Get the free Ej-130

Get, Create, Make and Sign ej-130

Editing ej-130 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ej-130

How to fill out ej-130

Who needs ej-130?

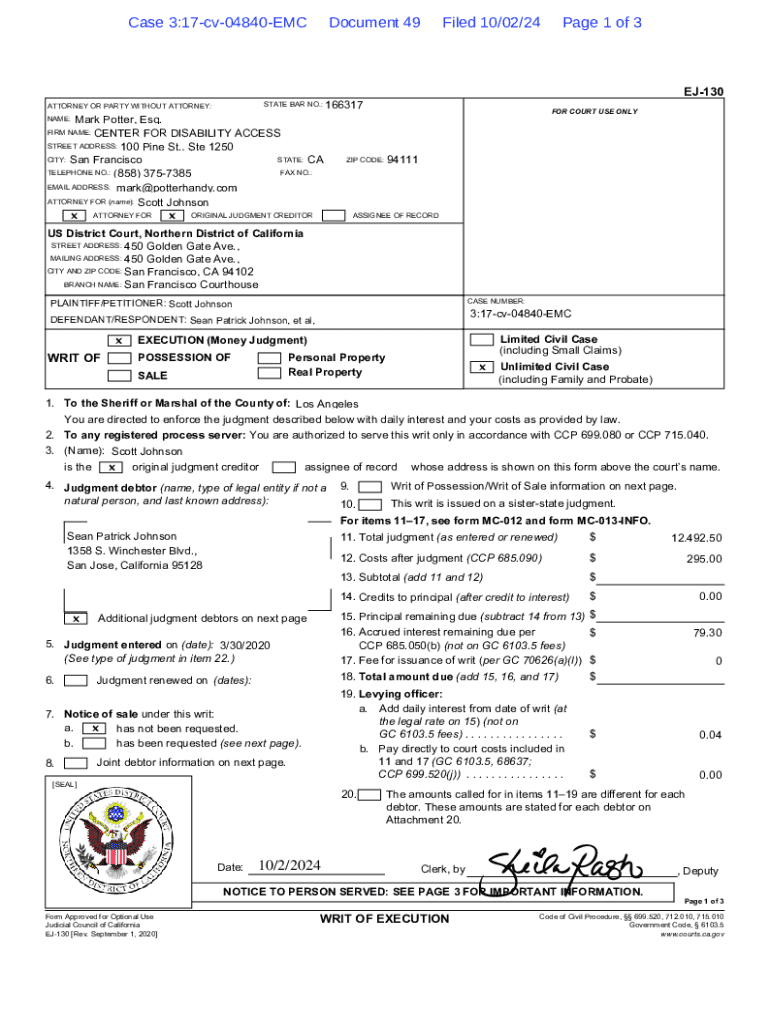

Understanding the EJ-130 Form: A Guide for Effective Debt Collection

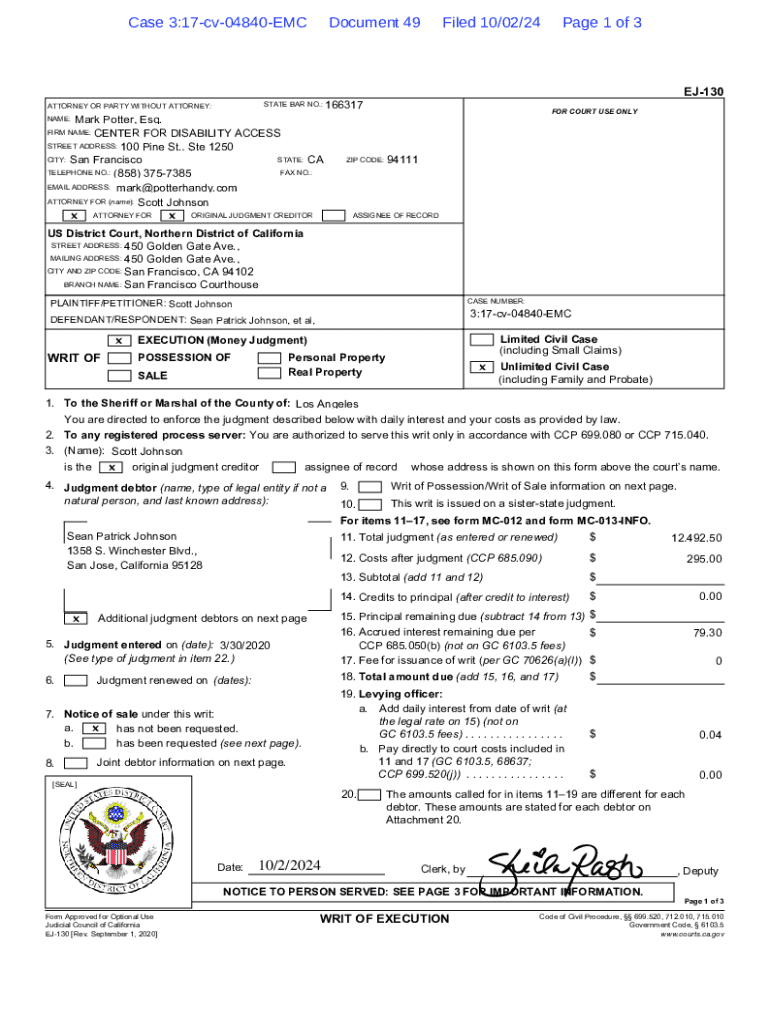

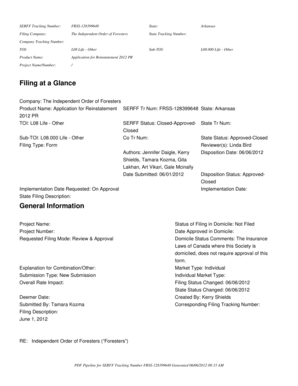

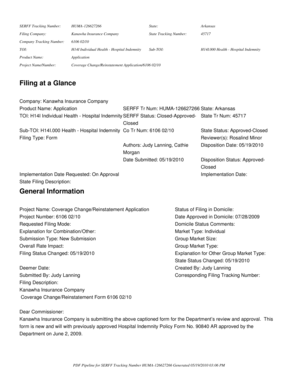

Overview of the EJ-130 Form

The EJ-130 Form, known as the 'Request for Writ of Execution,' is a crucial legal document utilized in the context of debt collection within the California judicial system. Its primary purpose is to facilitate the enforcement of a court's judgment in cases where a debtor has failed to comply with a financial obligation. In essence, the EJ-130 Form streamlines the process by allowing judgment creditors to officially request the court to issue a writ of execution to seize assets or compel payment from the debtor.

The importance of the EJ-130 Form cannot be overstated. It serves as the bridge between the judgment awarded and the actual recovery of funds. This form positions the creditor to act legally and conveys the necessary authority to court-appointed officials or sheriffs to execute the court's judgment. Understanding how to correctly complete and submit the EJ-130 Form is essential for any individual or team involved in debt recovery.

Understanding the components of the EJ-130 Form

The EJ-130 Form comprises several key sections that must be completed accurately to ensure its effectiveness. The first critical element involves the details about the parties involved in the judgment—specifically the creditor and the debtor. This includes names, addresses, and contact information. Understanding this is vital, as inaccuracies can cause delays or lead to the dismissal of your request.

The form also requires specific information regarding the judgment itself—most notably, the amount owed, including any applicable interest accrued since the judgment was awarded. Additional components include the case number and location of the original judgment. Familiarity with common terminology is also important. For instance, a 'writ of execution' refers to the court order authorizing the seizure of assets, while 'debtor' denotes the party who owes money to the creditor.

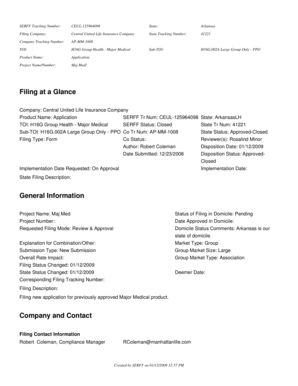

Step-by-step instructions for completing the EJ-130 Form

Filing the EJ-130 Form requires meticulous attention to detail. Start by gathering all necessary information and documentation, such as the original judgment, proof of the debtor’s assets, and any communication records with the debtor. Having these documents on hand can expedite the process and ensure accuracy.

When filling out the EJ-130 Form, follow these steps carefully: 1. **Identifying Information**: Enter your name and contact details as the judgment creditor, along with the debtor’s information. 2. **Description of Property**: Clearly describe the property or assets you seek to recover, ensuring this matches the items referenced in the judgment. 3. **Judgment Details**: Include the case number, the court that issued the original judgment, and the total amount owed, including any interest. 4. **Signature and Date Requirements**: Sign and date the form to verify your request and commit to the accuracy of the information provided. Common errors to avoid include misreporting the judgment amount or omitting critical details, both of which can lead to processing delays.

Submitting the EJ-130 Form

Once the EJ-130 Form is complete, the next step is submission. The form must be filed with the court that issued the original judgment, typically the superior court in your jurisdiction. This can often be done in person, but many courts also allow electronic filing, which can simplify the process and reduce filing times. It's essential to check local rules since submission protocols can vary by county.

Typically, there is a filing fee associated with submitting the EJ-130 Form. The amount may vary depending on the jurisdiction, so it’s advisable to confirm the exact fee with the court. Ensure that payment is made at the time of filing, as failure to do so can result in administrative issues or delays in processing your request.

After submission: next steps

After submitting the EJ-130 Form, expect a review process from the court. This may involve the court reviewing the details for accuracy and consistency with the original judgment. Be prepared for possible feedback or requests for additional information, which can delay the issuance of the writ of execution.

Once the court approves the request, you will receive the writ of execution, which you must serve to the debtor. Serving the writ is a critical step that formally notifies the debtor of the execution and initiates the enforcement process. Various methods are available for serving the form, including personal service by a sheriff or a registered process server, and in some cases, mail delivery. Make sure to follow the applicable legal requirements for service to validate it.

Responding to challenges

In some cases, a debtor may oppose the writ of execution by claiming an exemption. If this occurs, it is essential to be prepared to respond effectively. Begin by gathering all necessary documentation, including proof of the judgment and evidence demonstrating that the exemption claimed by the debtor is invalid.

To formally oppose a claim of exemption, you must file a response with the court within a designated timeframe. This typically includes a statement denying the exemption claim and providing supporting evidence or documentation. Being proactive in this regard can significantly impact your ability to recover the owed amount.

Managing and tracking your judgments

To ensure a smooth debt recovery process, it's crucial to monitor the status of your EJ-130 submission. After filing, you can check the progress of your application by contacting the court or using their online case lookup feature, if available. Staying informed allows you to anticipate any issues or delays and respond quickly.

Additionally, utilizing tools such as PDFfiller can greatly enhance your document management process. With PDFfiller, users can easily edit, sign, and collaborate on legal forms, including the EJ-130 Form. This cloud-based platform simplifies legal document management, ensuring you can access your files anytime and from anywhere, ultimately streamlining your workflow.

Supplementary forms and templates related to the EJ-130

Aside from the EJ-130 Form, several other essential forms are pertinent to debt collection processes. These may include forms such as the Earnings Withholding Order (EWO), which allows creditors to receive direct payments from the debtor's wages. Being familiar with these documents can enhance your ability to recover debts efficiently.

For those looking for convenience, accessing downloadable templates and editable examples of these forms can be particularly valuable. PDFfiller offers customizable templates that can save time and reduce errors, enabling users to tailor documents according to their specific needs.

Legal resources and tools

An array of interactive tools is available on PDFfiller that further enhance document management efficiency. These tools facilitate editing, signing, and tracking of legal documents, making it simpler to handle complexity often associated with debt recovery processes.

For individuals and teams who find themselves needing additional assistance, consulting with legal professionals can provide the guidance necessary for navigating complex legal frameworks surrounding debt collection. Engaging with attorneys or paralegals familiar with the EJ-130 Form and related processes can offer insights and strategies tailored to your unique situation.

Common questions about the EJ-130 Form

As with most legal documents, users often have specific questions regarding the EJ-130 Form. Common inquiries may include how to handle discrepancies in judgment amounts, the timeline for processing the form, and procedures following a denial of the writ. Addressing these queries is essential for ensuring that users feel confident and informed throughout the process.

To minimize confusion, individuals can seek out FAQs on platforms like PDFfiller, which provide tailored guidance designed to facilitate a better understanding of filling out and submitting the EJ-130 Form effectively.

Tips for successful debt collection

Leveraging the EJ-130 Form as part of your debt recovery strategy requires a proactive approach. A key best practice is maintaining detailed records of all communications with the debtor, which can serve as critical evidence should disputes arise. Additionally, being persistent yet respectful in communication with debtors often yields positive results.

Understanding the full scope of the legal framework surrounding debt collection can provide you with insights into advocating for your rights effectively. Utilize all available legal avenues, including the EJ-130 Form and other supplementary resources. By adopting these strategies, creditors can maximize their chances of successfully recovering owed amounts while remaining compliant with applicable laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ej-130 for eSignature?

Can I create an electronic signature for signing my ej-130 in Gmail?

How do I edit ej-130 on an Android device?

What is ej-130?

Who is required to file ej-130?

How to fill out ej-130?

What is the purpose of ej-130?

What information must be reported on ej-130?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.