Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A comprehensive guide to Sec Form 4

Overview of Sec Form 4

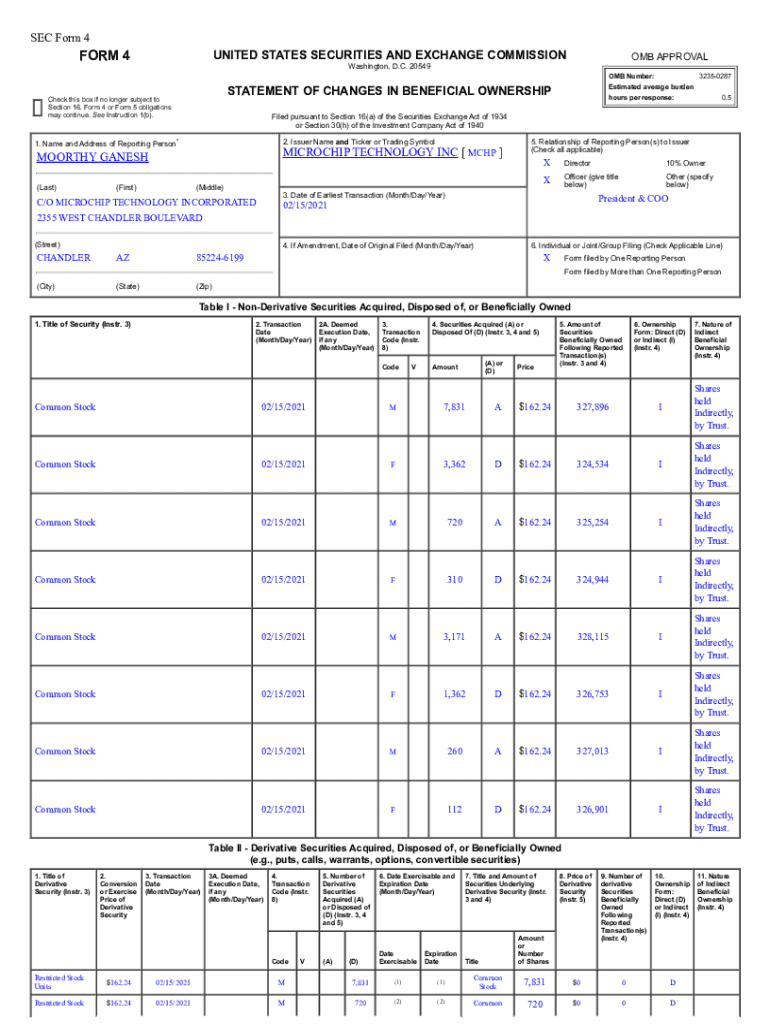

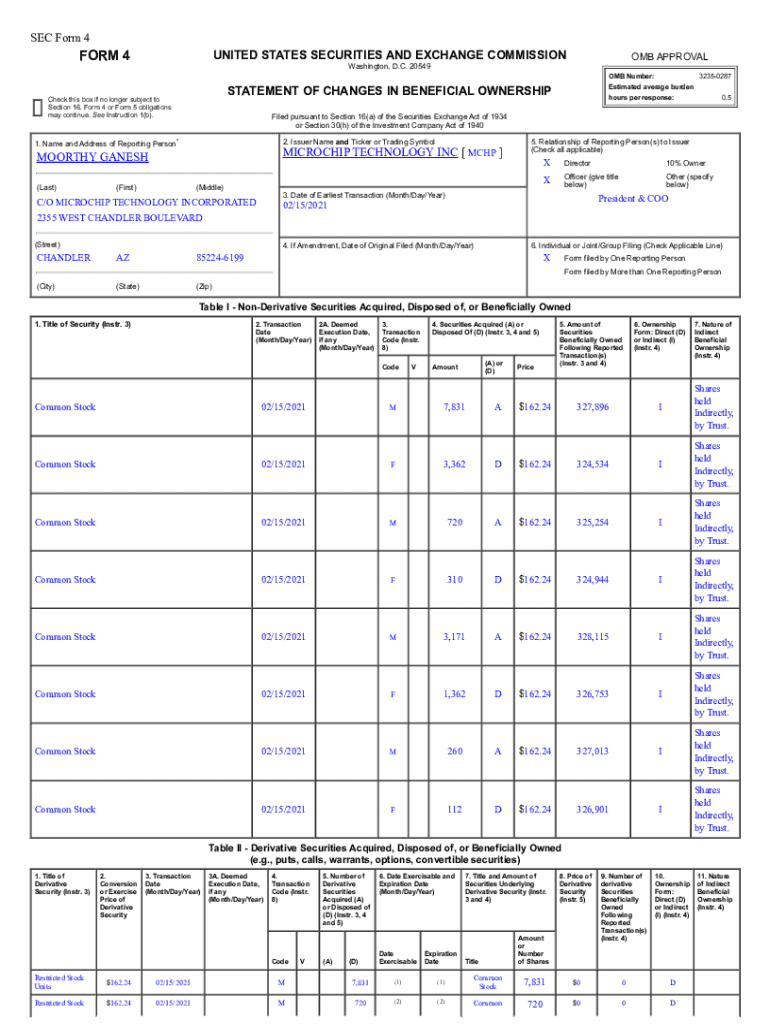

Sec Form 4 is a crucial document required by the U.S. Securities and Exchange Commission (SEC) that facilitates the disclosure of insider trading activity. Essentially, this form is used by corporate insiders—executives and board members—to report their transactions involving the company's securities. Its importance lies in fostering transparency and accountability in the financial markets, ensuring that stakeholders are informed of potential conflicts of interest.

Key stakeholders who must utilize Sec Form 4 include corporate insiders, the companies they are associated with, and regulatory bodies. Insiders are required to file this form whenever they engage in buying or selling shares of their own company’s stock, thus helping prevent fraudulent activities and maintaining market integrity.

Understanding transaction codes

Transaction codes in Sec Form 4 play a fundamental role in enhancing the transparency of insider trades. These codes categorize the nature of the transaction, making it easier for regulators and the public to understand the type of activity being reported. The clear delineation provided by transaction codes allows investors to assess the motives and implications of insider transactions more efficiently.

Selecting the appropriate transaction code is vital. To ensure accuracy, insiders should assess the specifics of their trade, including whether it involves a buy or sell transaction or a special case like an award or disposition. This step-by-step consideration helps ensure that all transactions are reported accurately and comprehensively.

Filling out Sec Form 4

Filling out Sec Form 4 involves several essential fields that must be completed to provide a clear picture of the insider's trading activity. Key sections include insider information, which identifies the individual involved, the nature of the transaction that details what occurred, the date of the transaction to establish a timeline, and ownership details to specify the amount of securities owned post-transaction.

Common mistakes when completing Sec Form 4 can lead to compliance issues and potential penalties. Insiders often forget to include their full name or misrepresent the number of shares involved. To avoid errors, double-checking the form for accuracy, ensuring all necessary fields are filled out, and staying updated on the SEC’s guidelines is crucial. Employing a checklist can further guard against these common pitfalls.

Editing and signing the form

Once the Sec Form 4 is filled out, users often need to make edits or modifications. Using pdfFiller simplifies this process. To edit the form, users can upload the PDF directly to the platform, utilize its powerful editing tools to make changes, and recheck all entries for accuracy. The interface is user-friendly, ensuring that even those less technically inclined can successfully navigate its features.

Additionally, signing the form electronically adds a layer of convenience. With pdfFiller’s eSignature tools, users can quickly apply their signatures, which are legally recognized and secure. This digital signing process accelerates the filing times, allowing insiders to comply with regulatory deadlines effortlessly.

Managing your Sec Form 4 submissions

Effective management of Sec Form 4 submissions is critical to ensure compliance with SEC regulations. Best practices include setting reminders for filing deadlines and maintaining an organized filing system. Tracking filed forms helps insiders provide timely updates and corrections if necessary, thereby reducing the risk of penalties for late filings.

Using pdfFiller offers features that aid in document organization and archival. Users can store their submitted forms securely, retrieve them easily when audits are conducted, and ensure they remain compliant with filing requirements. Such capabilities showcase how modern document management tools are essential for maintaining regulatory compliance.

Frequently asked questions

The following common queries regarding the Sec Form 4 can help clarify its requirements: First, the filing deadline for Sec Form 4 is within two business days following the transaction. Missing this deadline can lead to penalties for both individuals and companies, as timely reporting is essential in maintaining market trust. Furthermore, insiders looking to amend a previously submitted Form 4 should file a new form indicating the correction to ensure accurate records.

To ensure a hassle-free filing experience, maintaining awareness of changes in filing requirements and seeking assistance when unsure can be beneficial. Regularly checking the SEC's website for updates ensures that insiders are well-equipped to fulfill their obligations.

Resources for further assistance

To further aid insiders in navigating the complexities of the Sec Form 4, various resources are available. The SEC provides comprehensive regulatory guidelines that serve as a primary reference. Accessing these guidelines allows users to familiarize themselves with compliance requirements.

Additionally, community and support forums can be invaluable for discussing issues related to Sec Form 4. Engaging with other professionals can yield helpful insights and solutions to common challenges faced when filing or managing compliance.

Conclusion of key takeaways

Accurately completing and filing the Sec Form 4 is essential for maintaining compliance with insider trading regulations. This form not only ensures that corporate insiders remain transparent in their trading activities but also builds investor confidence in the market. Utilizing platforms like pdfFiller aids in simplifying the document management process, offering a streamlined approach to editing, signing, and organizing file submissions.

Ultimately, a proactive approach to managing Sec Form 4 submissions, leveraging technology like pdfFiller, can significantly enhance efficiency, ensuring that regulatory obligations are met without hassle.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

How do I make changes in sec form 4?

How do I fill out sec form 4 using my mobile device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.