Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

How-to Guide Long-Read on Sec Form 4

Understanding Sec Form 4

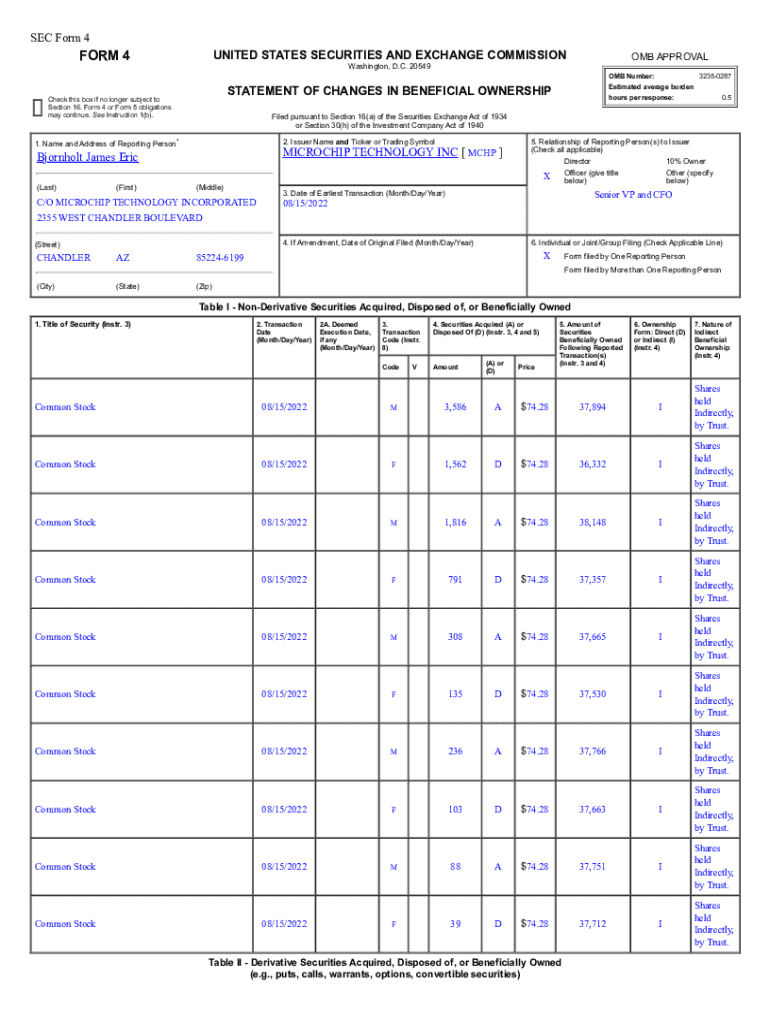

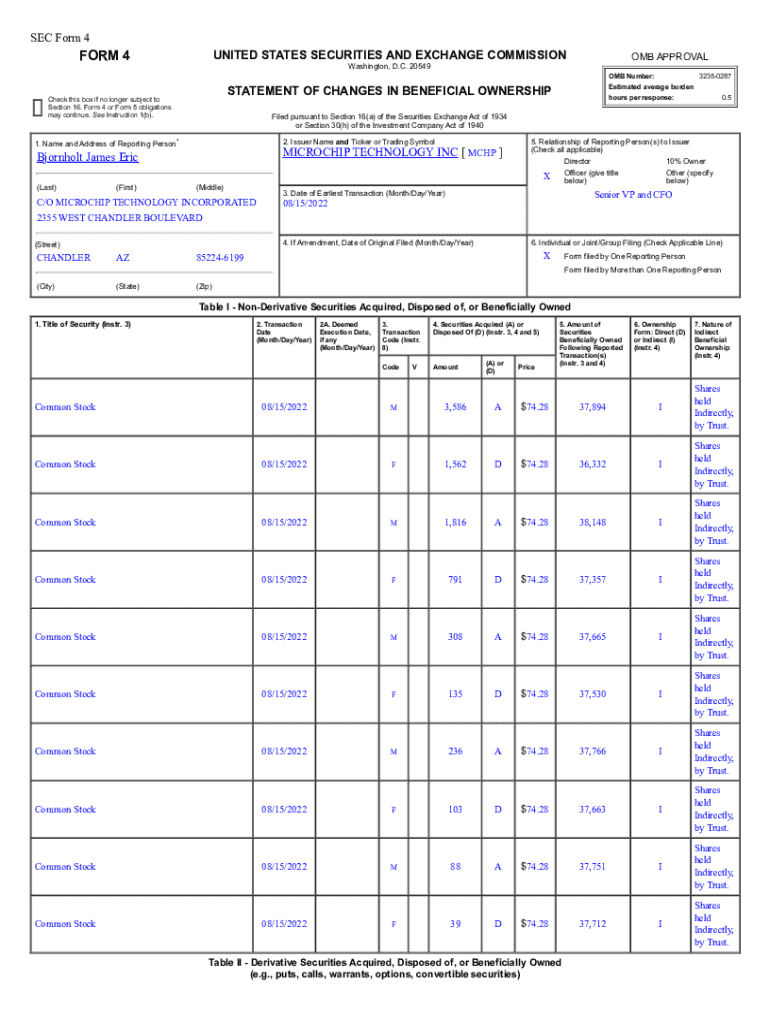

Sec Form 4, officially known as the 'Statement of Changes in Beneficial Ownership of Securities', is a critical document filed with the Securities and Exchange Commission (SEC) by insiders of publicly traded companies. This form is pivotal for ensuring transparency and maintaining the integrity of securities markets by allowing regulators and the public to track trades made by executives, directors, and major shareholders. As such, Sec Form 4 plays a significant role in the regulatory landscape, providing essential insight into the buying and selling of securities by those who have access to non-public information.

The importance of Sec Form 4 extends beyond mere regulatory compliance. It serves as a tool for shareholders and potential investors to gauge insider sentiment regarding the company’s health. Insider buying can be perceived as a positive signal, while selling may raise flags. Understanding Sec Form 4 is thus crucial for anyone interested in following market trends or investing in public companies.

Key features of Sec Form 4

Sec Form 4 covers a range of securities, including stocks, options, and other derivative instruments. Filers are required to disclose specific details regarding the nature of their transactions such as purchases, sales, and the underlying value of the securities in question. One of the key features of this form is its reporting requirements; insiders must complete and submit it within two business days after executing transactions that entail a change in their ownership interests. This rapid reporting cycle enhances market transparency.

Preparing to fill out Sec Form 4

Before diving into filling Sec Form 4, it’s essential to identify who needs to file it. The requirement primarily falls on individuals classified as insiders, which includes company executives, directors, and those with a stake of 10% or more in the company’s securities. However, there are exemptions for certain types of transactions, such as gifts or small sales, which are less than a specific monetary threshold. Understanding who qualifies for these exemptions can save individuals the headache of unnecessary reporting.

Gathering the necessary information is the next critical step in the preparation process. Filers must have access to their personal and financial information and be familiar with the transaction codes that correspond to different types of security transactions. For instance, codes are assigned for various actions such as acquisitions, disposals, and stock swaps, each serving a particular purpose in documenting the nature of the stock transactions accurately.

Step-by-step instructions for filling out Sec Form 4

Accessing Sec Form 4 is straightforward. The form can be found online via the SEC's EDGAR system, where it is available for viewing and downloading. For those who prefer a paper form, a PDF version can be downloaded from the SEC's website, allowing for offline completion. Make sure to download the most recent version to ensure compliance with current regulations.

Detailed breakdown of each section

The form encompasses several crucial sections that need to be filled out comprehensively. The cover page requires basic identifying information, such as the filer’s name, address, and the date of the filing. Ensuring accuracy here is vital as incorrect information can lead to compliance issues.

A critical part of Sec Form 4 is reporting transactions. It’s essential to understand the differences between various transaction codes; for example, 'P' indicates a purchase while 'S' denotes a sale. Equally important is the proper reporting of acquisitions versus disposals, ensuring clarity in the intended message of the filing. Finally, signatures and certifications are required to affirm the accuracy of the information provided, reinforcing the integrity of the submission.

Common mistakes and how to avoid them

Despite its structured format, many filers encounter common mistakes while completing Sec Form 4. One prevalent error is inaccuracies in reporting transaction codes. It’s crucial to double-check each entry to ensure it corresponds correctly to the specific financial activity being reported. Omissions of required information not only lead to confusion but may also incur regulatory scrutiny and penalties. Therefore, meticulous attention to detail is a must.

Another frequent issue relates to late filings. Failing to submit the form on time can lead to considerable consequences, including fines and potential legal issues with regulators. Establishing a workflow or schedule for submitting forms in a timely manner can significantly mitigate this risk. Best practices for ensuring timely submissions include maintaining an organized record of transactions as they occur and setting reminders for filing deadlines.

Utilizing pdfFiller for Sec Form 4

pdfFiller provides a seamless solution for individuals and teams looking to streamline the process of filling out Sec Form 4. The platform allows users to edit PDFs easily, ensuring that the final document accurately reflects all necessary information. Additionally, collaboration features enable teams to work together on submissions, facilitating quick and efficient workflows.

One of the standout features of pdfFiller is its eSign capability, which allows users to electronically sign documents. This feature speeds up approval processes and minimizes delays associated with traditional signing methods. With pdfFiller, users can manage all their documents in one cloud-based location, drastically improving the ease of access and tracking.

Step-by-step guide to using pdfFiller for Sec Form 4

Using pdfFiller is an efficient way to fill out Sec Form 4. The process begins by uploading the form to the platform. This step allows you to convert the PDF into an editable format, ensuring that all necessary fields are easily accessible.

Following the upload, users can edit sections for accuracy. The platform’s tools facilitate adding or correcting information, ensuring compliance with filing requirements. Once completed, the form can be saved and stored directly on the platform, allowing for easy retrieval in the future. Moreover, users can share the document with others for collaboration, making it an ideal solution for teams.

Real-world examples and case studies

Examining successful filings of Sec Form 4 can provide remarkable insights into best practices. Many companies have embraced transparent information disclosure, leading to higher investor confidence and improved market performance. For instance, insiders who consistently file their forms promptly and accurately tend to create a more favorable image among shareholders.

Conversely, analyzing mistakes made in past filings highlights the importance of accuracy and timely submissions. Learning from the experiences of others provides valuable lessons on the significance of meticulous record-keeping and adherence to deadlines. Engaging in these case studies can shape a more disciplined approach to regulatory compliance.

Staying updated on regulatory changes

The regulatory landscape surrounding Sec Form 4 is subject to change, impacting the way insiders must report their beneficial ownership. Recent updates may include adjustments in filing deadlines or changes in what constitutes reportable transactions. Staying informed is critical for compliance and to mitigate any risks associated with non-compliance.

Resources such as the SEC's website, industry newsletters, and compliance alert services can serve as excellent tools for ongoing education. Tracking these changes not only ensures timely compliance but also enhances one's understanding of the market.

Engaging with the community

Participating in online forums and support groups can be invaluable for those navigating the complexities of Sec Form 4. Communities composed of similarly situated professionals frequently gather to discuss insights and share experiences related to filing requirements. These platforms can offer quick answers to pressing questions and provide a sense of camaraderie among fellow filers.

Leveraging social media platforms further aids in sharing insights and resources. Groups focused on compliance and securities can be found on platforms like LinkedIn and Twitter. Engaging with these communities enhances the learning experience and fosters valuable networking opportunities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 4 directly from Gmail?

How do I edit sec form 4 in Chrome?

How can I edit sec form 4 on a smartphone?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.