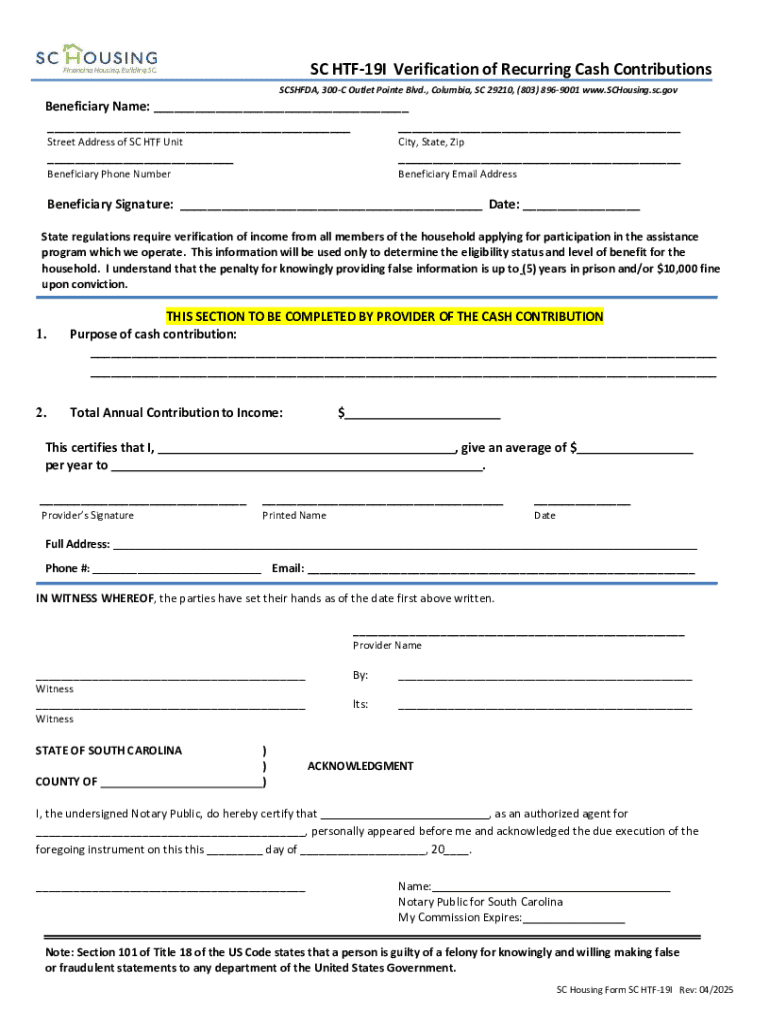

Get the free Sc Htf-19i Verification of Recurring Cash Contributions

Get, Create, Make and Sign sc htf-19i verification of

How to edit sc htf-19i verification of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sc htf-19i verification of

How to fill out sc htf-19i verification of

Who needs sc htf-19i verification of?

Comprehensive Guide to SC HTF-19I Verification of Form

Overview of SC HTF-19I Form Verification

The SC HTF-19I form is a critical document for financial and taxation purposes within many jurisdictions. Verification of this form ensures that all information submitted is accurate and compliant with regulatory standards. This process is vital for preventing delays in approvals and mitigating risks associated with incorrect or fraudulent reports.

Commonly utilized by both individuals and businesses, the verification of the SC HTF-19I form helps in validating the accuracy of income, tax identification details, and employment specifics. Ensuring this documentation is correctly verified impacts everything from tax assessments to loan approvals.

Understanding the Components of the SC HTF-19I Form

The SC HTF-19I form consists of several key sections, each requiring mindful attention to detail. Understanding these components ensures that applicants can accurately fill out the form, thereby avoiding submission errors that could complicate the verification process.

Supporting documents, including proof of income and identity verification, are often required. Failing to provide these can result in significant delays. It’s important to also be aware of common mistakes in form filling, such as incorrect or missing entries, which can affect the validity of the submissions.

Step-by-step guide to filling out the SC HTF-19I form

The first step in filling out the SC HTF-19I form is to prepare. Gather all necessary documents, which may include previous tax returns, pay stubs, and identification proof. Ensuring accuracy in personal information at this point is critical to prevent complications later on.

After completing each section, review your inputs thoroughly. A checklist can help minimize errors—pay special attention to numbers, spelling, and any mandatory fields that must not be overlooked. Addressing these aspects will pave the way for a smoother verification process.

How to verify the SC HTF-19I form

Verification of the SC HTF-19I form involves a straightforward process facilitated by pdfFiller’s interactive tools. This platform allows users to upload their completed forms and utilize various PDF editing tools for necessary corrections before final verification.

Interactive tools on pdfFiller simplify the verification process, allowing users to ensure their submissions meet all required standards before sending them off to the relevant authorities.

Troubleshooting common verification issues

During the verification process, users may encounter issues such as missing information or incorrect data entry. Recognizing these common problems early can help mitigate potential setbacks in the submission process.

If issues persist, contacting pdfFiller support can provide additional assistance to get your form verified and submitted accurately.

Collaborating with your team on form verification

Team collaboration on the SC HTF-19I form can be greatly enhanced using pdfFiller’s sharing features. By providing access to the form for all relevant team members, individuals can streamline the verification process.

These collaborative features encourage better teamwork and quick completion of the verification process, contributing to overall efficiency.

Advanced tips for SC HTF-19I form management

Effectively managing your SC HTF-19I form requires organization and security. Utilizing pdfFiller’s platform can aid in keeping your documents orderly while also ensuring sensitive information is protected.

These practices will not only enhance your workflow but also safeguard your sensitive data throughout the verification process.

Case studies of successful SC HTF-19I form verification

Real-world examples illustrate the challenges and solutions associated with SC HTF-19I form verification. For instance, a small business faced delays due to missing tax identifiers. By utilizing pdfFiller’s editing features to quickly address the oversight, they completed their verification smoothly, facilitating timely fund disbursement.

These case studies emphasize the importance of leveraging relevant tools and best practices, which not only expedites submission but also enhances final outcomes for users.

Frequently asked questions (FAQs) about SC HTF-19I verification

Understanding the SC HTF-19I form verification process can raise questions. Common misconceptions include the belief that a single error will lead to automatic rejection. In reality, many organizations allow for corrections if caught within initial reviews.

Best practices involve preparing meticulously ahead of time, ensuring all required documents are ready and accurately filled, thereby simplifying future interactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the sc htf-19i verification of in Chrome?

How do I edit sc htf-19i verification of straight from my smartphone?

Can I edit sc htf-19i verification of on an iOS device?

What is sc htf-19i verification of?

Who is required to file sc htf-19i verification of?

How to fill out sc htf-19i verification of?

What is the purpose of sc htf-19i verification of?

What information must be reported on sc htf-19i verification of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.