Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Comprehensive Guide to SEC Form 4: Understanding, Filing, and Best Practices

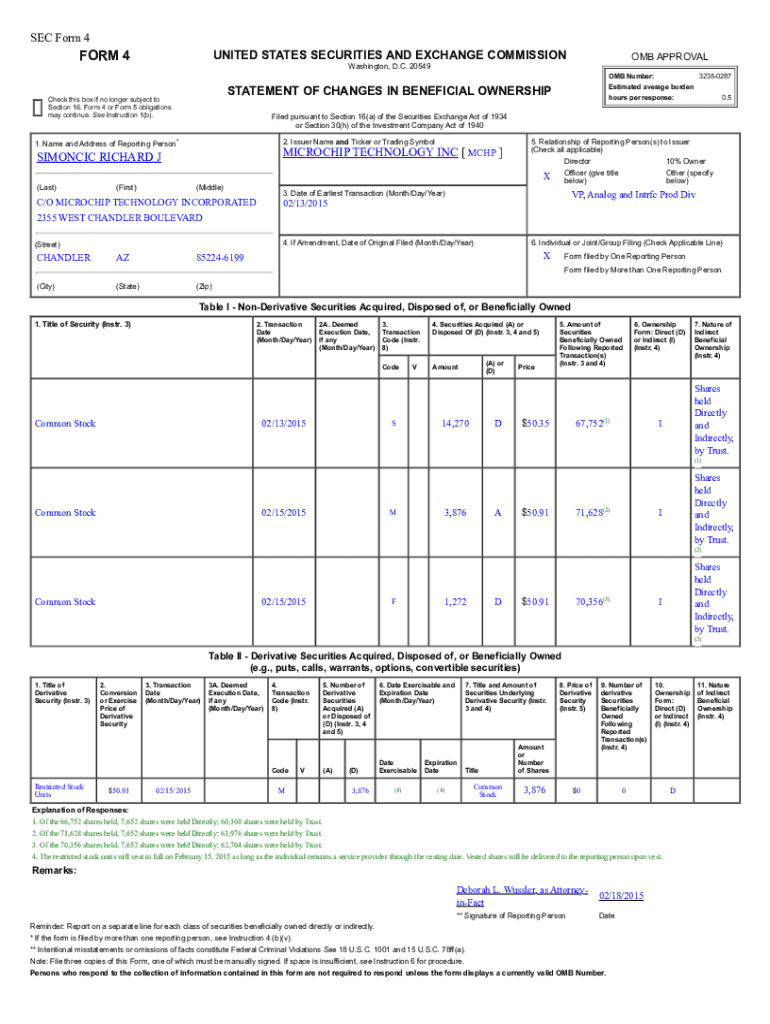

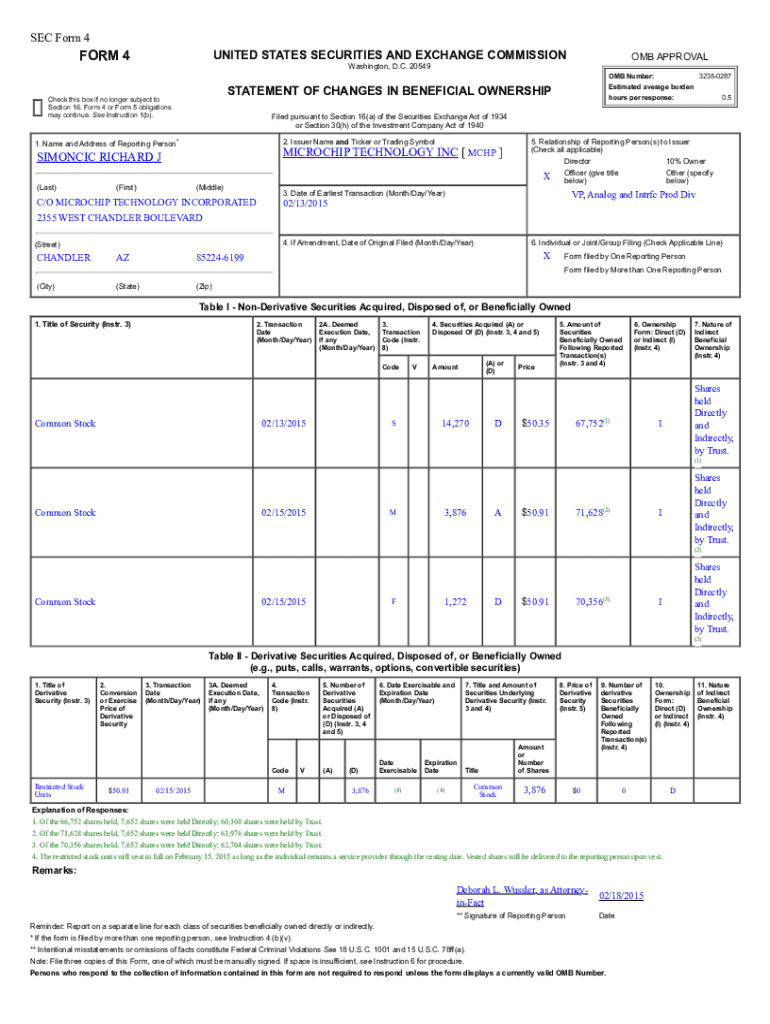

Understanding SEC Form 4

SEC Form 4 is a critical document in the realm of securities trading, specifically designed for corporate insiders. It serves to inform the public about the transactions made by these insiders in their company's securities. The purpose of this form is to promote transparency and reduce the risk of insider trading exploitation.

Key elements of SEC Form 4 include information about the transactions, such as transaction dates, nature of the transaction, and the amount of securities involved. This form is significant as it holds insiders accountable for their trading activities, ensuring that investors have the necessary information to make informed decisions.

Who needs to file SEC Form 4?

Filing SEC Form 4 is mandatory for corporate insiders, which include officers, directors, and significant shareholders of publicly traded companies. These individuals need to report any changes in their holdings of the company's securities. Timely reporting is crucial, as it helps maintain transparency in the market and provides investors with real-time data about stock ownership changes.

The SEC requires Form 4 to be filed within two business days of the transaction date. This strict timeline underscores the importance of quick reporting in upholding investor confidence and trust in market fairness.

Detailed breakdown of SEC Form 4

Understanding the structure of SEC Form 4 can simplify the filing process. The document is divided into several key sections, each with specific information that needs to be disclosed:

These sections work together to provide a clear picture of all trading activity conducted by insiders, ensuring market participants are kept informed.

Common transaction codes

SEC Form 4 uses specific transaction codes to categorize different types of transactions. Understanding these codes is essential when filling out the form to accurately reflect the nature of the insider's trading activities. The most commonly used transaction codes include:

Utilizing these codes correctly ensures that the transactions are adequately reported, maintaining full compliance with SEC regulations.

Step-by-step instructions for filling out SEC Form 4

Filling out SEC Form 4 can be straightforward if you follow a step-by-step approach. Here’s how to prepare and complete the form effortlessly:

Best practices for filing SEC Form 4

Ensuring compliance with SEC regulations when filing Form 4 is of the utmost importance. Here are some best practices to keep in mind:

Utilizing advanced document management solutions can greatly enhance your filing experience. pdfFiller helps streamline the process with features that allow for effortless editing, eSigning, and team collaboration, providing a holistic solution for managing SEC Form 4.

Troubleshooting common issues

Filing SEC Form 4 is crucial, yet errors can happen. It's essential to be vigilant about potential mistakes. Here’s a list of common errors to look out for when filing:

If you discover an error after submitting SEC Form 4, it’s crucial to understand how to correct it. Amendments can be made by filing a new Form 4 that identifies the original filing and specifies the correct information.

Resources for further assistance

For those seeking in-depth knowledge about SEC Form 4, accessing official guidelines and regulations is essential. The SEC website offers comprehensive resources and filing instructions for all their forms, including Form 4.

pdfFiller also provides additional tools, such as templates for various SEC forms, tracking features for changes and submissions, and an all-in-one online platform. Utilizing such tools can enhance your document management and filing efficiency.

Conclusion of the guide

Filing SEC Form 4 accurately and promptly is crucial for maintaining integrity in the capital markets. By understanding the requirements, implementing best practices, and utilizing efficient tools like pdfFiller, filers can navigate the complexities of compliance with ease. Embracing these practices not only ensures adherence to regulations but also promotes transparency within the investing community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the sec form 4 in Chrome?

How do I edit sec form 4 on an iOS device?

How do I edit sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.