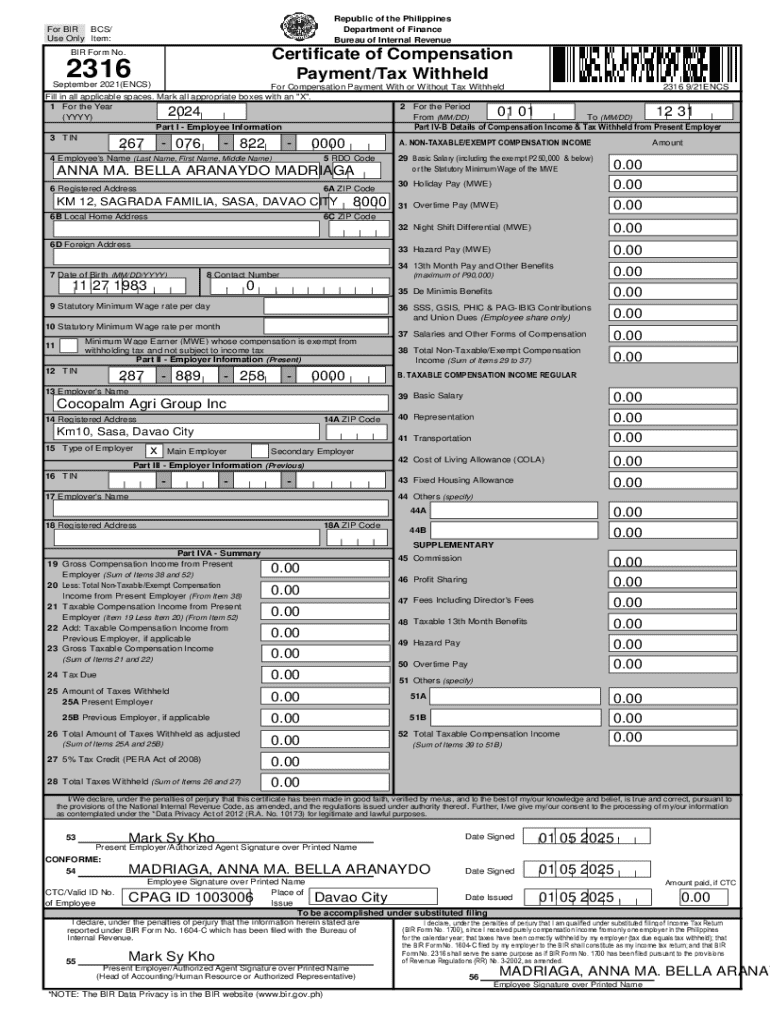

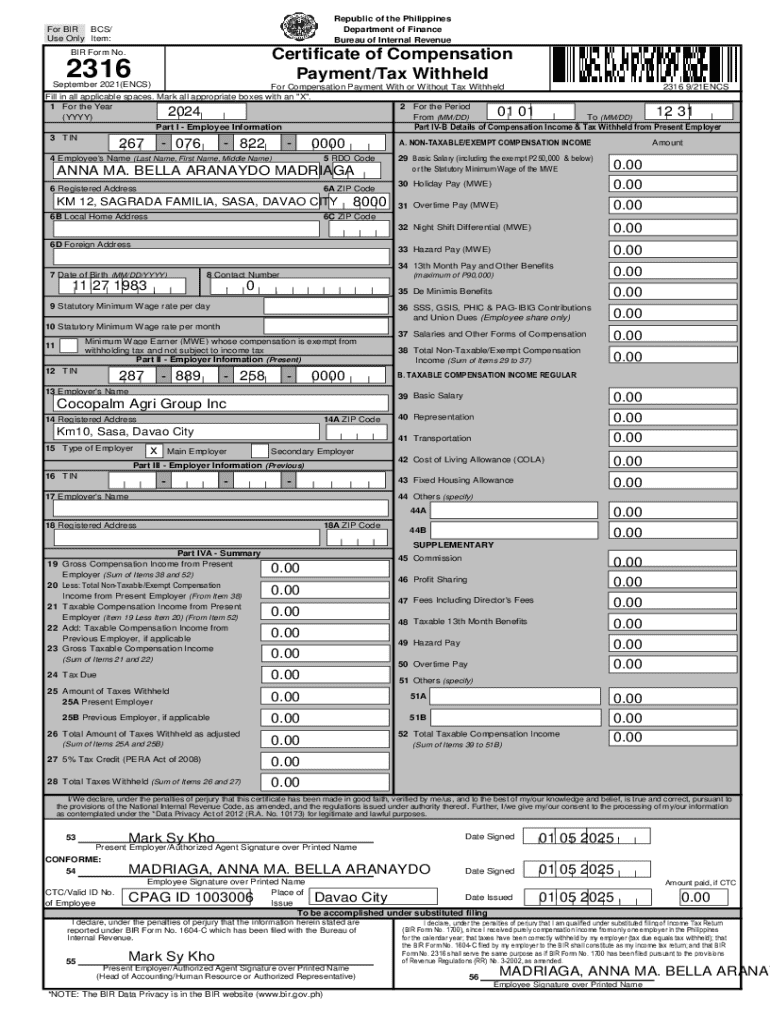

Get the free Bir Form No. 2316

Get, Create, Make and Sign bir form no 2316

Editing bir form no 2316 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bir form no 2316

How to fill out bir form no 2316

Who needs bir form no 2316?

A comprehensive guide to BIR Form No. 2316

Understanding BIR Form No. 2316

BIR Form No. 2316 serves as the Certificate of Compensation Payment/Tax Withheld for the Year. This essential document provides a summary of an employee's taxable compensation and the tax withheld by the employer over the preceding year. It acts as a crucial reference for employees during their annual income tax return filing, showcasing tax compliance and contributing to transparency in compensation-related policies.

Employers are not only required to issue this form to employees receiving salaries, but they also play a significant role in ensuring that the details are accurate. The importance of BIR Form No. 2316 extends beyond mere compliance; it builds trust between employees and employers by ensuring that tax regulations are adhered to.

Who is required to file BIR Form No. 2316?

The filing of BIR Form No. 2316 is mandatory for all employees receiving regular compensation from their employers, without exception for residency status. Employers bear the responsibility to produce this document accurately and within the stipulated time frame. In general, any individual classified as an employee under the tax regulations of the Philippines is subject to this requirement.

However, certain categories of employees are exempt from requiring BIR Form No. 2316. For instance, employees with compensation below the taxable threshold or those covered under specific exemption provisions may not need to file this form. It's critical that both employers and employees understand these exemptions to avoid unnecessary complications.

When should BIR Form No. 2316 be filed?

BIR Form No. 2316 must be issued by employers and provided to employees annually, ideally by January 31 of the following year. This timeline allows employees to utilize the form to support their income tax return preparation. Meeting the deadline ensures that both parties remain compliant with the Bureau of Internal Revenue's regulations and helps streamline the tax filing process for employees.

Key dates to remember include not only the January deadline for form issuance but also the overall tax return filing deadline, which usually falls around April 15. Abiding by these timelines is essential to facilitate an organized and stress-free tax filing experience.

How to fill out BIR Form No. 2316

Filling out BIR Form No. 2316 requires careful attention to detail. Below are the steps one should follow to ensure accuracy:

Common mistakes include failing to report all sources of compensation or neglecting to include correct withholding amounts. Carefully reviewing the form before submission can minimize these errors.

Editing and managing your BIR Form No. 2316

Utilizing pdfFiller for document management provides a streamlined approach to handling BIR Form No. 2316. With pdfFiller, users can upload the form and make necessary edits effortlessly. This capability allows users to ensure that every detail is accurate and complete before submission.

Moreover, pdfFiller offers eSigning features, enabling employers and employees to digitally sign the document without needing to print it out. This not only saves time but promotes a more eco-friendly approach. Organizing forms digitally makes retrieval simple, ensuring that you can access your documents whenever necessary.

FAQs about BIR Form No. 2316

Here are some common queries regarding BIR Form No. 2316, which can help clarify aspects that may be confusing to employees and employers alike.

Important considerations

Filing BIR Form No. 2316 has significant tax implications. The documented details serve as a basis for annual income tax returns, determining the employee's tax obligations. Incorrect information could lead to discrepancies in tax calculations, potential audits, or re-assessment of taxes owed.

Consequences of non-compliance can be severe, including penalties or legal action for employers who fail to provide this form accurately and on time. Therefore, both employees and employers must prioritize compliance with the filing requirements.

Resources for further assistance

For anyone needing further information about BIR Form No. 2316, several resources are readily available. The Bureau of Internal Revenue offers official guidelines and FAQs on their website, providing clarity on procedural aspects and reporting requirements. Engaging with tax professionals can also yield personalized advice tailored to individual situations.

Community forums can be valuable for sharing experiences and gaining insights on common challenges faced while managing this form. Utilizing local expertise can often pave the way for a smoother filing experience.

Leveraging pdfFiller for all your document needs

pdfFiller stands out as a comprehensive document management solution. Beyond BIR Form No. 2316, it empowers users to manage all kinds of PDF forms effectively. Features include the ability to edit, eSign, collaborate, and store documents in a cloud-based platform, enhancing access and organization.

Using pdfFiller for your BIR Form No. 2316 streamlines the process, enabling users to complete their tax documentation with ease and ensure compliance. Its intuitive interface also allows for collaboration among team members, ensuring that every stakeholder can contribute efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my bir form no 2316 in Gmail?

How do I make changes in bir form no 2316?

How do I edit bir form no 2316 on an Android device?

What is bir form no 2316?

Who is required to file bir form no 2316?

How to fill out bir form no 2316?

What is the purpose of bir form no 2316?

What information must be reported on bir form no 2316?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.