Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4 Form: A Comprehensive How-To Guide

Understanding the SEC Form 4

SEC Form 4 is a critical document designed to disclose insider transactions in public companies. It is mandated by the Securities and Exchange Commission (SEC) for corporate insiders to report their transactions within two business days. The primary purpose of this form is to enhance transparency and maintain market integrity by providing investors and analysts with timely information about the trading activities of individuals who have access to non-public information.

For corporate insiders, compliance with SEC Form 4 is not just a regulatory requirement but also a means of building trust with investors. By disclosing their trades, insiders contribute to a more equitable financial marketplace where investors can make informed decisions. This form plays a vital role in preventing insider trading and ensuring that all market participants can compete fairly.

Key users of SEC Form 4

The primary users of SEC Form 4 are corporate insiders, such as executives, directors, and employees of publicly traded companies. These individuals are privy to sensitive information that can influence stock prices. By filing this form, they publicly disclose transactions involving their company’s securities, allowing investors to gauge insider confidence and alignment with shareholder interests.

Investors and analysts also benefit significantly from SEC Form 4 filings. They utilize this information to track insider transactions as it can provide insights into the company's future prospects. Increased buying activity by insiders may indicate confidence in the company, while heavy selling may raise red flags. Consequently, analyzing Form 4 reports has become a crucial aspect of investment research.

Key components of SEC Form 4

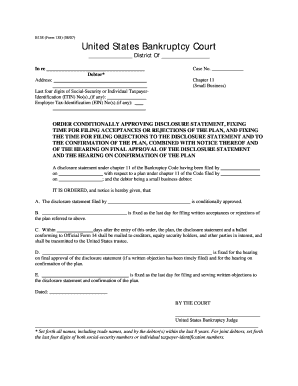

SEC Form 4 contains several key components that must be filled out accurately to ensure compliance with SEC regulations. At the top of the form, there are required sections that include detailed information about the reporting person. This information typically includes the individual’s name, address, and relationship to the issuer, i.e., the company whose securities are being traded.

The form also requires details about the transaction, including the date of the transaction, the type of transaction (e.g., purchase, sale, or option exercise), and the number of shares involved. The exact nature of the transaction is crucial for regulatory compliance and for investors who analyze these trades for insights into the underlying company's trajectory.

Transaction codes

In SEC Form 4, various transaction codes are used to categorize the type of transaction being reported. Understanding these codes is essential, as they convey critical information about the nature of the insider’s activities. Some common transaction codes include:

Each code has significant implications for how analysts gauge insider sentiment towards the company. For example, a high volume of purchases (P) may suggest confidence in the company's future, whereas numerous sales (S) can be perceived negatively.

Step-by-step guide to filling out SEC Form 4

Filing out SEC Form 4 may seem daunting, but with a few straightforward steps, you can complete it effectively. First, SEC Form 4 can be accessed directly from the SEC's website or through other authorized platforms. A convenient option is using pdfFiller, which simplifies the entire process of document management.

Accessing the form

To obtain SEC Form 4, you can visit the SEC’s EDGAR database, where you can access the form in PDF format. Alternatively, using pdfFiller enhances this process, as it offers interactive tools that allow you to fill out the form directly in the platform, reducing the risk of errors.

Complete the header section

Once you have the form, begin by filling in the header section with the reporting person’s details. This includes the individual’s full name, their identification number, and contact information. Utilizing cloud-based tools like pdfFiller can streamline this process with autofill features that expedite data entry.

Filling in transaction details

Next, move on to the transaction details. Ensure that you accurately state the transaction’s date and select the appropriate transaction code as discussed earlier. Be thorough with the number of shares and the price per share transaction if available. Use examples to guide completion, such as: if you sold 1000 shares of XYZ Corporation on January 10, you would note this under the date, indicate the transaction type as 'S' (for sale), and enter the shares sold.

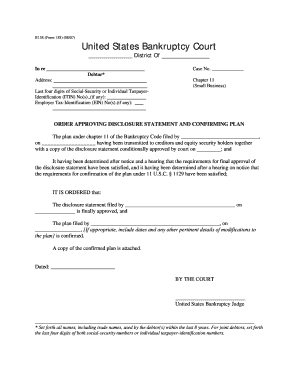

Signature requirements

After completing the necessary sections, the final step is signing the form. It could be required that the individual files this form electronically or physically, depending on organizational protocols. Timely filing is paramount; delays can lead to penalties and reputational damage for both the insider and the company.

Editing and managing your SEC Form 4

After submitting your SEC Form 4, you may find the need to edit or manage the document for various reasons. Utilizing the functionality of pdfFiller provides seamless editing tools that allow you to make adjustments easily. Whether correcting a mistake or updating details, pdfFiller’s intuitive interface ensures that you can track changes effectively and save versions without hassle.

Utilizing pdfFiller's features for editing

When using pdfFiller, you can access features such as typewriting, annotations, and digital signature options to refine the form. The ability to save different document versions can prevent the loss of essential edits and can facilitate tracking changes throughout the filing process.

Collaborative features for teams

If you are working within a team, collaboration tools within pdfFiller allow multiple users to access and edit a single document. This is particularly beneficial for legal and finance teams who must coordinate to ensure compliance and accuracy. You can share documents securely, enhancing teamwork without compromising the document's integrity.

Common mistakes to avoid

Filing SEC Form 4 might seem straightforward, but there are common pitfalls that insiders need to avoid to ensure compliance. A prevalent issue is missed deadlines; failing to file within the required two-day period can result in penalties and regulatory scrutiny. Therefore, understanding critical timelines and maintaining a filing schedule is essential.

Another frequent mistake involves misunderstanding transaction codes. For instance, failing to select the correct code or making typographical errors can lead to misinterpretation of the filing. Familiarizing yourself with the correct codes and verifying your entries before submission is vital to avoid unnecessary complications.

Resources for further assistance

When in need of guidance while filing SEC Form 4, various resources are available. The official SEC guidelines provide comprehensive instructions on completing Form 4, which can be accessed through their website. Here you will find step-by-step guidance as well as FAQs addressing common concerns.

In addition to the official resources, several tutorials and webinars are hosted online focusing on SEC filings and compliance guidelines. These educational materials can equip you with the needed knowledge to navigate the filing process confidently. Moreover, if complexities arise, consulting with legal or financial advisors specializing in SEC regulations can offer the additional support necessary to ensure compliance.

Leveraging technology for efficiency

Embracing technology can significantly enhance the efficiency of your SEC Form 4 filing process. Integrating SEC Form 4 into your document workflow using platforms like pdfFiller allows for easier management and retrieval of forms. The advanced features of pdfFiller help ensure that your reporting tasks are streamlined, making the entire process less daunting.

Staying compliant with regulatory changes

Remaining informed about regulatory changes is essential for compliance success. pdfFiller provides updates and tools ensuring users are abreast of changes to the SEC filing requirements. This proactive approach can safeguard you against regulatory penalties and support your organization's integrity.

Conclusion: Empowering your filing process with pdfFiller

Completing SEC Form 4 doesn’t have to be a burdensome task. With pdfFiller, the process is simplified, enabling users to fill out, edit, eSign, and collaborate on documents from anywhere with an internet connection. By leveraging these capabilities, you can enhance your filing experience and ensure compliance while maintaining transparency in your trading activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sec form 4 in Gmail?

How do I complete sec form 4 on an iOS device?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.