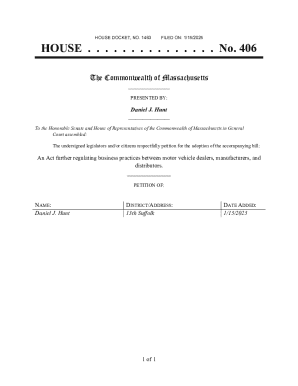

Get the free Registered Bank Disclosure Statement

Get, Create, Make and Sign registered bank disclosure statement

Editing registered bank disclosure statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registered bank disclosure statement

How to fill out registered bank disclosure statement

Who needs registered bank disclosure statement?

Your Comprehensive Guide to the Registered Bank Disclosure Statement Form

Understanding the registered bank disclosure statement form

The registered bank disclosure statement form is a critical document that financial institutions are required to provide, ensuring transparency and compliance within the banking sector. This form plays a significant role in maintaining investor trust by providing essential insights into the financial health and operational conduct of registered banks.

Transparency in banking is paramount, not just for regulatory compliance but for fostering trust among consumers and investors. With the financial landscape continuously evolving, the need for transparent reporting has never been more essential. The registered bank disclosure statement serves as a vital communication tool, bridging gaps between banks and the stakeholders they serve.

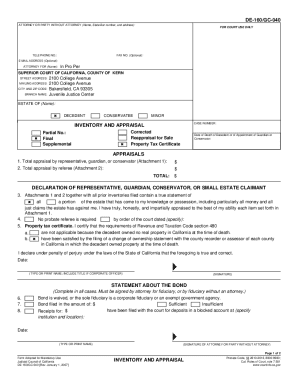

Key components of the form

Understanding the key components of the registered bank disclosure statement form helps elucidate what information is being shared and why it matters. The form comprises several required sections that provide a complete view of the bank's status, operations, and compliance.

Each of these sections has a defined purpose, facilitating better evaluation by regulators and the public. The financial data, for instance, is crucial for assessing the bank's profitability and operational integrity.

Step-by-step guide to completing the disclosure statement

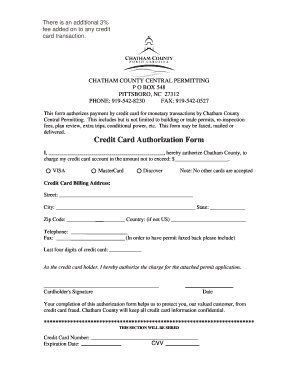

Filling out the registered bank disclosure statement form can be straightforward if you follow a systematic approach. Start with preparing your documents to ensure you have all the necessary information at hand.

When it comes to filling out the form, break it down section by section. Start with the personal information, ensuring that all details are accurate and up-to-date. Next, focus on the financial disclosure details, providing thorough and honest insights into the bank's financial standing. Lastly, address the compliance checkpoints by detailing how the bank meets regulatory requirements.

Common mistakes include missing signatures, incorrect financial figures, or leaving sections blank. To avoid such issues, it's advisable to have a checklist for verification, ensuring completeness and accuracy before submission.

Editing and managing your disclosure statement

Once you've completed the form, you might need to make edits or adjustments. Using pdfFiller offers a seamless way to handle these updates and manage your documents effectively.

Moreover, managing your documents in the cloud allows for secure storage and easy access from anywhere, providing peace of mind that your important documents are protected and organized. Keeping your forms in a centralized location simplifies future edits and updates as required.

eSigning your disclosure statement

eSignatures have revolutionized the process of signing documents. The registered bank disclosure statement can be easily signed electronically, ensuring both legal validity and security. Leveraging eSignatures not only enhances compliance but also expedites the processing time for your disclosures.

This electronic touch adds convenience and urgency, especially for time-sensitive submissions, while still adhering to legal standards.

Frequently asked questions (FAQs)

After submitting your registered bank disclosure statement form, you may have several questions. Understanding the process and what to expect can alleviate concerns.

Additional tips for a successful submission

To ensure a smooth submission experience, consider the following best practices. Timely submissions are crucial, so be mindful of deadlines to avoid penalties.

These practices foster a smoother experience while ensuring compliance with all necessary regulations.

Unique features of pdfFiller for your form management

pdfFiller stands out by offering a host of features designed to simplify document management. One of the most significant advantages is the ability to access your documents anywhere, any time — a feature that's invaluable for busy professionals.

These features not only streamline the editing and submission processes but also elevate your overall document management experience.

Customer testimonials and user experience

Real user experiences often highlight how tools like pdfFiller enhance the process surrounding the registered bank disclosure statement form. Customers have shared success stories where their interactions with the form have been significantly improved due to the features offered by pdfFiller.

These testimonials emphasize the value of using pdfFiller for effective document management, particularly for regulatory requirements like the registered bank disclosure statement.

Conclusion

Navigating the registered bank disclosure statement form can seem overwhelming, but with the right tools and insights, the process becomes manageable. pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

Embracing transparency in banking enables not just compliance but cultivates trust and confidence among stakeholders. By ensuring that every disclosure is meticulously prepared and submitted on time, banks can uphold their reputations and contribute positively to the industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my registered bank disclosure statement directly from Gmail?

How do I complete registered bank disclosure statement online?

How do I make edits in registered bank disclosure statement without leaving Chrome?

What is registered bank disclosure statement?

Who is required to file registered bank disclosure statement?

How to fill out registered bank disclosure statement?

What is the purpose of registered bank disclosure statement?

What information must be reported on registered bank disclosure statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.