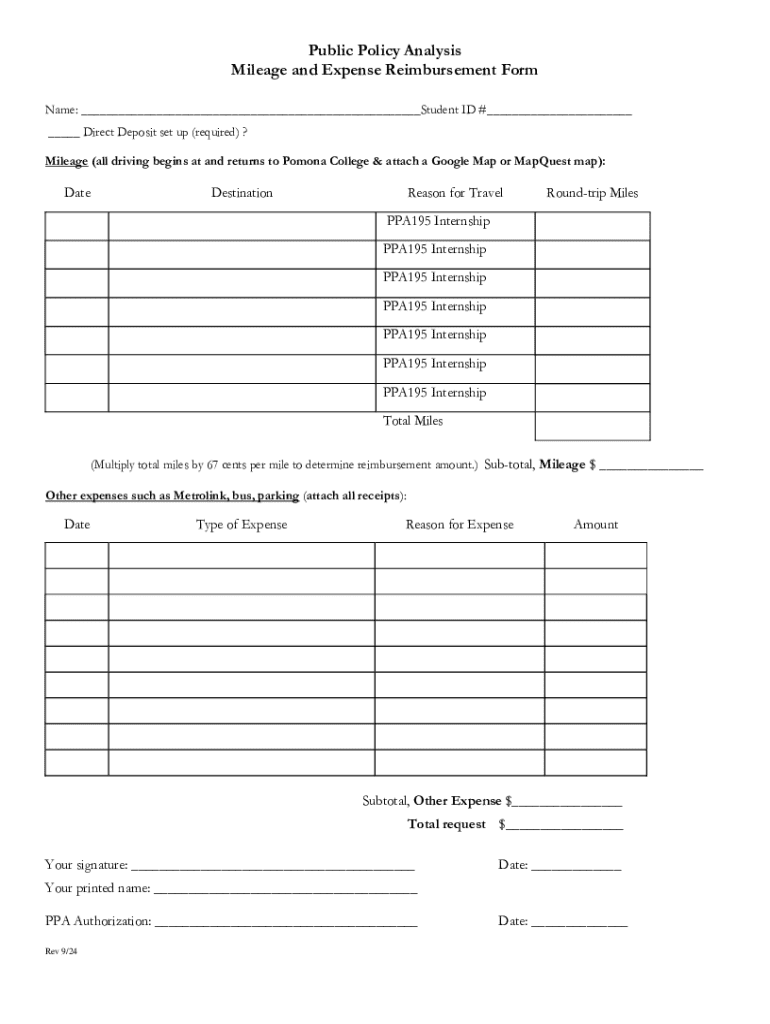

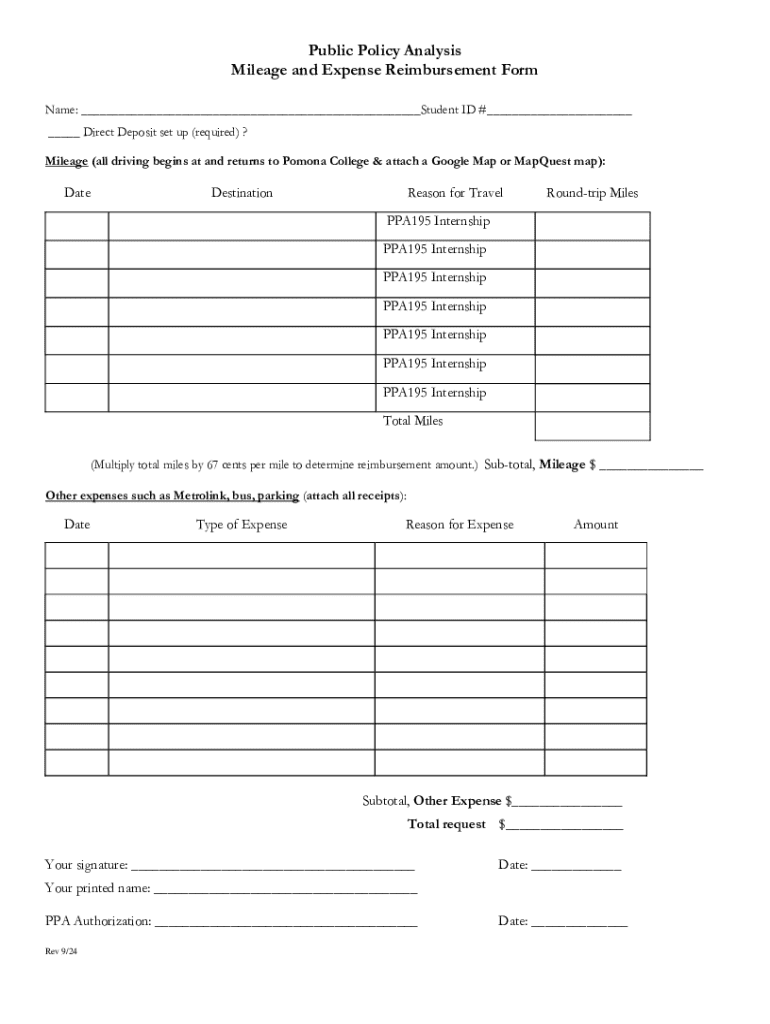

Get the free Mileage and Expense Reimbursement Form

Get, Create, Make and Sign mileage and expense reimbursement

How to edit mileage and expense reimbursement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mileage and expense reimbursement

How to fill out mileage and expense reimbursement

Who needs mileage and expense reimbursement?

Mileage and Expense Reimbursement Form: A How-to Guide

Understanding the mileage and expense reimbursement form

Accurate tracking and reporting of expenses and mileage is crucial for both employees and employers. These forms not only ensure that employees are reimbursed for their expenditures but also serve as a record that can be reviewed for compliance and accuracy. Sending in a well-prepared mileage and expense reimbursement form can cut out delays in reimbursement and foster trust between employees and management.

Common scenarios requiring a mileage and expense reimbursement form include travel for company meetings, offsite client visits, and attending industry conferences. Employees are often required to travel for business purposes in their personal vehicles or incur various expenses like meals and accommodations, which necessitate a formal claim for reimbursement.

Additionally, proper documentation of expenses is essential due to legal and tax implications; businesses are obligated to maintain accurate financial records, and employees must ensure they are compliant with IRS guidelines when claiming mileage and other reimbursable expenses.

Key features of pdfFiller's mileage and expense reimbursement form

pdfFiller offers a comprehensive mileage and expense reimbursement form designed to streamline the reimbursement process for employees. One significant feature is its user-friendly interface, which simplifies navigation so users can find the required information easily. This enhances the overall experience for individuals or teams who need to utilize the document regularly.

The cloud-based nature of pdfFiller allows users to access their forms from anywhere, at any time, which is particularly advantageous for employees constantly on the go. This flexibility allows for faster submissions and timely reimbursements.

Incorporating comprehensive editing tools, users can customize their forms to fit specific business needs, whether that means adding additional fields or modifying existing ones. Moreover, the platform includes eSigning capabilities that facilitate efficient approvals without the need for physical documentation.

Collaboration tools further enhance productivity by allowing team members to provide inputs and reviews on shared forms, enabling a collective approach to managing company expenditures.

Step-by-step guide to filling out your mileage and expense reimbursement form

Filling out your mileage and expense reimbursement form accurately ensures you receive proper compensation. Here’s a comprehensive step-by-step guide:

Managing your mileage and expense reimbursement form with pdfFiller

pdfFiller makes it easy to manage your completed mileage and expense reimbursement forms effectively. First, users can securely save and store their forms in the cloud, ensuring that important documents are always accessible regardless of location.

Tracking the progress of submitted forms is straightforward as pdfFiller provides updates on your submission status. In case you need to revise a submitted form, the platform allows easy access to edits, maintaining an efficient workflow for expense reporting.

Furthermore, pdfFiller enables users to import and export data, facilitating thorough and accurate accounting practices. This makes it simple to provide data to your finance department for tax purposes or for regulatory compliance.

Best practices for mileage and expense reimbursement

To ensure smooth processing and compliance, it’s advisable to follow a few best practices when submitting your mileage and expense reimbursement form. First, consistently track your mileage using a reliable method. Whether it’s a mileage tracking app or a simple notebook, document all trips and the purpose behind them.

Equally important is maintaining records of all receipts and documentation related to expenses. This forms the backbone of your reimbursement claim, as companies often require proof of payment for meals, lodging, and other purchases.

Regularly reviewing company policies on mileage and expenses can help ensure compliance and prevent misunderstandings regarding what is eligible for reimbursement. Staying informed is key to avoiding any discrepancies that can lead to denials.

Lastly, maintaining open communication with your finance department regarding any questions about expense reports can help resolve issues swiftly and facilitate a smoother reimbursement process.

FAQs on mileage and expense reimbursement forms

Having clear answers to frequently asked questions regarding mileage and expense reimbursement forms can ease concerns among employees. The types of expenses eligible for reimbursement often include travel-related costs such as vehicle mileage, accommodation, meals, and other business-related expenses.

In cases where discrepancies arise during mileage reporting, it’s essential to document any changes and communicate promptly with your supervisor or finance team to clarify the situation. Resolving these discrepancies effectively keeps the reimbursement process on track.

If a claim is denied, first review the denial reason, which could range from insufficient documentation to policy non-compliance. Understanding the cause enables one to rectify the issue and resubmit the claim more effectively.

Conclusion: Maximizing efficiency with pdfFiller

Leveraging pdfFiller's robust features significantly enhances the efficiency and management of your mileage and expense reimbursement forms. From easy navigation and electronic signatures to collaborative tools and cloud storage, pdfFiller stands out as a powerful solution for document handling.

By utilizing pdfFiller for your mileage and expense reimbursement needs, you can ensure timely submissions, accurate record-keeping, and a more streamlined reimbursement process, ultimately freeing up time to focus on your core job responsibilities.

Additional considerations

Staying informed about changes in reimbursement policies can be crucial. As companies often adjust their policies in response to new laws or to manage costs better, regular communication within teams ensures everyone is on the same page. This is especially important in dynamic work environments.

Besides mileage and expense reimbursement forms, pdfFiller can also be used for other document needs such as contracts and invoices, all of which can be managed efficiently from their cloud-based platform. This versatility can enhance overall productivity and organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my mileage and expense reimbursement in Gmail?

How can I edit mileage and expense reimbursement on a smartphone?

How do I complete mileage and expense reimbursement on an iOS device?

What is mileage and expense reimbursement?

Who is required to file mileage and expense reimbursement?

How to fill out mileage and expense reimbursement?

What is the purpose of mileage and expense reimbursement?

What information must be reported on mileage and expense reimbursement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.