Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

The Ultimate Guide to Sec Form 4: Everything You Need to Know

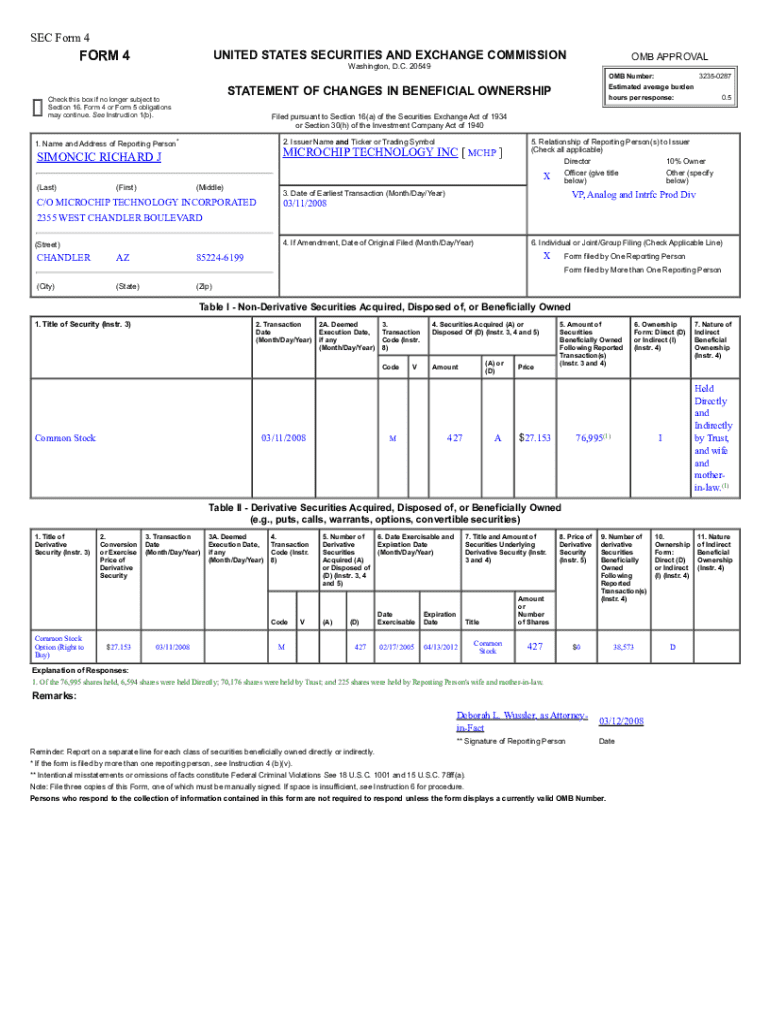

Understanding Sec Form 4

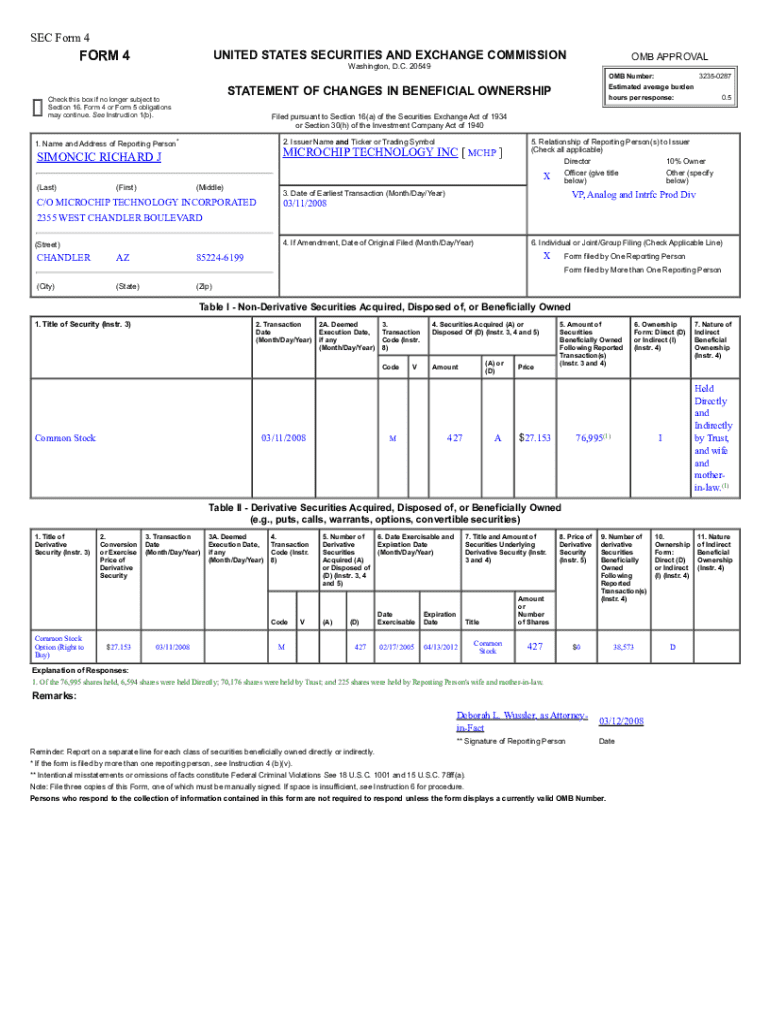

The Sec Form 4 is a crucial document filed with the Securities and Exchange Commission (SEC) in the United States. Its primary purpose is to disclose the buying and selling activities of corporate insiders—those who have access to non-public information regarding their companies. This form is vital for maintaining market integrity by ensuring transparent disclosure of insider trading transactions.

Key parties involved in filing the Form 4 typically include corporate officers, directors, and beneficial owners. Their compliance with the rules surrounding this form helps the SEC monitor trading activities for potential insider trading violations, which can be detrimental to fair market practices.

Who needs to file Sec Form 4?

The responsibility to file Sec Form 4 falls primarily on corporate insiders, as outlined under Rule 16(a). This regulation mandates that individuals holding significant decision-making power within their companies report any changes in their ownership of the company's equity securities. This requirement serves as a deterrent against potential abuses of insider information.

Entities that need to file include publicly traded corporations within the U.S., along with their executives, directors, and anyone owning more than 10% of the company's stock. This wide-ranging requirement ensures a level playing field for all investors by making insider transactions transparent.

Detailed breakdown of Sec Form 4 sections

Sec Form 4 is structured into several sections aimed at collecting detailed information about the insider and their transactions. Each section plays a significant role in providing clarity and specificity in reporting, thereby facilitating compliance with SEC regulations.

Step-by-step guide to filling out Sec Form 4

Filling out the Sec Form 4 accurately is essential for compliance. Here’s a step-by-step guide to help navigate the process.

Best practices for managing Sec Form 4 filings

Successful management of Sec Form 4 filings involves robust record-keeping and diligent monitoring of compliance deadlines. Proper documentation serves as a safeguard for potential audits while fostering organizational accountability.

Common challenges and solutions in filing Sec Form 4

Filers often encounter misunderstandings surrounding ownership terms, which can lead to inaccuracies in filings. It's critical to clarify these terms to ensure the correct representation of ownership stakes.

Additionally, if errors are discovered after submission, knowing how to amend a submitted Form 4 is vital. To rectify mistakes, the SEC allows filers to submit an amended Form 4, ensuring compliance with regulatory expectations.

Resources and tools for Sec Form 4

To assist with filling out Sec Form 4, interactive tools on platforms like pdfFiller can significantly ease the process. Features such as eSignature integration and collaborative tools support filing efficiency for teams.

Transaction codes for Form 4

Transaction codes are pivotal for accurately reporting different types of transactions on Sec Form 4. Understanding these codes helps insiders communicate the nature of their transactions effectively.

Industry insights for Sec Form 4

Analyzing industry trends in insider trading reporting can provide valuable insights into market activities. Recent statistics reflect a growing trend in Form 4 submissions, indicating increased scrutiny on insider transactions.

Additionally, staying updated on recent regulatory changes is crucial for compliance. Any amendments to reporting requirements can have significant implications for how companies document insider trading activities.

Personalizing your Sec Form 4 experience

Personalizing your Sec Form 4 experience can enhance the efficiency and accuracy of filings. Customizing templates within pdfFiller allows insiders to streamline future submissions.

User testimonials highlight real-world improvements in filing experiences, showcasing how platforms like pdfFiller empower users to manage their documents more effectively and collaboratively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sec form 4?

How do I fill out sec form 4 using my mobile device?

How do I edit sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.