Get the free Form 603

Get, Create, Make and Sign form 603

How to edit form 603 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 603

How to fill out form 603

Who needs form 603?

How to Fill Out Form 603

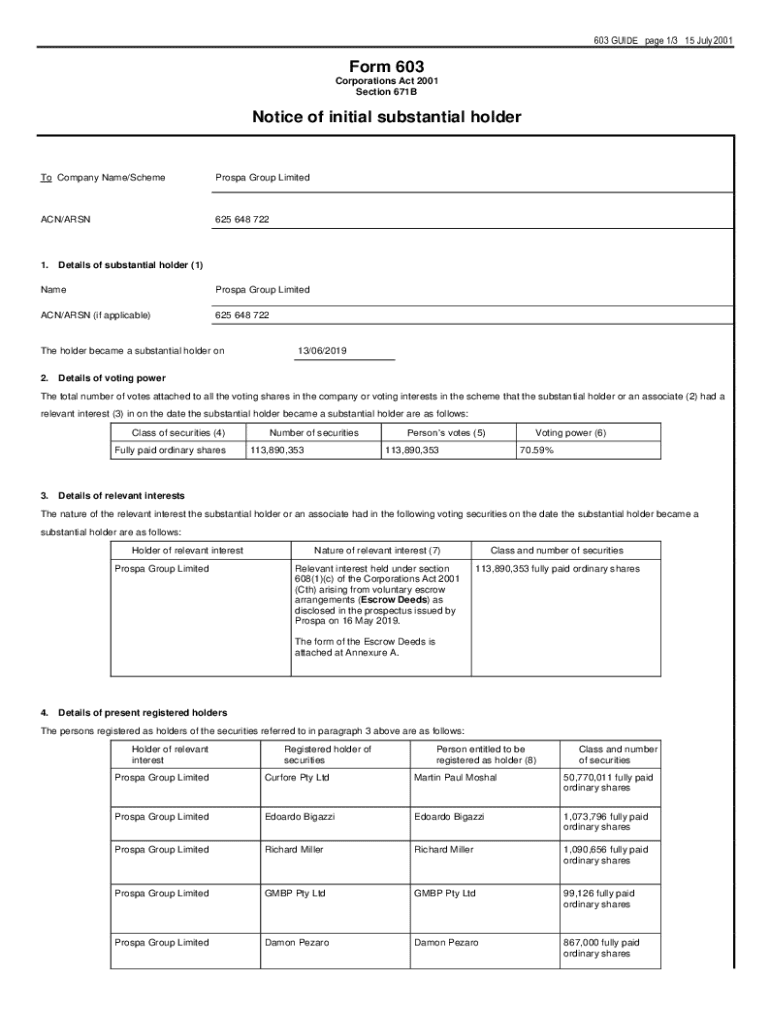

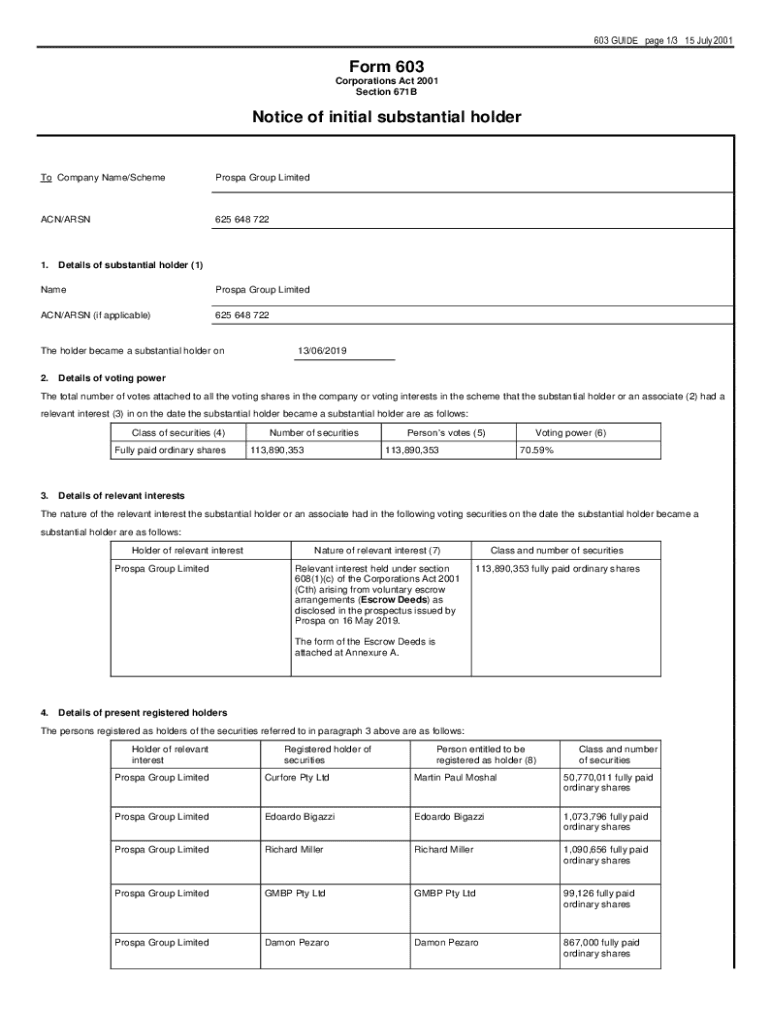

Understanding Form 603

Form 603 is a crucial document used primarily in various regulatory and administrative tasks. It may be utilized for different purposes, depending on the context in which it's applied, such as tax submissions or compliance records related to specific industries.

Importance of Form 603

Filing Form 603 accurately is critical for ensuring compliance with relevant regulations. A correctly filled form can prevent legal issues and facilitate smoother processing of applications, thus saving time and resources.

Conversely, errors or omissions in the form can lead to significant consequences. These may include delays in approval, fines, or potential legal liabilities, illustrating the necessity of meticulous attention when completing the document.

Key features of Form 603

Understanding the layout and requirements of Form 603 is vital. The form typically contains several sections, each requiring specific information that contributes to the overall purpose of the document.

Required documentation

In order to complete Form 603 effectively, it is critical to gather all required documentation beforehand. This preparation streamlines the process and reduces the likelihood of errors.

Step-by-step guide to completing Form 603

Successfully completing Form 603 involves following a systematic process. Begin by ensuring you have everything you need at hand before you start filling out the form.

Filling out the form

As you fill out Form 603, pay particular attention to detail in each section. Here’s a brief guide on what to include:

Reviewing your form

Before submitting Form 603, it's important to conduct a thorough review. Verify all entries to confirm they are correct and complete.

Editing Form 603 with pdfFiller

Utilizing pdfFiller simplifies the process of editing Form 603. The platform enables seamless document management with an array of tools designed to enhance your experience.

Using editing tools

pdfFiller offers various editing tools that can be beneficial as you handle Form 603. These tools might include text additions, checkmarks, and signature placements, all crucial for personalizing your form.

Signing and submitting Form 603

Once you have filled out and reviewed Form 603, it’s time to sign and submit it. pdfFiller offers robust eSigning capabilities, allowing you to verify your identity with just a few clicks.

Frequently asked questions (FAQs)

While filling out Form 603, you may encounter several common questions or misunderstandings. Below are answers to help clarify any concerns.

Managing Form 603 after submission

After submitting Form 603, proper management of your documentation is essential. Maintaining organized records helps in case you need to address any follow-up inquiries.

Follow-up actions

After you’ve submitted Form 603, it can be beneficial to have a strategy in place for follow-up actions to ensure your application processes smoothly.

Additional tips for success

Ensuring successful management of Form 603 doesn’t end at submission. Here are some best practices for ongoing document organization while leveraging pdfFiller’s extensive platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 603 directly from Gmail?

How do I edit form 603 on an iOS device?

How do I complete form 603 on an iOS device?

What is form 603?

Who is required to file form 603?

How to fill out form 603?

What is the purpose of form 603?

What information must be reported on form 603?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.