Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

SEC Form 4 Form - How-to Guide

Understanding the SEC Form 4: Key components

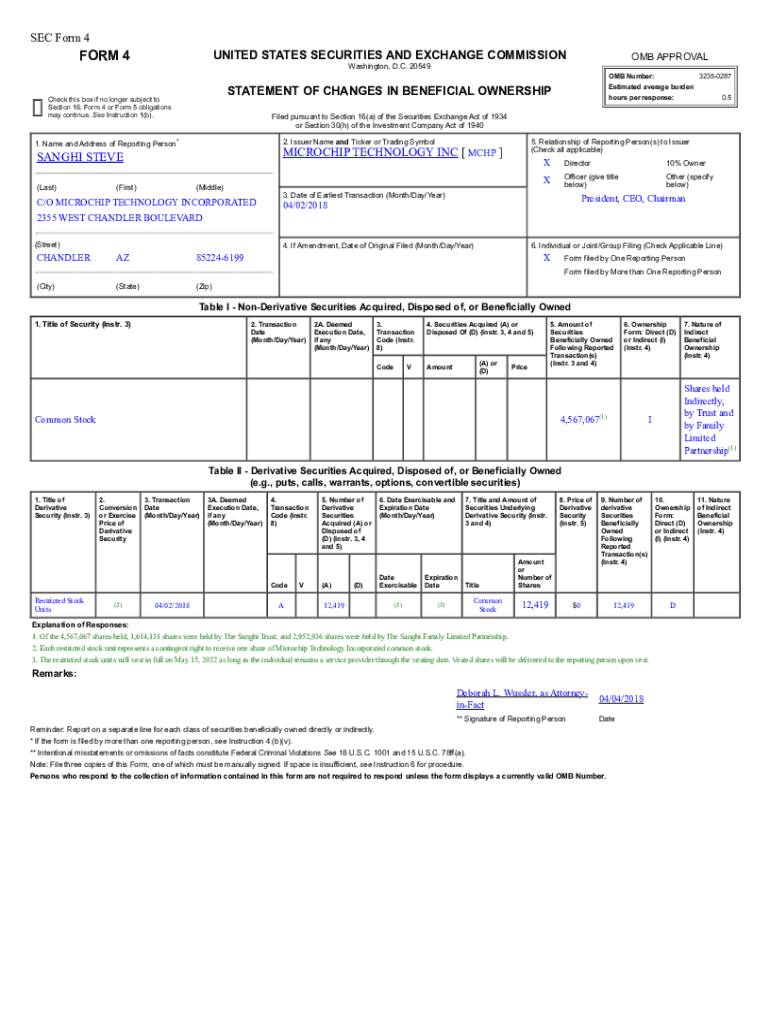

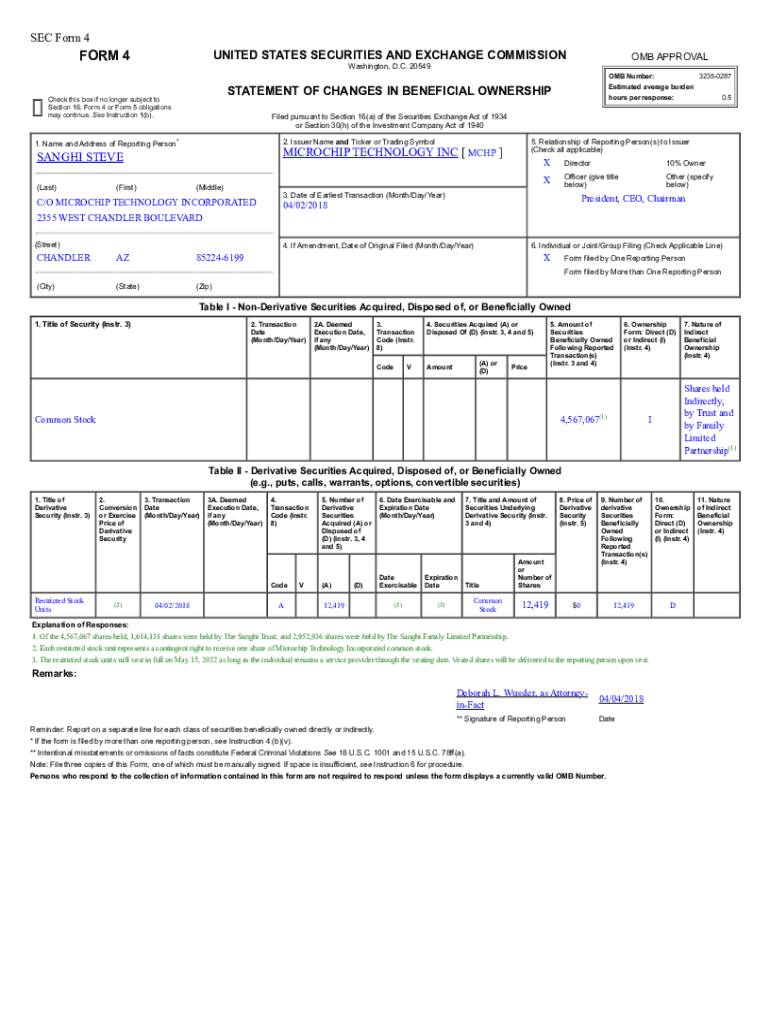

SEC Form 4 is a crucial document that insiders of publicly traded companies must file with the U.S. Securities and Exchange Commission (SEC) whenever they buy or sell shares of their company's stock. The form is designed to provide transparency regarding the trading activities of these insiders, who typically include executive officers, directors, and large shareholders. The significance of SEC Form 4 lies in its role in monitoring insider trading, ensuring that the market participants are informed about the buying and selling patterns of those who have privileged access to material information about the company.

Filing SEC Form 4 is mandatory for insiders and must be submitted within two business days of the transaction taking place. This quick reporting requirement helps maintain an orderly and fair market by reducing information asymmetry between insiders and general investors. Misleading or late filings can attract penalties, thus compliance is paramount.

Step-by-step guide to filling out SEC Form 4

Completing SEC Form 4 requires careful attention to detail. Before filling out the form, gather all necessary information about the transaction, including the date, number of shares traded, and the price per share. It's also helpful to review the definitions of terms used within the form to ensure you fully understand each section.

When completing the form, start with the Filer Information section, where you must provide your legal name, address, and the nature of your relationship to the issuer of the securities. Then move on to the Transaction Information section, which outlines the specifics of the transactions you performed, including any purchases or sales of stock.

Tools for filling out SEC Form 4

Utilizing tools like pdfFiller can significantly ease the process of completing SEC Form 4. pdfFiller provides a user-friendly platform that allows you to drag and drop elements, ensuring that you can easily add necessary information or adjust existing entries. Additionally, the platform supports eSigning, making it straightforward to acquire required signatures quickly without the hassle of printing and scanning physical documents.

For teams filing jointly on transactions, collaborative features offered by pdfFiller can be invaluable. These features allow real-time collaboration, so multiple team members can work on the same document simultaneously. Furthermore, users can track version history, ensuring that you can easily review or revert to previous forms if needed.

Submitting SEC Form 4: Procedures and best practices

When it comes to submission, insiders have the option of electronically filing their SEC Form 4 through the SEC's EDGAR system or submitting a paper version. Electronic filing is highly encouraged due to its efficiency and immediate processing. It's critical to remember the two-business-day requirement for submission to avoid potential penalties.

After submitting your form, confirm the submission feedback. The SEC provides confirmation which is vital to ensure your filing was received. Regular monitoring for any further communication from the SEC is also recommended, especially if there are issues that need to be addressed.

Managing edited and filed SEC Form 4 documents

Keeping a complete transaction history is vital for compliance and transparency. Tracking changes made in your SEC Form 4 documents not only assists in maintaining accurate records but also helps in assessing the trends in your transactions over time. With pdfFiller, you can benefit from encryption features that secure sensitive information stored within your documents. This is particularly pertinent given the confidential nature of insider trading data.

If you find that an amendment is necessary due to reporting errors or changes in ownership, understand the procedures for amending a submitted SEC Form 4. It is essential to follow the SEC's guidelines closely to rectify the filing, thereby ensuring continued compliance.

Navigating regulatory considerations and compliance

Compliance with SEC regulations is of utmost importance for insiders. Understanding relevant laws and regulations surrounding SEC Form 4 is crucial to avoid legal repercussions. Non-compliance can lead to serious consequences, including fines, penalties, and even criminal charges in egregious cases. Therefore, familiarity with the expectations relating to your filings ensures that you protect yourself and your company from potential legal actions.

Stay informed regarding any changes in regulatory frameworks that govern insider trading. Engaging with financial consultants or legal advisors with expertise in securities regulations can further cement your understanding and compliance strategy.

Frequently asked questions about SEC Form 4

It's common for filers to have questions regarding the completion and submission of SEC Form 4. Some of the most frequently asked questions include: What are the most common mistakes made during the filing process? How does SEC Form 4 differ from other SEC filings like Form 3 or Form 5? Can a submitted SEC Form 4 be amended, and if so, how? Finally, what steps can be taken if the filing deadline is missed?

To mitigate errors, ensure that you double-check all entries, classifications, and timestamps prior to submission. Understanding the unique requirements of SEC Form 4 as compared to other forms is crucial. If amendments are required, familiarize yourself with the SEC's process for submitting corrections to maintain compliance. And importantly, if you miss a filing deadline, consult with legal counsel to address any repercussions proactively.

Best practices for future document management

Embracing cloud-based solutions for document management enhances your ability to securely store and manage sensitive information. pdfFiller provides users with the tools necessary to keep their documents organized, with templates that can be regularly updated to reflect changing compliance requirements. By leveraging these solutions, insiders can create a streamlined filing process, ensuring that SEC Form 4 and any other necessary documents are always readily accessible.

Regular updates to templates and resources are critical in adapting to ongoing changes in legislation and internal company policies. pdfFiller's platform allows users to maintain their document infrastructure efficiently, ensuring that there are always compliant and up-to-date forms ready for filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the sec form 4 in Chrome?

How can I fill out sec form 4 on an iOS device?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.