Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding and Completing Sec Form 4: A Comprehensive Guide

Understanding Sec Form 4

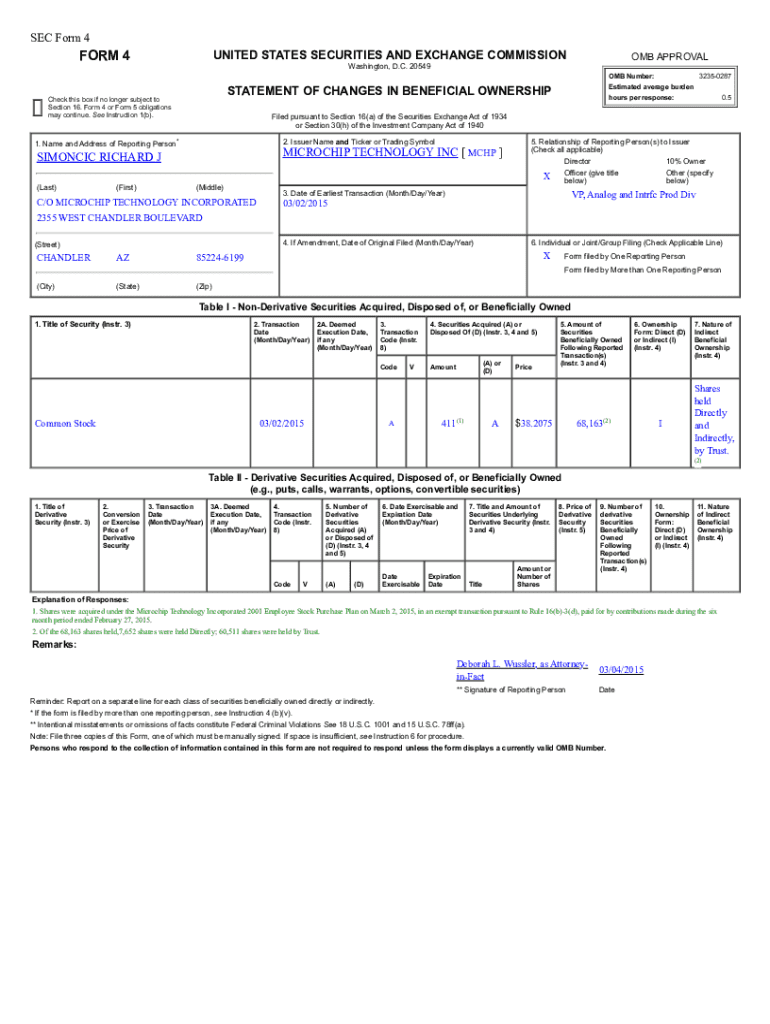

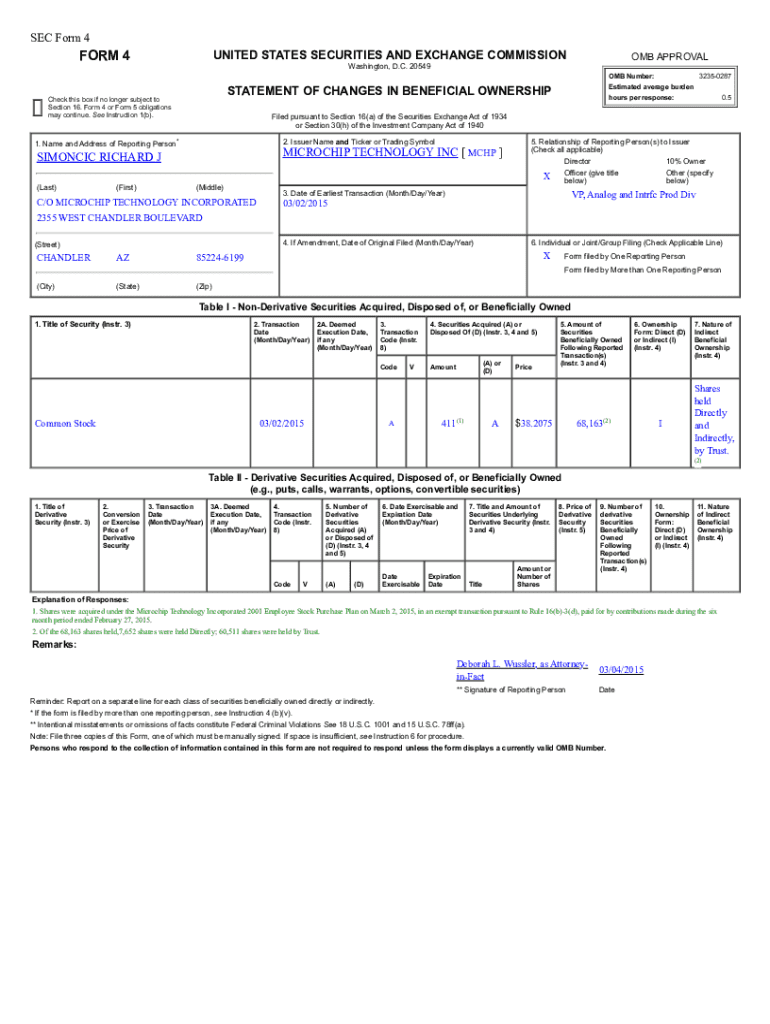

Sec Form 4, or Form 4, is a crucial document used by insiders of publicly traded companies to report changes in their ownership or the ownership of securities. This form is filed with the United States Securities and Exchange Commission (SEC) and serves the primary purpose of providing transparency to the market regarding insider trading activities. By reporting these changes, the form helps to maintain fair trading practices, ensuring that all investors have equal access to important information.

The importance of regulatory compliance cannot be overstated, as firms and individuals must adhere to the SEC's regulations to avoid penalties and maintain investor confidence. Failure to file or inaccurate disclosures can lead to significant legal consequences. Thus, understanding the nuances of Sec Form 4 is essential for everyone involved in the management of securities.

Who needs to file Sec Form 4?

Sec Form 4 must be filed by 'insiders' of a company, which includes officers, directors, and shareholders who own more than 10% of a company's stock. These individuals are typically privy to sensitive information about the company's operations and financial performance, making their transactions of heightened interest to the public.

Common scenarios for filing include stock option exercises, sales of shares, or any other transaction that alters an insider's holdings. It's imperative that these filings are made promptly, typically within two business days following the transaction, to ensure transparent disclosure.

Preparing to complete Sec Form 4

Preparing to fill out Sec Form 4 can significantly streamline the filing process. The first step is gathering the required information, which includes the insider's personal details like their name, title, and relationship to the entity, alongside the issuer's information, such as the company name and stock exchange details.

Understanding transaction codes is also vital. These codes describe the nature of each transaction, ranging from direct purchases and sales to gifts and inheritances. Selecting the correct code helps in accurately representing the transaction's context.

Step-by-step instructions for filling out Sec Form 4

To access Sec Form 4, visit the SEC's official website or use platforms like pdfFiller, which offers a user-friendly interface for document management. Once you have secured the form, ensure you are working with the most recent version. If you're using pdfFiller, you can navigate straight to the form and utilize their extensive editing features.

Filling in Sec Form 4

When filling Sec Form 4, pay close attention to each section. Begin with Section 1, which captures the reporting person’s information—their full name, title, and address. Ensure accuracy here as this information must match SEC records. Move on to Section 2, where you provide issuer information, including the name and stock symbol of the company involved.

Transactions

Section 3 focuses on transactions. This is where precision is key to avoid errors. Fill out the transaction details, including the date, type, quantity of shares, and transaction price. Common mistakes at this stage include incorrect transaction dates and missing details, which can lead to compliance issues.

Using pdfFiller tools for efficient completion

Utilizing pdfFiller can significantly streamline your completion of the Sec Form 4. With its PDF editing features, you can easily fill in the required fields, add electronic signatures, and date your form right within the platform. Moreover, pdfFiller allows for collaboration, which is beneficial if you are filing within a team.

Reviewing and finalizing your Sec Form 4 submission

After completing the Sec Form 4, it’s critical to review your work. Double-check every section for accuracy and completeness. A checklist is beneficial in this regard. Ensure that the reporting person's details are accurate, issuer information matches public records, and transaction details are precise. This step not only helps prevent errors but is essential for meeting the SEC's strict compliance standards.

Saving and storing your completed Sec Form 4 is equally important. Using pdfFiller, you can easily save your document in various formats and maintain a digital archive. Best practices suggest keeping multiple backups, ensuring that your records remain secure and easily retrievable.

Filing Sec Form 4: your options

When it comes to filing Sec Form 4, individuals have the option to file electronically or submit a paper form. Electronic filing often proves to be more efficient and is highly recommended due to the immediacy and ease of tracking submissions. On the other hand, paper submissions, while still accepted, can lead to delays and potential issues regarding legibility and processing.

Filing electronically through the SEC EDGAR system involves creating an account, following the step-by-step filing guide provided by the SEC, and uploading your completed form. Once submitted, you should expect confirmation of your filing and receive a public record of your transaction.

What to expect after submission

After submission, it’s essential to monitor the status of your filing. The SEC typically processes filings within a few business days, and you can easily track progress through the EDGAR system. If there are any issues with your submission, you may receive a notification requesting corrections.

Frequently asked questions about Sec Form 4

Several common queries arise when it comes to Sec Form 4. For instance, if you make an error in your submission, it is generally best practice to file an amended Form 4 to correct inaccuracies. Additionally, late filings can attract penalties, underscoring the importance of timely submissions. Lastly, changes in ownership must be reported accurately on Sec Form 4 to ensure compliance with SEC regulations.

Additional support and resources

Finding assistance while filling out Sec Form 4 can be critical for ensuring compliance. Users can reach out to the SEC directly for specific inquiries or consult resources available through pdfFiller, which offers dedicated customer support for users facing difficulties.

Additionally, online forums and communities can provide valuable insights and peer support. Engaging with these communities can help users learn best practices and stay informed about any changes in regulations.

Continuing education

Staying updated on regulatory changes impacting Sec Form 4 is vital, and various resources are available. Participating in courses and webinars focused on SEC filings and compliance can enhance one's understanding and application of the guidelines surrounding insider transactions. Regularly reviewing the SEC's official updates will help in keeping your practices current.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sec form 4?

How do I make changes in sec form 4?

Can I sign the sec form 4 electronically in Chrome?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.