have successfully navigated their tax filing processes leveraging pdfFiller’s services, attesting to its effectiveness and convenience in managing various document-related tasks.

Interactive tools

For quick reference, pdfFiller offers an interactive FAQ section that addresses common concerns related to the certificate of compensation payment tax form. Additionally, a checklist for form preparation can be a valuable resource to ensure that all necessary steps are completed before submission, minimizing the risk of errors.

Contact information

Should you have any inquiries regarding filing your certificate of compensation payment tax form, pdfFiller provides robust support services to assist with your queries. Furthermore, community forums are available for user discussions on tax forms, providing a platform for sharing experiences and solutions among users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get certificate of compensation paymenttax?

How do I make changes in certificate of compensation paymenttax?

Can I edit certificate of compensation paymenttax on an iOS device?

What is certificate of compensation payment tax?

Who is required to file certificate of compensation payment tax?

How to fill out certificate of compensation payment tax?

What is the purpose of certificate of compensation payment tax?

What information must be reported on certificate of compensation payment tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.