Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding Sec Form 4: A Comprehensive Guide

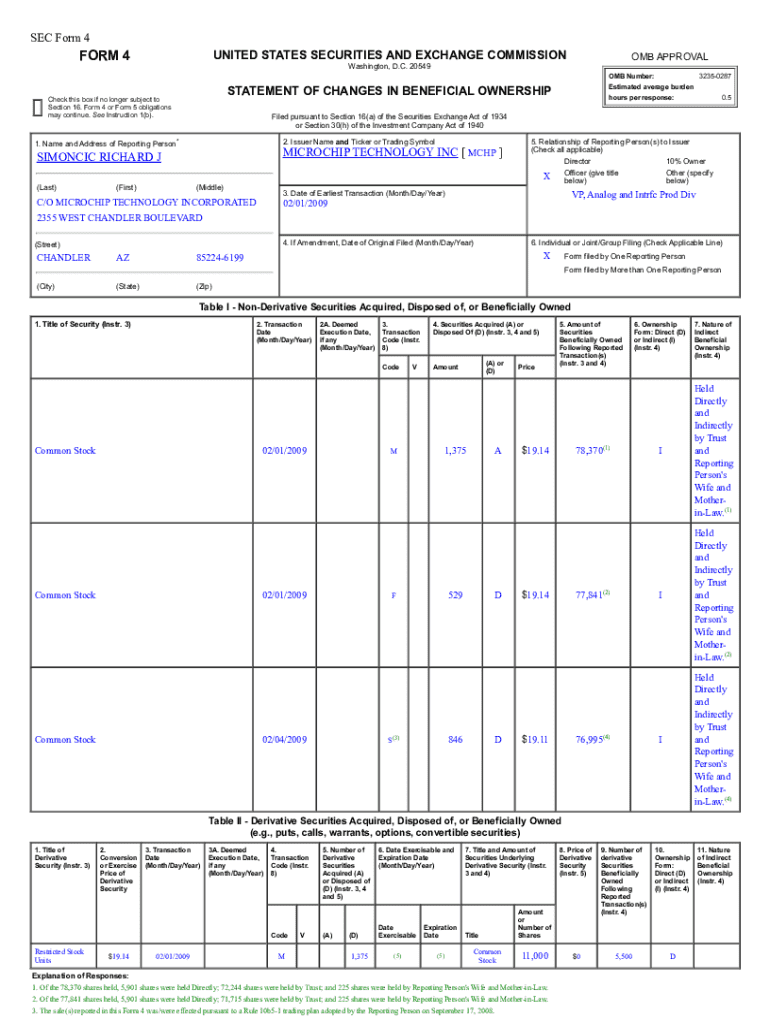

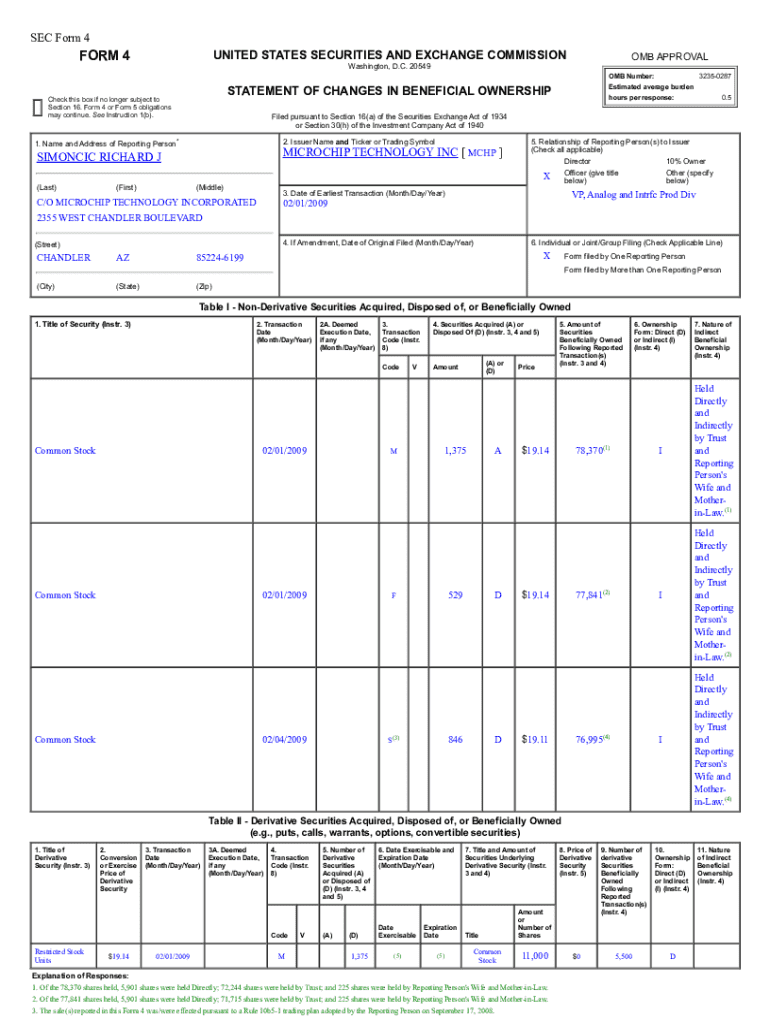

Overview of Sec Form 4

Sec Form 4 is a crucial document required by the U.S. Securities and Exchange Commission (SEC) to report changes in the ownership of securities by insiders of a company, such as executives and major shareholders. This form plays a significant role in ensuring transparency in the financial markets and protecting investors by disclosing timely information about insider trading activities.

The primary purpose of Sec Form 4 is to provide a comprehensive record of any changes in the ownership of equity securities by company insiders. This documentation is essential within the framework of securities regulation and aims to keep the investing public informed about the financial dealings of key figures within publicly traded companies.

Moreover, Sec Form 4 serves critical legal and regulatory implications. Non-compliance with the reporting requirements can lead to penalties for the insiders involved and could adversely impact the reputation of the company. Therefore, understanding the situations that necessitate filing this form is fundamental for those within the corporate landscape.

Detailed sections of Sec Form 4

Filing out Sec Form 4 can seem like an intricate task; however, understanding its detailed sections can simplify the process significantly. Each part of the form requires careful attention to detail to ensure compliance and accuracy in reporting.

Transaction codes

Transaction codes are the backbone of Sec Form 4, categorizing the nature of ownership transactions. They are crucial for distinguishing between various types of transactions performed by insiders.

Selecting the appropriate transaction code is vital for ensuring accurate reporting. It is essential to review the details of each transaction type before selecting the code that accurately represents your particular transaction.

Required information

Sec Form 4 contains several mandatory fields that must be completed accurately to avoid compliance issues. Most notably, the form includes sections for personal information, financial information, and supplemental information.

Before filling out Sec Form 4, it is advisable to gather all necessary documents such as transaction confirmations and personal identification to ensure that you have the accurate information needed.

Section-by-section guide to filling out Sec Form 4

Completing Sec Form 4 can be broken down into several vital steps. Following this orderly approach will minimize the risk of errors and enhance the efficiency of the filing process.

Step 1: Filling out personal information

Begin with providing personal information, including your name and company affiliation. It is essential to ensure that the name matches exactly how it appears in official company documents to avoid discrepancies.

Step 2: Providing your financial information

Next, accurately disclose all financial data, emphasizing the date of the transaction and the specifics of the securities involved. Ensure to cross-reference transaction records to avoid mistakes in reporting the volume and price of securities.

Step 3: Completing the supplemental information

In this step, you will fill out optional fields. However, it is advisable to include as much pertinent information as possible, as it may provide context to the SEC and improve understanding of your transaction.

Step 4: Reviewing your form

Prior to submission, take the time to thoroughly review your completed Sec Form 4. Ensure all entries are correct and consistent. Check for common pitfalls such as typos or data mismatches, and consider utilizing a checklist to systematically confirm the accuracy of your entries.

Editing and modifying Sec Form 4

Editing and modifying Sec Form 4 after initial submission might be necessary if errors are identified later. Common reasons for editing include incorrect transaction details or personal information inaccuracies. Understanding how to navigate changes efficiently can mitigate compliance risks.

To edit Sec Form 4 using pdfFiller, the process is straightforward. Start by accessing your form within the pdfFiller platform. Utilize the intuitive editing tools provided to update the necessary sections of the form.

Signing and submission of Sec Form 4

Once your Sec Form 4 is complete and reviewed for accuracy, it's time for submission. You have the option of signing electronically or manually. Understanding the nuances between these two methods enhances your awareness of compliance requirements.

To electronically sign Sec Form 4 securely using pdfFiller, make use of the eSign feature that streamlines the signing process, ensuring your signature is both valid and secure.

Lastly, send your completed Sec Form 4 to the appropriate regulatory bodies or directly to the SEC. Track the submission status and obtain confirmation if possible, as this ensures that you have fulfilled your compliance obligations timely.

Managing Sec Form 4 post-submission

After submission of Sec Form 4, it’s important to maintain a proactive approach to managing your documents. Regularly checking the status of your form and ensuring its acceptance by the regulatory agency is vital for compliance.

Should there be a need to update or amend your form after submission, it is crucial to know the procedures for doing so. Keeping your documents organized and establishing a version history using tools available through pdfFiller can significantly enhance document management and retention.

FAQs about Sec Form 4

Individuals may have numerous questions when filling out Sec Form 4, from common issues regarding form submission to specific inquiries related to transaction codes. Addressing these questions promptly can alleviate concerns and foster a clearer understanding of the filing process.

For troubleshooting common issues encountered during the disclosure process, consider familiarizing yourself with common errors such as incorrect signing, missing fields, or improper transaction codes.

For additional assistance, the SEC provides resources, and utilizing platforms like pdfFiller can also enhance your efficiency and accuracy when filling out the form.

Resources and references

For official guidelines regarding Sec Form 4, consulting the SEC’s website is crucial for understanding compliance requirements and procedural rules. Engaging with user testimonials on platforms like pdfFiller highlights the experiences of past users, establishing a context of reliability and effectiveness in handling the Sec Form 4 process.

Moreover, incorporating tools developed by pdfFiller can enhance the user experience significantly, providing features designed to streamline application and management of the form, backed by a cloud-based accessibility that allows for seamless document handling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sec form 4?

How do I execute sec form 4 online?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.