Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding Sec Form 4: A Comprehensive Guide

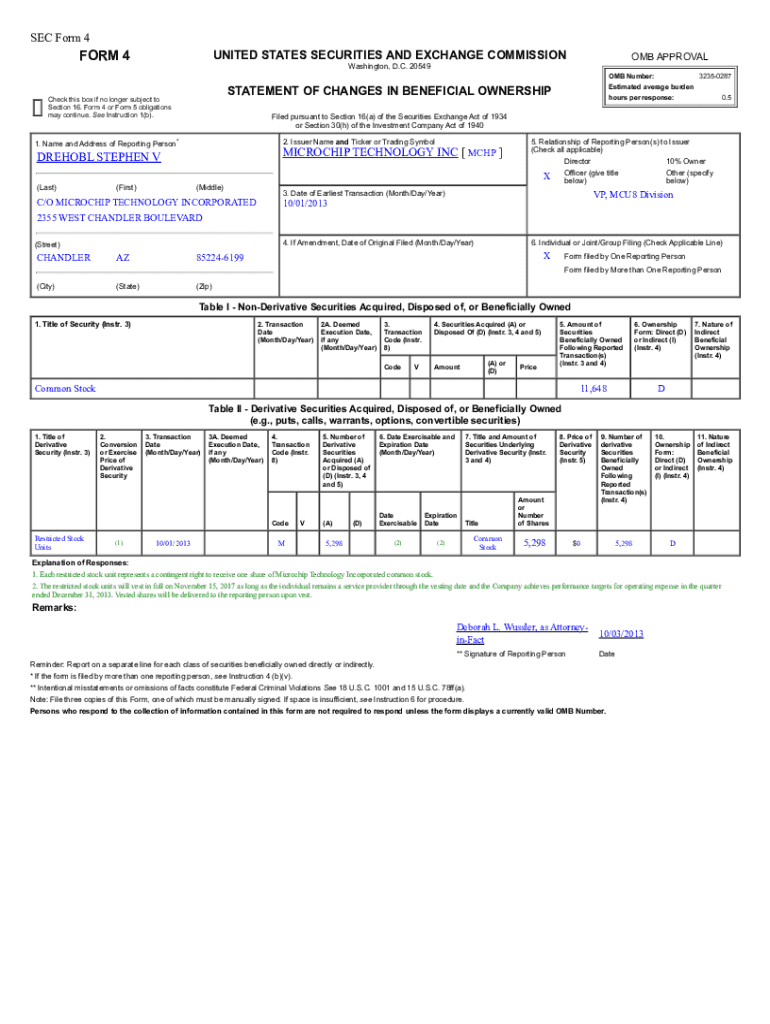

Understanding Sec Form 4

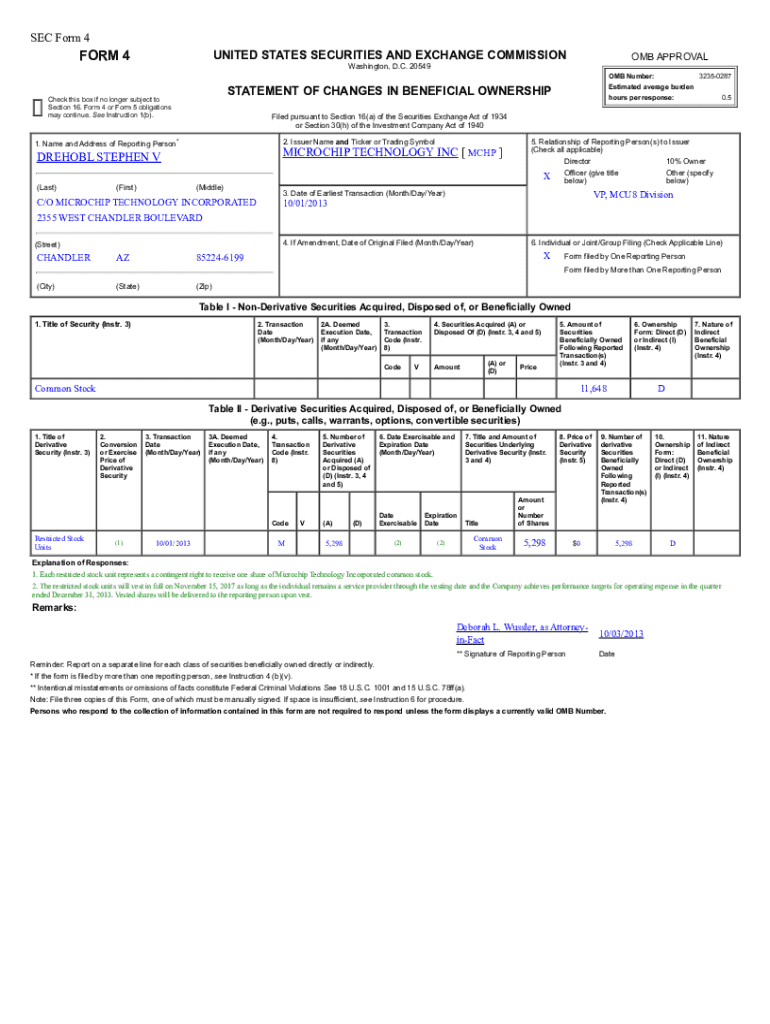

Sec Form 4 is a critical document required by the U.S. Securities and Exchange Commission (SEC) for reporting changes in the ownership of securities by corporate insiders. This form is integral in ensuring that executives, directors, and significant shareholders maintain compliance with the regulations set forth to promote transparency in corporate governance. The purpose of Sec Form 4 is to keep the market informed about conflicts of interest and insider trading, thus enhancing trust among potential investors.

The importance of Sec Form 4 extends beyond mere compliance; it serves as a safeguard for investors by disclosing potential conflicts and significant financial movements from those in the know. By mandating disclosures on security transactions involving their own company’s stock, the SEC aims to uphold the integrity of the securities market.

How Sec Form 4 fits into the regulatory framework

The SEC oversees the enforcement of the rules and regulations governing the securities market, including the filing of Sec Form 4. Its role is fundamental in safeguarding investors, maintaining fair and efficient markets, and facilitating capital formation. The SEC enforces compliance through various regulatory frameworks that are designed to uphold transparency and accountability among publicly traded companies.

Central to the SEC’s mandate is the Securities Exchange Act of 1934, which regulates the securities industry, including the requirements for timely filing of ownership changes. Non-compliance with these regulations carries significant penalties, including fines and potential legal action, underscoring the importance of understanding and correctly filing Sec Form 4.

Preparing to file Sec Form 4

Before filling out Sec Form 4, it is crucial to gather all necessary information and documentation. This includes identifying the type of security involved (stocks, options, etc.), the transaction dates, and precise details about the reporting individual, such as their position within the company and the nature of their ownership.

Key documents that may be required include purchase agreements, broker statements, and any other records pertaining to the transaction. Understanding who needs to file is equally important; typically, this includes executives, directors, and shareholders owning over 10% of a class of securities. Any transaction by these insiders must be reported within specific time frames to remain compliant.

Step-by-step guide to completing Sec Form 4

Completing Sec Form 4 requires careful attention to detail. Begin by filling out the header information, which includes your name, title, and the company for which you are filing. Next, provide your details as the reporting person, including your relationship to the entity involved.

The subsequent sections require a detailed account of the transaction being reported—whether you're buying, selling, or exercising options. Be specific about the transaction's date and amount. Lastly, it must be clear whether your ownership is direct or indirect, as this impacts how the transaction is viewed in terms of compliance.

To ensure accuracy, check for common errors such as incorrect transaction dates or missing signatures. Filing inaccuracies can lead to penalties, so meticulous review is necessary.

Submission process for Sec Form 4

Once completed, Sec Form 4 must be submitted to the SEC. The preferred method of filing is electronically via the SEC's EDGAR system, which facilitates faster processing and compliance tracking. For traditionalists, paper filing is still an option, but it comes with stricter requirements regarding formatting and timely delivery. Be sure to follow the guidelines to avoid issues with submission.

After submitting, you should receive a confirmation of submission. It is crucial to keep this confirmation as proof of filing and for tracking purposes. Knowing how to access filed forms can provide further peace of mind and health of your compliance record.

Managing and tracking Sec Form 4 filings

Post-filing, it is essential to review and understand the implications of your Sec Form 4 submission. Keeping documented records organized will be invaluable for future reference and audits. Engage in a routine of regular monitoring to ensure compliance and address any potential issues swiftly.

Utilizing tools such as pdfFiller helps maintain robust documentation practices. This platform offers functionality to track your filings and amend records when necessary, ensuring you're always in good standing with the SEC. Additionally, establish a specific process for reviewing your filing status regularly to stay ahead of compliance.

Interactive tools and resources

pdfFiller offers a wealth of features designed to enhance your experience with Sec Form 4. Through this platform, users can easily edit PDF forms, ensuring that all information is current before submission. The eSigning features provide a secure way to finalize documents digitally, expediting the process.

For added convenience, pdfFiller includes customizable templates specifically for Sec Form 4. These templates simplify the filling process, significantly minimizing the risk of errors. Furthermore, the collaborative tools available on the platform enhance teamwork, allowing multiple users to engage in document completion and management.

Best practices for compliance and record keeping

To ensure ongoing compliance with SEC regulations, establishing a routine for monitoring changes in filing requirements is paramount. Regular updates should be integrated into your operational processes. Being proactive can save substantial time and resources, especially leading up to regulatory deadlines.

Additionally, maintaining thorough documentation and audit trails allows for efficient reviews and compliance checks. Documenting all transactions with detailed records benefits not just compliance but also internal audits and external inquiries that may arise.

Resources for further learning

For corporate professionals looking to stay informed, continuing education on SEC regulations is invaluable. Whether through formal courses or webinars, expanding your understanding of compliance issues can empower more informed decision-making regarding filings.

Navigating the SEC website also offers fresh insights and guidance on evolving regulations. Familiarizing yourself with FAQs and updates provides a comprehensive view that can enhance your approach to regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in sec form 4?

Can I create an electronic signature for signing my sec form 4 in Gmail?

How do I complete sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.