Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Sec Form 4 Form - How-to Guide

Overview of Sec Form 4

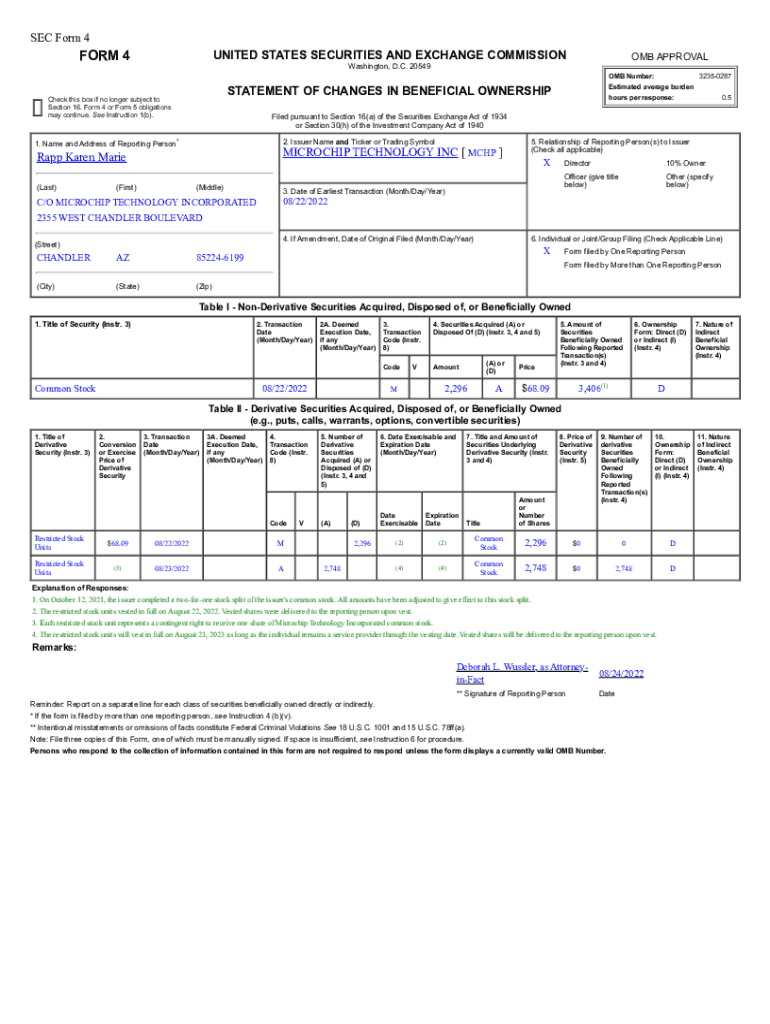

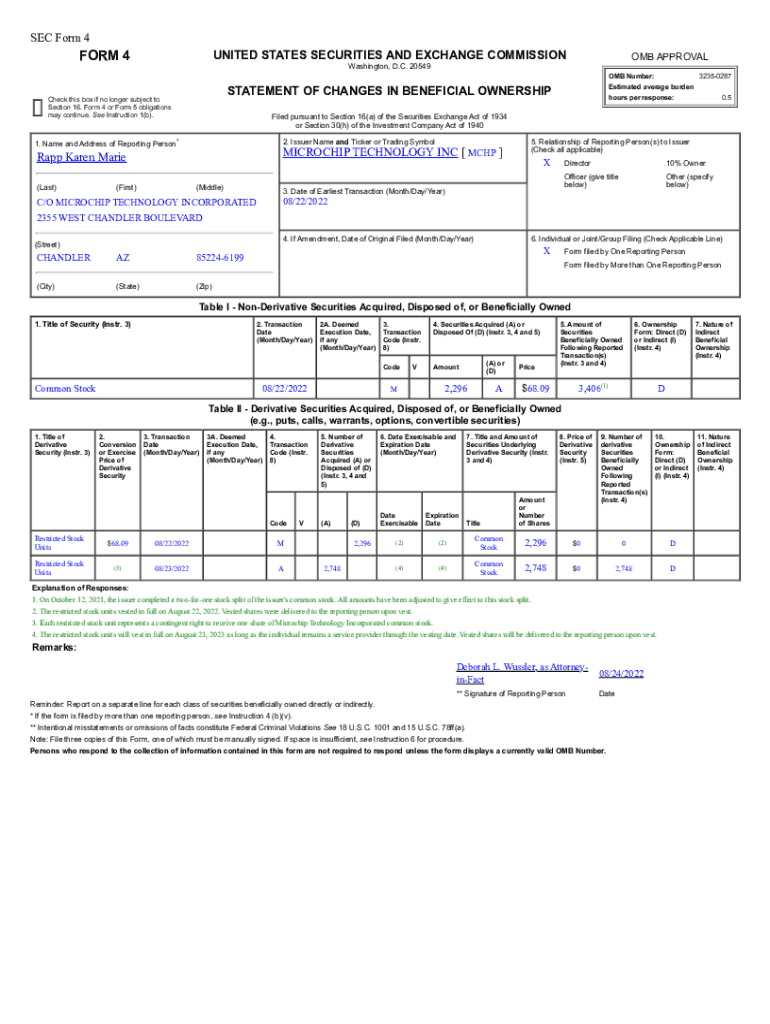

Sec Form 4 is a vital filing document used by the U.S. Securities and Exchange Commission (SEC) that enables insiders of publicly traded companies to report their transactions involving the company's stock or other equity securities. Specifically aimed at corporate officers, directors, and beneficial owners of more than 10% of a class of the company's equity securities, Sec Form 4 serves as a transparent mechanism to promote accountability and inform the public about insider trading activities.

Unlike other SEC forms, such as Form 3, which is used for an initial report of securities ownership, and Form 5, which is for annual statements of changes, Form 4 is concerned specifically with reporting transactions within a 2-day window of the trade. This emphasis on timely reporting is crucial for ensuring that the marketplace remains informed and that insider actions are transparent.

Understanding the importance of Sec Form 4 in the financial regulatory landscape is essential. It helps deter potential insider trading misconduct, promotes investor confidence, and maintains the integrity of capital markets, ultimately serving the interests of both companies and their shareholders.

Preparing to fill out Sec Form 4

Before completing Sec Form 4, it is crucial to gather all necessary information to ensure the form is filled out correctly and complies with SEC requirements. The first set of necessary information includes personal identification details, such as full name, address, and relationship to the issuer. This information establishes the identity of the reporting person.

Transaction specifics are also essential. This includes the date of the transaction, the amount of securities bought or sold, and the price per security. Understanding the nature of your reporting obligations is vital, especially if transactions occur during various trading windows. Familiarizing yourself with SEC filing requirements will further facilitate a smooth completing process.

Step-by-step instructions for completing Sec Form 4

Completing Sec Form 4 involves several key sections. In Section 1, you'll begin with the identification of the reporting person. Here, you must accurately input required information, including the reporting person's name, address, and relationship to the issuer. Common mistakes to avoid include incorrect spellings and omissions, which can lead to unnecessary complications.

Next, Section 2 requires issuer and security details. You should gather information such as the name of the issuer, the class of securities involved, and the CUSIP number. This ensures clarity and accuracy in your reporting. In Section 3, you'll need to detail the transaction information. Include specifics of the transacted securities and categorize the transaction type – whether it’s a purchase, sale, or conversion. Providing detailed examples can illustrate these transactions effectively.

Lastly, in Section 4, you'll need to provide your signature and certification. This is where the importance of electronic signatures comes into play. Utilizing pdfFiller, you can easily eSign your document, streamlining the process while ensuring compliance with the SEC’s requirements.

Editing and reviewing your Sec Form 4

Accuracy in SEC filings is non-negotiable. Mistakes can trigger audits or even penalties from the SEC. Hence, reviewing your completed Sec Form 4 is crucial before submission. pdfFiller offers various editing features that enable you to make quick corrections or rephrase sections for clarity.

For teams working collaboratively, utilizing tools for feedback is beneficial. pdfFiller allows you to share your form with team members, inviting comments and suggestions. This collaboration can lead to a more refined final product, ensuring all aspects of the form are thoroughly vetted.

Submitting Sec Form 4

Submitting your Sec Form 4 accurately is equally important as completing it. You can file the form through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. This online portal allows for efficient and timely submissions. Leveraging pdfFiller maximizes your submission process; once the form is correctly completed, you can submit directly from the application.

After submitting your form, it is important to confirm that your submission was successful. Keep an eye out for confirmation notifications from the SEC. Following up can help mitigate potential issues that may arise post-filing.

Common issues and troubleshooting

While completing Sec Form 4, some common issues arise. Frequently encountered challenges include missing information, incorrect transaction codes, or failure to file within the 2-day window. Addressing these challenges proactively can save time and reduce stress when making submissions.

To ensure successful completion, double-check all entries, and familiarize yourself with the formatting requirements set by the SEC. If you find yourself needing assistance, various resources, including the SEC’s official website, can offer guidance and troubleshooting tips.

Utilizing pdfFiller’s tools for managing your forms

Creating a workspace dedicated to your Sec Form 4 submissions can streamline the process significantly. Utilizing pdfFiller, you can easily manage all your forms in one accessible location. Track changes and revisions effectively, ensuring that everyone stays on the same page.

Taking advantage of templates for recurring use of the Sec Form 4 can simplify future filings. Once you’ve set up your detailed template, you can make minor updates for each transaction, preserving both time and effort. This approach also enhances consistency in your filings.

Transaction codes for Sec Form 4

Transaction codes are crucial when filling out Sec Form 4 as they specify the nature of the transaction being reported. Understanding these codes is essential for accurate reporting and compliance. Each code corresponds to a particular type of transaction, and including the correct code is necessary to avoid confusion.

A comprehensive list of transaction codes includes options like 1 – Purchase of stock, 2 – Sale of stock, and Code M for the exercise of derivative securities. Selecting and applying the correct transaction code is vital, as inaccuracies can prompt further scrutiny from regulatory bodies.

Additional considerations and best practices

When utilizing Sec Form 4, maintaining best practices is essential for effective financial reporting. Keeping records of all transactions is vital for transparency and compliance. Additionally, create a set of compliance tips for teams handling multiple forms to ensure consistency in filings, protecting both individuals and companies from potential penalties.

Best practices for document management and storage include systematically organizing your forms, implementing a structured filing system, and ensuring that all team members are trained in handling SEC forms. This structured approach will save time in the long run and reduce the likelihood of errors during filing.

Relevant resources and tools

Essential tools for individuals and teams navigating SEC filings extend beyond just the forms themselves. pdfFiller provides a cloud-based platform that allows for seamless document creation and editing. Its integration capabilities with existing workflows enhance efficiency during the filing process.

Accessing real-time updates on SEC regulations and requirements is crucial for staying compliant. Subscribing to SEC newsletters and utilizing online resources will keep you informed about changes that could impact your filing processes and deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec form 4 without leaving Google Drive?

Can I edit sec form 4 on an Android device?

How do I fill out sec form 4 on an Android device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.