Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding Sec Form 4: A Comprehensive Guide

Overview of Sec Form 4

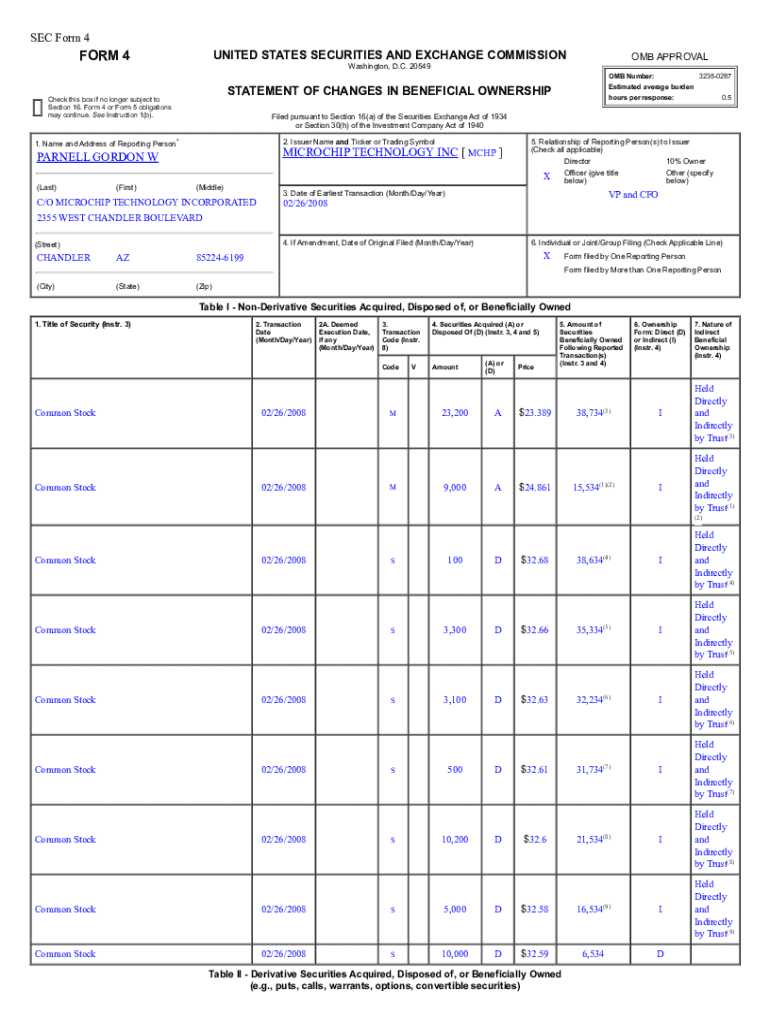

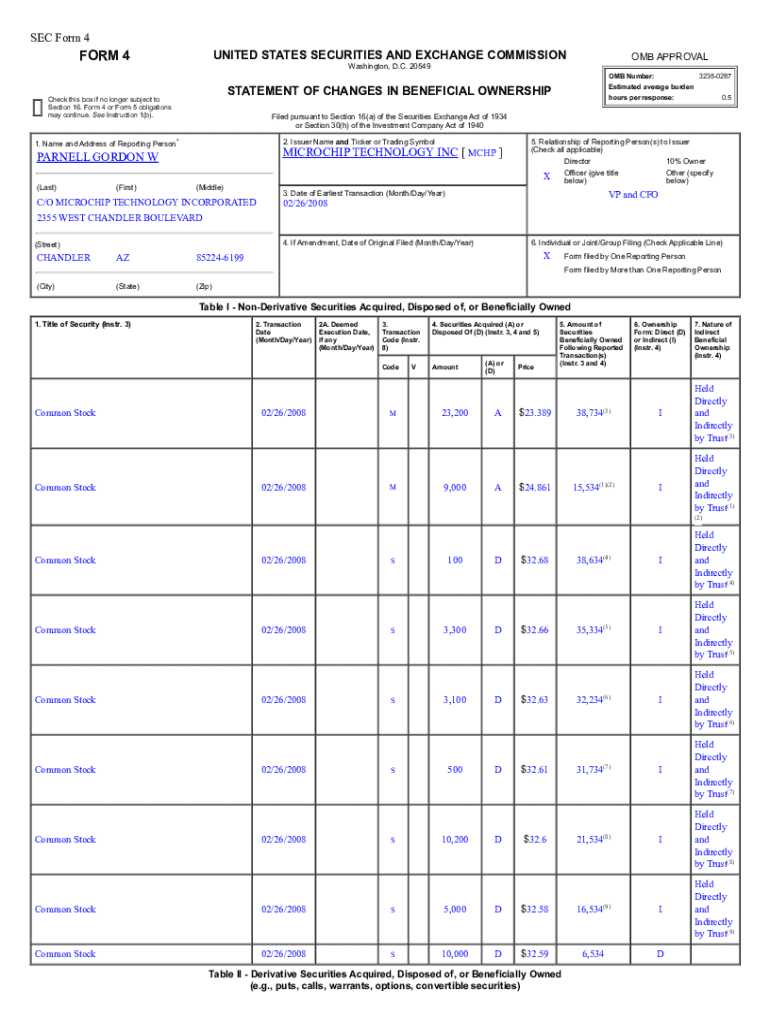

The SEC Form 4 is a critical document used in securities regulation, primarily designed to report changes in the holdings of company insiders. Specifically, Form 4 is required by the Securities and Exchange Commission (SEC) when directors, officers, or beneficial owners of a company register a transaction of their securities. This ensures transparency and provides stakeholders with essential information regarding insider trades.

Understanding its importance is crucial for maintaining trust in the financial markets. Filing Form 4 helps prevent insider trading and gives investors insights into how insiders are managing their investment portfolios. This timely reporting mechanism plays a vital role in maintaining market integrity.

Who needs to file Sec Form 4?

Filing Sec Form 4 is mandatory for certain individuals and entities that are classified as insiders. Generally, those required to file include corporate officers, directors, and shareholders who own more than 10% of a company’s stock. This tight framework ensures that all significant changes to securities ownership are made public, thereby upholding accountability.

Beyond sole proprietors, various types of entities like investment companies or limited liability companies (LLCs) with insider ownership responsibilities also fall under this requirement. Ensuring compliance with Sec Form 4 is paramount for maintaining legal and ethical standards in corporate governance.

Detailed breakdown of Sec Form 4

The structure of Sec Form 4 is designed for clarity and efficiency. It generally consists of several key components, which are structured to guide filers through the necessary information submissions. Each section aims to delineate different aspects of the security being reported, which ensures transparency and accuracy in reporting.

Key sections of the form include: 1. **Personal Information:** Basic identifying details of the filer. 2. **Description of Securities:** This defines the type of securities involved in the transaction, such as common stock or options. 3. **Transaction Dates:** Specific dates when the transactions occurred, which are crucial for maintaining accurate records. 4. **Ownership Changes:** Detailed reporting on how insider ownership has changed, including the amount sold or purchased.

Transaction codes and their meanings

Each transaction reported on Sec Form 4 must include specific codes that categorize the type of transaction conducted. These codes are essential for the SEC and the public to interpret the reported activity correctly. The various transaction codes can include: 1. **P:** Purchase of securities. 2. **S:** Sale of securities. 3. **D:** Disposition of securities. 4. **A:** Acquisition of securities as a gift or inheritance.

Accurate transaction coding is not just a mere formality; it significantly affects how transactions are interpreted and audited. Misclassifying a transaction can lead to regulatory scrutiny and potential penalties, underscoring the importance of diligence every step of the way.

Step-by-step instructions for completing Sec Form 4

Filling out Sec Form 4 can seem daunting, but by breaking it down into manageable steps, individuals can streamline the process significantly. Before starting, ensure you gather all required documentation and information.

Preparation steps include: - Collecting personal identifying information. - Reviewing past filings for consistency. - Retrieving broker transaction records.

Here is a detailed guide on filling out each section of Sec Form 4: 1. **Personal Information:** This section should include your name, address, and relationship to the reporting company. 2. **Details About Transactions:** Clearly state the dates of purchase or sale, as well as the number of securities involved. 3. **Verifying Ownership Claims:** Accurately declare your changes in ownership, ensuring all discrepancies are addressed. This includes carefully calculating total securities held before and after the transaction.

Common mistakes to avoid

When completing Sec Form 4, filers often encounter similar pitfalls that can easily compromise accuracy and compliance. Common mistakes include: - Incorrectly entering transaction dates, leading to potential discrepancies later. - Misreporting the type of transaction performed. - Failing to keep a record of transactions which creates gaps in reporting.

To minimize errors, it’s essential to double-check all entries and maintain a pre-filing checklist. Using digital platforms, such as pdfFiller, can provide templates and validation tools that help guide users in completing the form correctly.

Editing and managing Sec Form 4

Managing forms effectively can make a significant difference in compliance and operational efficiency. Utilizing pdfFiller for editing Sec Form 4 offers a range of benefits for individuals and teams looking to improve workflow. The cloud-based nature of pdfFiller allows users to access their documents anytime, anywhere, enhancing flexibility.

Key features include: - **Collaboration Tools:** Multiple individuals can work on the same document in real time. - **eSigning Capabilities:** Ensuring that transactions are authenticated and legally binding.

For exporting completed forms, pdfFiller provides various formats, ensuring that users can save their documents securely. It’s vital to safeguard sensitive information during export by utilizing encryption and secure sharing options available through the platform.

Interactive tools and support

Engaging with interactive form tools can greatly ease the process of filling out Sec Form 4. pdfFiller offers an array of user-friendly features that streamline document creation. Integration of video tutorials and visual aids allows users to understand how to complete forms effectively, further enhancing the experience.

When it comes to nuances in filing, seeking professional assistance can be beneficial, especially for intricate transactions. Resources for finding expert help, including legal advisors familiar with SEC regulations, can provide necessary guidance when complexities arise.

Post-filing considerations

After filing Sec Form 4, understanding the review process is important. Once submitted, the information undergoes review by the SEC, which may take time, depending on the specifics of the transaction and workload at the commission. Keeping a record of your submissions, along with any confirmations received, plays a substantial role in compliance.

In 2023, ongoing regulatory changes are adding dimensions to Sec Form 4 filings. Current trends indicate heightened scrutiny on insider trading practices, elevating the importance of detailed reporting. Case studies demonstrating recent instances of legal consequences for failures in compliance illustrate the real-world applications of proper form management and its implications for corporate health.

FAQs about Sec Form 4

Readers often have questions concerning Sec Form 4, especially regarding submission and compliance timelines. Common queries include: 1. **What is the filing deadline for Form 4?** It must typically be filed within two business days of the transaction. 2. **What happens if a form is filed late?** Late filings can incur penalties and impact reputational standing. 3. **Can I amend a filed Form 4?** Yes, amendments can be made by filing a new Form 4 which specifies it’s an amendment.

Addressing these concerns proactively can prevent issues down the line. Understanding deadlines and the need for accuracy will put you in a better position as you navigate the reporting requirements inherent to Sec Form 4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sec form 4 directly from Gmail?

How do I edit sec form 4 in Chrome?

Can I create an eSignature for the sec form 4 in Gmail?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.