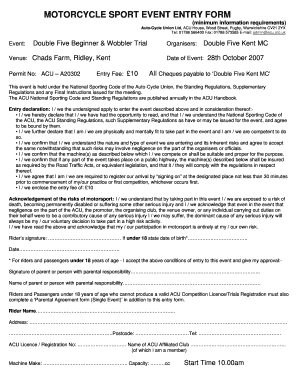

Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

How to Complete Form 10-Q: A Comprehensive Guide

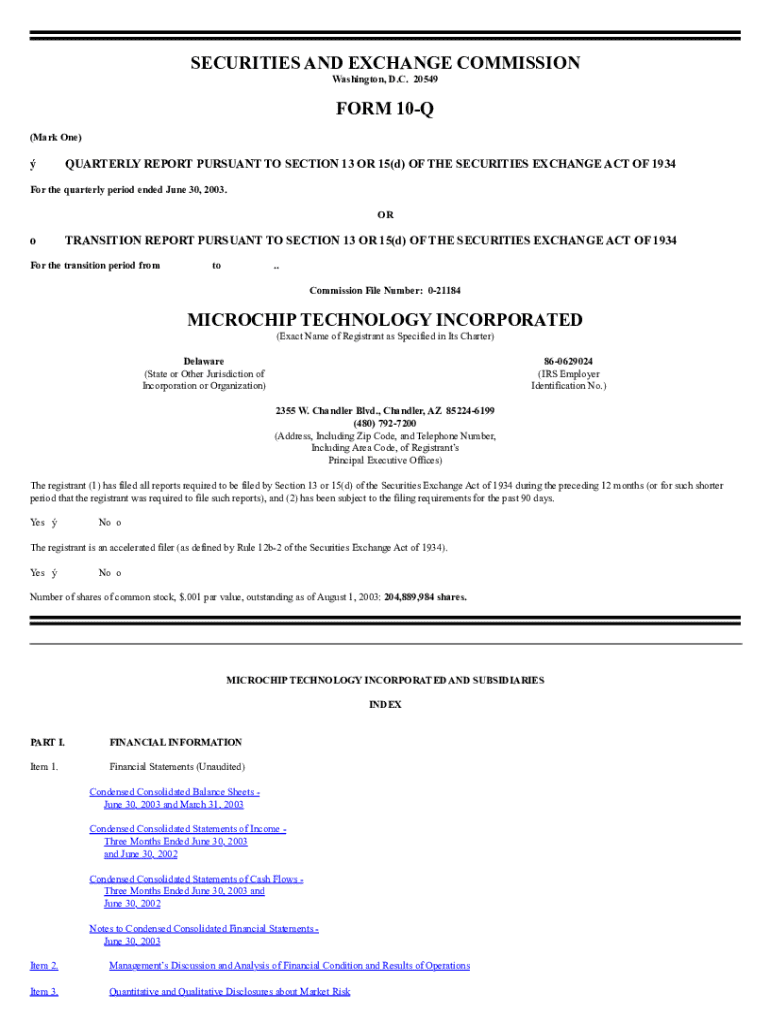

Understanding Form 10-Q

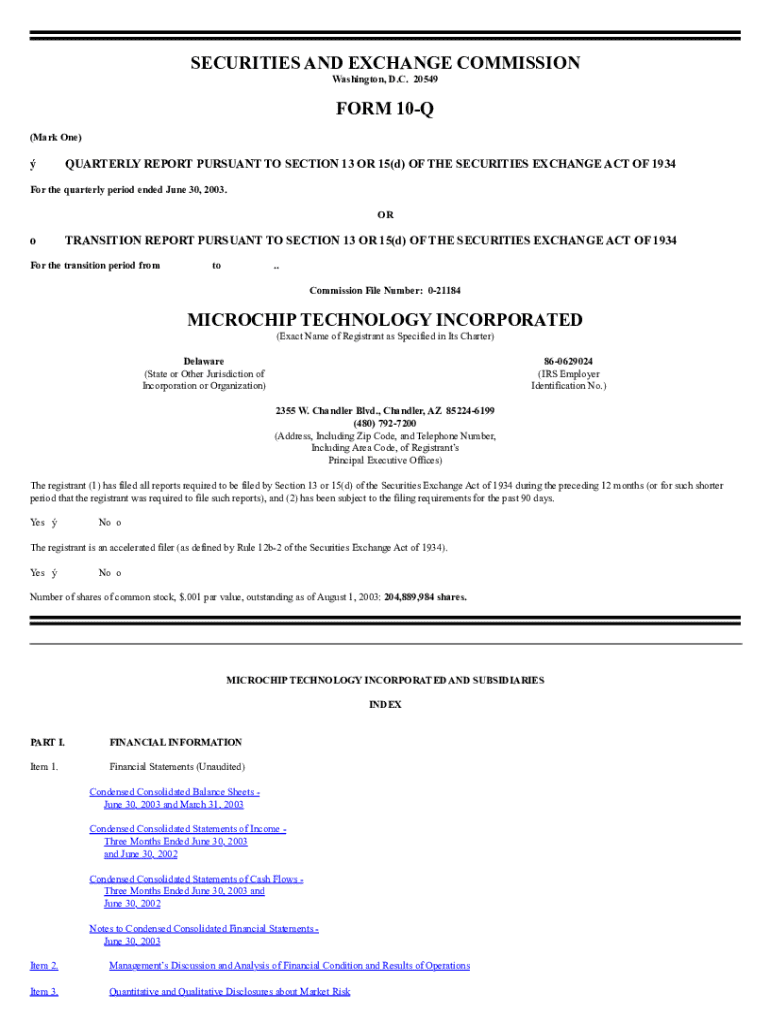

Form 10-Q is a quarterly financial report required by the U.S. Securities and Exchange Commission (SEC) to provide essential updates on a publicly traded company's financial status. Unlike the more comprehensive Form 10-K, which is submitted annually, the Form 10-Q offers a snapshot of a company’s recent performance and operational changes with an emphasis on quarterly results.

This form serves a critical role in ensuring transparency and accountability for companies in the public sphere. While Form 10-K includes detailed analyses over a longer period, Form 10-Q focuses on the most recent quarter, offering investors an immediate insight into a company’s financial health and operational activities.

Why is Form 10-Q important?

Form 10-Q plays a pivotal role in the investment landscape. For investors, it provides timely updates that influence decision-making. It contains interim financial statements that can serve as indicators of a company's quarterly performance, allowing stakeholders to stay informed about its direction and financial health.

Moreover, compliance with Form 10-Q filing is not just good practice; it's a regulatory requirement. Companies that fail to adhere to these guidelines may face serious consequences, such as penalties from the SEC and reputational damage in the eyes of investors. Hence, the significance of this form extends well beyond mere compliance—it fundamentally impacts investor trust and market performance.

Key components of Form 10-Q

A typical Form 10-Q includes several vital sections, each contributing to a comprehensive overview of a company's ongoing financial condition. These sections are mandated by the SEC and provide investors with critical insights.

Filing requirements for Form 10-Q

Identifying who must file Form 10-Q is critical for compliance. All publicly traded companies are required to file this form quarterly. This requirement is enforced by the SEC to ensure that adequate information is available to investors.

The deadlines for filing Form 10-Q are also stringent. Companies typically must file within 40 to 45 days after the end of the fiscal quarter, depending on their market capitalization. Adhering to these deadlines is not merely procedural—late filings can lead to significant penalties and eroded investor confidence.

Step-by-step guide to completing Form 10-Q

Completing a Form 10-Q does not have to be overwhelming. Following a structured approach can simplify the process. Below, we outline a step-by-step guide to effectively completing this essential document.

Resources and tools for form completion

Utilizing appropriate resources can significantly streamline the completion of Form 10-Q. For example, pdfFiller offers a user-friendly platform that simplifies document creation and management, making it easier for businesses to focus on their content rather than the intricacies of form completion.

The platform includes features such as e-signatures, cloud-based collaboration tools, and templates specifically designed for Form 10-Q. This ensures that multiple stakeholders can contribute efficiently and securely.

Common questions and troubleshooting

Navigating the intricacies of Form 10-Q can lead to various questions and uncertainties. Familiarizing yourself with common issues can enhance the filing experience.

Practical examples and case studies

Learning from real-world examples can offer invaluable insights into effectively completing the Form 10-Q. Reviewing successful submissions can reveal what makes them effective, while analyzing less successful ones can help understand common pitfalls.

Conclusion: Mastering your 10-Q submission

Completing Form 10-Q requires attention to detail, thorough understanding, and timely execution. Recognizing its importance in the broader financial reporting landscape is essential for companies aiming to establish trust and maintain transparency with stakeholders.

By following structured guidelines, utilizing effective tools like pdfFiller, and remaining vigilant about compliance, individuals and teams can master the art of Form 10-Q submission. In turn, this diligence not only fulfills regulatory requirements but also fortifies a company’s reputation within the market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 10-q without leaving Chrome?

Can I sign the form 10-q electronically in Chrome?

Can I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.