Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Understanding the Form 10-Q: A Comprehensive Guide

Understanding SEC Form 10-Q

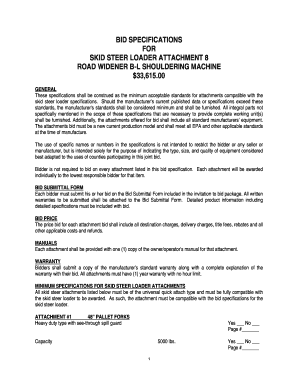

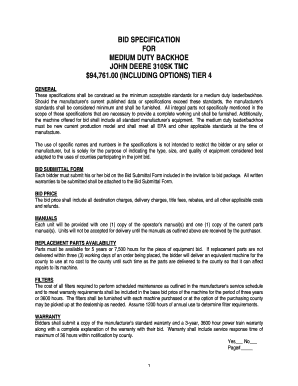

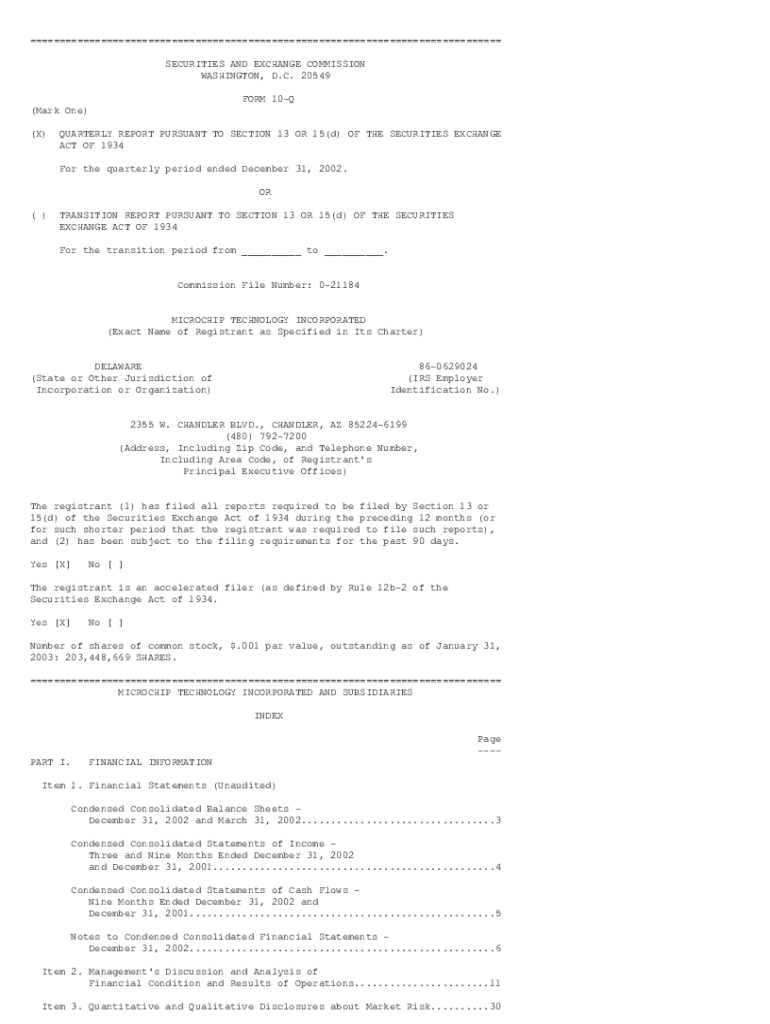

Form 10-Q is a quarterly report mandated by the U.S. Securities and Exchange Commission (SEC) that provides a comprehensive overview of a company's financial performance over a three-month period. Unlike the annual Form 10-K, the Form 10-Q is less detailed but must be filed more frequently, typically within 40 days after the close of the company's fiscal quarter. This document serves as a vital tool for investors and analysts, allowing them to track the ongoing financial health of publicly traded companies.

The significance of Form 10-Q lies in its role as a primary source of financial and operational information. It includes insights into the company's current financial position, management insights, and potential risks, providing stakeholders with up-to-date data to assist in investment decisions. Understanding the distinctions between Form 10-Q and Form 10-K is crucial. While both are essential for transparency, Form 10-K requires comprehensive annual disclosures, whereas Form 10-Q offers a snapshot of quarterly performance.

Purpose and key elements of Form 10-Q filings

The primary purpose of Form 10-Q is to keep investors informed about the company's financial status on a quarterly basis, ensuring timely data regarding performance, operations, and risks affecting the business. It acts as a transparent communication channel between a company and its shareholders, keeping stakeholders updated with essential information.

Key reporting sections in Form 10-Q include:

Navigating the 10-Q filing requirements

Understanding the filing requirements for Form 10-Q is imperative for publicly traded companies. Specifically, all companies registered with the SEC are required to file Form 10-Q quarterly. This includes domestic companies, foreign companies operating in the U.S., and those on major exchanges such as the NYSE and NASDAQ. Each of these organizations must adhere to filing deadlines, generally set at 40 days after the end of each fiscal quarter.

Consequences of delayed or missed filings can be significant. Companies may face penalties, enforcement actions, or damage to their reputation, impacting investor confidence and stock prices. Regular and timely filings promote investor trust and demonstrate a commitment to transparency.

Filling out the Form 10-Q

Completing Form 10-Q accurately is crucial for compliance and effective communication. Here are step-by-step instructions for filling out the form:

Common pitfalls to avoid include inaccuracies in financial data, incomplete disclosures in the MD&A section, and failing to submit on time. Attention to detail and adherence to deadlines are key to successful filing.

Tools and resources for completing your Form 10-Q

Utilizing efficient tools can simplify the Form 10-Q preparation process. pdfFiller, for instance, offers a robust platform for document management. It provides interactive editing features that allow users to fill out forms seamlessly, reducing errors and improving efficiency.

Additional capabilities include eSignature functionalities, enabling secure and convenient signing of documentation. Integrating with other compliance software can further streamline reporting and ensure that all aspects of the Form 10-Q are accurately and timely documented.

How to access and submit a Form 10-Q

Accessing the official templates for Form 10-Q is straightforward. The SEC provides standardized forms that companies can download from its website. Once completed, the submission process involves electronic filing with the SEC, facilitating quick and efficient filing.

Key steps in the submission process include:

Key highlights and considerations

Form 10-Q is subject to updates and regulatory changes impacting its requirements. Staying informed about such changes is critical for compliance and effective reporting. Companies should monitor SEC announcements to keep up with significant alterations in financial reporting protocols.

Analyzing the Form 10-Q can provide deep insights into a company's financial health, allowing investors to evaluate performance trends and market positioning. Key considerations include recent changes in the business environment that may affect future performance, risks disclosed in the report, and any deviations from previous forecasts.

Frequently asked questions (FAQs)

Investors often focus on several critical parts of Form 10-Q, including revenue trends, net income figures, cash flow statements, and risk disclosures. These sections help assess the company's operational efficiency and market risks.

For businesses, preparing for the quarterly reporting process efficiently typically involves establishing a consistent internal timeline, ensuring financial data is promptly collected and reviewed. Regular updates and communication among the finance team can facilitate a smoother reporting cycle.

Failing to file Form 10-Q on time can lead to significant repercussions, including fines from the SEC, increased scrutiny from investors, and potential damage to the company's reputation. Therefore, prioritizing timely submissions is crucial.

Related solutions and services

pdfFiller offers a suite of additional document management solutions that can cater to a company's needs when it comes to compliance. Choosing pdfFiller simplifies the Form 10-Q preparation and management processes through integrated features that enhance collaboration, efficiency, and accuracy.

Testimonials from users underscore the benefits of utilizing pdfFiller for Form 10-Q preparation, highlighting ease of use, flexibility, and robust customer support.

Engaging with experts on Form 10-Q

Starting the conversation around Form 10-Q can provide valuable insights from financial analysts and advisory services. Engaging with experts not only offers clarity on regulatory nuances but also allows companies to remain informed about best practices in financial reporting.

Additionally, accessing ongoing educational resources regarding SEC filing requirements can equip financial professionals with the latest insights and tools necessary for effective compliance and reporting, ensuring that businesses meet both regulatory expectations and investor demands.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 10-q directly from Gmail?

Can I create an eSignature for the form 10-q in Gmail?

How do I fill out form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.