Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

How to edit sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Sec Form 4: A Comprehensive Guide to Filling Out the SEC Form 4

Understanding SEC Form 4

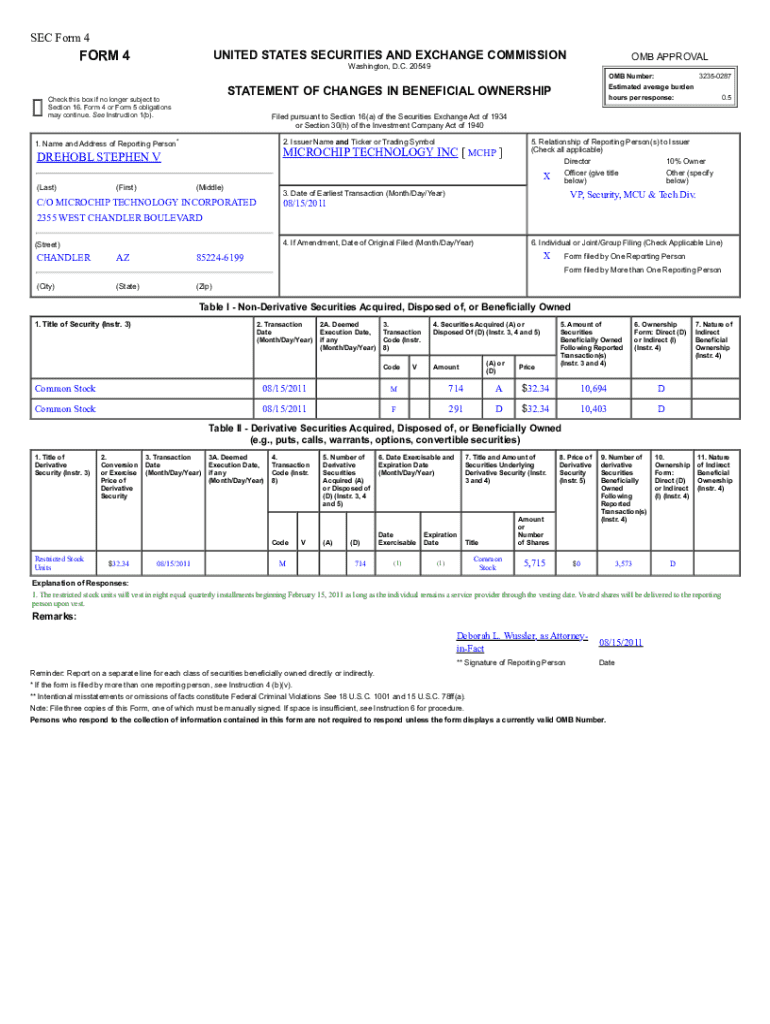

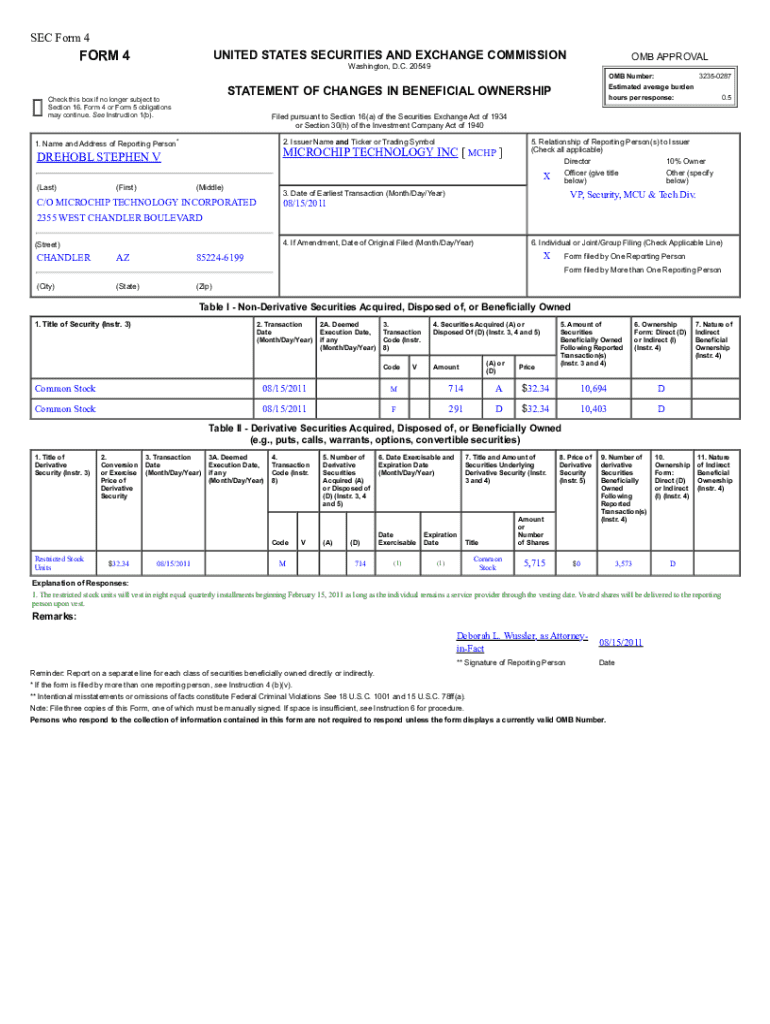

SEC Form 4 is a crucial document that insiders of publicly traded companies file with the U.S. Securities and Exchange Commission (SEC) to report their transactions in company equity securities. The purpose of this form is to maintain transparency and enable investors to track insider trading activities, which can provide valuable insights into the management’s confidence in the company.

The importance of SEC Form 4 in corporate governance cannot be underestimated. It plays a vital role in ensuring that company insiders do not manipulate stock prices by obscuring their trading activities. This transparency is essential for protecting the interests of all shareholders. But who is required to file this form? Typically, corporate officers, directors, and any shareholders owning more than 10% of the company's equity securities must file SEC Form 4 whenever they buy or sell the company's stock.

Key components of SEC Form 4

Understanding the key components of SEC Form 4 is necessary for anyone tasked with filling it out. The document requires specific information, including the reporting person’s details, their relationship to the issuer, and the precise nature of the transactions. This ensures that all involved parties are clearly identified and that the transaction details are transparent.

Breaking down each section further, the form requests transaction dates, the amount and type of securities transacted, and ownership details. This comprehensive information helps the SEC monitor insider trading activities and maintain an equitable market environment. Key terminology, such as ‘beneficial ownership’ and 'direct transaction,' is also defined to enhance understanding.

Navigating the filing process

Filing SEC Form 4 can seem daunting, but following a structured approach can simplify the process considerably. Start by gathering all necessary information, such as the reporting person's identity, transaction details, and the type of securities involved. It’s crucial that you have clean, organized data ready before starting the filing process.

Next, access the SEC's EDGAR system, an online platform where filings are made. After logging in, complete SEC Form 4 by filling out each required section accurately. Don’t forget to review all the details before submission. Finally, file the form and expect confirmation from the SEC, which acts as proof of your submission. To avoid any painful mistakes, double-check your figures and be mindful of filing deadlines, as late submissions can lead to penalties.

Transaction codes and their significance

Transaction codes are specific notations used in SEC Form 4, each representing a different type of transaction. Understanding these codes is critical for accurate reporting. For instance, Code A signifies a direct purchase of shares, while other codes like Code C indicate the acquisition of shares through a retirement option.

Using the correct transaction codes is important because inaccuracies can lead to misinformation and potentially more significant legal issues. Familiarity with the range of different codes is recommended. Codes are not just a matter of record-keeping; they provide context about the transaction, which is vital for maintaining investor trust and market integrity.

Resources for completing SEC Form 4

Completing SEC Form 4 can be streamlined significantly with the right tools and resources. Several software options facilitate efficient form completion; look for PDF editors, eSigning platforms, and document management solutions that allow for seamless integration into your workflow. These tools help in storing, editing, and managing forms securely.

Moreover, downloadable templates can serve as a guide. Sample completed SEC Form 4 documents provide real-world examples of how the form should look when filled out correctly. Access official SEC guidance through FAQs and user manuals for further assistance. Utilizing these resources can save time and ensure accuracy during the filing process.

Common mistakes to avoid

Even seasoned professionals can make mistakes when filing SEC Form 4. Common errors include failing to meet filing deadlines and providing inaccurate information, which can result in significant penalties. Late filings are closely monitored, as they can severely affect market perceptions and investor trust.

Best practices include establishing a routine to review and verify all information before submission. Utilizing platforms like pdfFiller can enhance accuracy and compliance, as these solutions often include specialized features designed to double-check entries and ensure every requirement is met.

Managing your SEC Form 4 documentation

Proper documentation management is essential after you have filed SEC Form 4. Digital document management systems help in storing your submissions safely, allowing for easy retrieval whenever required. Utilizing these systems ensures secure access and promotes collaboration when working in teams.

In instances where errors are discovered post-filing, understanding procedures for amending or resubmitting the form is crucial. Knowing when and how to amend ensures compliance with regulations and upholds the integrity of the filing process, maintaining a thorough record of all transactions and communications.

Frequently asked questions (FAQs)

Having clarity on SEC Form 4 can reduce anxiety for filers, which is why FAQs are incredibly helpful. One common question is how often SEC Form 4 must be filed, which is typically whenever there is a transaction involving stock purchased or sold. It's important to note that a missed deadline can lead to fines and other consequences.

Delegating filing responsibilities can also raise questions; it is indeed possible but requires careful consideration and trust in the appointed individuals. This approach can save time but also necessitates proper oversight to ensure compliance and accuracy.

Additional tools provided by pdfFiller

pdfFiller offers an array of tools tailored to streamline the SEC Form 4 filing process. With intuitive features like eSigning capabilities and real-time editing, users can work collaboratively on documents, ensuring everyone remains informed and engaged throughout the filing process.

This centralized platform reduces the chances of miscommunication and enhances compliance through effective document management tools. Users can efficiently manage their documents from any device, dramatically reducing the time spent on form preparation and submission.

Importance of compliance and transparency

SEC Form 4 plays a vital role in maintaining the integrity of capital markets. Compliance with SEC regulations fosters an environment of accountability and transparency, ensuring that insider trading does not compromise the trust placed in the market by investors.

Accurate filing of SEC Form 4 underpins not just individual companies but the overall health of financial markets. Non-compliance can lead to severe repercussions, including fines and diminished investor confidence. The trust investors place in financial reporting is paramount, and maintaining it is essential for the long-term success of any publicly traded company.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sec form 4 to be eSigned by others?

How do I edit sec form 4 in Chrome?

How do I fill out sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.