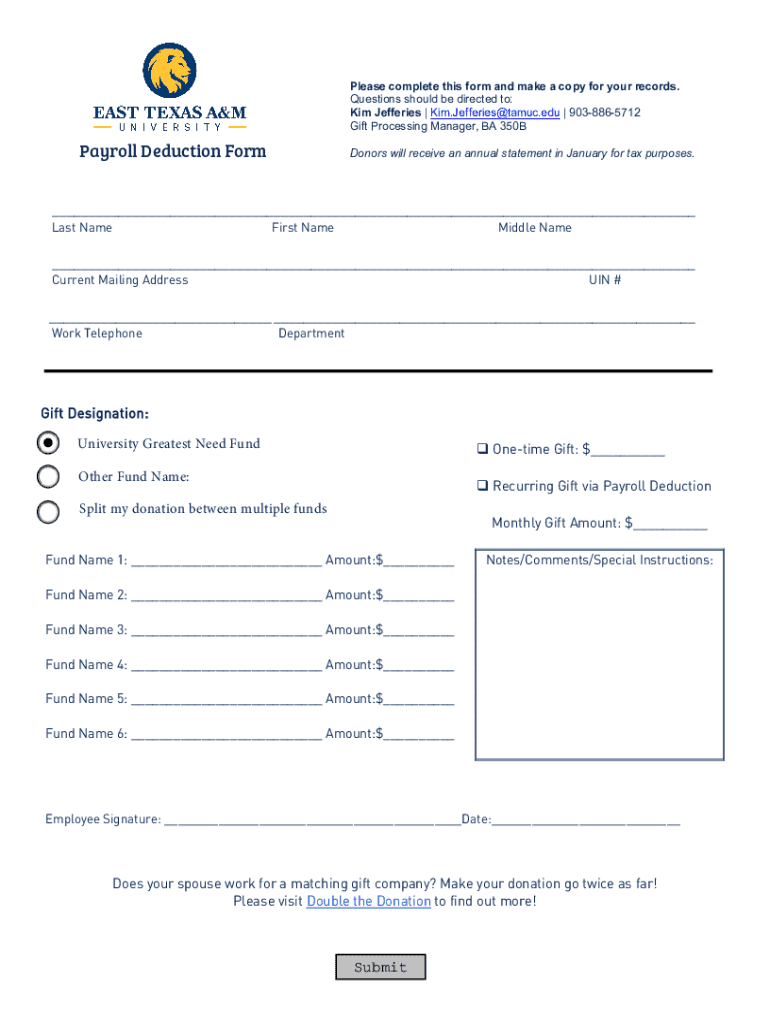

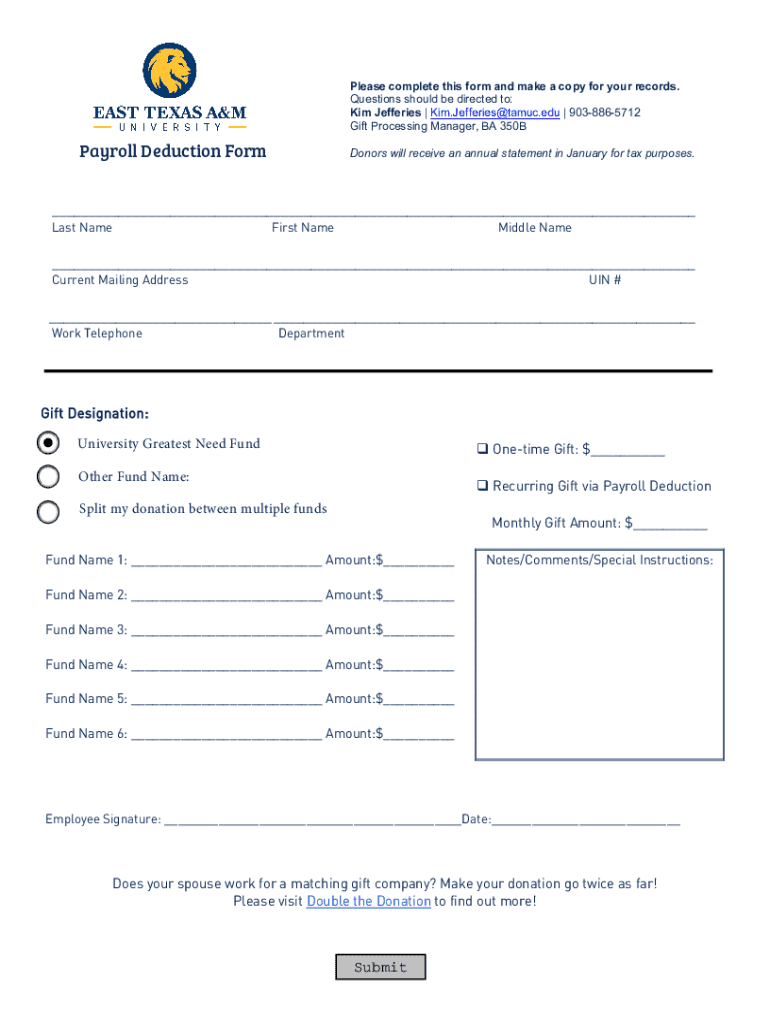

Get the free Payroll Deduction Form

Get, Create, Make and Sign payroll deduction form

Editing payroll deduction form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payroll deduction form

How to fill out payroll deduction form

Who needs payroll deduction form?

The Ultimate Guide to Payroll Deduction Forms

Understanding payroll deduction

A payroll deduction form is a necessary document that allows employees to authorize their employer to deduct specific amounts from their salaries for various purposes. These deductions can include federal and state taxes, employee benefits, and retirement contributions, among others. Understanding the function and importance of this form is essential for both employees and employers, as it serves as a formal agreement that enhances the accuracy and compliance of payroll processes.

The primary purpose of a payroll deduction form is to facilitate administrative efficiency in managing employee compensation. For employees, these deductions can be a strategic way to manage finances, with amounts being withheld for savings or benefits that will aid them in the future.

Importance of the payroll deduction form

For employers, the payroll deduction form carries significant legal implications. It's crucial for ensuring that deductions comply with regulatory requirements. If the form is not properly completed or filed, it may lead to penalties, back taxes, or compliance issues with employment law.

For employees, the benefits are equally profound. Properly completed forms enable employees to manage their finances proactively. They allow for systematic deductions that can lead to savings for retirement or healthcare, often with tax advantages that reduce the burden of taxable income. This not only simplifies budgeting but also aligns with individual long-term financial goals.

Accessing the payroll deduction form

Accessing the payroll deduction form is straightforward. Employees can typically obtain it from their employer’s human resources department or online through companies like pdfFiller. This platform provides a user-friendly experience and ensures users have the latest version of the form.

Additionally, pdfFiller offers robust accessibility options that facilitate easy downloading and filling out of the form right from your computer or mobile device. It's essential to ensure you have the correct form to avoid any complications.

While completing the form, you may need to submit certain documents such as identification and proof of eligibility for specific deductions, which can include insurance cards or retirement plan enrollment options. Gathering these documents ahead of time will help streamline the submission process.

Step-by-step instructions for filling out the payroll deduction form

Filling out a payroll deduction form can seem daunting, but following a systematic approach can make it a breeze. Here’s a detailed guide to help you through the process.

Editing and customizing your payroll deduction form on pdfFiller

pdfFiller provides powerful editing tools that enhance the functionalities of the payroll deduction form. If you need to make adjustments or updates, the platform’s interface is intuitive and easy to navigate.

You can easily edit details directly within the form. If you need to add a signature, pdfFiller offers eSigning features, allowing you to insert your signature digitally with just a few clicks. This not only saves time but also ensures that the process adheres to legal standards.

Submitting the payroll deduction form

Once you've completed and reviewed your payroll deduction form, the next step is submission. pdfFiller offers various submission options that cater to your preferences.

You can submit the form online through pdfFiller or print and mail it to your HR department directly. Each method has its own timing considerations, and it’s essential to choose the one that aligns best with payroll deadlines. Preparing ahead ensures that your deductions can be applied in a timely manner.

Troubleshooting common issues

After submitting your payroll deduction form, you may encounter some common issues. It's crucial to be prepared for these potential pitfalls, as they can affect your paycheck and financial planning.

Common problems include incorrect information entered on the form or missing signatures. Addressing these errors quickly will help ensure that your deductions are correctly implemented on your paycheck.

Managing your deductions post-submission

After submitting your payroll deduction form, it’s vital to keep track of how those deductions affect your paychecks. Verifying deductions displayed on pay stubs is an important financial management step.

If your financial circumstances change or if you wish to make alterations in your deductions—such as increasing retirement contributions or changing insurance—it's essential to know how to update your payroll deductions accordingly.

Additional tools and resources

pdfFiller offers a range of interactive tools that can enhance your experience with payroll deduction forms. Their platform not only allows you to fill out forms but also provides you with templates and related forms that may be essential for comprehensive payroll and tax management.

Utilizing these resources can ensure that you are well-equipped to handle all aspects of payroll and taxation, making the process seamless and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my payroll deduction form directly from Gmail?

How can I edit payroll deduction form from Google Drive?

Can I edit payroll deduction form on an iOS device?

What is payroll deduction form?

Who is required to file payroll deduction form?

How to fill out payroll deduction form?

What is the purpose of payroll deduction form?

What information must be reported on payroll deduction form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.