Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding and Completing the SEC Form 4 Form: A Comprehensive Guide

Understanding SEC Form 4

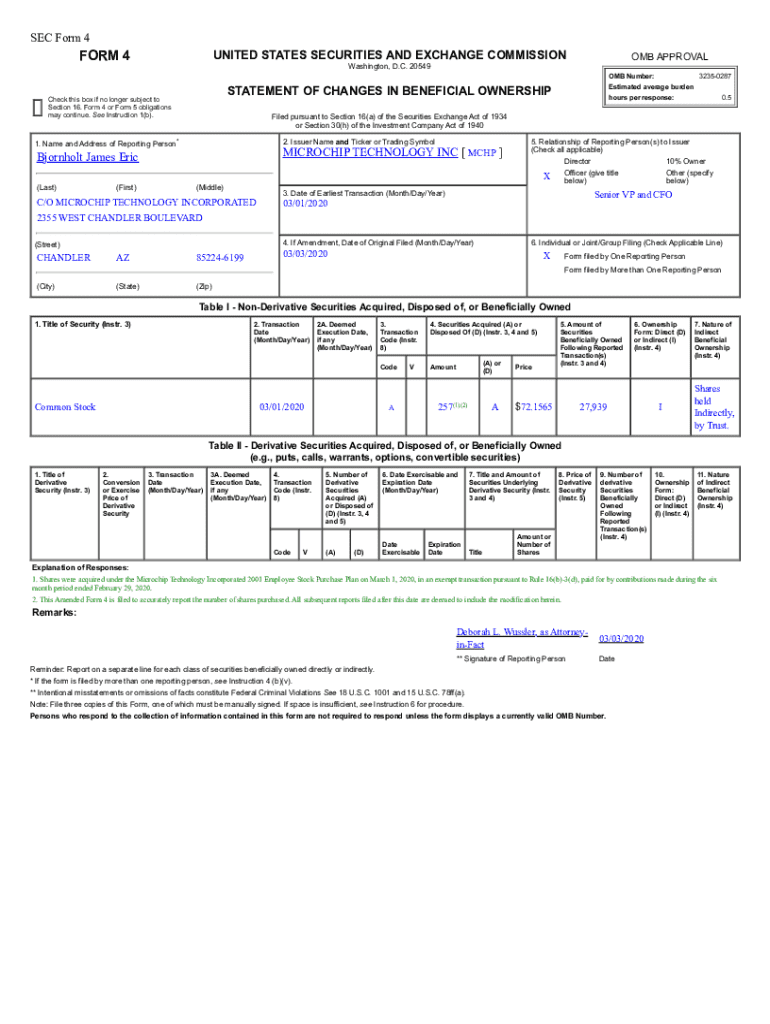

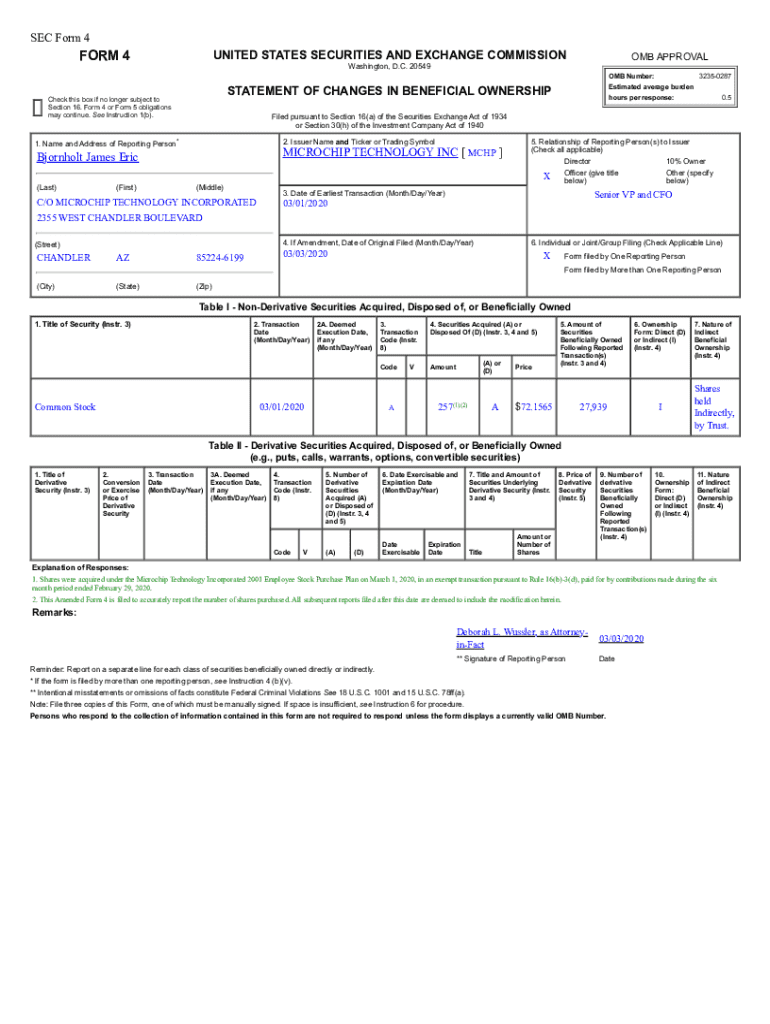

SEC Form 4 is a crucial document in the realm of securities regulation that serves to report transactions by company insiders, including executive officers, directors, and beneficial owners of more than 10% of a company's stock. The primary purpose of this form is to disclose to the public any changes in the holdings of these individuals, thereby fostering transparency and accountability in the market.

File SEC Form 4 within two business days of the transaction to comply with the Securities Exchange Act of 1934 regulations. Timely reporting is vital; failure to do so can lead to penalties and negatively impact investor confidence.

Importance in Securities Regulation

The importance of SEC Form 4 lies in its role in maintaining market integrity. By requiring insiders to report their transactions, the SEC fosters a transparent environment where shareholders can make informed decisions. This reporting helps prevent insider trading and promotes fair trading practices.

Moreover, SEC Form 4 transactions are scrutinized by investors and analysts alike, making it a key tool for assessing a company’s management confidence in its performance. When insiders buy shares, it may signal optimism; conversely, selling may raise red flags about a company's future prospects. Thus, the implications of these transactions extend beyond the individuals involved.

Key components of SEC Form 4

Understanding the key components of SEC Form 4 is essential for accurate reporting. The form is structured to capture detailed information about the reporting person and their transactions. Critical sections include details such as the name, address, and the relationship to the issuer of the reporting person.

Additionally, it’s critical to understand the transaction codes used on the form. These codes detail the nature of the transaction, such as whether it was a purchase, sale, or other event affecting ownership.

Understanding Transaction Codes

Common transaction codes include 'P' for a purchase and 'S' for a sale. Selecting the correct code is essential for compliance. Errors in transaction codes can lead to rejections or delays in processing. Knowing how to accurately choose these codes is vital for successfully completing your filing.

Step-by-step guide to filling out SEC Form 4

Filling out SEC Form 4 may seem daunting, but following a clear step-by-step guide simplifies the process. Before you start, ensure that you have all the necessary information gathered, including personal details, transaction specifics, and ownership information. This preparation minimizes errors and expedites the filing process.

Be cautious of common errors that can occur at each step, such as incorrect spelling in the reporting person's details or erroneous transaction dates. Verifying the information thoroughly before submission will help in avoiding delays or rejections.

Submitting your SEC Form 4

When you're ready to submit SEC Form 4, understanding the various methods available for submission is crucial. You can choose between electronic or paper submission, though electronic submission is highly recommended as it’s faster and more efficient.

After submission, you will receive a confirmation that your filing was successful. It's essential to track your submission status to ensure compliance and to address any potential issues promptly.

Utilizing pdfFiller for your SEC Form 4

Incorporating pdfFiller into your document management strategy can streamline the SEC Form 4 completion process. This platform offers cloud-based convenience for quick access, editing, and collaboration, enabling teams to work on submissions effectively regardless of location.

pdfFiller also enhances your filing experience by providing editing and signing features that simplify document creation. Using pdfFiller, you can easily edit the SEC Form 4 to reflect accurate details and utilize e-signature features to ensure compliance.

Managing and storing your forms

After filing your SEC Form 4, effective document management becomes vital. Organizing your forms securely and systematically is the key to easy access in the future. Use cloud storage to maintain a central repository for all your filings which also helps in protecting sensitive information.

Creating a suitable filing system, tailored to individuals or teams, is crucial. Consider using tagging systems or folders for different filing years or transaction types to simplify ongoing management. Additionally, utilizing interactive tools on pdfFiller can help you create templates that streamline future filings.

Additional considerations

It's essential to stay informed about regulatory changes that may impact SEC Form 4 filing requirements. Frequent updates from the SEC can affect how insiders file their forms, which means monitoring their website and related financial news can help ensure compliance.

Understanding the consequences of failing to file SEC Form 4 or submitting incorrect filings is equally important. Such oversight can lead to reputational damage and financial penalties, reinforcing the need for diligence and accuracy in reporting.

FAQs about SEC Form 4

Related forms and templates

In addition to SEC Form 4, other related SEC forms include Form 3, which reports initial ownership, and Form 5, which provides a summary of transactions not previously reported. Understanding these forms and their specific purposes can enhance your overall compliance strategy.

Accessing templates via pdfFiller can ease the document handling process. The platform allows you to navigate seamlessly through multiple forms, improving efficiency and ensuring compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sec form 4?

How do I complete sec form 4 on an iOS device?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.