Impact investment initiative for form: Navigating Opportunities and Challenges

Understanding impact investment initiatives

Impact investment refers to investments made with the intention of generating positive social and environmental impact alongside a financial return. This approach positions funds in a way that seeks to address pivotal issues such as climate change, education inequity, and healthcare access, all while providing investors with a sustainable financial return.

The importance of impact investing in today’s economy resonates strongly amid growing concerns about sustainable development and corporate responsibility. With a new generation of conscientious investors rising, impact initiatives provide a pathway to channel resources toward meaningful change across communities, making these investments increasingly critical.

Key goals encompass poverty alleviation, combating climate change, and enhancing community resilience.

Focus sectors typically include health, sustainability, education, and social enterprises.

Types of impact investment initiatives

Diving into the various types of impact investment initiatives reveals a diversified landscape that caters to specific community needs. Community investments prioritize local projects and services, promoting engagement and measurable local impact.

Environmental impact initiatives focus on funding ventures that address climate change and foster sustainable ecosystems. Simultaneously, social impact initiatives are dedicated to tackling societal challenges including poverty alleviation, education improvement, and healthcare access.

Projects that focus on enhancing community infrastructure, affordable housing, and local business development.

Investments directed towards renewable energy, conservation projects, and technologies that reduce carbon footprints.

Efforts targeted at improving health care systems, educational opportunities, and social services.

Navigating the impact investment landscape

The impact investment landscape is populated by various stakeholders, each playing a crucial role in fostering a community of responsible capital allocation. Impact investors, consisting of both individuals and organizations, actively bridge financial sustainability with social progress.

Key players also include nonprofits and social enterprises that bring to life the missions of impact investing through innovative solutions and programs. Utilizing frameworks and standards such as IRIS+ and GIIRS ensures that investors comprehensively assess their investments' potential impact, facilitating transparent reporting and accountability.

Impact investors are crucial in channeling funds towards initiatives with defined social objectives.

Nonprofits and social enterprises provide venues for implementing impact-driven projects.

Frameworks like IRIS+ offer standardized metrics for measuring impact, enhancing comparability and clarity for investors.

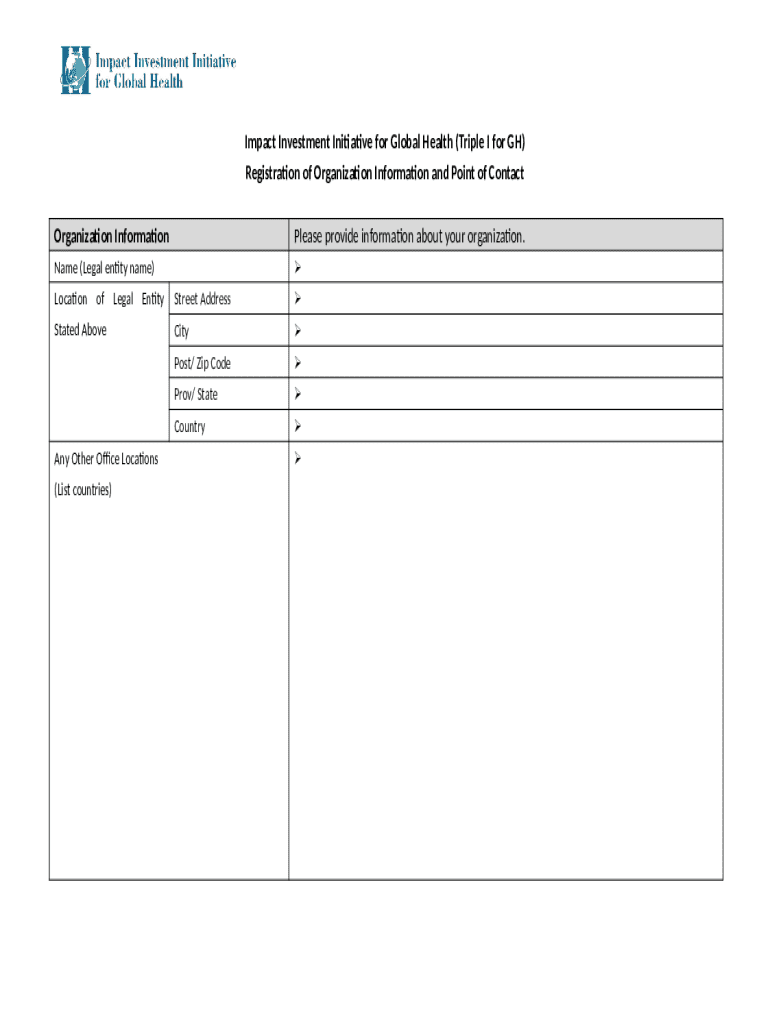

The role of forms in impact investment initiatives

Forms serve as vital instruments in the impact investment process, ensuring clarity and structure in the application and reporting process. Commonly used forms include investment proposals, applications for funding, and various impact assessment reports.

Utilizing well-structured forms allows for accurate data collection and analysis, ensuring that all stakeholders are aligned on the expected outcomes. A good investment proposal should encapsulate essential components like the project’s vision, goals, target audience, and anticipated impact metrics, all vital for making sound investment decisions.

Investment Proposals outline the project's objectives, expected impacts, and financial needs.

Impact Assessment and Reporting Forms capture data regarding project outcomes and are essential for measuring success.

Tips for successfully completing impact investment forms

Completing impact investment forms requires detailed attention and organization. Following a structured approach ensures that all necessary documentation is compiled, facilitating a smooth application process.

A step-by-step guide might include gathering relevant data, presenting it clearly, and being aware of common pitfalls, such as miscommunication or overlooked metrics. Being thorough is vital while also highlighting key impact metrics can be achieved through effective visual representations in the submission.

Prepare necessary documentation, including financials and impact forecasts.

Avoid common pitfalls by double-checking submissions for completeness.

Utilize visual data presentations, such as infographics, to enhance understanding.

Leveraging technology and tools for impact investment forms

Modern technology provides impactful solutions for managing documentation in impact investments. Platforms like pdfFiller streamline the creation, editing, and management of critical forms, enhancing the overall process efficiency for investors.

Using pdfFiller, investors can easily edit PDFs, utilize e-signing features, and collaborate in real-time. These tools not only save time but also minimize errors, allowing investors to focus on understanding the implications and details of their investments.

Editing PDFs efficiently allows for real-time update capabilities.

eSigning enables streamlined approvals without delays.

Collaboration features foster teamwork among stakeholders for comprehensive proposals.

Collaborating for greater impact

In impact investing, collaboration amplifies potential outputs, rather than working in isolation. Networking with other investors and stakeholders can uncover synergies and shared goals, ultimately leading to increased investment effectiveness.

Establishing community partnerships enhances impact initiatives by leveraging local knowledge and resources. Collaborating on investments fosters a greater understanding of community needs, ensuring that projects are culturally appropriate and more likely to succeed.

Connect with other investors and stakeholders to share resources and insights.

Collaborative investing models can lower risk and share potential returns.

Community partnerships enrich project design and implementation through local engagement.

Case studies: successful impact investment initiatives

Examining successful impact investment initiatives reveals important lessons and best practices. Profiles of noteworthy initiatives highlight the effective allocation of resources and the tangible outcomes achieved through strategic investments.

Impact measurement is vital; before-and-after comparisons can showcase success, revealing how targeted investments have transformed communities, provided essential services, or contributed to environmental sustainability.

Profiles might include social enterprises that successfully addressed food insecurity.

Notable environmental initiatives that demonstrated significant carbon reduction.

Educational projects that led to improved student outcomes and community engagement.

Getting involved in impact investment initiatives

If you’re interested in launching your own impact investment initiative, clarity in your goals and objectives is essential. Engaging with stakeholders, including community members and potential partners, can lay a strong foundation for meaningful engagement and buy-in.

Educational resources abound for those looking to deepen their impact investing knowledge. Whether through online courses or learning from veteran investors, the landscape is rich with opportunities to gain expertise.

Set clear goals and objectives that resonate with community needs.

Engage with stakeholders early to ensure alignment and support.

Access educational resources like courses and mentorship programs to build skills.

Staying informed on impact investment trends

With the impact investment sector evolving rapidly, staying informed on trends and developments is crucial. Upcoming events and conferences present vital networking opportunities and insights into emerging strategies, while reports and guides can provide deep dives into current investments and opportunities.

Signing up for industry newsletters or following influential organizations on social media helps investors keep pace with innovations and changes in impact investing, allowing them to adapt and respond effectively.

Attend events that focus on exchanging ideas and best practices among impact investors.

Consult industry reports regularly for insights into trends and market directions.

Engage with innovations in impact investing, such as technology-driven solutions.

Engaging with pdfFiller for impact investment documentation

Utilizing pdfFiller's features simplifies the process of managing impact investment documentation. The platform allows users to easily edit, sign, and share essential forms, ensuring that all necessary documents are available and well-organized.

Signing up for pdfFiller provides numerous benefits, including cloud-based storage and easy access to documents from anywhere. This enhances collaboration and the ability to quickly incorporate feedback into investment proposals.

Ease of signing up to pdfFiller and starting with essential document templates.

Features like cloud storage allow access from any device at any time.

Positive testimonials from users highlight increased efficiency and collaboration.

Future of impact investment initiatives

The impact investment sector is expected to continue evolving as more individuals and organizations recognize the importance of socially responsible investing. Emerging trends in technology, such as blockchain for transparent transactions, and a push for standardized metrics for evaluating impact promise to reshape the landscape.

As education around impact investing becomes more prevalent, new opportunities for collaboration and innovative investment strategies are likely to surface. This adaptability will be crucial for sustaining momentum and achieving meaningful social and environmental change over the next decade.

Emergence of technology tools that provide greater transparency and tracking of impacts.

An increasing focus on educational resources to build investment capabilities.

Predictions indicate a growing integration of impact investing into mainstream financial practices.