Get the free Form 144

Get, Create, Make and Sign form 144

Editing form 144 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 144

How to fill out form 144

Who needs form 144?

Form 144: A Comprehensive How-to Guide

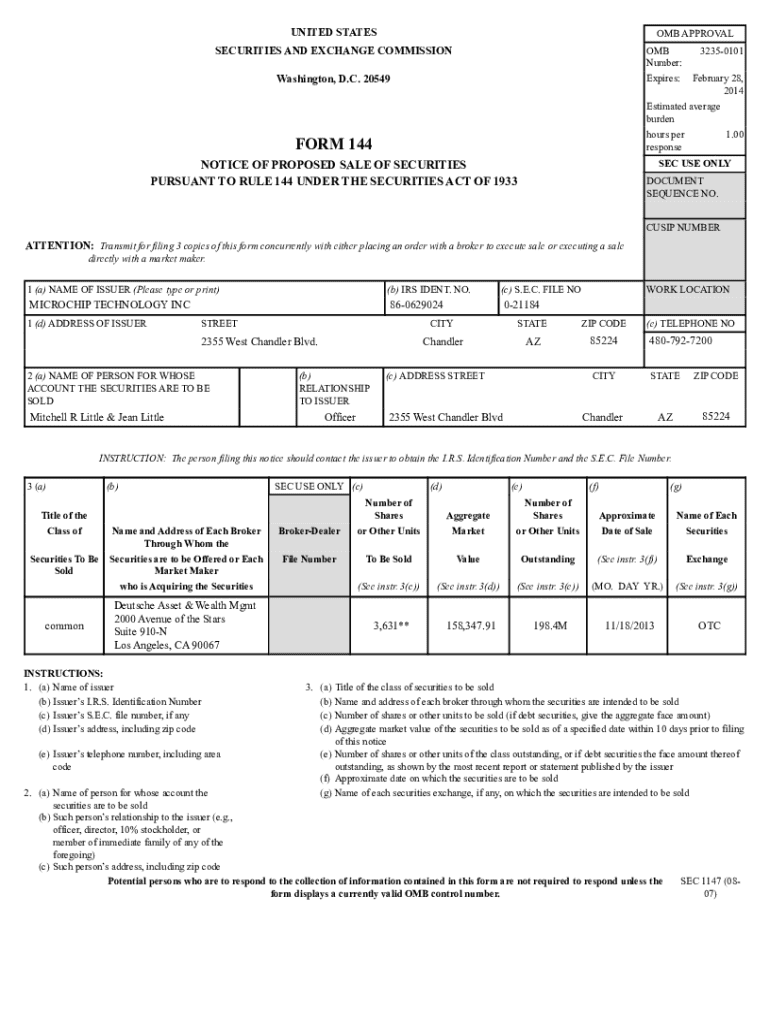

Understanding Form 144

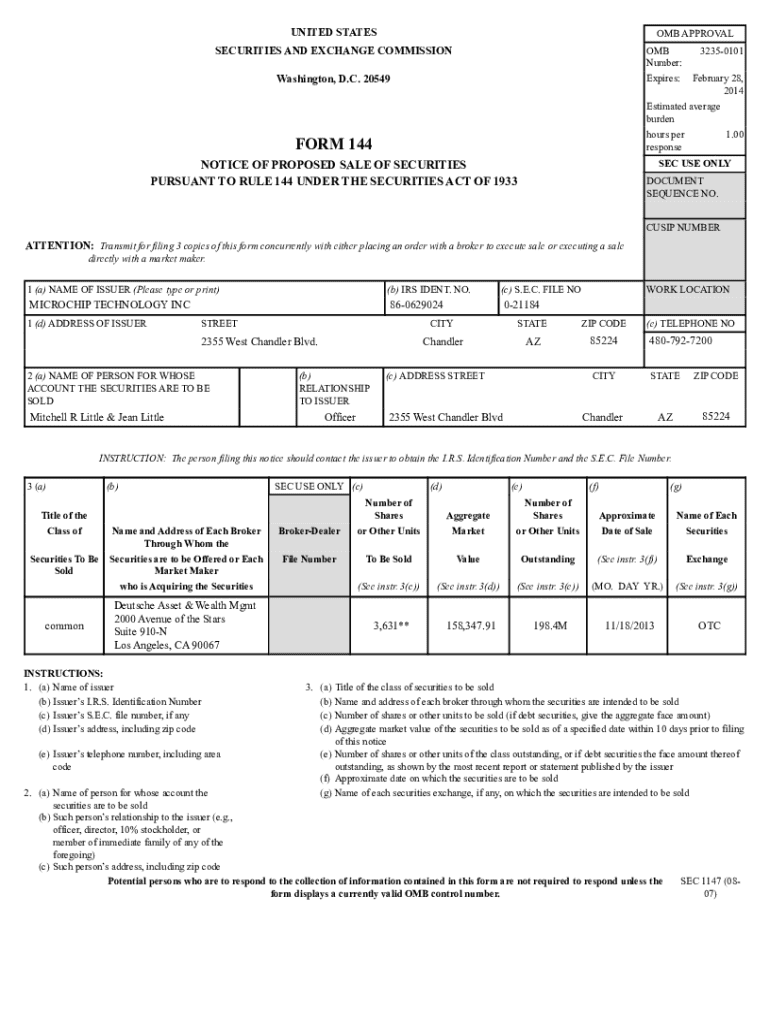

Form 144 is a filing with the SEC required for certain individuals and entities engaged in the sale of securities. Its primary purpose is to notify the SEC of proposed sales of restricted or control securities in a company, ensuring compliance with securities regulations. By filing this form, sellers provide transparency into their transactions, which is essential for market integrity and investor protection.

Importantly, Form 144 is necessary to comply with the Securities Act of 1933, which governs public offerings of securities. Typical filers include officers, directors, and beneficial owners of more than 10% of a company's stock. Their compliance helps maintain ethical trading practices and fosters trust within the financial markets.

Key information required on Form 144

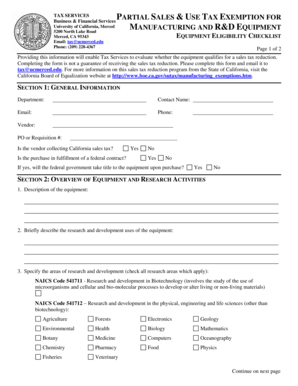

Filling out Form 144 requires careful attention to various sections, each designed to capture specific details about the proposed sale of securities. Key information includes:

Common mistakes when filling this form often involve inaccurate reporting of shares or missing signatures. Double-checking the entries can help secure compliance and avoid penalties.

Example scenario for filing Form 144

Consider a fictional case where John, a director of XYZ Corp, decides to sell his shares. Here's a simplified step-by-step guide based on this scenario:

Using visual aids, such as screenshots of the filled Form 144, can further clarify the process, making it easier for users to complete their own submissions.

Form 144 filing changes to know

In the ever-evolving landscape of securities regulation, recent updates to Form 144 have emerged that all filers must be aware of. These changes often include adjustments to timelines, requiring that filings are made during specified windows to enhance compliance monitoring.

As effective as September 2024, the SEC has introduced faster processing times, thereby reducing the submission window from 10 to 7 days post-transaction. Filers should be aware of these new requirements to avoid any potential pitfalls.

To remain compliant, regularly reviewing the SEC’s guidelines and seeking professional advice when necessary can help ensure that filings meet the latest requirements.

Form 144 filing tips

Completing and submitting Form 144 requires precision and diligence. Here are some best practices for ensuring your filing goes smoothly:

Utilizing document management solutions can streamline the process, providing a clear path for those unfamiliar with SEC protocols.

Using pdfFiller for Form 144 management

pdfFiller offers an intuitive platform that simplifies the form filling and management process for Form 144. Users can start by accessing the template directly from the pdfFiller dashboard, which provides a user-friendly interface.

Once the form is located, users can edit directly within the platform, filling in their information with ease. The platform also enables users to eSign their documents, reinforcing the integrity of the submission. Following these steps makes the overall filing process much more efficient and stress-free.

Reporting software supports accurate SEC Form 144 compliance

Utilizing compliant reporting software can significantly aid in ensuring accurate and timely submissions of Form 144. These software solutions often integrate automated updates with SEC guidelines, facilitating the filing process.

Benefits of these tools include enhanced accuracy, time savings, and a reduced likelihood of oversight, making them invaluable for teams and individuals alike.

Important updates: After-hours filings and fee structures

A recent policy change effective September 16, 2024, introduces provisions for after-hours filings, catering to users who may not complete their transactions during conventional business hours. This adjustment allows for flexibility in the filing process, yet it is essential to understand any fee implications tied to such changes.

Filers should remain vigilant about any potential fees that may arise from after-hours submissions, strategizing accordingly to mitigate any unexpected costs.

Insider trading disclosure and related topics

Understanding Form 144 also entails being aware of related forms, such as Form 4 and Form 5. These filings work in tandem with Form 144, providing insights into the trading activities of insiders. Rule 10b5-1, which protects corporate officers from insider trading accusations under specific circumstances, is vital for those needing to file Form 144, as it impacts how insider transactions are viewed.

Filers must remain informed about ongoing developments in insider trading regulations and understand how these forms intertwine to ensure compliance and safeguard their interests.

How to file Form 144 on EDGAR

Filing Form 144 electronically through the SEC’s EDGAR system allows for a more streamlined submission process. To begin, users must create an account on EDGAR, ensuring they have the necessary credentials to file. Once logged in, the process involves completing the required form fields and attaching any supporting documentation.

Navigating EDGAR can present challenges, particularly regarding file formats and submission timelines. Users should familiarize themselves with guidelines on acceptable formats and deadlines to avoid common pitfalls.

Further considerations for Form 144 filers

Once Form 144 is submitted, filers must stay on top of their ongoing compliance responsibilities. This includes monitoring any changes in regulations that could affect their filings and understanding the implications of their actions post-submission.

Engaging in training seminars and online forums can enhance understanding of SEC regulations and networking opportunities. These resources are invaluable for sharing experiences and best practices with peers, fostering a collaborative and informed community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out form 144 using my mobile device?

How do I edit form 144 on an Android device?

How do I complete form 144 on an Android device?

What is form 144?

Who is required to file form 144?

How to fill out form 144?

What is the purpose of form 144?

What information must be reported on form 144?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.