Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Sec Form 4 Form: Your Comprehensive Guide to Understanding, Completing, and Managing Your Filings

Understanding Sec Form 4: What it is and why it matters

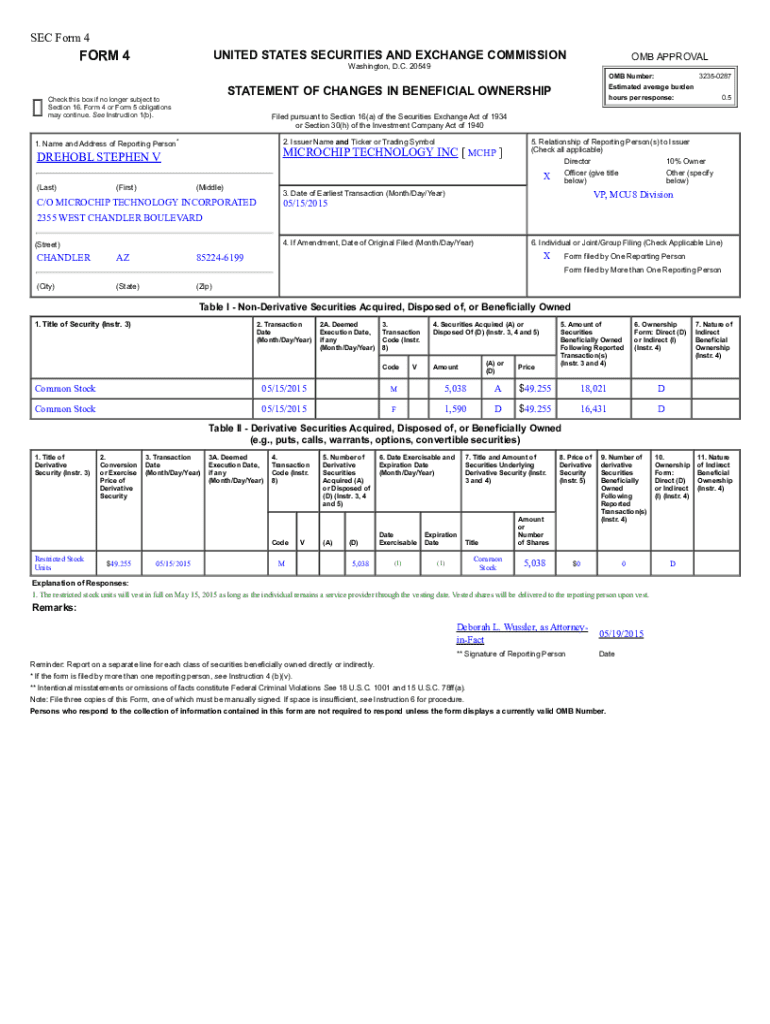

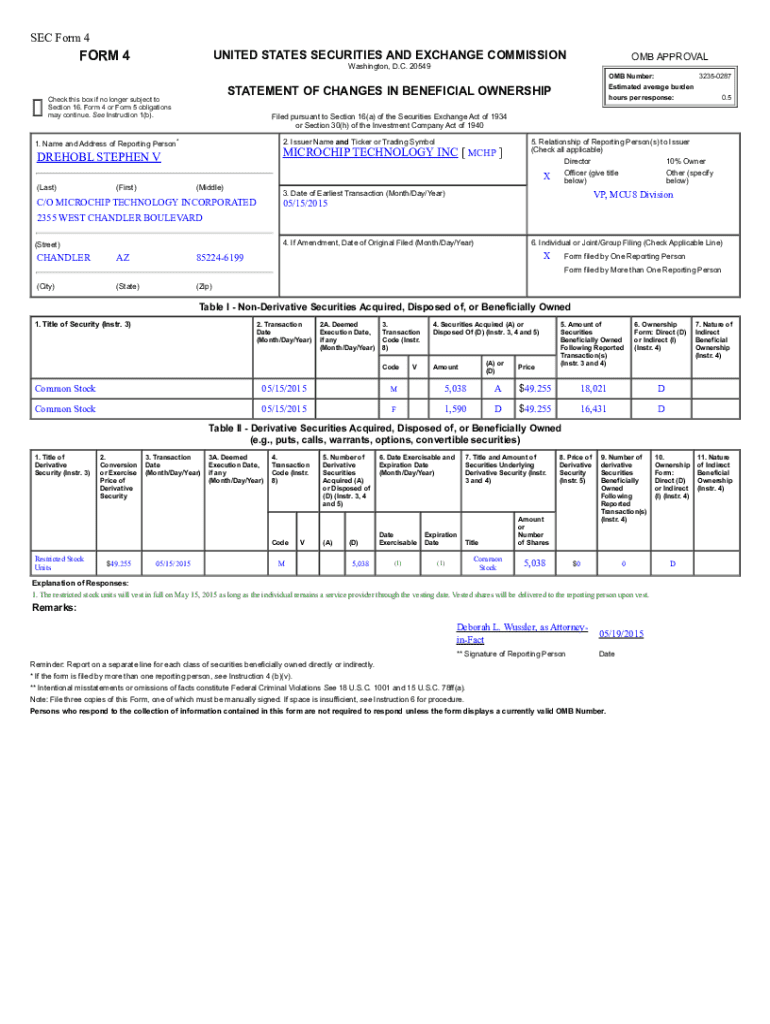

Sec Form 4, formally known as the Statement of Changes in Beneficial Ownership, is a crucial document used by corporate insiders—individuals who hold significant positions within a company, such as executives and directors. This form is primarily intended to report changes in the ownership of securities and to provide transparency in the marketplace, ensuring that all investors have access to timely information regarding stock ownership changes.

The importance of Sec Form 4 extends beyond mere compliance; it serves as a vital tool for regulatory reporting. By requiring insiders to disclose their transactions within a specific timeframe, the SEC aims to prevent insider trading and promote fair practices in the securities market. Understanding the filing requirements and deadlines for Sec Form 4 is essential for both individual filers and companies overseeing multiple reporting persons.

Key components of Sec Form 4

Sec Form 4 comprises several key components designed to capture the necessary information about the transactions of reporting persons. Each section plays an important role in ensuring that the information reported is clear and complete. Four main sections encompass the reporting person’s information, issuer information, transaction details, and signature with the date.

Additionally, Sec Form 4 includes transaction codes that categorize the actions undertaken by the reporting person. Understanding these codes is vital for accurate reporting.

Step-by-step guide to filling out Sec Form 4

Filling out Sec Form 4 can seem daunting, but it’s manageable when broken down into simple steps. Firstly, gather all required information before starting. This includes personal identification and detailed transaction records. Documentation might include trading confirmations and brokerage statements, which provide necessary data.

When completing each section, be meticulous. Provide accurate reporting person information and specific issuer details. In the transaction details section, be clear about the nature of the transaction and adhere to signing requirements. Once completed, review your submission thoroughly, as common mistakes could lead to unnecessary complications.

Interactive tools for Form 4 management

Managing Sec Form 4 filings becomes more efficient with tools designed for document handling. pdfFiller offers innovative solutions that allow users to edit and eSign the Sec Form 4 effortlessly. Features include collaborative tools that enable team members to work together seamlessly on document preparation, making it easier to manage complex filings.

Using a cloud-based platform like pdfFiller provides several advantages, including easy access from any device and automatic saving of progress. Furthermore, users can navigate their document management workflows more effectively, ensuring timely and compliant filings without the usual hassles associated with paperwork.

Navigating transaction codes on Sec Form 4

Transaction codes are essential for accurately reporting actions taken on Sec Form 4. Understanding what each code signifies helps prevent errors in filing. Common transaction codes include P for purchase, S for sale, and D for disbursement among others. Familiarity with these codes ensures that reporting persons correctly classify their transactions.

It is critical to use these codes correctly to maintain compliance as incorrect classifications can lead to delayed filings or inquiries from regulatory bodies. By understanding when and how to use these codes, individuals can enhance accuracy in their reports.

Sec Form 4 filing best practices

Timely filing of Sec Form 4 is not just a recommendation; it is a legal requirement. Companies and individuals must stay on top of these obligations to safeguard against penalties or legal repercussions. Keeping organized records is one of the best practices for efficient tracking of securities transactions, alongside ensuring all relevant documentation is readily accessible.

Applying strategies like setting reminders for filing deadlines within platforms like pdfFiller can also streamline the process. Adopting a proactive approach towards filings helps encourage proper documentation and mitigates risks associated with late or inaccurate submissions.

Resources for further assistance

Utilizing the SEC’s own resources can greatly enhance understanding and compliance with Sec Form 4 filing requirements. The SEC website offers guidelines, instructional materials, and examples that can assist filers. Additionally, addressing common questions through FAQs can clarify uncertainties faced during the form-filling process.

Case studies: Successful filing experiences

Real-world examples of successful Sec Form 4 filings illustrate the value of diligence in documenting transactions. One notable case involved a rapidly growing tech firm where the CFO struggled to meet filing deadlines due to complex trading transactions. By leveraging pdfFiller’s collaborative features, the team streamlined their reporting process, ultimately submitting accurate filings promptly and avoiding potential fines.

Another instance involved a seasoned executive who faced challenges with understanding transaction codes when filling out Sec Form 4. By utilizing extensive resources available on pdfFiller and the SEC's website, the executive was able to correctly classify transactions, ultimately improving compliance and transparency in reporting.

Exploring alternatives: Other forms similar to Sec Form 4

While Sec Form 4 is vital for reporting changes in beneficial ownership, other forms like Sec Form 5 and Form 13D also play crucial roles in regulatory compliance. Sec Form 5 is used for annual disclosures, whereas Form 13D is typically filed by individuals or groups acquiring more than 5% of a company’s shares. Understanding when to use these forms and their differences is fundamental for insiders and their compliance teams.

Sec Form 4 in the context of compliance

The implications of accurate Sec Form 4 filings extend beyond regulatory compliance; they are vital for maintaining corporate transparency and fostering investor trust. Accurate reporting of securities transactions helps create a level playing field within the financial markets, as it allows all market participants to make informed decisions based on the same information.

By adhering to industry standards and legal requirements regarding Sec Form 4, companies not only comply with the law but also commit to ethical business practices that enhance their credibility. Timely and accurate filings demonstrate responsibility and accountability, which can significantly impact investor confidence and corporate reputation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sec form 4?

How do I make changes in sec form 4?

How do I complete sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.