Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Sec Form 4: Your Comprehensive Guide to Understanding and Filing

Understanding Sec Form 4: An overview

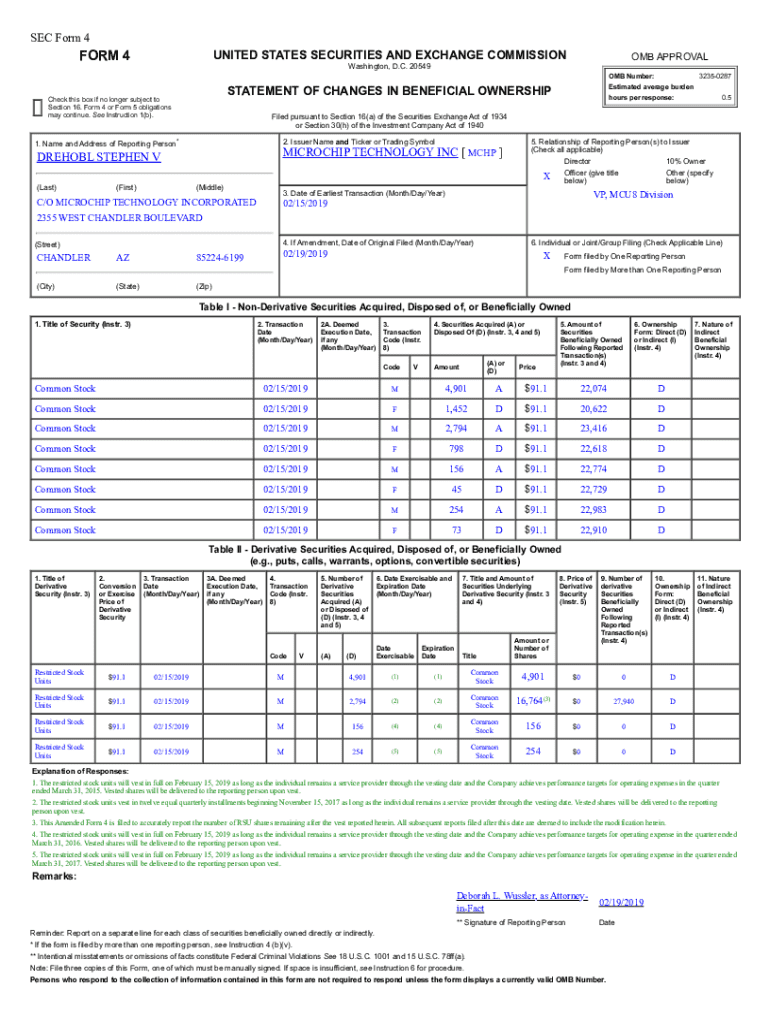

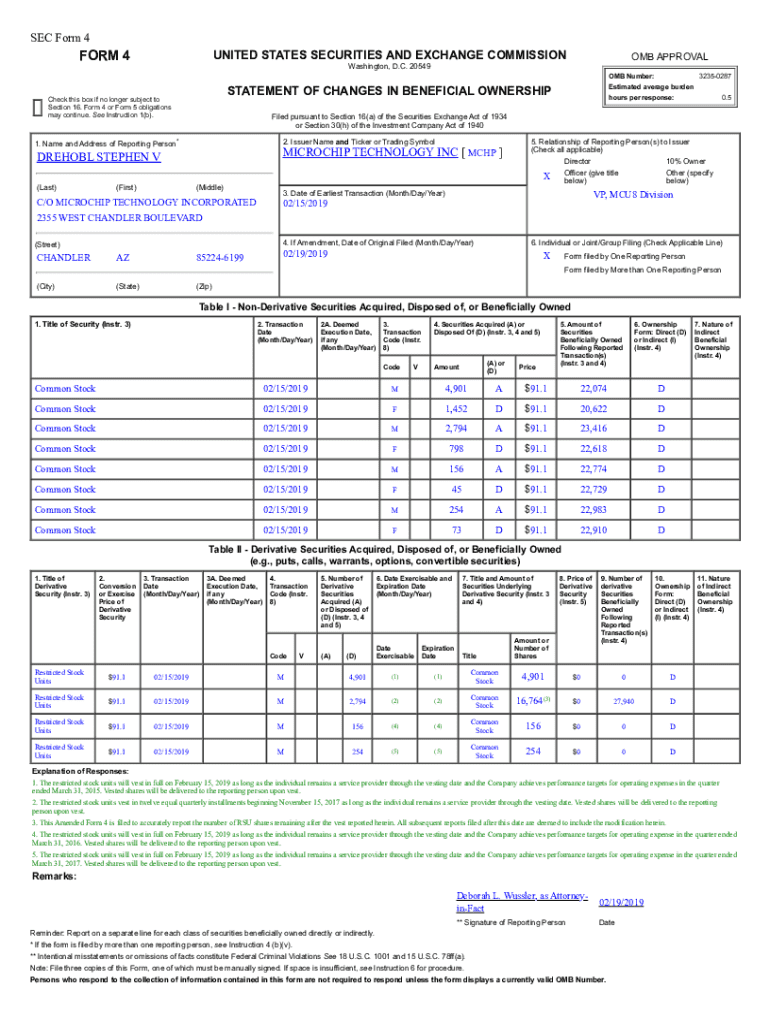

The SEC Form 4 is a crucial document required by the U.S. Securities and Exchange Commission (SEC) for reporting changes in the ownership of securities. This form is primarily used by corporate insiders, including officers, directors, and beneficial owners of more than 10% of a company's equity securities. The key purpose of Form 4 is to provide transparency in the securities markets by ensuring that stockholders are aware of insider trading activities, thereby helping to prevent misleading actions and maintain investor confidence.

Accurate reporting through Form 4 is essential. It aids in preventing market manipulation and ensures that all securities transactions are disclosed in a timely manner. Misreporting or failing to file can lead to significant penalties and undermine the integrity of the financial markets. As such, it is vital for anyone in a position of insider trading to understand the importance of this form and the implications of their disclosures.

Essential components of Sec Form 4

To effectively complete the SEC Form 4, it’s important to understand the various sections of the document. Each segment is designed to collect precise information regarding the nature and details of the transaction, ensuring transparency and compliance with SEC regulations.

The main sections of Sec Form 4 include the transacting party's information, details about the securities ownership, transaction codes, and the dates and durations of transactions. Each of these components plays a vital role in accurately reporting changes in ownership, which ultimately supports investor trust in the markets.

Common mistakes when filling out the Sec Form 4 include incorrect transaction codes, missing signatures, and failure to report transactions within the required time frame. Double-checking all entries can prevent unnecessary scrutiny from regulatory bodies.

Step-by-step guide to filling out Sec Form 4

Filling out the Sec Form 4 is systematic, and proper organization of information is key to ensuring accuracy. Here’s a step-by-step guide to help simplify the process.

Interactive tools available on pdfFiller

Using pdfFiller for your SEC Form 4 submissions enhances your filing experience immensely. The platform offers an array of interactive tools geared toward simplifying the document management process.

These features not only enhance usability but also promote team collaboration, as everyone can access the form from anywhere, ensuring timely completion and submission.

Keeping track of your securities transactions

Managing your securities transactions effectively involves diligent record-keeping and document management. Storing previous forms securely and ensuring easy access for future references is critical, and pdfFiller provides an excellent solution for this.

The platform allows you to maintain an organized repository of all your filled forms, making tracking changes and recalling past transactions simple. Moreover, pdfFiller helps you manage edit history inputs, allowing you to revisit older versions of documents and understand the modifications made over time.

Resources for further assistance

For individuals looking for more detailed guidance on filing the SEC Form 4, the official SEC guidelines are invaluable. They provide a comprehensive overview of compliance and requisite details necessary for proper submissions.

Additionally, links to educational content and tutorials can enhance your understanding of the process. Familiarizing yourself with a glossary of key terms related to Form 4 can also minimize confusion and streamline the filing experience.

Best practices for using Sec Form 4 efficiently

Embracing best practices when filing the Sec Form 4 can significantly reduce errors and enhance the efficiency of the filing process. Being proactive about preparing for regular reporting is crucial.

Set up a schedule to review and document any securities transactions promptly, as this will aid in timely filings. Using checklists helps ensure no critical information is overlooked. Create a standard operating procedure for submitting forms, incorporating tips to minimize errors, such as always cross-referencing your data with latest SEC guidelines.

Case studies

Exploring case studies can highlight the real-world application of the SEC Form 4. For instance, consider a company where the CEO buys a significant amount of shares during a market dip. Filing Form 4 in a timely manner ensures all stakeholders and investors are informed about the insider transaction, fostering trust and confidence in the company’s leadership.

On the other hand, proactive use of pdfFiller equips companies with tools to streamline the filing process. Successful companies often report an increase in efficiency and a reduction in clerical errors thanks to pdfFiller’s intuitive interface for edits and collaboration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sec form 4?

How do I complete sec form 4 online?

How can I edit sec form 4 on a smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.