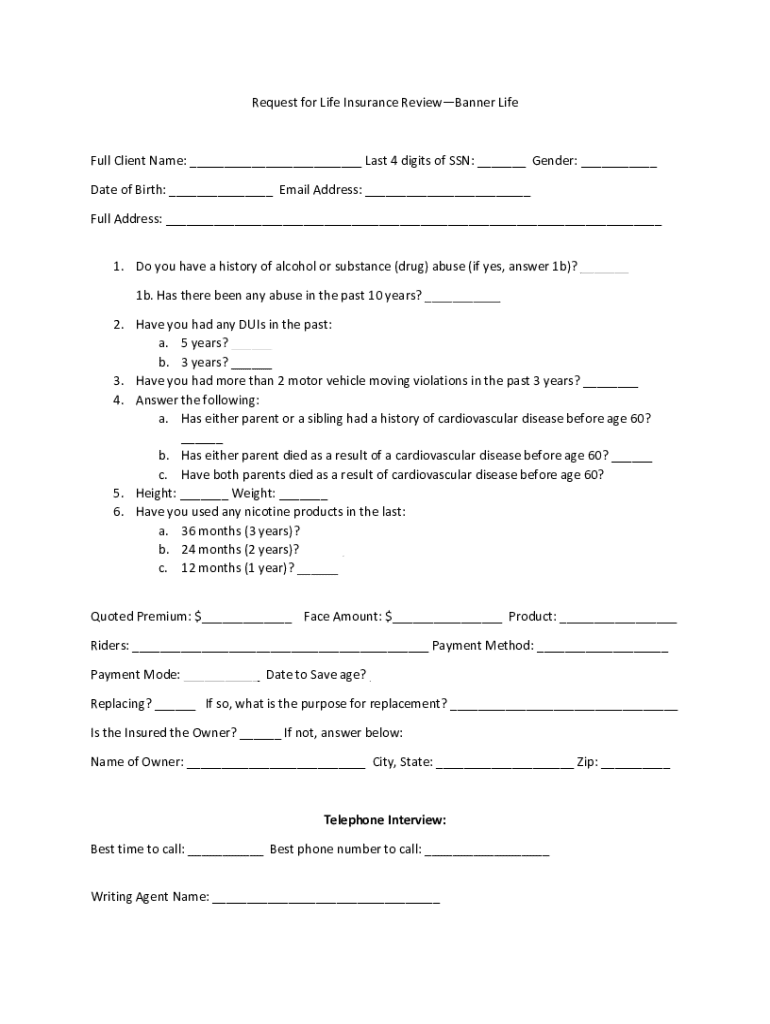

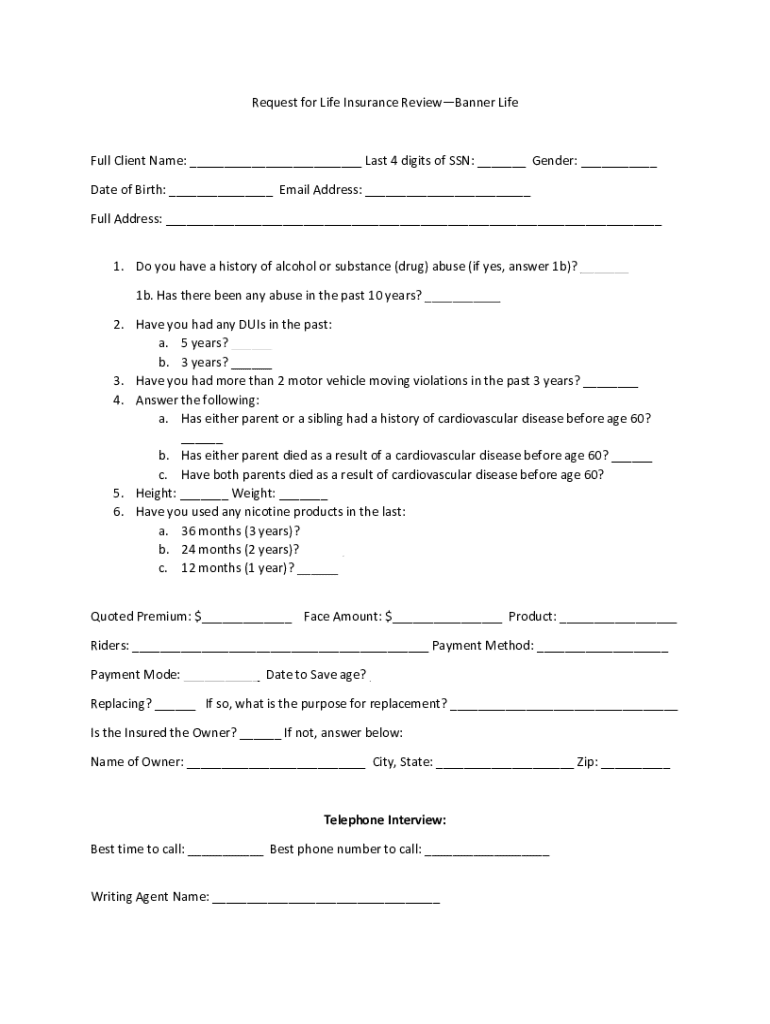

Get the free Request for Life Insurance Review—banner Life

Get, Create, Make and Sign request for life insurance

How to edit request for life insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out request for life insurance

How to fill out request for life insurance

Who needs request for life insurance?

Request for life insurance form: A comprehensive guide

Understanding life insurance forms

A life insurance form is a crucial document that individuals must complete when applying for life insurance coverage. This form collects essential personal information, beneficiary details, and health history, ensuring that the insurance provider can accurately assess risk and determine coverage.

The importance of life insurance forms lies in their role in the application process. They act as the foundation upon which insurance policies are built. By accurately filling out these forms, applicants not only facilitate a smoother approval process but also ensure they receive the most appropriate coverage for their needs.

There are several types of life insurance forms, including standard applications for whole and term life policies, simplified issue applications, and medical questionnaire forms. Understanding the type of form you need is crucial in ensuring that you receive a policy that aligns with your life insurance goals.

How to determine which life insurance form you need

Determining which life insurance form you need starts with assessing your life insurance needs. This involves understanding not only the type of financial protection you want to provide for your loved ones but also the specific characteristics of coverage that matter to you.

Several factors influence your choice of form, including:

A quick guide to different life insurance types includes term life insurance, which offers coverage for a specific period, and whole life insurance, which provides lifetime coverage and includes a savings component. Each type will require a different form tailored to its specifics.

Accessing the life insurance form

Finding the appropriate life insurance form can often be done through online sources. Many insurance providers have their forms available on their websites, making it easier for applicants to access necessary documentation.

pdfFiller is another excellent resource for locating life insurance forms. Simply navigate to pdfFiller’s extensive database, where you can search for specific forms by category or keyword. The importance of using reliable sources cannot be overstated; correct forms are essential to ensuring compliance with insurance regulations.

Step-by-step guide to filling out the life insurance form

Before you begin filling out the life insurance form, ensure you prepare adequately. Gathering necessary documents is the first step. This may include identification, health history, and financial details relevant to your application.

Understanding the required information laid out in the form is equally vital. The form typically includes various sections such as:

Common mistakes to avoid while filling out the form include incomplete information, inaccuracies in your health history, and neglecting to review your entries before submission. These errors can delay the approval process or even result in denied claims.

Editing and customizing your life insurance form

Once you've filled out your life insurance form, utilizing pdfFiller’s editing features can help to ensure everything is accurate. You can easily make changes, add or remove fields, customize the document to meet specific requirements, and assure that the form complies with insurance standards.

Editing your document can significantly enhance clarity and professionalism, essential when submitting any insurance application.

Signing your life insurance form

eSigning your form is crucial in today's digital age, as it ensures the document is considered legally binding. With pdfFiller, eSigning can be executed simply, making it a straightforward process.

When it comes to signing, understand your options. You can electronically sign your form using mouse, touchscreen, or stylus, giving you flexibility. Alternatives to electronic signatures include handwritten signatures, though they may slow down the submission process.

Submitting your completed life insurance form

Before you hit that submit button, conducting a review is essential. Create a checklist of items to ensure everything looks accurate—consider factors such as personal information, beneficiaries, and your health disclosures.

Submitting your form online offers benefits like faster processing. Alternatively, if opting for paper submission, remember it may take longer for processing and approval. After submission, expect a confirmation response from the insurance provider indicating the next steps.

Managing your life insurance documentation

Once your life insurance form is submitted and your policy is approved, secure storage of your documentation is paramount. Using cloud services like pdfFiller ensures your policy details are accessible yet protected from unauthorized access.

It’s also important to keep track of policy updates. Make use of pdfFiller tools for ongoing management, monitoring changes in policy terms, coverage amounts, and any necessary renewals or amendments.

Frequently asked questions about life insurance forms

1. What if I make a mistake on my form? You can correct errors, but it's crucial to handle them carefully—consult your insurance provider for guidance on making corrections after submission.

2. How long does it take for my application to be processed? Processing times can vary, but typically range from a few days to a couple of weeks depending on the type of insurance and complexity of your application.

3. Can I update my life insurance form after submission? Yes, most insurance providers allow updates to your policy information, but you may need to submit additional forms.

Accessing help and resources

If you need further assistance while filling out your life insurance form, pdfFiller’s customer support is readily accessible. Reach out via their website to find knowledgeable representatives who can answer your questions.

Additionally, numerous online resources and tutorials are available to guide you through common processes and misunderstandings in filling out life insurance forms. Engaging with insurance advisors for personalized guidance can also offer significant benefits, ensuring your needs are fully met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out request for life insurance on an iOS device?

Can I edit request for life insurance on an Android device?

How do I fill out request for life insurance on an Android device?

What is request for life insurance?

Who is required to file request for life insurance?

How to fill out request for life insurance?

What is the purpose of request for life insurance?

What information must be reported on request for life insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.