Get the free Open Enrollment Guide

Get, Create, Make and Sign open enrollment guide

Editing open enrollment guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out open enrollment guide

How to fill out open enrollment guide

Who needs open enrollment guide?

Comprehensive Open Enrollment Guide Form: Navigate Your Insurance Choices

Understanding open enrollment

Open enrollment is a designated period during which individuals can enroll in, change, or cancel health insurance plans without needing a qualifying event, such as a job change or a significant life event. This process is crucial in the insurance landscape, enabling consumers to evaluate their coverage options and select plans that best fit their needs. During open enrollment, providers often release new plans, pricing structures, and coverage details, making it an opportune time to reassess healthcare needs.

Key terms associated with open enrollment include premiums (the amount you pay for your insurance policy), deductibles (the amount you pay for covered health care services before your insurance kicks in), and copayments (a fixed amount you pay for a covered service, usually at the time of service). Understanding these terms can empower consumers to make informed decisions during this period.

Who should use the open enrollment guide form?

The open enrollment guide form is beneficial for both individuals and teams. For individuals, it serves as a structured approach to understanding personal choices regarding health insurance. It typically simplifies the selection process, consolidating complex information in a user-friendly manner. Individuals can assess their medical needs, budget constraints, and preferences to choose the right plan.

For teams and organizations, the open enrollment guide form can facilitate collaborative decision-making, ensuring that all members have access to clear and consistent information. By using a centralized tool, team leaders can engage employees, encourage discussions about health coverage options, and support collective decision-making for the overall wellbeing of the workforce.

When does open enrollment occur?

Open enrollment periods vary by insurance provider and plan type, primarily occurring once a year. Most health insurance exchanges and employer-sponsored plans set specific timelines for open enrollment, often aligning with the end of the calendar year. It’s crucial for individuals and organizations to stay updated on renewal dates to avoid missing the opportunity to make necessary changes to their coverage.

Additionally, special enrollment periods exist for individuals who may experience life changes such as marriage, the birth of a child, or loss of other health coverage. Understanding when these periods occur allows individuals to take timely action to secure or modify their health insurance plans.

Key aspects of open enrollment

Several key aspects need careful consideration during open enrollment, beginning with benefits and coverage options. Health insurance plans generally fall into two categories: individual and family plans. Individual plans cater to a single person, while family plans accommodate multiple members, often providing a more economical solution for families while also offering comprehensive coverage tailored to shared medical needs.

Employer-sponsored plans are often seen as a gold standard for many individuals because they typically cover a significant portion of premiums. Understanding what options are available, including pricing increases, network restrictions, and unique benefits, is essential. Individuals should evaluate their unique medical needs, especially if they have pre-existing conditions, and match these needs against the plan's offerings to ensure adequate coverage.

Process of completing the open enrollment guide form

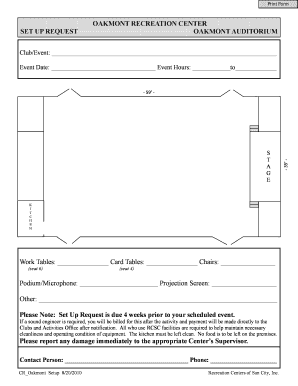

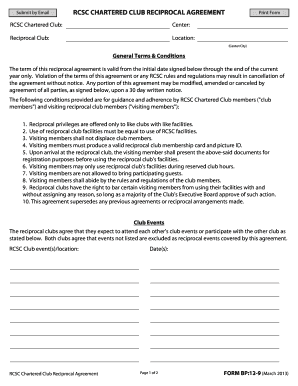

Completing the open enrollment guide form involves several structured steps. First, it’s essential to gather all necessary documentation, which includes personal identification documents, proof of residency, and any existing insurance information. This foundational data is crucial for making informed decisions.

Next, individuals should evaluate their coverage needs based on personal and family health histories, current treatments, expected medical expenses, and any specific requirements. Understanding these details enables you to make empowered choices about your health coverage.

Once you've assessed your needs, completing the form itself is the next step. Many forms are designed to be user-friendly, guiding users through the process. It’s important to follow the provided step-by-step instructions closely to avoid missing any critical details.

Finally, submissions should be done by their specified deadlines. Opting for an electronic submission process via pdfFiller can streamline this step significantly, ensuring your application is submitted on time, while also allowing you to save and manage your documents efficiently.

Maximizing your benefits

Making the most of open enrollment requires best practices and proactive strategies. Educating yourself about available benefits is critical; utilize resources such as webinars and employer information sessions to gain insights. Additionally, leveraging interactive tools for comparison can aid significantly in decision-making. Many platforms provide calculators and assessment tools that simplify evaluating different health plans.

For organizations, it's vital to communicate coverage details effectively within teams. Ensure timely announcements and reminders leading up to the open enrollment period, and consider engaging employees with visual or promotional materials outlining their options. This approach fosters informed decision-making and enhances employee satisfaction.

Common myths and misconceptions

Many myths surround the open enrollment process, leading to confusion among potential enrollees. One prevalent misconception is the belief that individuals can change their insurance plan at any time during the year. In reality, the open enrollment period is the only time to switch plans unless an individual experiences a qualifying event.

Another myth is that people don’t need health insurance until they fall ill. This mindset can lead to significant financial strain, as healthcare costs can quickly accumulate, even for routine check-ups or emergencies. Understanding that health insurance serves as a preventive measure is crucial for minimizing potential medical expenses.

Frequently asked questions

If you miss the open enrollment deadline, you typically must wait until the next open enrollment period, barring qualifying life events. Such events can include changes in marital status, birth of a child, or loss of other health coverage, which may allow for an application outside the standard enrollment times.

People often wonder how they can modify their choices after submission. This usually depends on the policies of the insurance provider; some may allow changes during specific periods or only in response to qualifying events. Additionally, ensuring you understand what constitutes a qualifying life event helps clarify your options for coverage modification.

Technological tools to simplify open enrollment

Leveraging technology can significantly enhance the open enrollment experience. Tools like pdfFiller can simplify document management by allowing users to edit, eSign, and collaborate on forms electronically. This eliminates the hassle of physical paperwork, ensuring a smoother and more efficient process.

Moreover, using cloud-based solutions can help track progress and send reminders, ensuring that both individuals and team members stay organized throughout the enrollment period. This proactive approach minimizes the chances of missing critical deadlines.

Navigating changes in coverage

Open enrollment is not only about making current choices; it’s also about adapting to changes in insurance coverage based on legislative adjustments. Keeping abreast of such changes can help individuals identify new opportunities or necessary adaptations in their plans.

Additionally, anticipating future enrollment cycles and remaining compliant with insurance regulations is key to successfully navigating insurance landscapes. Furthermore, external factors such as economic changes can impact coverage options; adapting strategies accordingly can promote better health outcomes.

Resources for additional support

Various resources are available to support individuals and organizations during the open enrollment process. Accessing sample open enrollment guides or templates can provide valuable insights into what to expect. Furthermore, reaching out for expert help and support can clarify doubts and ensure your form is filled out accurately.

Online tools and calculators also play a significant role in assisting potential enrollees in calculating health insurance costs and making data-driven decisions that enhance their coverage experience.

Real-life scenarios: case studies

Examining success stories can illuminate the benefits of thorough preparation during open enrollment. For instance, individuals who take the time to evaluate their health needs and utilize comprehensive guides report higher satisfaction with their plans. Similarly, organizations that encourage teams to collaborate and discuss coverage options often see increased employee engagement and satisfaction with health benefits.

These case studies underscore the importance of using resources such as the open enrollment guide form to foster informed decisions and enhance the overall experience during this critical period.

Navigating challenges in open enrollment

Like any process, open enrollment comes with its challenges. Common obstacles include confusion over plan details, new policy changes, or delays in document processing. However, utilizing platforms like pdfFiller can help mitigate these issues. By simplifying the document handling process and providing collaborative tools, users can navigate through complexities more efficiently.

Adopting a strategic approach to tackling these challenges can transform potential frustrations into seamless experiences, empowering individuals and teams to make the best health insurance choices.

Assistance for individuals with special needs

It's essential to acknowledge that individuals with special needs may encounter unique challenges during open enrollment. Alternative solutions should be explored to ensure they receive comprehensive support and suitable coverage options. Many communities offer targeted resources and support networks to assist these individuals in understanding their options.

Providing accessible information and guidance tailored to the specific needs of individuals with disabilities can help in fostering an inclusive environment that ensures equitable healthcare access.

Future outlook and trends in open enrollment

As insurance landscapes evolve, it’s important to anticipate changes related to open enrollment periods. Future enrollment cycles may see increased technology integration and personalized options driven by data analytics. Understanding these trends can prepare individuals and organizations to adapt their strategies effectively.

Considering the role of technology in personalizing the enrollment experience can enhance engagement and ensure individuals make informed choices based on their preferences and needs, paving the way for a more effective enrollment experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send open enrollment guide for eSignature?

How do I make changes in open enrollment guide?

How do I edit open enrollment guide on an Android device?

What is open enrollment guide?

Who is required to file open enrollment guide?

How to fill out open enrollment guide?

What is the purpose of open enrollment guide?

What information must be reported on open enrollment guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.