Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

A Comprehensive Guide to SEC Form 4: Filing Made Easy with pdfFiller

Understanding SEC Form 4

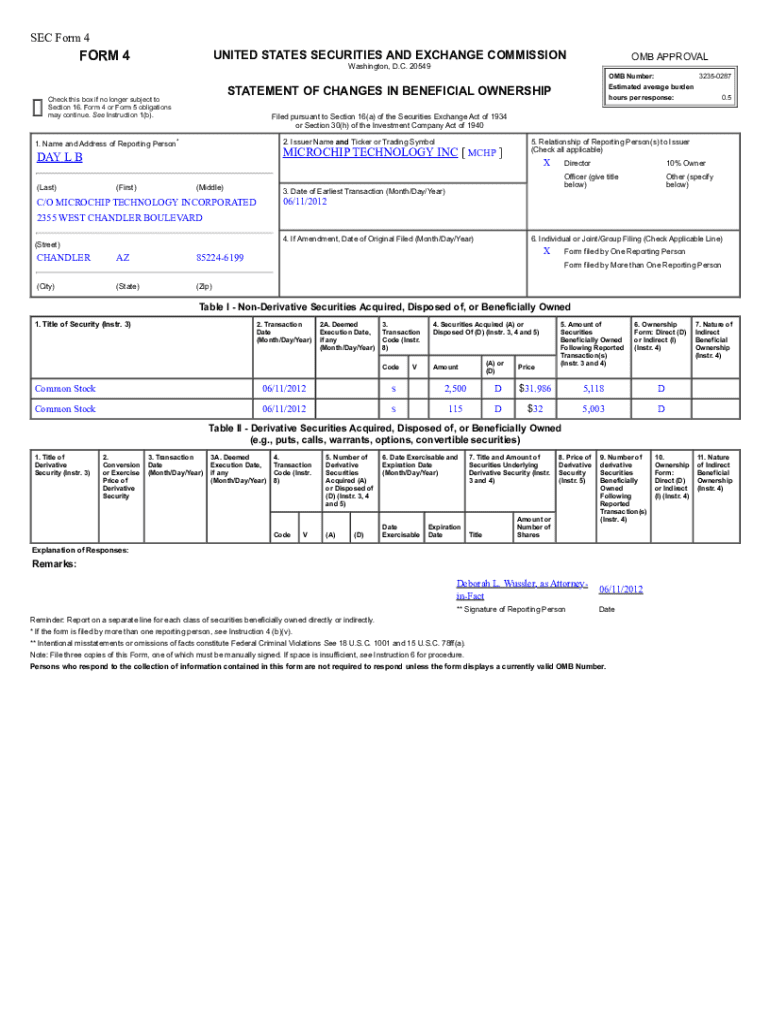

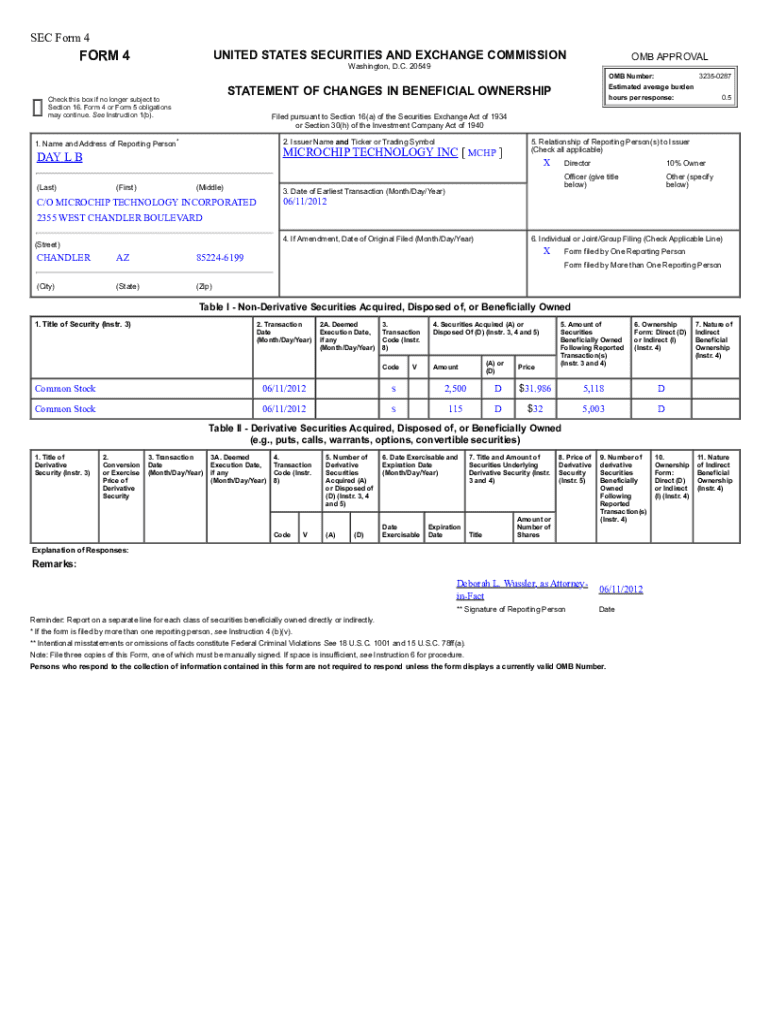

SEC Form 4 is a critical document required by the U.S. Securities and Exchange Commission (SEC) for reporting changes in the ownership of equity securities by certain insiders of publicly traded companies. This includes company officers, directors, and significant shareholders who own more than 10% of a company's shares. The information reported helps maintain transparency in the financial markets, offering insights into how insiders are managing their loyalty to the company.

The importance of SEC Form 4 lies in its role in preventing fraud and abuse of insider information. By mandating that changes in ownership are disclosed, the SEC creates a more level playing field for all investors, ensuring that material information is accessible to everyone.

Key components of SEC Form 4 include details about the insider, the type of transaction being reported, and the number of shares acquired or disposed of. Accurately filled SEC Form 4 submissions provide crucial data points that contribute to wider financial analyses and trends.

Who Needs to File SEC Form 4?

The primary filers of SEC Form 4 are officers, directors, and beneficial owners who hold more than 10% of a class of the company’s equity securities. These individuals are often referred to as 'insiders' due to their intimate knowledge of the company and its operations. The SEC requires them to file this form within two business days following any relevant transaction.

Certain situations mandate the filing of SEC Form 4, including purchases, sales, and gifts of securities. Each transaction must be reported regardless of whether it is a purchase or sale; thus, even a minor transaction requires submission to ensure compliance with regulations.

Detailed breakdown of SEC Form 4 sections

Completing SEC Form 4 involves various sections that must be carefully filled out to reflect accurate information. The first section is 'Filer Information.' Here, the filer must provide personal details such as their name, address, and relationship with the issuer. Accuracy at this point is vital, as it sets the tone for all subsequent disclosures.

Next, the 'Reporting Owner Information' section identifies the ownership and relationship with the issuing company. This ensures clarity and transparency about who is making the report. The 'Transactions Section' outlines the specific nature of the transactions that must be reported, including purchase and sale of securities. Key transaction codes must also be accurately reported, such as Code A for acquisitions and Code D for dispositions of securities.

Step-by-step guide to completing an SEC Form 4

Completing an SEC Form 4 requires careful preparation. Prior to filling out the form, gather all necessary information and documents, including ownership records, transaction histories, and personal identification details. Organizing a user-friendly digital workspace ensures a smooth filing process.

When filling out the form, adhere to detailed instructions for each section. It is essential to double-check entries to avoid common errors, such as misreporting transaction numbers or codes. An example of a completed SEC Form 4 can be invaluable as it provides a clear visual reference for accuracy.

Electronic filing of SEC Form 4

Electronic filing of SEC Form 4 significantly enhances the efficiency and accuracy of the filing process. Utilizing digital tools allows filers to submit their reports promptly, avoiding the risks associated with manual filing. pdfFiller offers various tools that simplify the electronic signing and submission, which is especially beneficial for busy insiders.

For optimal electronic filing, it is important to familiarize oneself with pdfFiller's comprehensive features, which streamline the filing process. Following simple stepwise instructions via pdfFiller not only eases the process but ensures that submissions are timely and compliant with SEC regulations.

Common mistakes to avoid when filing SEC Form 4

Filers must be vigilant to avoid common pitfalls when submitting SEC Form 4. Misreporting ownership and transaction data can lead to severe consequences, including regulatory scrutiny. It is equally vital to ensure submissions are made within the required timeframes, as late filings may incur penalties that can tarnish reputations or affect market perceptions.

Failing to follow up on confirmed filings can also result in discrepancies. Filers should maintain a proactive approach to their submissions, ensuring documentation is complete and accurate post-filing.

Resources for further assistance

For additional support in navigating SEC Form 4, pdfFiller provides tools that aid in filling and managing the form. Its features enhance the usability of the form, ensuring that users can edit, sign, and submit documents effortlessly from any location. Furthermore, accessing resources from regulatory bodies can provide further clarification on filing guidelines.

Engaging with community forums and expert advice channels can also be invaluable, as they provide insights from experienced users and professionals who specialize in SEC filings. Making use of these resources can bolster users' confidence when dealing with compliance matters.

Understanding the implications of non-compliance

The consequences of failing to file SEC Form 4 accurately or on time can be significant. Regulatory penalties may be imposed, which could include fines and potential criminal charges in severe cases. Moreover, the long-term damage to a company’s reputation can occur when insiders fail to uphold compliance standards, creating distrust within the investor community.

Maintaining compliance in business practices surrounding SEC Form 4 is essential not just for individual filers but also for the credibility of the entire organization. Companies must foster a culture of transparency and accountability to mitigate risks associated with non-compliance.

Best practices for document management with SEC Form 4

Effective document management strategies are key to ensuring a smooth filing experience for SEC Form 4. Using pdfFiller's collaborative features allows for teamwork, enabling multiple contributors to work on the same document seamlessly. This eliminates chances for miscommunication and errors which may arise from manual handling of forms.

Cloud storage further enhances document management by offering easy access and sharing capabilities. By regularly updating records and tracking transactions, insiders can maintain accurate and up-to-date information, which is integral to the preparation of timely and correct filings.

Frequently asked questions (FAQs) about SEC Form 4

Many individuals have queries regarding SEC Form 4, particularly concerning filing and compliance. Common questions include 'What transactions must be reported?' and 'How do I handle complex filings?' Addressing these queries ensures that filers can navigate any uncertainties they may encounter.

It’s vital to clarify specifics of transaction reporting as each situation may require different considerations. Additionally, for unusual situations, seeking professional advice can be a prudent step to ensure compliance is maintained.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sec form 4?

Can I create an electronic signature for signing my sec form 4 in Gmail?

How do I edit sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.