Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Sec Form 4 Guide: Everything You Need to Know

Understanding Sec Form 4

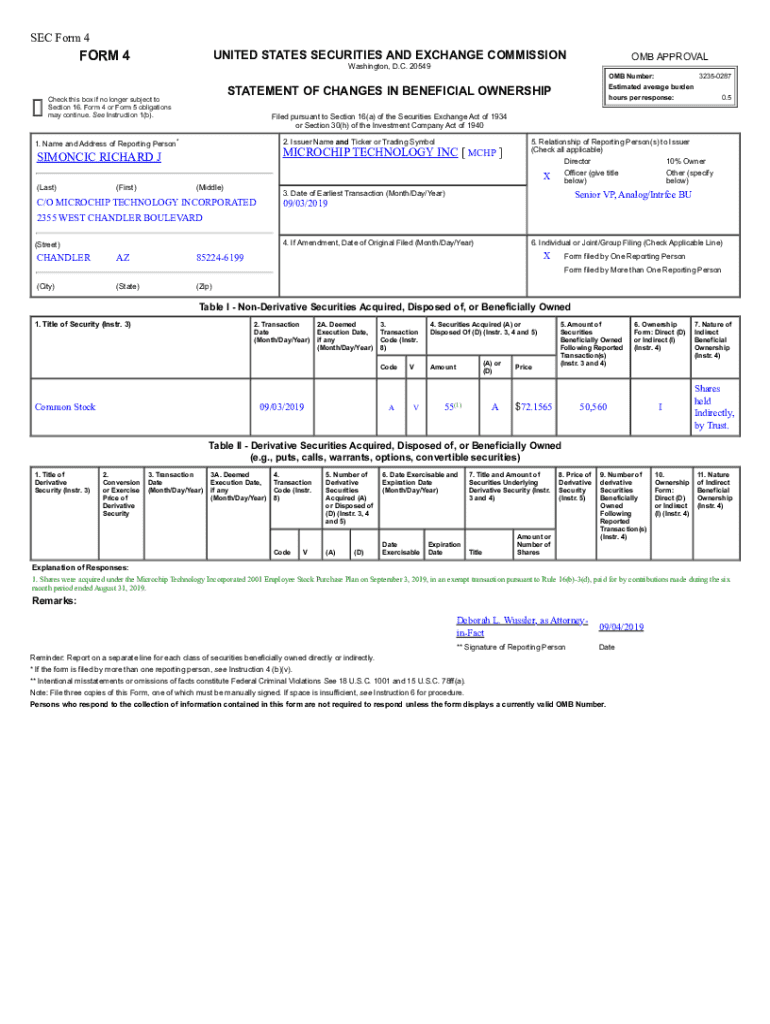

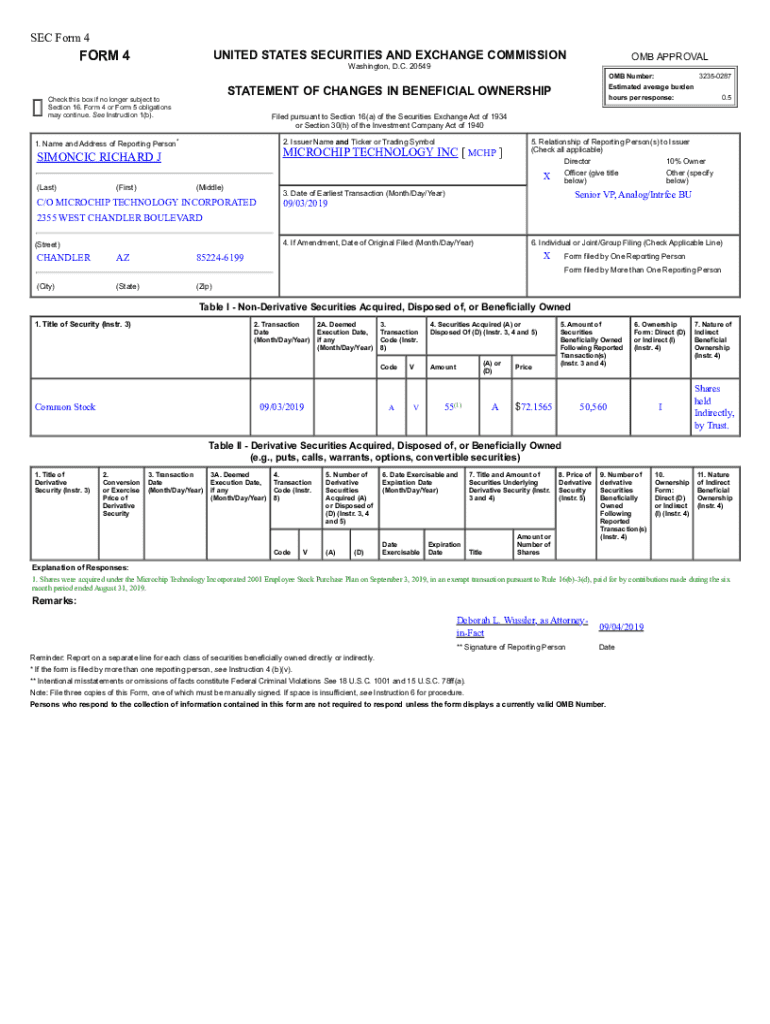

Sec Form 4 is a crucial document for insiders of publicly traded companies, facilitating transparency in trades involving corporate securities. This form is pivotal for regulatory compliance, ensuring that important information about stock transactions is reported accurately and promptly to the Securities and Exchange Commission (SEC). The core purpose of Sec Form 4 is to outline the buying and selling of a company's stock by corporate insiders, helping preserve market integrity by providing timely information to the investing public.

Insiders are typically defined as individuals with access to nonpublic information about a company. This group includes executives, board members, and major shareholders, who have significant influence and insight regarding the company's operations and stock performance. By mandating these individuals to report their trades, the SEC helps prevent insider trading and promotes fair trading practices.

Who must file Sec Form 4

The entities required to file Sec Form 4 consist of corporate insiders, which encompasses a broad spectrum of individuals associated with the company. Specifically, this group includes:

Understanding the definition of 'insider' is essential in the context of securities trading. Insiders have a fiduciary responsibility to their company and shareholders, which means they must act in the best interest of the organization and its investors. Failure to comply with filing requirements can lead to severe legal repercussions, including fines and penalties.

Key components of Sec Form 4

Sec Form 4 is structured with various sections that capture essential information about the trading activity. The key components of the form include:

Accuracy in the submission of these components is paramount. Each piece of information reported must reflect reality, as inaccurate filings can lead to scrutiny from regulatory bodies and damage trust with investors. Ensuring the veracity of data helps maintain the transparency required for effective market operation.

Common transaction codes

Transaction codes play a pivotal role in Sec Form 4 by defining the nature of each trade. Understanding what each code signifies can prevent errors in the filing process. Common transaction codes include:

Using the correct transaction codes is essential, as a misreporting could result in an investigation by the SEC. Insiders should familiarize themselves with these codes to ensure compliance and avert potential issues.

Step-by-step instructions for filing Sec Form 4

Filing Sec Form 4 involves a structured approach to ensure that all necessary information is captured accurately. Here’s how to navigate the process:

Gathering necessary information

Before filling out the form, it is vital to gather all the necessary details. This includes the insider's name, their relationship to the company, transaction type, date of transaction, number of shares, and any applicable transaction codes. Confirming these details can avoid complications later on.

Filling out Sec Form 4

When filling the form, start by entering the insider's name and company information at the top section. Sequentially complete each section according to the requirements specified, ensuring that all fields are filled accurately. Pay particular attention to transaction codes and dates to avoid any discrepancies.

Reviewing your submission

Once the form is completed, it’s crucial to review your submission carefully. Verify that all data corresponds with your records, particularly the transaction codes and dates. Employ best practices, such as having another person review the data to catch any mistakes you might have missed.

Utilizing pdfFiller for Sec Form 4

Leveraging pdfFiller’s functionalities eases the process of editing, signing, and managing Sec Form 4 documents. The cloud-based platform provides several advantages for document management.

Seamless editing capabilities

Users can edit PDFs directly on pdfFiller, allowing for real-time updates as transaction details change. This flexibility is particularly beneficial, ensuring that you can modify the document from any location, thus managing your filing process on-the-go.

eSigning and collaboration features

With pdfFiller, you can easily add electronic signatures to your Sec Form 4, ensuring compliance with SEC requirements for electronically filed documents. Moreover, sharing capabilities allow teams to collaborate seamlessly, which is invaluable for those who share filing responsibilities.

Storage and management of Sec Form 4

In terms of document management, pdfFiller offers secure storage solutions for your Sec Form 4, protecting sensitive information while allowing you to track multiple versions of the form. This ensures that you can maintain a history of your submissions and changes over time, streamlining your filings.

Common errors and how to avoid them

When filing Sec Form 4, errors can lead to compliance issues and misinterpretations of insider actions. Common mistakes often include:

To avoid these errors, it's crucial to stay organized with deadlines and double-check all entries before submission. Implementing a reminder system can help keep track of when filings are due, ensuring timely compliance.

Legal considerations surrounding Sec Form 4

The legal framework surrounding Sec Form 4 filings is complex, and understanding your compliance obligations is paramount. Failure to comply with SEC regulations can lead to steep fines and reputational damage. The SEC monitors these filings routinely for inaccuracies and will enforce penalties when necessary.

Protecting confidential information

When filling out Sec Form 4, there is great importance in safeguarding sensitive information. Insiders should make sure to keep all data secure during the preparation and submission process. Employing platforms, such as pdfFiller that prioritize data privacy, can help mitigate risks associated with disclosing sensitive information.

Frequently asked questions (FAQs)

Understanding the repercussions of filing Sec Form 4 and what to do next is vital for insiders. One common question is, 'What happens after filing Sec Form 4?' After submission, the SEC reviews the filings for accuracy, and if there are discrepancies, an insider may be contacted for clarification.

Another frequent inquiry concerns amendments to pre-existing forms. Insiders may need to amend a previously filed Sec Form 4 due to errors or changes in transaction details. To amend, follow the procedures outlined by the SEC, which typically involves submitting a new form indicating that it is an amendment, detailing the changes from the original filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sec form 4 online?

Can I edit sec form 4 on an iOS device?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.